444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global Automotive Driver State Monitoring Systems market is expected to grow significantly in the coming years. Automotive Driver State Monitoring Systems (DSMS) is a rapidly growing technology that helps drivers stay alert and focused while driving. It uses various sensors and cameras to monitor the driver’s state, including their eye movement, head position, and other factors. The technology can also detect fatigue and drowsiness in drivers, alerting them to take a break before continuing their journey.

The market for Automotive Driver State Monitoring Systems is primarily driven by the increasing demand for advanced safety features in vehicles. Governments around the world have imposed strict regulations to ensure that cars are equipped with advanced safety features to reduce the number of accidents on the roads. As a result, the market for Automotive Driver State Monitoring Systems is expected to witness significant growth in the coming years.

Meaning

Driver State Monitoring Systems are a set of technologies that are used to monitor the driver’s condition while driving. The system includes various sensors and cameras that can detect the driver’s eye movement, head position, and other factors. The technology can also detect fatigue and drowsiness in drivers, alerting them to take a break before continuing their journey.

The Automotive Driver State Monitoring Systems market is primarily driven by the increasing demand for advanced safety features in vehicles. Governments around the world have imposed strict regulations to ensure that cars are equipped with advanced safety features to reduce the number of accidents on the roads. As a result, the market for Automotive Driver State Monitoring Systems is expected to witness significant growth in the coming years.

Executive Summary

The global Automotive Driver State Monitoring Systems market is expected to grow significantly in the coming years. The market for Automotive Driver State Monitoring Systems is primarily driven by the increasing demand for advanced safety features in vehicles. The technology can also detect fatigue and drowsiness in drivers, alerting them to take a break before continuing their journey. The Automotive Driver State Monitoring Systems market is expected to witness significant growth in the coming years.

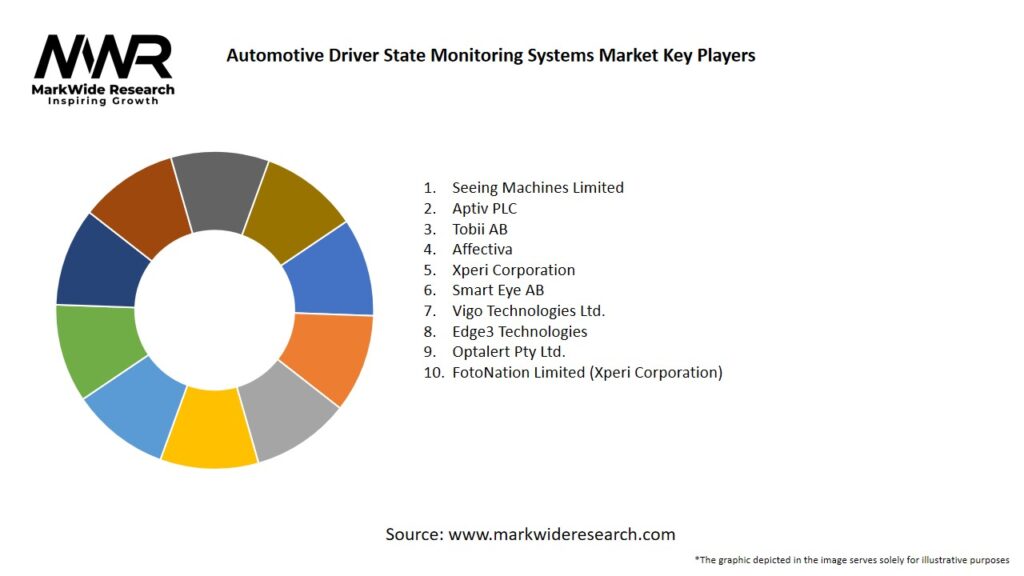

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

New regulation mandates (e.g., UNECE R157 in Europe) require DSMS for all new passenger cars, creating a large addressable market.

Infrared-based eye-tracking cameras remain the most widely implemented sensing modality due to reliability in low-light conditions.

Edge-AI deployments allow on-board processing, minimizing latency and privacy concerns compared to cloud-based solutions.

Integration of DSMS with Advanced Driver Assistance Systems (ADAS) and Level 2+ automated driving functions is increasingly common.

Cost optimization through SoC integration is enabling DSMS inclusion in vehicles priced under €25,000.

