Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Global heater core shipments exceeded 60 million units in 2024, with electric heater core volumes growing at a double-digit rate.

-

Aluminum cores have captured over 70% of the material segment due to superior thermal conductivity, weight reduction, and corrosion resistance.

-

Asia Pacific leads production and consumption, accounting for approximately 50% of global volume, driven by China, India, and Southeast Asia manufacturing hubs.

-

Aftermarket sales represent nearly 30% of total revenue, reflecting regular maintenance cycles and regional variations in coolant quality.

-

Regulatory trends aimed at reducing cabin heat-up time and improving fuel economy are prompting OEMs to specify higher-efficiency core designs and integrated thermal management systems.

Market Drivers

-

Passenger Comfort and Safety: Rapid defrosting and consistent cabin heating are critical for driver visibility and comfort in cold climates, driving demand for efficient heater cores.

-

Electrification of Vehicles: BEVs and PHEVs require electric heater cores or integrated PTC (positive temperature coefficient) elements, creating a new sub-segment with specialized design requirements.

-

Lightweight Materials: OEM mandates for fuel efficiency and reduced emissions incentivize the adoption of aluminum cores and optimized fin geometries that cut weight without sacrificing performance.

-

Aftermarket Replacement: Corrosion from coolant additives and clogging from debris necessitate periodic core replacement, sustaining aftermarket revenue.

-

Integrated Thermal Management: Advanced HVAC systems, including heat-pump integration and waste-heat recovery, require heater cores engineered for variable flow rates and multi-mode operation.

Market Restraints

-

Coolant Quality Variability: Inconsistent coolant chemistry across regions leads to premature core corrosion or fouling, undermining performance and brand reputation.

-

High Development Costs: Designing electric heater cores with PTC elements and corrosion-resistant coatings involves significant R&D investment.

-

Complex HVAC Integration: Integrating heater cores into compact electric-vehicle HVAC modules poses packaging and thermal-control challenges.

-

Standardization Challenges: Diverse vehicle platforms and HVAC architectures limit the scalability of a single core design across multiple models.

-

Price Pressure in Aftermarket: Independent workshops often choose low-cost replacement cores, pressuring OEM and Tier-1 supplier margins.

Market Opportunities

-

Electric Heater Core Expansion: As global BEV adoption accelerates, suppliers can capitalize on demand for dedicated electric cores, PTC integration, and rapid heating solutions.

-

Corrosion-Resistant Coatings: Development of advanced coatings and surface treatments can extend core life, reduce warranty claims, and support premium product positioning.

-

Modular HVAC Platforms: Offering modular core designs compatible with multiple vehicle segments allows Tier-1 suppliers to reduce production complexity and inventory costs.

-

Value-Added Aftermarket Services: Bundling heater cores with coolant-quality testing kits and preventative maintenance solutions can drive aftermarket growth.

-

Global Emerging Markets: Expansion into regions with growing vehicle fleets—such as Eastern Europe, Latin America, and Africa—presents new aftermarket and OE opportunities.

Market Dynamics

-

Material Innovation: Transition from copper-brass to all-aluminum cores has reshaped supplier dynamics, favoring those with brazing and extrusion expertise.

-

Electrification Impact: Hybrid and electric platforms are redefining core performance metrics, emphasizing fast heat-up, electrical efficiency, and multi-mode operation.

-

Regulatory Influence: Energy-efficiency standards and consumer ratings (e.g., rapid cabin warm-up times) increasingly dictate heater core specifications.

-

Aftermarket vs. OEM Channel: OEMs focus on long-life, corrosion-resistant products, while aftermarket channels emphasize cost-effectiveness and rapid availability.

-

Supply Chain Consolidation: Mergers and partnerships among HVAC module builders, core manufacturers, and coating specialists are streamlining R&D and production.

Regional Analysis

-

Asia Pacific: Dominates both production and consumption, with China and India ramping up local content of aluminum cores to reduce import dependency.

-

North America: High adoption of dual-mode HVAC systems in electric vehicles and stringent climate-control requirements in cold states drive demand for advanced cores.

-

Europe: Regulatory focus on fuel economy and cold-weather performance, combined with growing EV registrations, fosters growth in aluminum and electric heater cores.

-

Latin America: Aftermarket remains the primary channel, with replacement cycles influenced by coolant quality and seasonal climate variations.

-

Middle East & Africa: Low ambient temperatures at high elevations (e.g., South Africa’s highveld) and emerging EV infrastructure spur niche demand for heater cores.

