444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global Automotive Dynamic Spotlight market has witnessed significant growth in recent years. Automotive dynamic spotlights are advanced lighting systems that help drivers see objects on the road at night or in low light conditions. They are an essential safety feature in modern vehicles and have become increasingly popular among car buyers worldwide.

The market for Automotive Dynamic Spotlights is projected to continue to grow in the coming years, primarily driven by the growing demand for advanced safety features in vehicles. According to market research, the global automotive dynamic spotlight market was valued at USD 1.36 billion in 2020 and is expected to reach USD 3.32 billion by 2028, at a CAGR of 12.0% during the forecast period of 2021-2028.

Meaning of Automotive Dynamic Spotlight

Automotive dynamic spotlights are a type of advanced lighting system used in vehicles to provide improved visibility in low light conditions. They use advanced technologies such as LED and laser to provide a more focused and brighter beam of light that helps drivers see objects on the road more clearly. These spotlights are also designed to move with the direction of the vehicle to ensure that the beam of light is always focused on the road ahead.

Executive Summary

The global Automotive Dynamic Spotlight market is experiencing significant growth, primarily driven by the increasing demand for advanced safety features in vehicles. The market is projected to continue to grow in the coming years, driven by the growing popularity of advanced lighting systems in modern vehicles.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Adoption of LED-based dynamic spotlights is outpacing traditional xenon systems due to superior energy efficiency, longer lifespan, and compact form factors.

Integration with ADAS features, such as camera-based high-beam control and pedestrian recognition, is driving system complexity and value.

Cost parity between basic adaptive lighting and static LED headlamps is narrowing, encouraging uptake even in mid-segment vehicles.

Regulatory changes—such as ECE R123 in Europe—have standardized performance requirements, giving automakers confidence to deploy advanced lighting across model ranges.

Market Drivers

Safety Regulations: Stricter headlamp performance standards and requirements for glare control are compelling OEMs to adopt dynamic lighting.

Technological Advancements: Progress in high-power LEDs, miniaturized optics, and real-time sensor integration is making dynamic spotlights more reliable and affordable.

Consumer Demand: Buyers increasingly associate advanced lighting with premium features and improved nighttime comfort, boosting sales of vehicles equipped with adaptive headlamps.

Electric Vehicle Integration: EVs benefit from the energy efficiency of LED dynamic spotlights, aligning with their low-power consumption ethos and supporting extended range.

Autonomous Driving: Dynamic spotlights play a key role in ensuring sensor visibility and safety during low-light autonomous operations, making them integral to self-driving platforms.

Market Restraints

High System Cost: Despite falling LED prices, the inclusion of sensors, control modules, and complex optics still adds significant cost compared to standard lighting.

Integration Complexity: Synchronizing dynamic spotlights with multiple vehicle sensors and ECUs increases development time and validation requirements.

Regulatory Variations: Differing headlamp regulations across regions can complicate global rollouts, necessitating region-specific calibrations.

Aftermarket Limitations: Complex adaptive lighting systems are difficult to retrofit, limiting aftermarket growth and focusing adoption through OEM channels.

Maintenance Challenges: Repairing or recalibrating dynamic spotlight modules can be more expensive and time-consuming than conventional headlamps.

Market Opportunities

Mid-Tier Vehicle Penetration: As component costs decline, dynamic spotlights can transition from luxury models into mainstream segments, creating high-volume opportunities.

Software Upgrades: Over-the-air software enhancements can enable new beam-pattern features and adaptive algorithms, offering recurring revenue streams.

Connected Services: Integration with navigation data and cloud-based lighting profiles can allow context-aware illumination—e.g., adjusting for weather or roadwork zones.

Aftermarket Diagnostics: Development of specialized service tools and calibration kits can open aftermarket revenue channels for repair shops and dealers.

Emerging Markets: Growing vehicle production and rising road-safety awareness in regions such as Southeast Asia and Latin America present new adoption frontiers.

Market Dynamics

Platform Consolidation: OEMs are standardizing modular lighting architectures that support both static and dynamic modules, reducing complexity and cost.

Partnership Ecosystems: Collaborations between car manufacturers, lighting specialists (e.g., OSRAM, Valeo), and sensor providers are accelerating innovation cycles.

Shift to Digital Matrix: Transition from mechanical shutters to digital matrix LED technology is enabling finer beam control and faster response times.

Niche Differentiation: Brands are leveraging bespoke beam signatures and welcome-light animations as brand identifiers, adding marketing value.

Sustainability Focus: Lifecycle assessments increasingly favor energy-efficient dynamic spotlights over legacy systems, aligning with automotive ESG goals.

Regional Analysis

Europe: The most mature market, driven by ECE regulations and early consumer acceptance of adaptive headlights. Germany, the UK, and France lead in penetration rates.

