Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Chain sprockets account for over 40 % of drivetrain maintenance costs in heavy trucks and motorcycles, making durability improvements a key value driver.

-

Advanced materials (e.g., carburizing steels, alloyed aluminum) and precision machining are reducing wear rates by up to 50 % compared to conventional sprockets.

-

Aftermarket replacement demand outpaces OEM fitment growth, driven by routine service requirements and performance upgrades.

-

E-bike and light electric vehicle segments are emerging as significant new adopters of compact, corrosion-resistant sprocket assemblies.

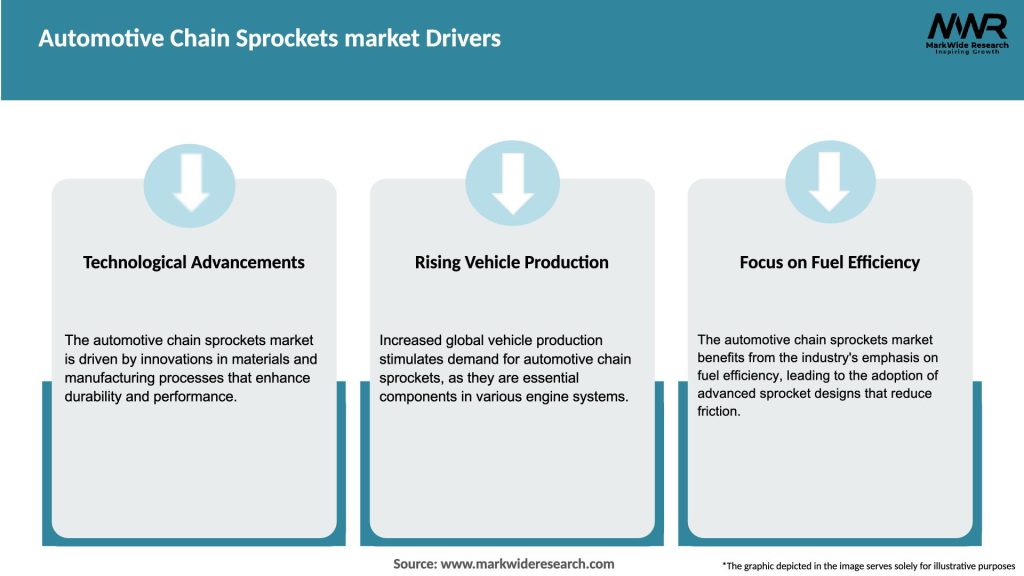

Market Drivers

Several factors are propelling the growth of the Automotive Chain Sprockets market:

-

Rising Two-Wheeler Ownership: Expansion of motorcycle and scooter fleets in Asia Pacific and Latin America is driving OEM and aftermarket sprocket sales for both commuter and performance models.

-

Aftermarket Service Demand: Regular maintenance cycles for chain-driven vehicles—typically every 10,000–20,000 km—generate recurring replacement sprocket and chain kit purchases.

-

E-Mobility Adoption: Growth in electric bicycles, scooters, and motorcycles requires specialized sprockets made from lightweight, corrosion-resistant materials to optimize range and longevity.

-

Material and Surface Advances: Innovations in steel alloy composition, cryogenic treatment, and nano-coatings are extending sprocket life and reducing noise, attracting premium OEM and aftermarket uptake.

-

Performance Upgrades: Enthusiast segments in motorsports and recreational vehicles increasingly demand high-strength, precision-balanced sprockets to support higher torque and rpm capabilities.

Market Restraints

Despite positive trends, the market faces several challenges:

-

Cyclic Commodity Prices: Fluctuations in steel and aluminum costs can compress supplier margins and create pricing pressure, especially in the value-focused aftermarket.

-

Competition from Belt Drives: In some motorcycle and small EV segments, toothed belt drives—offering quieter and maintenance-free operation—pose an alternative to chain and sprocket assemblies.

-

Supply Chain Complexity: Just-in-time production demands and globalized supply chains expose sprocket manufacturers to lead-time risks and geopolitical disruptions.

-

Backward Integration: Some large OEMs are insourcing sprocket production to capture more of the drivetrain value chain, limiting available market for independent suppliers.

Market Opportunities

The Automotive Chain Sprockets market presents several avenues for expansion:

-

Lightweight Sprockets: Development of high-strength aluminum and composite sprockets for electric and performance applications can open new OEM partnerships.

-

Modular Replacement Kits: Offering sprocket-chain assemblies with matched wear rates and installation tools simplifies aftermarket servicing and improves user experience.

-

Corrosion-Resistant Coatings: PVD and DLC coatings tailored for harsh climates can create value-added products in marine, off-road, and electric vehicle markets.

-

Smart Sprockets: Embedding RFID or simple wear-indicator sensors into sprocket components could enable predictive maintenance in connected fleet applications.

-

Emerging Market Expansion: Establishing localized production or distribution channels in Africa, Southeast Asia, and Latin America to reduce costs and better serve growing two-wheeler populations.

