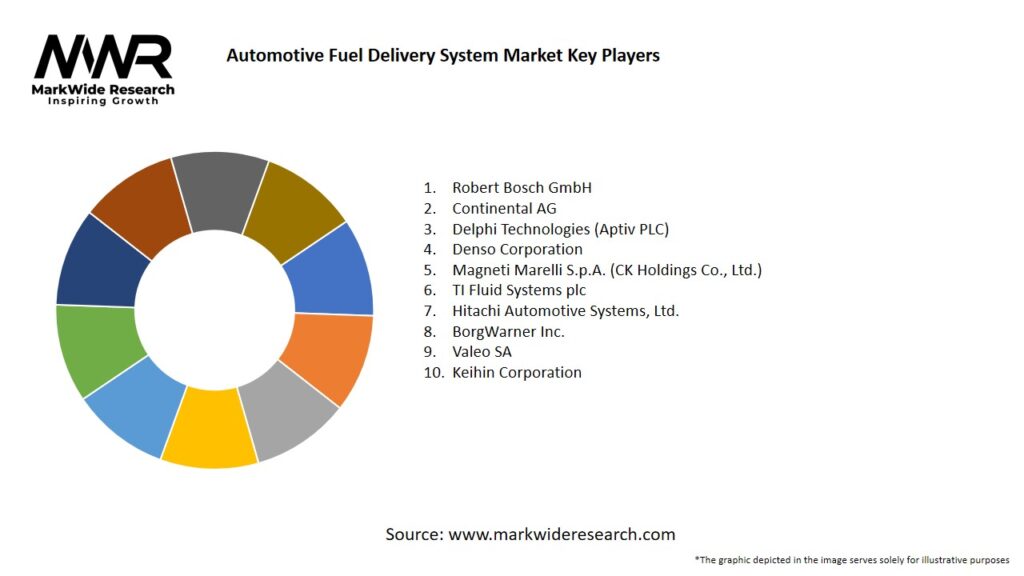

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Global vehicle production exceeding 85 million units in 2024 underpins steady OEM demand for fuel delivery components.

-

Gasoline direct injection (GDI) systems now account for over 60% of new passenger car fuel delivery technologies in mature markets.

-

Common-rail diesel remains dominant in heavy-duty applications, with pressures above 2,000 bar improving efficiency and reducing NOₓ.

-

Aftermarket sales of fuel pumps and injectors grew by 4% CAGR from 2021–2024, fueled by aging vehicle populations and maintenance cycles.

-

Emerging markets in Asia Pacific and Latin America are investing in retrofitting legacy carbureted fleets with electronic injection kits to meet local emission standards.