North America: Growing adoption following the acceptance of adaptive driving beam (ADB) systems under FMVSS standards; premium segments show highest uptake.

Asia Pacific: China spearheads growth as local OEMs integrate dynamic lighting into EV and luxury models; Japan and South Korea follow with strong R&D footprints.

Latin America: Emerging interest in higher-end models, though cost sensitivity delays widespread adoption; regulatory harmonization may accelerate growth.

Middle East & Africa: Premium imports drive niche uptake, but infrastructure and cost considerations limit broader implementation.

Competitive Landscape

Leading Companies in the Automotive Dynamic Spotlight Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

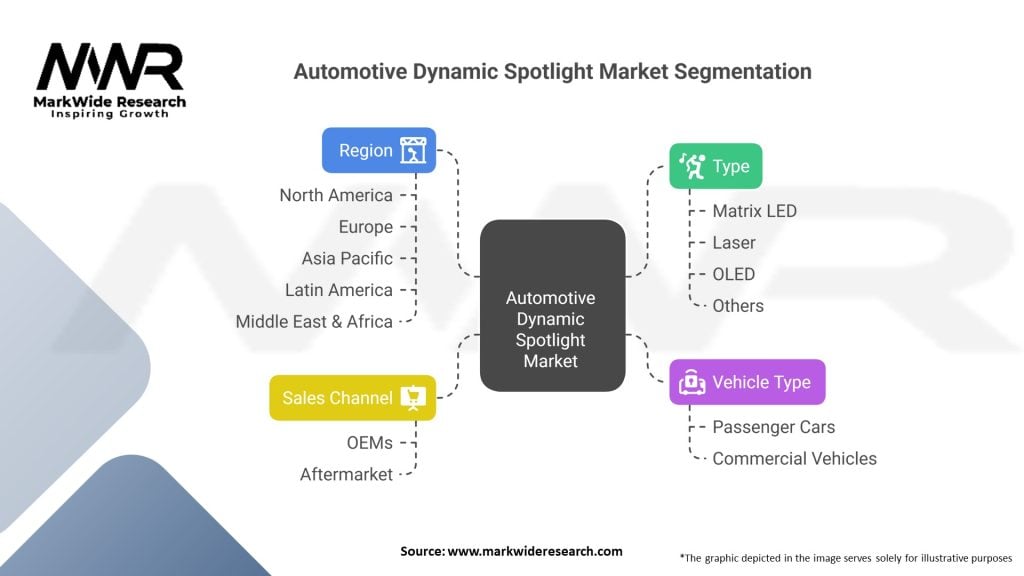

Segmentation

Technology: Mechanical Adaptive Headlamps, Digital Matrix LED Headlamps, Laser-Assisted Spotlights.

Vehicle Type: Passenger Cars, Commercial Vehicles, Electric Vehicles, Two-Wheelers.

Distribution Channel: OEM Fitments, Aftermarket Replacements.

Region: Europe, North America, Asia Pacific, Latin America, Middle East & Africa.

Category-wise Insights

Mechanical Adaptive Headlamps: Utilize stepper motors or swivel mechanisms to physically redirect beams; well-proven but slower response and bulkier than digital variants.

Digital Matrix LED Headlamps: Employ individually addressable LEDs and micro-optics to create complex beam patterns with rapid adaptation and fine shading control.

Laser-Assisted Spotlights: Combine laser diodes with phosphor converters for extremely long-range beams, suitable for high-speed applications and auxiliary driving lights.

Key Benefits for Industry Participants and Stakeholders

Enhanced Safety: Improved detection of pedestrians, cyclists, and obstacles through optimized illumination reduces nighttime accident rates.

Competitive Differentiation: Cutting-edge lighting serves as a premium value proposition and brand-building feature.

Energy Efficiency: LED and laser systems consume less power, supporting EV range and reducing overall vehicle energy draw.

Regulatory Compliance: Meeting or exceeding global glare-control and headlamp performance standards mitigates homologation risks.

After-Sales Revenue: Calibration, diagnostics, and module replacement services foster recurring service income for dealerships and workshops.

SWOT Analysis

Strengths:

Superior driver visibility and safety enhancement.

Integration potential with ADAS and autonomous driving systems.

Weaknesses:

Higher upfront cost versus conventional headlights.

Complexity in calibration and repair processes.

Opportunities:

Expansion into mainstream vehicle segments as costs decline.

Software-driven feature upgrades offering subscription models.

Threats:

Regulatory delays in some markets can stall deployments.

Rising competition from lower-cost regional suppliers.

Market Key Trends

Software-Defined Lighting: Over-the-air updates unlock new beam patterns and animations post-purchase, extending system relevance.

Integrated Sensor Fusion: Merging camera, radar, and LIDAR inputs to refine beam adjustments for maximal safety and comfort.

Personalized Beam Signatures: Brands crafting unique light signatures for daytime running lights and beam patterns as identity markers.

