444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global Automotive Electric Motors market has been growing at a steady pace in recent years, and is expected to continue doing so in the coming years as well. Electric motors are increasingly being used in the automotive industry as they provide several advantages over traditional internal combustion engines, such as greater efficiency, lower emissions, and better performance.

Electric motors are used in a wide range of automotive applications, including power steering systems, cooling fans, and brake systems. They are also used in electric vehicles, hybrid vehicles, and plug-in hybrid vehicles.

According to a report by MarketsandMarkets, the global Automotive Electric Motors market is projected to grow from $19.4 billion in 2020 to $25.4 billion by 2025, at a CAGR of 5.5% during the forecast period.

Meaning

An electric motor is a device that converts electrical energy into mechanical energy. Automotive electric motors are used in vehicles to provide motion or rotation to various components, such as wheels, pumps, fans, and compressors. They work by using a magnetic field to produce a rotational force, which is then used to drive the component.

Electric motors are increasingly being used in the automotive industry as they provide several advantages over traditional internal combustion engines. They are more efficient, have lower emissions, and provide better performance. Electric motors are also more reliable and require less maintenance than traditional engines.

Executive Summary

The global Automotive Electric Motors market is expected to grow at a steady pace in the coming years, driven by the increasing demand for electric vehicles and the adoption of electric motors in various automotive applications. The market is projected to grow from $19.4 billion in 2020 to $25.4 billion by 2025, at a CAGR of 5.5% during the forecast period.

The key market drivers include the growing demand for electric vehicles, increasing concerns over emissions and fuel efficiency, and the adoption of electric motors in various automotive applications. The market restraints include the high cost of electric motors and the lack of charging infrastructure for electric vehicles.

The market opportunities include the development of new and innovative electric motors, the increasing demand for hybrid and plug-in hybrid vehicles, and the adoption of electric motors in emerging markets. The market dynamics include the changing regulatory environment, the increasing competition among market players, and the growing focus on research and development.

The regional analysis shows that Asia-Pacific is the largest market for Automotive Electric Motors, followed by Europe and North America. The competitive landscape of the market is highly fragmented, with several players operating in the market. The market segmentation is based on type, application, and region.

The key benefits for industry participants and stakeholders include the increased demand for electric vehicles, the growing focus on reducing emissions and improving fuel efficiency, and the adoption of electric motors in various automotive applications. The SWOT analysis shows that the market has several strengths, weaknesses, opportunities, and threats.

The key industry developments include the development of new and innovative electric motors, the increasing adoption of electric motors in various automotive applications, and the growing focus on research and development. The Covid-19 pandemic has had a significant impact on the market, with the demand for electric vehicles and electric motors being affected.

The analyst suggestions include the development of new and innovative electric motors, the increasing focus on research and development, and the adoption of electric motors in emerging markets. The future outlook for the market is positive, with the market expected to grow at a steady pace in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Premium BEVs predominantly use high-performance PMSMs for superior power density and efficiency, whereas mainstream models are increasingly adopting induction motors or SRMs to reduce reliance on rare-earth materials.

China remains the largest market by production volume, supported by government incentives and domestic supply chains for magnets, silicon steel, and power electronics.

Europe and North America are witnessing accelerated deployment of localized motor assembly plants to mitigate supply-chain risks and comply with local content regulations.

Vertical integration—where automakers develop in-house motor capabilities—is rising, as seen in announcements by major OEMs aiming to reduce module costs and protect intellectual property.

Market Drivers

Emission Regulations: Global CO₂ targets and ICE bans are propelling automakers to electrify entire fleets, directly increasing motor demand.

Declining Battery Costs: Lower battery pack prices improve EV affordability, stimulating broader consumer adoption and volume growth for electric motors.

Performance Expectations: Electric motors deliver instant torque and quiet operation, driving consumer preference for EVs over conventional vehicles.

Government Incentives: Subsidies, tax credits, and infrastructure investments in key markets accelerate EV sales and associated motor requirements.

Supply-Chain Localization: National policies encouraging domestic production of critical components lead to new motor plant investments.

Market Restraints

Raw Material Volatility: Fluctuating prices and geopolitical concentration of rare-earth elements pose cost and supply risks.

Manufacturing Complexity: Precision winding, magnet insertion, and thermal management add production complexity and capital expenditure.

Technical Standardization: Diverse motor architectures hinder economies of scale compared to standardized ICE powertrains.

Grid Infrastructure: Inadequate charging infrastructure may slow EV adoption, indirectly impacting motor unit growth.

Competition from Alternative Drive Systems: Emerging technologies like in-wheel motors and axial flux designs must overcome integration challenges.

Market Opportunities

Next-Gen Materials: Development of low-cost ferrite magnets and high-strength silicon steel can reduce dependency on rare-earth magnets.

Integrated Drive Modules: Combining motor, inverter, and gearbox into compact e-axle units offers weight savings and simplified assembly.