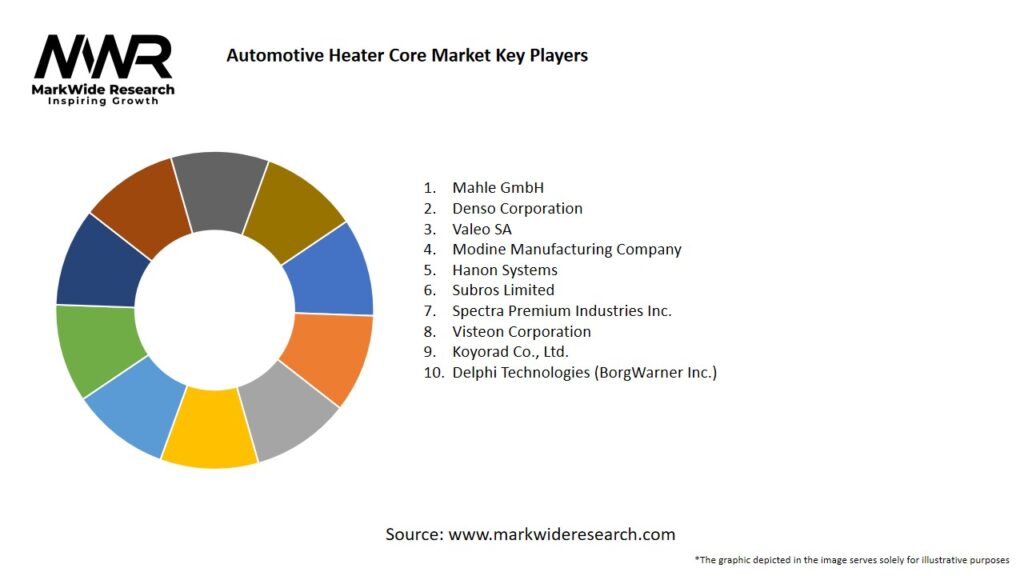

Competitive Landscape

Leading Companies in the Automotive Heater Core Market:

- Mahle GmbH

- Denso Corporation

- Valeo SA

- Modine Manufacturing Company

- Hanon Systems

- Subros Limited

- Spectra Premium Industries Inc.

- Visteon Corporation

- Koyorad Co., Ltd.

- Delphi Technologies (BorgWarner Inc.)

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

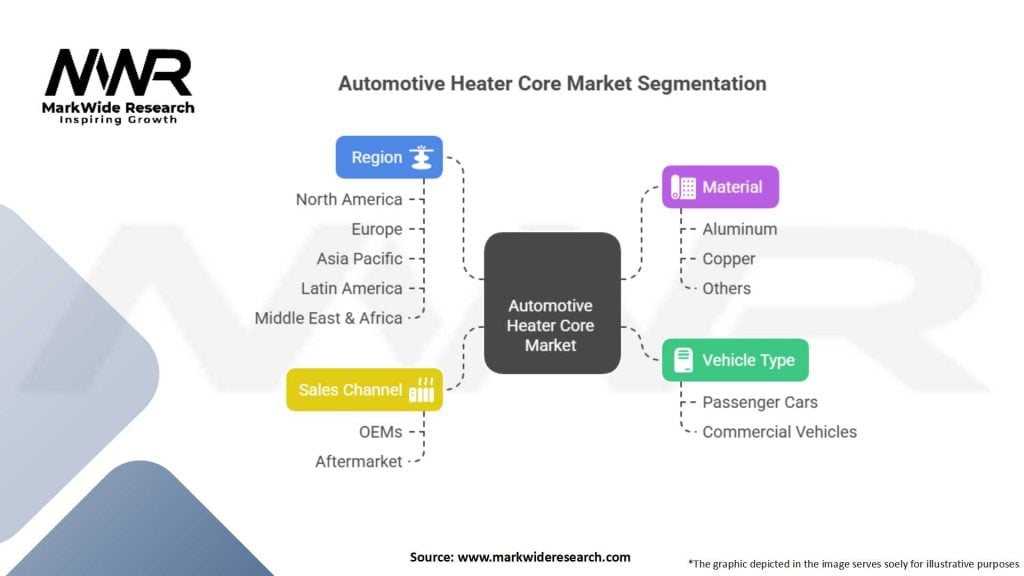

Segmentation

-

By Core Material: Aluminum, Copper-Brass, Composite (Aluminum-Polymer Hybrid)

-

By Type: Tube-and-Fin, Flat-Plate, Micro-Channel

-

By Propulsion: Internal Combustion Engine (ICE) Heater Cores, Electric Heater Cores (PTC-Integrated)

-

By End-User: OEM, Aftermarket (Dealerships, Service Centers, Independent Workshops)

Category-wise Insights

-

Aluminum Tube-and-Fin Cores: Predominant in modern ICE vehicles for their balance of weight, cost, and thermal performance.

-

Flat-Plate Cores: Offer high heat-transfer rates in compact footprints, suitable for EV HVAC modules.

-

Micro-Channel Cores: Emerging technology that minimizes fluid volume and enhances rapid heat transfer, ideal for next-gen electric platforms.