Market Dynamics

The Automotive Chain Sprockets market is influenced by the following dynamics:

-

Consolidation and Partnerships: Strategic alliances between chain manufacturers and sprocket producers streamline kit offerings, while M&A among bearing and transmission specialists consolidates market share.

-

Customization and Small-Batch Production: Additive manufacturing and flexible machining allow niche sprocket geometries for motorsport and custom motorcycle builders, supporting premium pricing.

-

Quality Standards: OEMs increasingly require ISO/TS-certified suppliers with rigorous metallurgical testing and traceability, raising the bar for entry.

-

Digital Design Tools: Advanced CAD/CAM and finite element analysis enable optimization of tooth profiles and root radii for balanced strength and fatigue resistance.

-

Regulatory Impact: Emissions regulations indirectly influence sprocket demand by accelerating electrification and alternative powertrain choices.

Regional Analysis

Adoption and growth vary by region:

-

Asia Pacific: Largest market, led by India, China, and Indonesia, due to booming two-wheeler production and aftermarket culture.

-

Europe: Mature market with demand for high-performance and premium aftermarket kits; electric scooter and cargo bike segments are expanding.

-

North America: Strong motorsport and recreational vehicle segments drive demand for specialized sprockets; moderate growth in commuter motorcycles.

-

Latin America: Growing aftermarket driven by widespread use of entry-level motorcycles; local manufacturing hubs emerging in Brazil and Mexico.

-

Middle East & Africa: Nascent market for performance and off-road sprockets; opportunities exist in commercial fleet conversions to EVs and smaller vehicles.

Competitive Landscape

Leading Companies in the Automotive Chain Sprockets Market:

- BorgWarner Inc.

- Tsubakimoto Chain Co.

- Regina Industries Ltd.

- Daido Kogyo Co., Ltd.

- SKF Group

- Renold Plc

- Hitachi Metals, Ltd.

- Kobo Chains GmbH

- Ketten Wulf Betriebs GmbH

- Donghua Chain Group

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

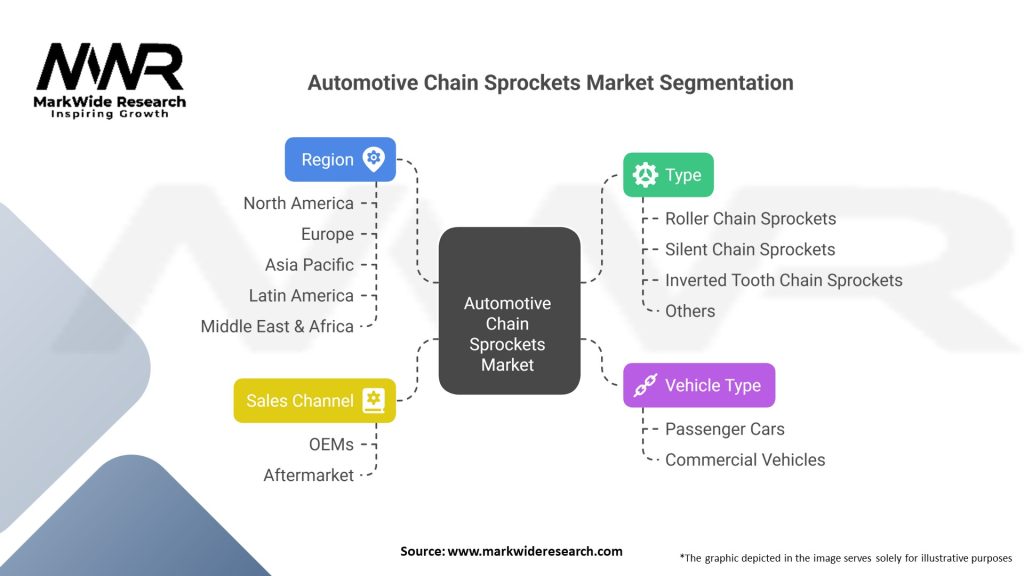

Segmentation

The market can be segmented by:

-

Vehicle Type: Two-Wheeler (Motorcycles, Scooters), Passenger Cars (Timing Chains), Commercial Vehicles (Industrial Conveyor Drives), Specialty & Off-Highway Vehicles

-

Material: Alloy Steel, Carbon Steel, Aluminum, Composite

-

Distribution Channel: OEM Fitment, Aftermarket Retail, Online E-Commerce, Fleet Services

-

Price Tier: Standard, Premium, Performance/Racing

Category-wise Insights

-

Alloy Steel Sprockets: Offer high fatigue strength and wear resistance, preferred by OEMs for standard fitment applications.

-

Aluminum Sprockets: Lightweight and corrosion-resistant, chosen for electric powertrains and performance motorcycles to reduce unsprung mass.

-

Composite Sprockets: Emerging materials such as glass-fiber reinforced polymers provide noise damping and simplified post-service disposal.

-

Performance Kits: Typically include hardened steel sprockets with matching O-ring or X-ring chains, targeted at aftermarket enthusiasts seeking durability and low maintenance.