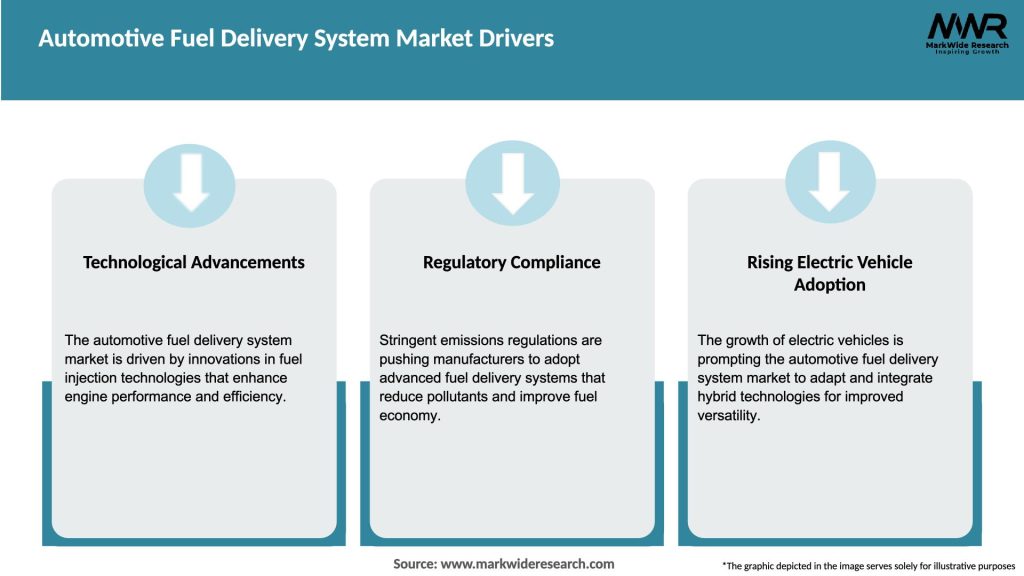

Market Drivers

-

Emission Regulations: Euro 7, EPA Tier 3, and Bharat Stage VI norms compel OEMs to adopt precise injection systems for cleaner exhaust.

-

Fuel Efficiency Targets: Corporate average fuel economy (CAFE) standards push the integration of high-pressure injectors and variable-rate pumps.

-

Alternative Fuels: Growing CNG/LPG vehicle segments require specialized delivery modules and regulator assemblies.

-

Electrification Hybridization: Mild-hybrid systems with start-stop engines depend on responsive fuel delivery to maintain drivability.

-

Aftermarket Maintenance: Regular replacement of wear-prone pumps and injectors in existing fleets supports a robust aftermarket business.

Market Restraints

-

High Development Costs: R&D and precision manufacturing for high-pressure systems demand significant capital investment.

-

Supply Chain Vulnerabilities: Dependence on semiconductors for pump control modules and precision steels for injectors can lead to bottlenecks.

-

Shift to EVs: The long-term transition to battery electric vehicles threatens to reduce demand for conventional fuel delivery systems.

-

Complex Certification: GDI and common-rail components require extensive durability and emissions testing, slowing product launches.

-

Technical Skill Gaps: Advanced fuel system servicing demands specialized diagnostic equipment and technician training, limiting widespread aftermarket adoption.

Market Opportunities

-

Electrified Pump Modules: Development of in-tank electric pumps optimized for hybrid and flex-fuel configurations.

-

Alternative Supply Channels: Expansion of remanufactured units and aftermarket retrofit kits in price-sensitive regions.

-

Digital Monitoring: Integration of flow and pressure sensors with IoT connectivity for predictive maintenance services.

-

Biofuel Compatibility: Designing seals and materials to withstand ethanol blends (E10, E85) and biodiesel in diesel engines.

-

3D-Printed Components: Use of additive manufacturing for rapid prototyping and low-volume specialty parts in motorsports and niche applications.

Market Dynamics

-

Technological Convergence: Merging of fuel delivery with engine management software for adaptive injection strategies.

-

Regulatory Evolution: Anticipated tightening of evaporative emission standards (LEVs) will drive innovations in leak-resistant lines and regulators.

-

Customer Expectations: Demand for smoother idle, lower noise, and faster cold starts steers design enhancements in pump and injector response times.

-

OEM–Supplier Collaboration: Early-stage partnerships accelerate development of next-gen fuel modules tailored to specific engine architectures.

-

Aftermarket Digitalization: Online ordering, telematics-based maintenance scheduling, and DIY repair guides are reshaping service models.

Regional Analysis

-

Asia Pacific: Largest volume market led by China and India, balancing growing ICE production with OEM electrification roadmaps.

-

North America: High adoption of GDI and turbocharged engines in pickups and SUVs; aftermarket demands premium-grade injectors.

-

Europe: Stringent CO₂ and Euro 7 drives rapid phase-out of older systems; aftersales focus on emissions-related recalls and upgrades.

-

Latin America: Price-sensitive market favors carburetor-to-MPFI (multipoint fuel injection) retrofits and locally remanufactured units.

-

Middle East & Africa: Fleet operators demand durable, high-flow pumps for heavy-duty and off-road applications under harsh conditions.

