Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

The shift toward downsized, turbocharged engines is increasing demand for bearings capable of handling higher loads and temperatures.

-

Advances in bearing materials, including aluminum-based and tri-metal alloys, are improving friction reduction and wear resistance.

-

Aftermarket sales account for a significant portion of revenue, driven by maintenance schedules and performance upgrades.

-

OEMs are collaborating with bearing suppliers to co-develop customized solutions that align with specific engine architectures.

-

Environmental regulations and the push for better fuel economy are propelling innovation in low-friction bearing designs.

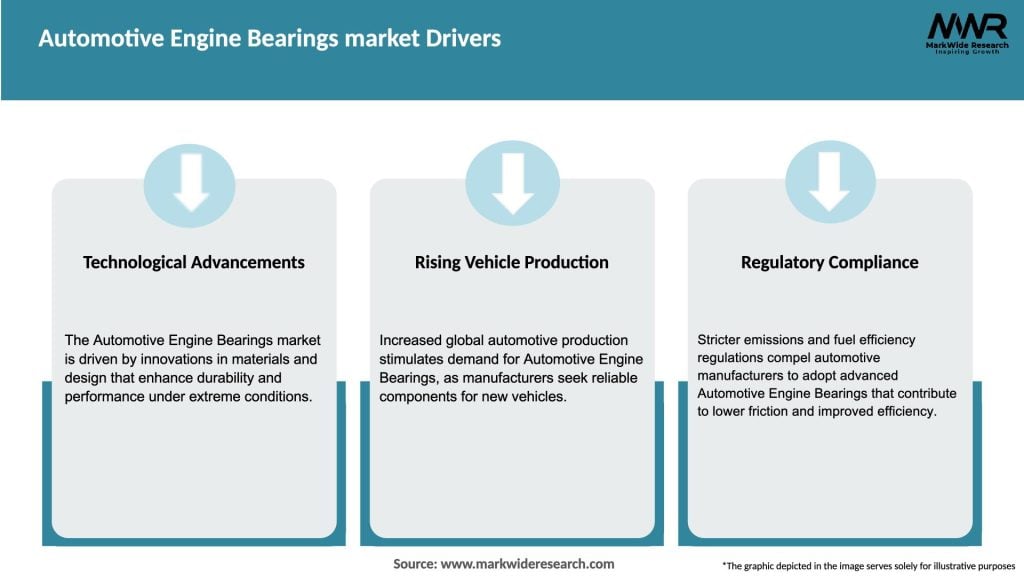

Market Drivers

-

Engine Downsizing and Turbocharging: Smaller-displacement engines running at higher pressures require bearings with superior load-bearing capacity and thermal stability.

-

Fuel Efficiency Regulations: Stricter CO₂ and fuel economy standards across regions are incentivizing low-friction bearing technologies to reduce parasitic losses.

-

Rising Vehicle Production: Growth in global automotive manufacturing, particularly in Asia Pacific, underpins consistent demand for both OEM and aftermarket bearings.

-

Aftermarket Expansion: Mature vehicle fleets in North America and Europe drive replacement bearing sales, as routine engine rebuilds and performance tuning grow.

-

Materials Innovation: Development of advanced alloys and surface treatments enhances bearing longevity, enabling engines to meet higher durability expectations.

Market Restraints

-

Electric Vehicle (EV) Adoption: Rapid growth in EVs, which use fewer traditional bearings, may gradually erode demand in ICE-centric segments.

-

Raw Material Price Volatility: Fluctuations in copper, aluminum, and lead prices can squeeze manufacturer margins.

-

Complex Certification Requirements: Meeting OEM approval standards and global quality certifications adds time and cost to new bearing development.

-

Competition from Low-Cost Producers: Import pressure from low-cost manufacturers in certain regions can limit pricing power for premium bearing suppliers.

-

Technological Shifts: Emergence of alternative engine architectures, such as rotary or fuel cell systems, could change lubrication and bearing requirements.

Market Opportunities

-

Aftermarket Performance Segment: High-performance bearings for motorsports and tuning enthusiasts can command premium pricing and drive innovation.

-

Hybrid Powertrain Bearings: Bearings optimized for start–stop cycles and regenerative braking applications are an emerging niche.

-

Advanced Coatings: Investments in DLC (diamond-like carbon) and other friction-reducing coatings offer differentiation and performance benefits.

