Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Demand for aluminum cylinder blocks is increasing, accounting for a growing share of passenger vehicle engine platforms due to superior strength-to-weight ratio and heat dissipation properties.

-

Compacted graphite iron (CGI) blocks are emerging as a premium solution in light commercial vehicles and performance engines, offering improved stiffness and fatigue resistance over traditional cast iron.

-

Integration of advanced manufacturing techniques—such as squeeze casting, high-pressure die casting, and 3D-printed cores—is enhancing dimensional accuracy and reducing production cycle times.

-

Engine downsizing and turbocharging strategies are driving the need for cylinder blocks capable of handling higher combustion pressures without significant weight penalties.

Market Drivers

Several factors are driving the growth of the Automotive Cylinder Block market:

-

Emission Regulations: Stricter CO₂ and pollutant limits globally are compelling manufacturers to adopt lightweight, high-efficiency engine components, boosting demand for aluminum and CGI blocks.

-

Engine Downsizing: The shift toward smaller displacement, turbocharged engines requires cylinder blocks designed to withstand higher pressures and temperatures, favoring advanced materials and designs.

-

Vehicle Production Growth: Rising automotive production in Asia Pacific, Latin America, and parts of Eastern Europe increases overall demand for engine blocks across passenger and commercial vehicle segments.

-

Material Innovations: Development of high-strength aluminum alloys, CGI grades, and metal-polymer hybrids is expanding application scope and improving block performance.

-

Manufacturing Advancements: Adoption of industry 4.0 practices—such as automated casting lines, real-time quality monitoring, and digital twins—is enhancing production efficiency and consistency.

Market Restraints

Despite positive trends, the market faces certain challenges:

-

High Material Costs: Aluminum alloys and CGI are more expensive than traditional gray cast iron, affecting cost-competitiveness in entry-level vehicle segments.

-

Technical Complexity: Advanced casting processes and multi-material assemblies require specialized equipment and skilled labor, creating entry barriers for smaller foundries.

-

Supply Chain Volatility: Fluctuations in raw material prices and availability—especially aluminum and alloying elements—can disrupt production schedules and increase costs.

-

Electric Vehicle (EV) Shift: The gradual transition to electric powertrains may reduce long-term demand for internal combustion engine components, including cylinder blocks.

Market Opportunities

The Automotive Cylinder Block market presents several avenues for growth and innovation:

-

Hybrid Engine Architectures: Cylinder blocks designed for mild-hybrid and plug-in hybrid applications, integrating water jackets and cooling channels optimized for dual power sources.

-

Additive Manufacturing: Use of 3D-printed sand cores and metal inserts to create complex cooling geometries and reduce machining requirements, shortening lead times.

-

Emerging Markets: Expanding automotive production in India, Southeast Asia, and Africa offers opportunities for local foundries to supply cost-effective cylinder blocks.

-

Aftermarket & Remanufacturing: Growing demand for remanufactured engine blocks and performance upgrades fuels aftermarket services catering to extended vehicle lifecycles.

-

Sustainability Initiatives: Lightweight block designs contribute to overall vehicle weight reduction, aligning with automaker commitments to carbon neutrality and circular economy goals.

Market Dynamics

The Automotive Cylinder Block market is influenced by the following dynamics:

-

Collaborative R&D: Alliances between automakers, material scientists, and foundries accelerate development of next-generation block materials and processes.

-

Digitization: Implementation of process control systems, predictive maintenance on casting lines, and digital quality inspection reduce scrap rates and improve yield.

-

OEM Integration: Vertical integration of cylinder block production within automaker-owned facilities ensures tight control over specifications and supply security.

-

Customization Trends: Growing demand for region-specific engine variants prompts quick-turn prototypes and flexible manufacturing cells for small-batch production.

-

Regulatory Alignment: Global harmonization of emission standards and safety regulations drives uniform block design requirements, simplifying cross-market adoption.

Regional Analysis

Adoption and production of automotive cylinder blocks vary across regions:

-

Asia Pacific: Leading region in cylinder block output—dominated by China, India, Japan, and South Korea—supported by large-scale vehicle manufacturing and investments in advanced foundries.

-

Europe: High demand for lightweight and CGI blocks driven by stringent EU emission targets and premium vehicle manufacturing hubs in Germany, France, and Italy.