Competitive Landscape

Leading Companies in the Automotive Fuel Delivery System Market:

- Robert Bosch GmbH

- Continental AG

- Delphi Technologies (Aptiv PLC)

- Denso Corporation

- Magneti Marelli S.p.A. (CK Holdings Co., Ltd.)

- TI Fluid Systems plc

- Hitachi Automotive Systems, Ltd.

- BorgWarner Inc.

- Valeo SA

- Keihin Corporation

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

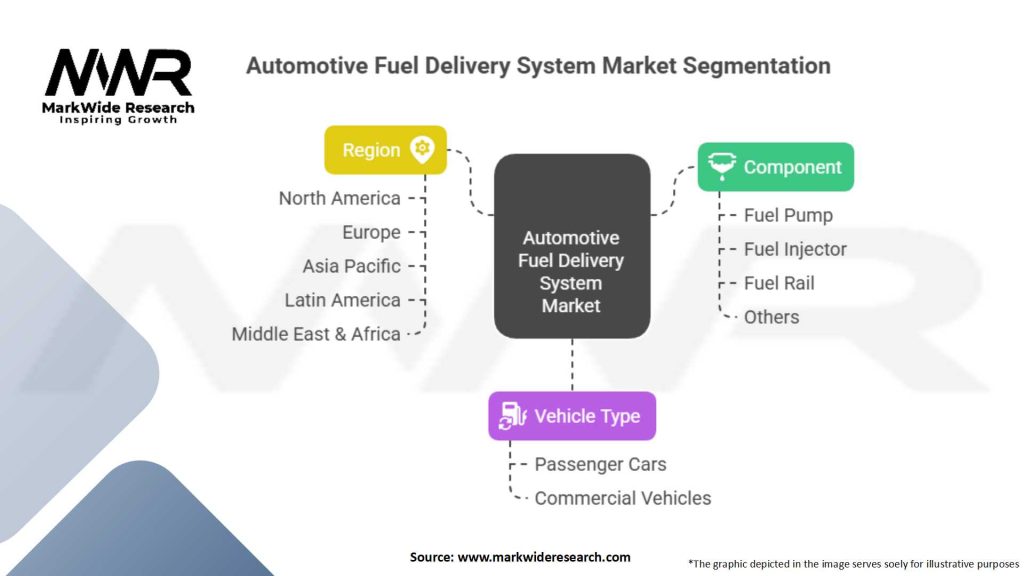

Segmentation

-

By Component: Fuel Pumps (in-tank, inline), Injectors (GDI, port fuel), Pressure Regulators, Fuel Rails, Filters

-

By Fuel Type: Gasoline, Diesel, CNG/LPG, Biofuels

-

By Vehicle: Passenger Cars, LCVs, HCVs, Off-Road Equipment

-

By Distribution Channel: OEM Supply, Aftermarket (Dealerships, Independent Garages, E-commerce)

Category-wise Insights

-

In-Tank Electric Pumps: Preferred for GDI systems; quieter operation and controlled cavitation.

-

High-Pressure Common-Rail Injectors: Critical for diesel efficiency and low emissions in commercial vehicles.

-

Multipoint Port Fuel Injectors: Cost-effective for mass-market gasoline engines, balancing performance and emissions.

-

Pressure Regulators & Rails: Ensure stable delivery pressure across varied engine loads; key to smooth throttle response.

-

Aftermarket Reman Units: Eco-friendly and cost-efficient option, especially in regions with high fleet age.

Key Benefits for Industry Participants and Stakeholders

-

Improved Engine Performance: Precise fuel metering enhances power output, drivability, and throttle response.

-

Emissions Reduction: Advanced injection strategies lower CO₂, HC, and NOₓ output to meet regulatory targets.

-

Extended Service Intervals: Robust filters and pump designs reduce wear, cutting maintenance frequency and costs.

