444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Automotive Electronic Logging Device (ELD/E-Log) market is witnessing significant growth as fleet management becomes increasingly crucial for businesses in the transportation industry. ELDs are digital devices designed to monitor and record a driver’s hours of service (HOS) electronically, replacing traditional paper logs. These devices offer a range of benefits, including improved compliance with government regulations, enhanced efficiency, and increased safety.

Meaning

An Electronic Logging Device (ELD) is a piece of hardware that connects to a vehicle’s engine and records data related to driving hours, duty status, and other relevant information. It replaces manual paper logbooks, automating the process of HOS recording and making it more accurate and reliable. ELDs are typically equipped with GPS technology, allowing fleet managers to track and monitor vehicle locations and driver activities in real-time.

Executive Summary

The Automotive Electronic Logging Device (ELD/E-Log) market is experiencing rapid growth due to the increasing demand for efficient fleet management solutions. The implementation of ELDs has become mandatory in many countries to ensure compliance with regulations and to promote road safety. As a result, the market is witnessing a surge in the adoption of ELDs across various industry verticals.

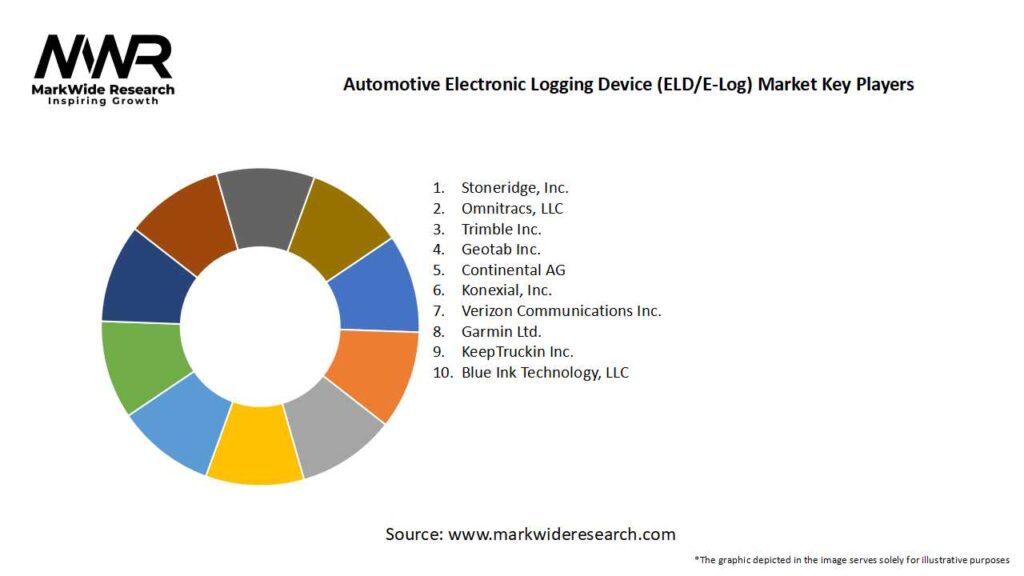

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Automotive Electronic Logging Device (ELD/E-Log) market is dynamic, driven by a combination of regulatory requirements, technological advancements, and industry trends. The market is witnessing a shift towards cloud-based platforms, data analytics, and integration with other fleet management systems. Additionally, partnerships and collaborations between ELD manufacturers, software developers, and fleet operators are fostering innovation and driving market growth.

Regional Analysis

The Automotive Electronic Logging Device (ELD/E-Log) market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share, primarily due to the early adoption of ELD regulations in the region. Europe is also experiencing substantial growth, driven by the enforcement of similar regulations and increasing focus on road safety. The Asia Pacific region, with its expanding transportation and logistics sector, presents immense growth potential for ELD manufacturers.

Competitive Landscape

Leading Companies in the Automotive Electronic Logging Device (ELD/E-Log) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