-

North America: Focus on performance and heavy-duty applications sustains gray cast iron block volumes, while aluminum block adoption rises in passenger vehicle segments.

-

Latin America: Growing assembly plants in Brazil and Mexico create demand for cost-effective cast iron and entry-level aluminum blocks; local content regulations favor domestic suppliers.

-

Middle East & Africa: Emerging opportunities in assembly operations and aftermarket remanufacturing; demand remains moderate but shows potential with infrastructure growth and fleet expansions.

Competitive Landscape

Leading Companies in the Automotive Cylinder Block Market:

- Nemak S.A.B. de C.V.

- Cummins Inc.

- GF Casting Solutions AG

- Linamar Corporation

- Hyundai WIA Corporation

- Aisin Seiki Co., Ltd.

- Bharat Forge Limited

- Thyssenkrupp AG

- Rheinmetall AG

- Iochpe-Maxion S.A.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

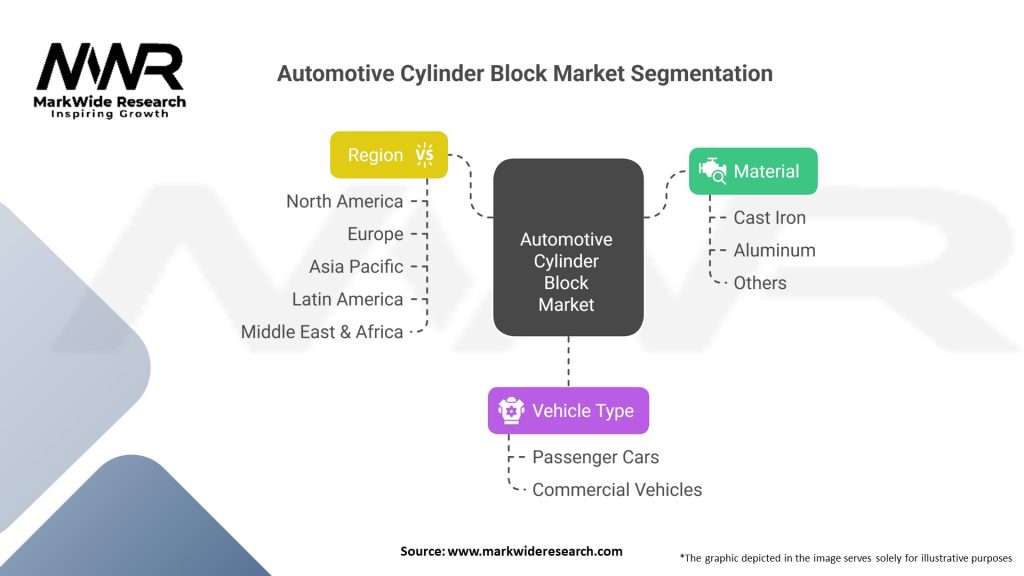

Segmentation

The market can be segmented by:

-

Material Type: Gray Cast Iron, Aluminum Alloy, Compacted Graphite Iron (CGI), Hybrid/Composite

-

Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy-Duty Trucks, Performance & Specialty Vehicles

-

Manufacturing Process: Sand Casting, Die Casting, Squeeze Casting, Investment Casting

-

End User: OEMs, Aftermarket Remanufacturers, Racing/Performance Tuner Shops

Category-wise Insights

-

Gray Cast Iron Blocks: Remain cost-effective and widely used in heavy-duty engines, valued for wear resistance and vibration damping.

-

Aluminum Alloy Blocks: Preferred in mass-market passenger cars for weight reduction and thermal efficiency, albeit at higher material cost.

-

CGI Blocks: Blend iron’s strength with reduced weight, ideal for light commercial and turbocharged engines where high pressure and stiffness are required.

-

Hybrid/Composite Designs: Emerging approach combining metal inserts with polymer or ceramic liners to optimize weight and thermal performance.

Key Benefits for Industry Participants and Stakeholders

-

Performance Enhancement: Advanced block materials and designs enable higher compression ratios and improved heat management, boosting engine efficiency.

-

Cost Optimization: Process improvements and material substitutions reduce casting defects, scrap, and machining time, lowering per-unit production costs.