Advanced Cooling Solutions: Innovations in liquid-cooling and heat-pipe technologies enable higher continuous power ratings.

Aftermarket Retrofits: Conversion kits for legacy vehicles present a niche but growing segment, especially in commercial fleets.

Service & Maintenance Models: Predictive maintenance and remote diagnostics for electric motors create value-added revenue streams.

Market Dynamics

Strategic Alliances: OEM-supplier collaborations accelerate development cycles and share investment risk for next-gen motor platforms.

Technological Convergence: Integration of power electronics, software controls, and motor design optimizes efficiency and performance.

Circular Economy Initiatives: Recycling programs for magnet materials and motor components support sustainability goals.

Customization vs. Standardization: Balancing bespoke motor designs for flagship models against modular platforms for high-volume segments.

Digital Manufacturing: AI-driven quality control and Industry 4.0 practices improve yield rates and reduce downtime.

Regional Analysis

Asia Pacific: Dominant share led by China’s volume production and government-backed EV programs; India emerging with nascent EV policies.

Europe: Strong growth through OEM investments in local e-motor plants; EU’s Green Deal drives high electrification targets.

North America: Rising domestic manufacturing driven by US Inflation Reduction Act incentives and Canada’s push for battery/motor supply chains.

Latin America: Slow but steady growth; partnerships with Chinese motor makers to establish assembly lines.

Middle East & Africa: Pilot projects in Gulf states focusing on fleet electrification, creating early opportunities for premium motor suppliers.

Competitive Landscape

Leading Companies in the Automotive Electric Motors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

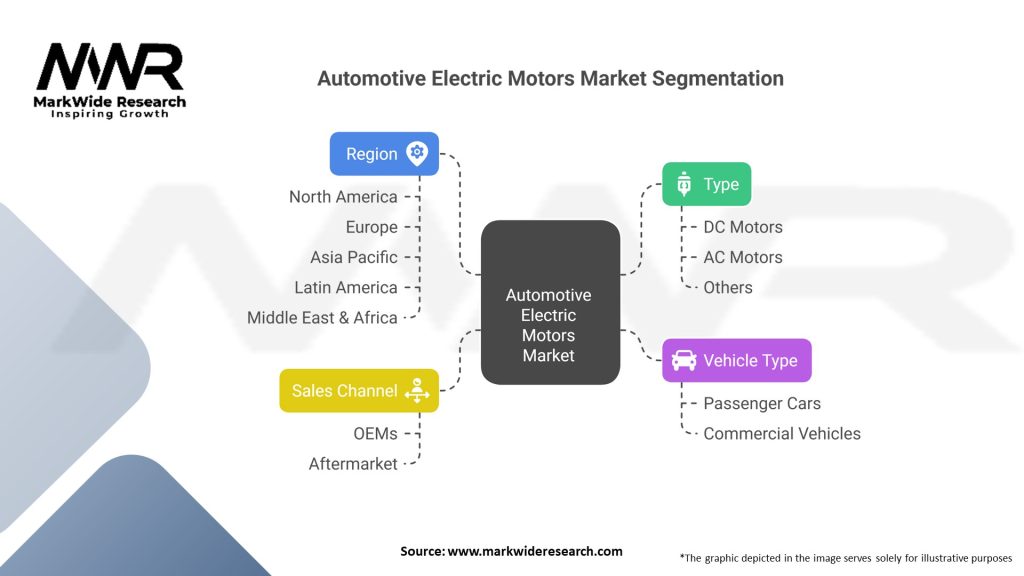

Segmentation

Motor Type: Permanent Magnet Synchronous Motors, Induction Motors, Switched Reluctance Motors, Axial Flux Motors.

Vehicle Type: Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles.

Output Power: <50 kW, 50–150 kW, >150 kW.

End User: OEMs, Aftermarket.

Category-wise Insights

PMSMs: Offer highest power density and efficiency but depend on rare-earth magnets; ideal for premium performance EVs.

Induction Motors: Lower material costs and robust design; favored in mass-market BEVs such as early Tesla models.

Switched Reluctance Motors: Eliminate magnets entirely, reducing raw-material risk but require advanced control to manage torque ripple.

Axial Flux Motors: Deliver ultra-high torque density in compact form factors; emerging in performance EV applications.

Key Benefits for Industry Participants and Stakeholders

Enhanced Vehicle Efficiency: High-efficiency motors extend driving range and reduce energy consumption.

Cost Optimization: Scalable manufacturing and standardized platforms lower unit costs as volumes ramp.

Regulatory Compliance: Meeting stringent CO₂ and emissions targets through full vehicle electrification.

Innovation Leadership: Collaborations on next-gen motor technologies strengthen competitive positioning.

Sustainability: Circular design and recycling programs support ESG objectives and reduce lifecycle impact.

SWOT Analysis

Strengths:

Rapid adoption driven by global electrification mandates.