-

Regional Growth: Rapid vehicle production expansion in India, Southeast Asia, and Eastern Europe presents greenfield opportunities.

-

Collaborative R&D: Partnerships between OEMs, bearing specialists, and research institutions to co-develop next-generation materials and designs.

Market Dynamics

-

Customization Trends: Engine makers increasingly demand bespoke bearings tailored to their specific crankshaft geometries and operating profiles.

-

Sustainability Pressures: Suppliers are under pressure to reduce lead content and improve recyclability in bearing manufacturing.

-

Digital Quality Control: Adoption of Industry 4.0–enabled inspection and traceability systems is enhancing product reliability.

-

Supply Chain Localization: OEMs are seeking local bearing sourcing to reduce logistics costs and inventory lead times.

-

Value-Added Services: Vendors are offering engineering support, simulation, and testing services alongside bearing products to deepen customer relationships.

Regional Analysis

-

Asia Pacific: Largest market share, driven by massive vehicle production hubs in China, India, and Southeast Asia; rapid capacity additions in both OEM and aftermarket sectors.

-

North America: Mature market with strong aftermarket activity and OEM collaborations focused on performance and durability enhancements.

-

Europe: Focus on stringent emissions and efficiency standards drives demand for low-friction bearings; high uptake of hybrid powertrains presents new requirements.

-

Latin America: Growing automotive production and fleet age are supporting both OEM and replacement bearing markets; cost sensitivity influences material choices.

-

Middle East & Africa: Nascent but growing demand aligned with expanding assembly plants and increasing vehicle ownership rates.

Competitive Landscape

Leading Companies in the Automotive Engine Bearings Market:

- SKF AB

- Schaeffler AG

- NTN Corporation

- Timken Company

- JTEKT Corporation

- NSK Ltd.

- GKN Automotive Limited

- RBC Bearings Incorporated

- Mahle GmbH

- ILJIN Co., Ltd.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

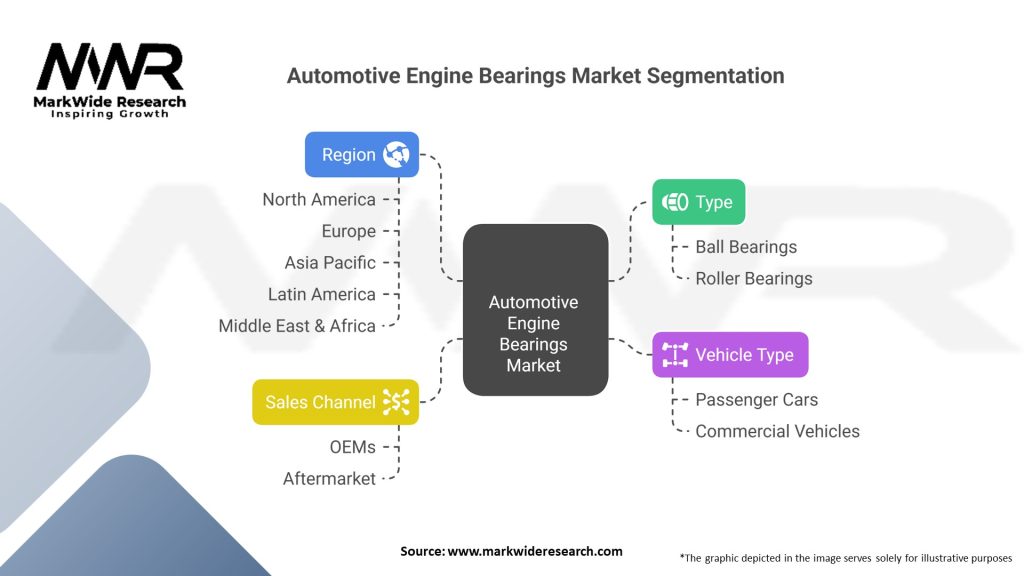

Segmentation

-

By Bearing Type: Main Bearings, Rod Bearings, Thrust Bearings, Camshaft Bearings.

-

By Material: Copper-Lead Alloys, Aluminum Alloys, Tri-Metal Alloys, Polymeric Coatings.

-

By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Off-Highway Equipment.

-

By Distribution Channel: OEM, Aftermarket (Wholesalers, Retailers, E-commerce).

Category-wise Insights

-

Main Bearings: Designed to support the crankshaft’s load and maintain alignment; high-pressure variants are critical in turbocharged and high-output engines.