-

Flex-Fuel Readiness: Compatibility with ethanol blends and LPG reduces dependency on single-fuel systems.

-

Predictive Maintenance: Sensor-enabled modules allow real-time diagnostics, minimizing downtime and repair expenses.

SWOT Analysis

Strengths:

-

High technical maturity and well-established OEM relationships.

-

Recurring revenue from both OEM production and aftermarket replacement.

-

Synergies with engine control and telematics systems for integrated solutions.

Weaknesses:

-

Exposure to ICE volume fluctuations amid EV transition.

-

Component complexity increases failure modes and warranty costs.

-

Regional price sensitivity challenges global standardization.

Opportunities:

-

Growth in hybrid and flex-fuel vehicle segments.

-

Aftermarket expansion in emerging regions through remanufacturing partnerships.

-

Digital services built around IoT-enabled flow and pressure monitoring.

Threats:

-

Accelerating shift to battery-electric vehicles reducing ICE parts demand.

-

Commodity price volatility in steels and electronic components.

-

Regulatory unpredictability in global fuel and emissions standards.

Market Key Trends

-

Piezoelectric Injectors: Offering finer spray control and faster injection cycles for ultra-low emissions.

-

Fuel Module Integration: Combined pump, filter, and sensor assemblies for compact packaging and simplified installation.

-

Digital Twin Simulation: Virtual modeling of fuel systems to optimize performance before physical prototyping.

-

Adaptive Flow Control: Real-time adjustment of pump displacement based on driver behavior and engine load.

-

Biofuel-Proof Components: Materials and seals designed to resist ethanol and biodiesel degradation.

Covid-19 Impact

COVID-19 led to a temporary slump in vehicle production and delayed aftermarket services in 2020–2021, reducing short-term demand for fuel delivery components. However, fleet operators deferred major overhauls in favor of essential pump and injector replacements, sustaining aftermarket revenues. Supply chain disruptions prompted localization of critical electronic control unit (ECU) manufacturing, which has since improved regional resilience.

Key Industry Developments

-

Bosch introduced the HDEV high-pressure pump for 3,500-bar GDI systems in 2023, setting new precision benchmarks.

-

Denso launched ethanol-compatible injector series tailored for Brazilian flex-fuel vehicles, boosting local market share.

-

Continental unveiled sensor-integrated fuel rails enabling closed-loop control and real-time diagnostics in 2024.

-

Marelli developed a combined pump–filter module for EV range-extender engines, facilitating smoother transitions in hybrid architectures.

Analyst Suggestions

-

Diversify into Hybrids: Prioritize development of fuel modules optimized for range extenders and mild-hybrid engines.

-

Embrace Remanufacturing: Establish certified reman centers in emerging markets to capture cost-sensitive aftermarket segments.

-

Expand IoT Services: Bundle hardware with subscription-based monitoring and predictive maintenance platforms.

-

Invest in Material R&D: Explore corrosion-resistant alloys and polymers for biofuel and high-pressure applications.

-

Monitor EV Adoption: Balance ICE investments with strategic pivots into e-mobility component families.

Future Outlook

Despite the rise of electric vehicles, internal combustion powertrains will persist in many regions through the 2030s, maintaining strong demand for advanced fuel delivery systems. OEMs and suppliers who innovate in high-pressure injection, flex-fuel compatibility, and digital service offerings will secure growth. Meanwhile, aftermarket channels will thrive on remanufacturing and retrofit solutions, particularly in markets where EV adoption lags economic or infrastructural limitations.

Conclusion

The Automotive Fuel Delivery System market stands at the intersection of legacy ICE requirements and the innovations bridging toward hybrid and alternative-fuel vehicles. By focusing on precision injection, biofuel compatibility, sensor integration, and aftermarket reman strategies, stakeholders can sustain revenue streams and adapt to evolving propulsion landscapes. Those who balance short-term ICE excellence with long-term electrification strategies will lead the market in performance, efficiency, and resilience.