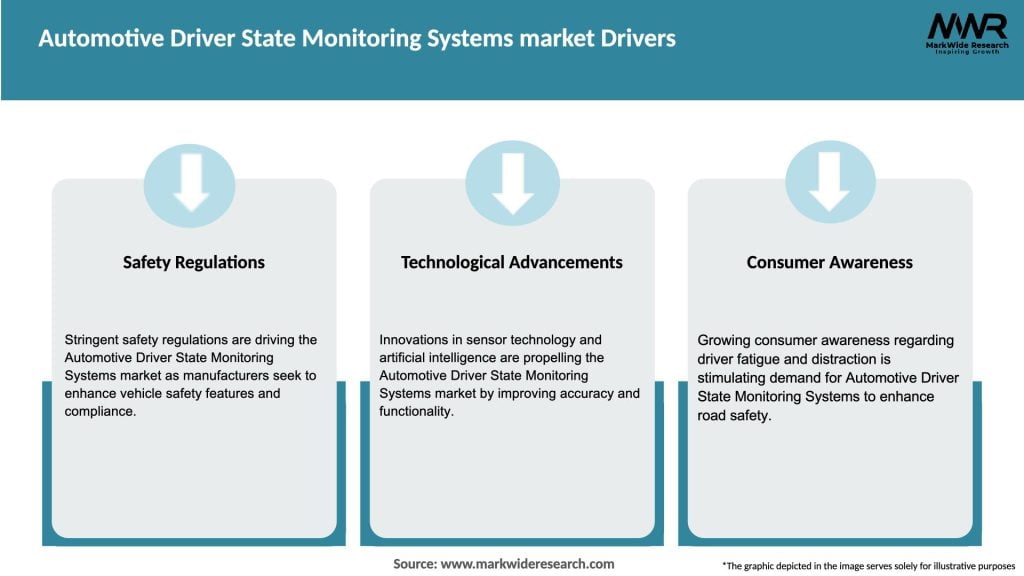

Market Drivers

Regulatory Mandates: UNECE R157 (Europe), NHTSA guidelines (USA), and China’s MEPV requirements are driving mandatory DSMS installations.

Safety Consciousness: Consumers and fleet operators demand advanced safety features to reduce crash risk associated with driver fatigue and distraction.

Technological Maturation: Improvements in CMOS sensor sensitivity, low-power edge-AI processors, and robust algorithms have enhanced detection accuracy.

OEM Differentiation: Automakers leverage DSMS as a value-added feature to strengthen brand positioning and justify premium pricing.

Autonomous Vehicle Transition: As vehicles progress toward higher automation levels, continuous driver monitoring remains critical to safety handover protocols.

Market Restraints

Privacy Concerns: Drivers may resist in-cabin cameras due to data privacy and surveillance apprehensions, necessitating strict GDPR/HIPAA-compliant data handling.

Integration Complexity: Seamless DSMS integration with existing ADAS architectures requires significant software and hardware coordination, extending development cycles.

Environmental Variability: Harsh lighting, occlusions (e.g., sunglasses, hats), and diverse seating ergonomics can impact detection reliability.

Cost Pressure: Entry-level vehicle segments may prioritize basic ADAS over DSMS if component costs cannot be sufficiently reduced.

User Acceptance: False positives (unnecessary alerts) can lead to driver annoyance and system deactivation, undermining effectiveness.

Market Opportunities

Fleet Management Services: Telematics providers can integrate DSMS data to monitor driver behavior, reduce liability, and optimize insurance premiums.

Aftermarket Solutions: Affordable DSMS retrofit kits for older vehicles present a sizable secondary market, especially in emerging economies.

Multimodal Health Monitoring: Expanding DSMS to detect medical emergencies (e.g., heart attacks) through pulse and respiration analysis opens new value propositions.

Subscription Models: OEMs and tier-1 suppliers can offer DSMS as a software-as-a-service upgrade, unlocking recurring revenue streams.

Cross-Industry Partnerships: Collaborations with mobile device manufacturers and chipmakers can accelerate sensor miniaturization and AI pipeline efficiency.

Market Dynamics

Sensor Fusion Advances: Merging camera data with steering-wheel grip sensors and seat-pressure mats boosts robustness against occlusion and lighting challenges.

AI Algorithm Evolution: Deep learning models trained on diverse demographic datasets improve detection across age, ethnicity, and facial accessories.

Data Privacy Regulations: OEMs must adopt on-device processing, encrypt sensitive data, and provide transparent driver consent flows.

Cost Optimization Trends: Consolidation of multiple ADAS functions onto unified SoCs reduces bill-of-materials and streamlines integration.

Consumer Feedback Loops: Telemetry-driven usage analytics guide iterative software updates to reduce false alert rates and enhance user trust.

Regional Analysis

Europe: Leading in regulatory enforcement (UNECE R157 effective mid-2024), robust OEM adoption, and strong aftermarket demand in Western Europe.

North America: Voluntary guidelines and state-level safety ratings (IIHS) are propelling DSMS uptake; high fleet telematics integration.

Asia Pacific: China mandates DSMS under MRV—Domestic OEMs (e.g., SAIC, Geely) rapidly adopting; Japan and South Korea following with national standards.

Latin America: Gradual adoption driven by multinational OEMs; fleet telematics providers begin offering DSMS retrofits in major markets.