Technological maturity of PMSMs and induction motors.

Weaknesses:

Supply-chain vulnerability for rare-earth elements.

High capital intensity for new production facilities.

Opportunities:

Emergence of alternative motor topologies (SRM, axial flux).

Expansion into retrofit and small commercial EV segments.

Threats:

Competition from emerging in-wheel and direct-drive architectures.

Potential regulatory changes in material sourcing and recycling.

Market Key Trends

Magnet-Light Designs: Reducing rare-earth usage via optimized magnetic circuits and alternative materials.

Integrated E-Axles: Bundling motor, inverter, and gearbox into single units for easier assembly.

Digital Twins: Virtual modeling of motor performance and life-cycle management for predictive maintenance.

High-Speed Motors: Designing ultra-compact, high-RPM motors to reduce torque-to-weight ratio and improve packaging.

Modular Platforms: Standard motor cores that can be scaled for various power and torque requirements.

Covid-19 Impact

Supply-chain disruptions during the pandemic highlighted dependency on overseas magnet supply, prompting OEMs to diversify sources and invest in local production. Temporary plant shutdowns delayed motor deliveries, but incentives and pent-up consumer demand accelerated EV rollouts once restrictions eased. Many manufacturers fast-tracked digitalization efforts to maintain quality and output during remote-working conditions.

Key Industry Developments

Tesla’s In-House Motor Rollout: Introduction of new axial flux motor design for Model Y, signaling shift towards proprietary motor technology.

Nidec’s Acquisition of Regal Beloit’s Motors Division: Expanded automotive motor portfolio and North American manufacturing footprint.

Bosch’s Low-Rare Earth Motor Launch: Field-weakening control and optimized rotor design reduce neodymium usage by over 50%.

Continental’s E-Axle Platform Expansion: New modular series supporting 100–200 kW outputs for midsize EV segments.

Magneti Marelli’s Launch of Compact Induction Motor: Targeted at cost-sensitive urban EVs with simplified cooling and reduced weight.

Analyst Suggestions

Diversify Magnet Sources: Secure supply agreements for ferrite and low-rare-earth alternatives to mitigate geopolitical risks.

Invest in Alternative Topologies: Pilot SRM and axial flux programs to build expertise ahead of commercialization waves.

Strengthen Vertical Integration: Develop in-house motor R&D and small-scale production to protect IP and incorporate rapid innovation.

Collaborate on Recycling Technologies: Partner with material recyclers to establish closed-loop magnet and copper recovery.

Future Outlook

The Automotive Electric Motors market is expected to grow at a high CAGR through 2030 as EV penetration exceeds 30% of global new vehicle sales. Breakthroughs in magnet materials, manufacturing automation, and integrated drive modules will drive down system costs and open new applications in commercial fleets, two-wheelers, and marine propulsion. OEMs that balance proprietary innovation with strategic partnerships will capture the greatest value in this evolving ecosystem.

Conclusion

The shift to electric mobility is irrevocably transforming the Automotive Electric Motors market. Through continuous innovation in motor topologies, materials, and manufacturing, stakeholders can meet the dual imperatives of performance and sustainability. Those who invest in resilient supply chains, modular platforms, and circular economy practices will lead the electrified future, delivering efficient, cost-effective, and eco-friendly propulsion solutions.

What is Automotive Electric Motors?

Automotive electric motors are devices that convert electrical energy into mechanical energy to drive vehicles. They are essential components in electric and hybrid vehicles, providing propulsion and enabling various functionalities.

What are the key players in the Automotive Electric Motors market?

Key players in the Automotive Electric Motors market include Tesla, Bosch, and Siemens, among others. These companies are involved in the design and manufacturing of electric motors for various automotive applications.

What are the main drivers of growth in the Automotive Electric Motors market?

The growth of the Automotive Electric Motors market is driven by the increasing demand for electric vehicles, advancements in battery technology, and the push for sustainable transportation solutions. Additionally, government regulations promoting electric mobility contribute to market expansion.

What challenges does the Automotive Electric Motors market face?

The Automotive Electric Motors market faces challenges such as high production costs, limited charging infrastructure, and competition from traditional internal combustion engine vehicles. These factors can hinder the widespread adoption of electric motors in the automotive sector.

What opportunities exist in the Automotive Electric Motors market?

Opportunities in the Automotive Electric Motors market include the development of more efficient and compact motor designs, integration with renewable energy sources, and the expansion of electric vehicle models. These trends can enhance market growth and innovation.

What are the current trends in the Automotive Electric Motors market?

Current trends in the Automotive Electric Motors market include the rise of autonomous electric vehicles, advancements in motor control technologies, and increased investment in electric vehicle infrastructure. These trends are shaping the future of automotive transportation.

Automotive Electric Motors Market:

| Segmentation | Details |

|---|---|

| Type | DC Motors, AC Motors, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Sales Channel | OEMs, Aftermarket |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Electric Motors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at