Eco-Friendly Materials: Shift toward recyclable plastics and low-VOC coatings for headlamp housings in line with sustainability goals.

Collaborative Standardization: Industry alliances working on interoperable adaptive lighting protocols to ease global rollouts.

Covid-19 Impact

During the Covid-19 pandemic, vehicle production slowdowns and supply chain disruptions delayed some new lighting system introductions. However, as consumer focus shifted to personal mobility and vehicle features that improve safety, pent-up demand for advanced technologies—including dynamic spotlights—helped accelerate adoption once production resumed. The crisis also prompted suppliers to diversify sourcing and localize production to mitigate future disruptions.

Key Industry Developments

Valeo’s PureBeam™ Launch: Introduction of a full-matrix LED module with integrated front-camera sensing and five-millisecond response times.

OSRAM-Hella Partnership: Jointly developing laser-enhanced digital matrix headlamps for next-generation EV platforms.

Magneti Marelli’s Aftermarket Program: Rolling out retrofit kits with self-calibrating dynamic modules, enabling older vehicles to upgrade safety features.

Koito’s Long-Range Laser Spotlight: Unveiling a laser-phosphor headlamp capable of illuminating up to 600 meters, targeted at premium SUVs and sports cars.

Regulatory Milestone: Japan’s MLIT approval of digital matrix LED systems for left-hand and right-hand drive interoperability, simplifying exports.

Analyst Suggestions

Invest in Modular Architectures: Develop adaptable platforms that support both mechanical and digital lighting variants to reduce development costs.

Leverage Software Services: Monetize lighting systems post-sale through feature subscriptions, over-the-air updates, and branded beam animations.

Strengthen Aftermarket Channels: Build partnerships with service networks to offer calibration and retrofit solutions, expanding revenue beyond OEM fitments.

Focus on Emerging Regions: Tailor cost-optimized dynamic spotlight offerings for growth markets, pairing them with localized support and training.

Future Outlook

The Automotive Dynamic Spotlight market is projected to grow at a robust CAGR through 2030, driven by falling LED and sensor costs, widespread ADAS integration, and evolving safety regulations. As electric and autonomous vehicles proliferate, dynamic lighting will transition from optional premium equipment to standard safety infrastructure. Continuous innovation in optics, control algorithms, and software services will further enrich user experiences and open new business models around personalized lighting and remote feature enhancements.

Conclusion

Automotive dynamic spotlights have evolved from niche luxury options into critical safety and comfort features that underpin modern vehicle design. By intelligently shaping and directing light, these systems enhance nighttime visibility, reduce collision risks, and support advanced driver-assistance and autonomous functions. As the market matures, stakeholders who prioritize modular architectures, software-driven innovation, and strategic partnerships will capture the greatest value in this rapidly expanding segment of the automotive lighting industry.

What is Automotive Dynamic Spotlight?

Automotive Dynamic Spotlight refers to advanced lighting systems in vehicles that adaptively adjust the direction and intensity of light based on driving conditions, enhancing visibility and safety. These systems often utilize technologies such as LED and laser lighting to provide dynamic illumination.

What are the key players in the Automotive Dynamic Spotlight market?

Key players in the Automotive Dynamic Spotlight market include companies like Hella, Osram, and Valeo, which are known for their innovative lighting solutions. These companies focus on developing adaptive lighting technologies that improve road safety and driving experience, among others.

What are the main drivers of growth in the Automotive Dynamic Spotlight market?

The growth of the Automotive Dynamic Spotlight market is driven by increasing consumer demand for enhanced safety features in vehicles, advancements in lighting technology, and the rising adoption of electric vehicles that require efficient lighting solutions. Additionally, regulatory requirements for improved vehicle visibility contribute to market expansion.

What challenges does the Automotive Dynamic Spotlight market face?

The Automotive Dynamic Spotlight market faces challenges such as high development costs associated with advanced lighting technologies and the complexity of integrating these systems into existing vehicle designs. Additionally, competition from traditional lighting solutions can hinder market penetration.

What opportunities exist in the Automotive Dynamic Spotlight market?

Opportunities in the Automotive Dynamic Spotlight market include the growing trend of autonomous vehicles, which require sophisticated lighting systems for navigation and safety. Furthermore, the increasing focus on energy-efficient lighting solutions presents avenues for innovation and market growth.

What trends are shaping the Automotive Dynamic Spotlight market?

Trends in the Automotive Dynamic Spotlight market include the integration of smart lighting systems that can communicate with other vehicle technologies and the development of customizable lighting features for enhanced user experience. Additionally, the shift towards sustainable materials in lighting design is gaining traction.

Automotive Dynamic Spotlight Market:

| Segmentation | Details |

|---|---|

| Type | Matrix LED, Laser, OLED, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Sales Channel | OEMs, Aftermarket |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Dynamic Spotlight Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at