-

Regulatory Compliance: Lightweight and high-strength blocks help automakers meet CO₂ emission targets and fuel economy standards.

-

Supply Security: Diversified global foundry networks and local production mitigate risks from trade disruptions and raw material volatility.

-

Aftermarket Revenue: Remanufacturing and performance upgrade markets provide additional revenue streams beyond OEM production cycles.

SWOT Analysis

Strengths

-

Established casting expertise and global production capacity

-

Proven material options (iron, aluminum, CGI) for diverse applications

-

Strong OEM partnerships ensuring long-term contracts

Weaknesses

-

High capital investment for advanced casting lines and machining centers

-

Material cost sensitivity in price-competitive segments

-

Technical barriers for smaller foundries to adopt CGI and hybrid designs

Opportunities

-

Expansion in emerging automotive markets and electric/hybrid engine architectures

-

Development of integrated block–head assemblies and modular designs

-

Growth of remanufacturing and performance tuning industries

Threats

-

Accelerating EV adoption reducing demand for traditional engine components over the long term

-

Raw material supply chain disruptions and price fluctuations

-

Technological obsolescence if unable to keep pace with lightweighting and digital manufacturing trends

Market Key Trends

-

Lightweighting Initiatives: Continuous shift toward aluminum and CGI to reduce engine mass and improve fuel economy.

-

Digital Quality Control: Use of X-ray CT scanning, 3D metrology, and AI-driven defect detection to ensure block integrity and reduce rework.

-

Modular Engine Platforms: Cylinder blocks designed as part of scalable engine families, allowing shared casting tooling and reduced development costs.

-

Green Manufacturing: Adoption of closed-loop sand reclamation, energy-efficient furnaces, and renewable energy sources in foundries to lower carbon footprint.

-

Hybrid Material Assemblies: Exploration of metal-polymer composites and 3D-printed inserts for advanced thermal barrier and vibration control.

Covid-19 Impact

The Covid-19 pandemic disrupted supply chains and temporarily reduced vehicle production, leading to foundry shutdowns and inventory imbalances. However, recovery efforts spurred investments in localizing block production to mitigate future disruptions. The crisis also accelerated digital transformation in casting operations—such as remote monitoring and predictive equipment maintenance—improving resilience and setting the stage for more agile production systems.

Key Industry Developments

-

Strategic Investments: Major foundries expanding capacity with new die-casting and CGI lines to meet evolving demand.

-

M&A Activity: Consolidation among regional foundries to pool resources for advanced material adoption and process upgrades.

-

R&D Collaborations: Joint ventures between material scientists and OEMs to develop next-generation alloys and casting methods.

-

Sustainability Programs: GreenFoundry initiatives promoting eco-friendly casting practices and circular economy principles.

Analyst Suggestions

-

Invest in Lightweight Materials: Prioritize CGI and aluminum alloy development to align with regulatory and consumer expectations for efficiency.

-

Embrace Digitalization: Deploy Industry 4.0 technologies—AI inspection, process automation, and digital twins—to boost yield and reduce cycle times.

-

Diversify Supply Base: Establish foundry partnerships in multiple regions to safeguard against geopolitical and logistic risks.

-

Explore EV-Compatible Designs: Develop hybrid block architectures and modular platforms that can transition from combustion to range-extender or hybrid applications.

Future Outlook

The Automotive Cylinder Block market is expected to maintain a moderate to strong growth trajectory over the next decade, driven by continued internal combustion engine demand in emerging markets, alongside innovation in lightweight and hybrid-material designs. While electric vehicles will gradually gain ground, a substantial global fleet of ICE and hybrid vehicles will sustain demand for cylinder blocks. Investments in advanced casting, digital manufacturing, and sustainability will differentiate successful players, enabling them to capture both OEM and aftermarket opportunities.

Conclusion

The Automotive Cylinder Block market remains a cornerstone of engine manufacturing, balancing the demands of regulatory compliance, cost efficiency, and performance. As automakers pursue weight reduction and emission targets, advanced materials like aluminum alloys and CGI will gain prominence, supported by digitalized production and collaborative R&D. Stakeholders who invest in innovative casting processes, expand global supply networks, and adapt to the evolving mobility landscape will be best positioned to thrive in a market that continues to blend traditional engineering with cutting-edge technologies.