Key Benefits for Industry Participants and Stakeholders

-

Extended Service Intervals: Improved sprocket materials and coatings reduce wear rates, lowering frequency of replacements and total cost of ownership.

-

Enhanced Efficiency: Optimized tooth profiles and precise tolerances minimize friction losses, contributing to marginal but valuable fuel or battery range gains.

-

Noise Reduction: Advanced surface finishes and self‐centering tooth designs decrease chain slap and vibration, improving rider and passenger comfort.

-

Customization Flexibility: Modular sprocket offerings allow rapid gear ratio changes, supporting performance tuning and varied load requirements.

-

Market Differentiation: Suppliers that innovate in materials, coatings, or sensor integration can command premium pricing and foster brand loyalty among OEMs and enthusiasts.

SWOT Analysis

Strengths

-

Established, high-volume production processes with mature metallurgy.

-

Recurring aftermarket revenue through maintenance cycles.

-

Ability to bundle with chains into complete drivetrain kits.

Weaknesses

-

Price sensitivity in entry-level two-wheeler segments.

-

Competition from alternative drive systems (belts, shaft drives).

-

Commodity nature of standard sprockets limits margin expansion.

Opportunities

-

Growth of electric two-wheelers and light EVs demanding specialized sprockets.

-

Adoption of smart maintenance features via embedded wear sensors.

-

Expansion into industrial and non-automotive chain drive applications.

Threats

-

Raw material price volatility affecting cost structures.

-

OEM insourcing to capture more value within integrated drivetrain assemblies.

-

Economic downturns leading to deferred maintenance and reduced aftermarket spend.

Market Key Trends

-

Electrification-Aligned Designs: Sprockets optimized for electric motor torque curves, with polymer dampers to mitigate drivetrain shock loads.

-

Smart Maintenance: Trials of RFID-tagged sprockets that communicate wear data to fleet management platforms for predictive service reminders.

-

Low-Noise Profiles: Adoption of crowning and specialized coatings to meet stricter noise regulations in urban environments.

-

Additive Manufacturing: Early-stage exploration of 3D-printed sprocket inserts for rapid prototyping and small-batch customization.

-

Sustainability Focus: Increasing use of recyclable alloys and reduced-waste machining processes to align with circular economy objectives.

Covid-19 Impact

The Covid-19 pandemic led to temporary OEM production slowdowns and deferred maintenance among end users, slightly dampening sprocket demand in 2020–2021. However, pent-up demand for aftermarket services and the resilience of motorcycle usage for socially distanced mobility contributed to a market rebound in 2022. Supply chain challenges highlighted the importance of regional warehousing and inventory buffers, prompting several suppliers to diversify manufacturing footprints.

Key Industry Developments

-

Strategic Acquisitions: Leading chain manufacturers acquiring sprocket specialists to offer complete drivetrain solutions under one roof.

-

New Product Launches: Introduction of hybrid metal-polymer sprockets combining steel strength with polymer noise-damping layers for e-mobility.

-

Regional Manufacturing Expansion: Establishment of production lines in Southeast Asia and Latin America to serve booming two-wheeler markets with reduced logistics costs.

-

Digital Platforms: Launch of online configurators enabling customers to specify sprocket pitch, tooth count, and material, streamlining order fulfillment.

Analyst Suggestions

-

Diversify Product Portfolio: Develop offerings across standard, premium, and e-mobility segments to capture growth in electrified applications while hedging against commodity pressures.

-

Invest in Advanced Materials: Focus R&D on novel alloys and surface treatments that extend wear life and reduce need for replacement, creating differentiated value.

-

Enhance Supply Chain Resilience: Build regional manufacturing or distribution hubs to mitigate lead-time risks and respond rapidly to market surges.

-

Embrace Digital Services: Explore embedding low-cost wear sensors and integrating sprocket data into predictive maintenance platforms to deepen customer engagement.

Future Outlook

The Automotive Chain Sprockets market is expected to grow at a CAGR of approximately 5–7 % over the next five years. Continued expansion of two-wheeler fleets in developing regions, coupled with rising aftermarket sales, will sustain baseline demand. At the same time, emerging electric two-wheelers and light EV applications will drive innovation in lightweight and corrosion-resistant sprocket designs. Suppliers that successfully integrate smart maintenance features, advanced materials, and digital ordering platforms will secure competitive advantages. While belt drives and insourced OEM production represent competitive pressures, the essential role of chain sprockets—particularly in high-torque and heavy-duty applications—ensures a resilient and evolving market landscape.

Conclusion

The Automotive Chain Sprockets market stands as a mature yet dynamic sector within the broader power transmission and drivetrain industry. By combining long-established manufacturing expertise with new materials technologies, digital tools, and connected maintenance solutions, market participants can meet evolving demands for durability, efficiency, and smart servicing. While challenges such as commodity pricing and alternative drive systems persist, substantial opportunities in electrification, aftermarket innovation, and emerging markets will drive continued growth. Stakeholders that invest strategically in product development, supply chain agility, and digital customer experiences will be best positioned to lead in this integral segment of automotive componentry.