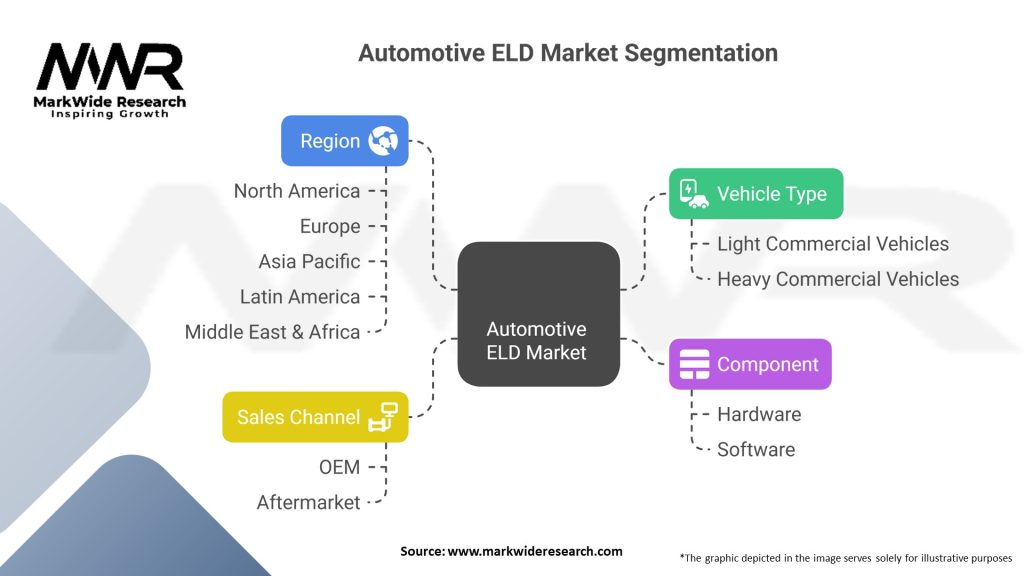

Segmentation

The market can be segmented based on the type of ELDs, including plug-and-play devices, hardwired devices, and mobile applications. Plug-and-play devices are the most commonly used ELDs due to their ease of installation and compatibility with different vehicle types. Hardwired devices offer a more permanent solution with advanced features. Mobile applications, leveraging smartphones or tablets, provide flexibility and cost-effectiveness for small-scale fleet operators.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the Automotive Electronic Logging Device (ELD/E-Log) market. While the initial phase of the pandemic caused disruptions in supply chains and reduced demand for non-essential goods, the subsequent recovery and increased focus on essential services like transportation and logistics have boosted the demand for ELDs. The pandemic has also highlighted the importance of contactless operations and efficient fleet management, further driving the adoption of ELDs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Automotive Electronic Logging Device (ELD/E-Log) market is poised for substantial growth in the coming years. Increasing government regulations, growing emphasis on road safety, and the need for efficient fleet management solutions will continue to drive market expansion. Integration with telematics and IoT technologies, as well as the emergence of advanced analytics and predictive maintenance, will shape the future of the market.

Conclusion

The Automotive Electronic Logging Device (ELD/E-Log) market is witnessing significant growth, driven by the increasing demand for efficient fleet management and compliance with government regulations. ELDs offer numerous benefits, including improved safety, enhanced efficiency, and streamlined operations. While implementation costs and data security concerns pose challenges, advancements in technology and the integration of ELDs with telematics and IoT hold promising opportunities for market players. As the market evolves, continuous innovation and strategic partnerships will be key to staying ahead in this dynamic and transformative industry.

What is an Automotive Electronic Logging Device (ELD/E-Log)?

An Automotive Electronic Logging Device (ELD/E-Log) is a technology used to automatically record driving hours and vehicle data, ensuring compliance with regulations for commercial drivers. It helps in tracking vehicle location, engine hours, and driver behavior, enhancing safety and efficiency in the transportation industry.

Who are the key players in the Automotive Electronic Logging Device (ELD/E-Log) market?

Key players in the Automotive Electronic Logging Device (ELD/E-Log) market include Omnicomm, Geotab, KeepTruckin, and Teletrac Navman, among others.

What are the main drivers of growth in the Automotive Electronic Logging Device (ELD/E-Log) market?

The growth of the Automotive Electronic Logging Device (ELD/E-Log) market is driven by increasing regulatory requirements for driver compliance, the need for improved fleet management, and advancements in telematics technology. These factors contribute to enhanced operational efficiency and safety in the transportation sector.

What challenges does the Automotive Electronic Logging Device (ELD/E-Log) market face?

The Automotive Electronic Logging Device (ELD/E-Log) market faces challenges such as the high cost of implementation for small fleets, resistance to change from traditional logging methods, and concerns over data privacy and security. These issues can hinder widespread adoption among smaller operators.

What opportunities exist in the Automotive Electronic Logging Device (ELD/E-Log) market?

Opportunities in the Automotive Electronic Logging Device (ELD/E-Log) market include the integration of artificial intelligence for predictive analytics, expansion into emerging markets, and the development of more user-friendly interfaces. These advancements can enhance the functionality and appeal of ELDs to a broader range of users.

What trends are shaping the Automotive Electronic Logging Device (ELD/E-Log) market?

Trends in the Automotive Electronic Logging Device (ELD/E-Log) market include the increasing adoption of cloud-based solutions, the rise of mobile applications for real-time tracking, and the integration of ELDs with other fleet management systems. These trends are transforming how fleets operate and manage compliance.

Automotive Electronic Logging Device (ELD/E-Log) Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Light Commercial Vehicles, Heavy Commercial Vehicles |

| Component | Hardware, Software |

| Sales Channel | OEM, Aftermarket |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Electronic Logging Device (ELD/E-Log) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at