-

Rod Bearings: Subjected to extreme cyclic loads; advanced surface treatments and alloy compositions are vital for fatigue resistance.

-

Thrust Bearings: Control axial movement of the crankshaft; precision machining and foil-based designs are gaining traction for low-speed load support.

-

Camshaft Bearings: Require tight tolerances to ensure accurate valve timing; polymer-lined bearings offer improved start–stop durability.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Engine Efficiency: Low-friction bearing designs contribute directly to fuel savings and reduced CO₂ emissions.

-

Improved Durability: Advanced materials extend service intervals and lower warranty claims for OEMs and aftermarket service providers.

-

Cost Optimization: Localized production and high-volume coated bearings can drive down per-unit costs.

-

Competitive Differentiation: OEMs can tout superior engine smoothness and reliability when specifying premium bearing technologies.

-

Aftermarket Revenue Streams: Maintenance-heavy fleets and performance upgrade markets provide recurring sales opportunities.

SWOT Analysis

Strengths:

-

Deep expertise in metallurgical engineering and precision manufacturing.

-

Strong OEM alliances and global distribution networks.

Weaknesses:

-

Exposure to raw material price swings.

-

High capital investment for advanced production and coating facilities.

Opportunities:

-

New bearing designs for start–stop and hybrid applications.

-

Expansion into high-growth emerging markets.

Threats:

-

Electric vehicle adoption reducing ICE bearing demand over time.

-

Competitive pressure from low-cost regional producers.

Market Key Trends

-

Lightweighting Initiatives: Development of thinner bearing shells without compromising load capacity to support vehicle weight reduction goals.

-

Ceramic Coatings: Exploration of ceramic-based overlay coatings for ultra-low friction and enhanced wear resistance.

-

Smart Bearings: Early-stage research into embedded sensors for real-time temperature and wear monitoring.

-

Circular Economy Models: Growth in remanufactured bearings and alloy recycling to meet sustainability targets.

-

Rapid Prototyping: Use of additive manufacturing for tooling and small-batch custom bearing geometries.

Covid-19 Impact

The pandemic temporarily disrupted global supply chains, leading to bearing shortages and extended lead times. However, stimulus-driven rebounds in vehicle production, particularly in Asia, quickly restored demand. OEMs accelerated localization efforts to mitigate future risks, and aftermarket players bolstered inventory levels to ensure service continuity for end users.

Key Industry Developments

-

Federal-Mogul’s New Aluminum Alloy: Launch of a next-generation aluminum-based bearing with 20% lower friction coefficient.

-

MAHLE’s Micro-Ceramic Coating: Introduction of a ceramic-enhanced overlay that extends fatigue life by up to 30%.

-

Clevite’s Hybrid Bearing: Debut of polymer-lined camshaft bearings optimized for start–stop engine cycles.

-

Iochpe-Maxion’s Latin America Expansion: Commissioning of a second high-volume plant to serve growing regional demand.

-

Nippon Piston Ring’s Sensor Pilot: Collaboration with an IoT startup to trial bearings with embedded temperature sensors.

Analyst Suggestions

-

Diversify Product Portfolios: Develop specialized bearings for hybrid and turbocharged applications to capture evolving OEM requirements.

-

Invest in Coating Technologies: Prioritize low-friction and wear-resistant coatings that deliver measurable fuel efficiency gains.

-

Expand Aftermarket Channels: Leverage e-commerce platforms and technician training programs to drive replacement sales.

-

Strengthen Regional Footprint: Localize production in high-growth markets to reduce logistics costs and improve responsiveness.

Future Outlook

While the rise of electric vehicles will gradually diminish demand for internal combustion engine bearings, the market is expected to remain healthy for at least the next decade due to sustained ICE production in emerging markets and the retrofit aftermarket. Continued innovation in materials and coatings, coupled with strategic partnerships, will be key to maintaining growth and commanding premium pricing in a competitive landscape.

Conclusion

The Automotive Engine Bearings market stands at the intersection of traditional metallurgical craftsmanship and forward-looking technological innovation. Suppliers who successfully balance cost, performance, and sustainability—while anticipating shifts toward hybrid and electrified powertrains—will be best positioned to capture both OEM and aftermarket opportunities. As engines become more efficient and environmentally compliant, advanced bearing solutions will remain indispensable for ensuring reliability, reducing frictional losses, and meeting the evolving demands of the global automotive industry.