Middle East & Africa: Slow penetration due to less stringent regulation; potential growth in Gulf Cooperation Council (GCC) countries with rising safety awareness.

Competitive Landscape

Leading Companies in the Automotive Driver State Monitoring Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

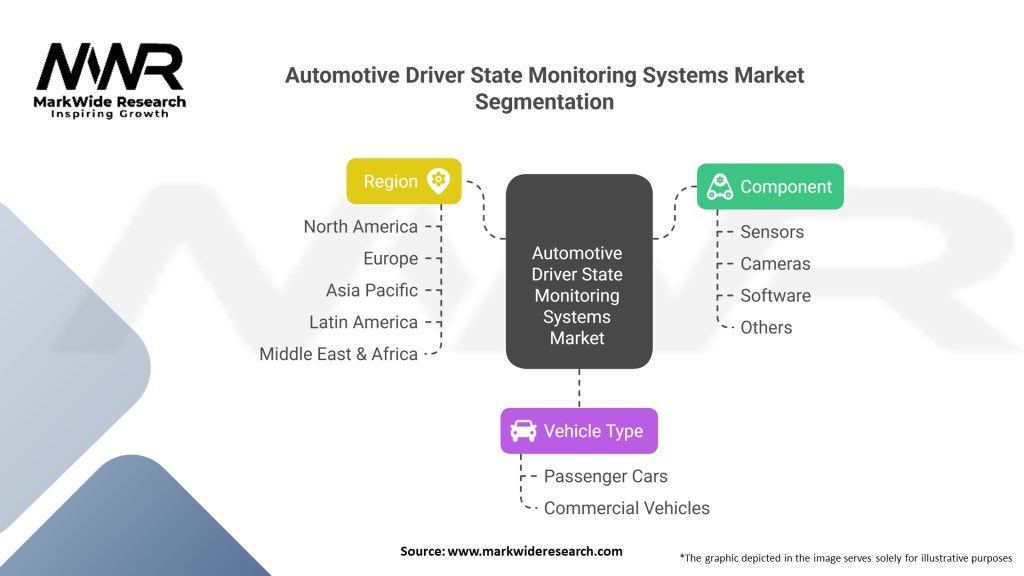

Segmentation

By Sensor Type: Infrared Camera, RGB Camera, Thermal Camera, Radar & Ultrasonic Sensor Fusion.

By Deployment: OEM-Integrated Systems, Aftermarket Kits.

By Vehicle Type: Passenger Cars, Commercial Vehicles (Trucks & Buses), Two-Wheelers (Pilot Projects).

By Level of Autonomy: Level 1 & 2 (ADAS), Level 2+ & 3 (Conditional Automation), Level 4+ (High Automation).

Category-wise Insights

Infrared Camera Systems: Predominant modality due to reliable eye-pupil detection in variable lighting; requires IR illumination and robust thermal performance.

RGB Camera Solutions: Lower cost but less effective under sunlight glare and nighttime; often paired with infrared in hybrid architectures.

Thermal Imaging: Effective for heart-rate and respiration monitoring; high component cost limits use to premium and commercial segments.

Radar & Ultrasonic Fusion: Emerging approach to detect head orientation and micro-movements; supplement camera data to reduce false negatives.

Key Benefits for Industry Participants and Stakeholders

Enhanced Road Safety: Early detection of drowsiness and distraction reduces crash rates and associated liabilities.

Regulatory Compliance: Meeting or exceeding mandatory DSMS requirements avoids fines and speeds vehicle homologation.

Insurance Incentives: Verified driver monitoring data can unlock lower premiums and usage-based insurance offerings.

Brand Differentiation: Advanced DSMS positions vehicles as safer, tech-savvy choices, appealing to safety-conscious consumers.

Data-Driven Services: OEMs and fleet operators gain granular insights into driver behavior for training, performance optimization, and product development.

SWOT Analysis

Strengths:

Regulatory tailwinds guarantee near-term uptake across major markets.

Proven sensor technologies with declining hardware costs.

Weaknesses:

Performance variability under extreme conditions (e.g., tinted windows, bright sunlight).

User acceptance hurdles if false alerts persist.

Opportunities:

Retrofitting existing vehicle parc through aftermarket channels.

Expansion into two-wheeler and micromobility segments as pilot programs.

Threats:

Rising privacy legislation may impose data handling burdens.

Competitive pressure from low-cost Chinese suppliers offering basic camera-only systems.

Market Key Trends

Edge-AI Proliferation: Moving all processing on-device to reduce latency and preserve privacy.

Sensor Miniaturization: Ultra-compact camera modules enabling seamless integration into rear-view mirrors and instrument clusters.

Subscription Services: Shift toward feature-unlock models, where advanced monitoring capabilities are habilitated via OTA updates.