-

PTC-Integrated Electric Cores: Provide self-regulating heating and fast cabin warm-up, critical for BEVs in cold climates.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Cabin Comfort: Rapid and uniform heating improves passenger satisfaction and safety in harsh environments.

-

Weight and Efficiency Gains: Advanced materials and core designs contribute to overall vehicle light-weighting and improved fuel or electrical efficiency.

-

Extended Service Life: Corrosion-resistant coatings and optimized coolant flow reduce maintenance frequency and warranty costs.

-

Modular Production: Standardized core platforms support multiple vehicle lines, lowering tooling and inventory requirements.

-

Aftermarket Revenue Streams: Regular replacement cycles ensure sustained demand, supporting distributors and service networks.

SWOT Analysis

Strengths:

-

Established core technology with predictable performance.

-

Growth of aluminum and micro-channel innovations.

-

Cross-channel demand (OEM + aftermarket).

Weaknesses:

-

Dependence on coolant quality and periodic maintenance.

-

High R&D costs for electric-vehicle core development.

-

Fragmented supplier base with variable quality.

Opportunities:

-

Electric heater core proliferation in BEVs and PHEVs.

-

Next-gen materials and coatings for durability.

-

Expansion into emerging automotive markets.

Threats:

-

Shift toward heat-pump HVAC strategies reducing reliance on traditional cores.

-

Regulatory changes in coolant chemistries affecting compatibility.

-

Competitive pressure from integrated HVAC suppliers offering turnkey modules.

Market Key Trends

-

Micro-Channel Heat Exchangers: Adoption of micro-channel cores for rapid, uniform heating in compact EV HVAC systems.

-

Smart HVAC Integration: Sensors monitoring coolant temperature and flow for adaptive heat control and improved energy management.

-

Eco-Friendly Coatings: Development of non-toxic, solvent-free anti-corrosion treatments aligning with green manufacturing goals.

-

Modular Electric Platforms: Standard electric heater core designs that can be deployed across diverse EV models.

-

Aftermarket Digital Platforms: Online channels offering bundled core and coolant kits with instructional diagnostics for DIY repairs.

Covid-19 Impact

The pandemic temporarily slowed vehicle production, resulting in deferred heater core OEM orders in 2020. However, as service centers reopened, deferred maintenance led to a surge in aftermarket replacements in 2021–22. Pandemic-driven supply chain disruptions prompted local sourcing of core materials and accelerated digital sales initiatives. Additionally, the health focus on in-cabin air quality pushed OEMs to integrate better HVAC filtration alongside heater cores, indirectly benefiting core suppliers through comprehensive HVAC system upgrades.

Key Industry Developments

-

Valeo introduced a modular electric heater core system in 2023, featuring high-efficiency flat-plate cores and integrated PTC elements.

-

Mahle launched micro-channel heater cores designed for next-generation EV HVAC modules with reduced coolant volume requirements.

-

Denso unveiled EcoCoat™ anti-corrosion coating for aluminum cores, enhancing durability in extreme climates.

-

Modine partnered with a major automaker to supply standardized heater cores across multiple commercial vehicle platforms, optimizing economies of scale.

Analyst Suggestions

-

Accelerate EV Core R&D: Prioritize development of electric heater cores and micro-channel designs to capture growing BEV market share.

-

Enhance Coolant Compatibility: Work with coolant suppliers to standardize formulations that protect cores across diverse global climates.

-

Invest in Smart Diagnostics: Integrate temperature and pressure sensors into core housings to support predictive maintenance models.

-

Expand Aftermarket Digital Presence: Develop user-friendly online platforms that bundle cores, coolant kits, and diagnostic guides for end-users.

-

Pursue Strategic Alliances: Collaborate with HVAC module integrators and coating specialists to offer turnkey thermal management solutions.

Future Outlook

The Automotive Heater Core market is set to evolve with the rise of electrified powertrains, increased emphasis on rapid cabin thermal management, and continued material innovations. Electric and micro-channel cores will gain share, while integrated HVAC modules with smart controls become standard on premium and mass-market EVs. Aftermarket demand will persist as fleets and private owners replace aging cores, especially in harsh climates. Suppliers who invest in next-generation core technologies, smart diagnostics, and sustainable materials will lead the market and shape the future of vehicle thermal comfort.

Conclusion

In conclusion, the Automotive Heater Core market remains a critical segment of the vehicle HVAC landscape, balancing traditional ICE applications with the emerging needs of electric mobility. Ongoing innovations in materials, design, and integration will determine market leaders, while a strong aftermarket ecosystem ensures reliability and recurring revenue. Organizations that align product development with electrification trends, modular design strategies, and digital service models will be best positioned to meet evolving passenger comfort and efficiency demands in a rapidly changing automotive environment.