Cross-Platform Standardization: Industry alliances defining common APIs for DSMS interoperability across OEMs and suppliers.

Integration with V2X: Future DSMS linking driver state data with vehicle-to-everything communication to warn nearby vehicles and infrastructure.

Covid-19 Impact

The Covid-19 pandemic temporarily delayed new vehicle registrations, slowing DSMS deployments in 2020. However, heightened hygiene concerns accelerated the adoption of contactless, camera-based monitoring over steering-wheel grips or wearable sensors. Post-pandemic recovery saw OEMs prioritize safety feature rollouts, with many highlighting DSMS in marketing campaigns to reassure consumers of enhanced in-cabin monitoring.

Key Industry Developments

UNECE R157 Enforcement: From July 2024, all new European passenger cars must include DSMS, triggering a surge in system integration projects.

Bosch Edge-AI Module Release: Launch of next-gen camera SoC with integrated AI accelerators, reducing power draw by 30%.

Seeing Machines GM Partnership: Collaboration to supply DSMS software across Chevrolet, Cadillac, and GMC models in North America.

Denso Thermal Camera Pilot: Field trials in Japan demonstrating sub-minute detection of microsleep events in commercial truck drivers.

Valeo Retrofit Kit Introduction: Aftermarket DSMS solution priced under €200, targeting taxi and ride-hail fleets in Western Europe.

Analyst Suggestions

Prioritize False-Alert Reduction: Invest in large, diverse training datasets and continuous software tuning to minimize nuisance warnings.

Emphasize Privacy by Design: Architect systems for on-board processing, anonymized data storage, and clear user consent workflows.

Target Fleet Segments Early: Leverage telematics integrations to demonstrate ROI in commercial deployments before broad passenger-car rollout.

Explore Service Models: Develop subscription-based feature upgrades for continuous revenue generation and OTA capability enhancements.

Future Outlook

The Automotive Driver State Monitoring Systems market is set to achieve double-digit annual growth over the next five years. As regulations solidify and consumer trust in AI-driven safety solutions deepens, DSMS will evolve from optional luxury add-ons into standard safety features across all vehicle segments. Ongoing convergence with ADAS, telematics, and connected-vehicle ecosystems will further enhance system value, paving the way for highly automated and ultimately autonomous mobility solutions where driver readiness can be assured at every level of autonomy.

Conclusion

Automotive Driver State Monitoring Systems represent a cornerstone technology in the pursuit of safer and more intelligent mobility. Fueled by strong regulatory mandates, relentless technological innovation, and growing stakeholder buy-in, the DSMS market will continue to expand rapidly. Success for OEMs and suppliers will hinge on balancing accuracy, cost, and privacy, while leveraging data-driven insights to refine user experience and unlock new service opportunities. By integrating DSMS into holistic active-safety ecosystems, the industry takes a vital step toward Vision Zero—a future with zero traffic fatalities and injuries.

What is Automotive Driver State Monitoring Systems?

Automotive Driver State Monitoring Systems refer to technologies designed to assess and monitor the state of a driver while operating a vehicle. These systems utilize various sensors and algorithms to detect signs of fatigue, distraction, or impairment, enhancing road safety and reducing accidents.

What are the key players in the Automotive Driver State Monitoring Systems market?

Key players in the Automotive Driver State Monitoring Systems market include companies like Denso Corporation, Continental AG, and Valeo, which are known for their innovative solutions in automotive safety and driver assistance technologies, among others.

What are the growth factors driving the Automotive Driver State Monitoring Systems market?

The growth of the Automotive Driver State Monitoring Systems market is driven by increasing concerns over road safety, advancements in sensor technologies, and the rising adoption of autonomous driving features. Additionally, regulatory pressures for enhanced vehicle safety standards are contributing to market expansion.

What challenges does the Automotive Driver State Monitoring Systems market face?

The Automotive Driver State Monitoring Systems market faces challenges such as high development costs, integration complexities with existing vehicle systems, and concerns regarding data privacy and security. These factors can hinder widespread adoption and implementation.

What future opportunities exist in the Automotive Driver State Monitoring Systems market?

Future opportunities in the Automotive Driver State Monitoring Systems market include the integration of artificial intelligence for improved driver monitoring accuracy and the potential for partnerships with ride-sharing services to enhance safety features. Additionally, the growing trend of connected vehicles presents new avenues for innovation.

What trends are shaping the Automotive Driver State Monitoring Systems market?

Trends shaping the Automotive Driver State Monitoring Systems market include the increasing use of machine learning algorithms for real-time driver assessment, the development of non-intrusive monitoring technologies, and a focus on enhancing user experience through intuitive interfaces. These innovations are crucial for the evolution of driver safety systems.

Automotive Driver State Monitoring Systems Market:

| Segmentation | Details |

|---|---|

| Component | Sensors, Cameras, Software, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Driver State Monitoring Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at