Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Serpentine belts dominate the accessory drive segment due to compact design and ease of replacement.

-

Timing belts are shifting toward glass-fiber and aramid reinforcements for longer service intervals and higher temperature tolerance.

-

Integration of belt-driven starter-generators in mild-hybrid vehicles boosts demand for specialized hybrid belts.

-

Aftermarket replacement volumes remain stable as belts are typically replaced every 60,000–100,000 km under manufacturer recommendations.

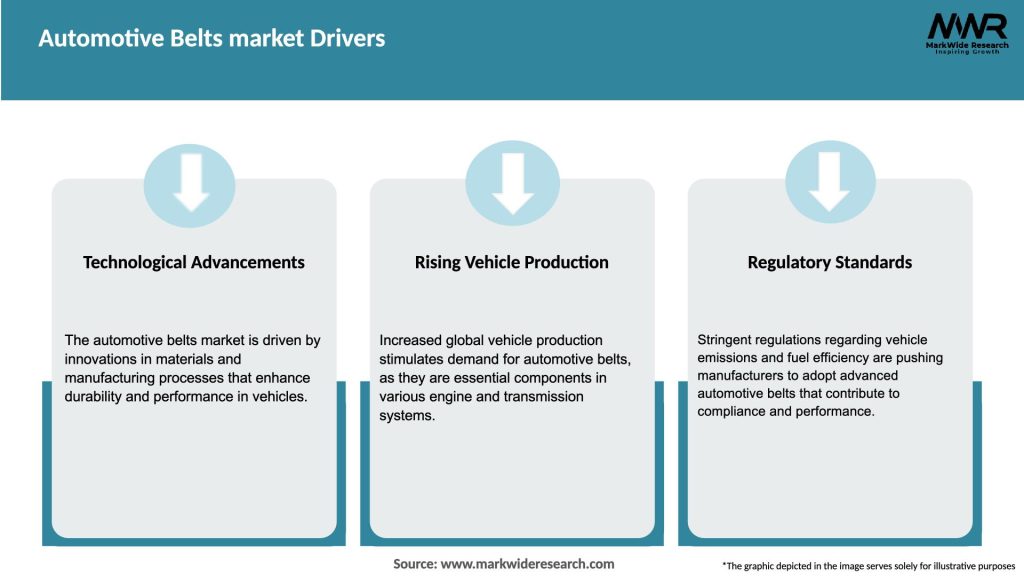

Market Drivers

-

Growing Vehicle Production: Rising light-vehicle output in emerging economies sustains OEM demand for original equipment belts.

-

Extended Service Life: Development of advanced elastomers and tensile cords extends replacement intervals, reducing lifecycle costs.

-

Hybrid Powertrain Adoption: Mild-hybrid and full-hybrid systems incorporate belt-driven starter-generators, creating a new segment for hybrid-rated belts.

-

Fuel Economy Regulations: Lightweight, low-tension belt designs reduce parasitic losses, helping manufacturers meet CO₂ targets.

-

Aftermarket Growth: Replacement belt volumes provide recurring revenue streams for distributors and parts suppliers globally.

Market Restraints

-

Raw Material Volatility: Fluctuations in rubber and synthetic polymer prices can impact belt manufacturing costs.

-

Competition from Chains: In some high-performance or heavy-duty applications, metal timing chains are preferred for longevity, limiting belt adoption.

-

Complex Engine Architectures: Increasing packaging constraints in compact engine compartments pose design challenges for belt routing.

-

Skill Gaps in Aftermarket: Proper belt installation and tensioning require trained technicians; shortages in skilled labor can lead to premature failures.

-

Environmental Concerns: Disposal and recycling of worn belts remain areas needing sustainable solutions in line with circular economy initiatives.

Market Opportunities

-

Sensor-Enabled Belts: Embedding wear-and-tension sensors for real-time condition monitoring and predictive maintenance alerts.

-

Bio-Based Materials: Research into renewable rubber alternatives and recyclable composites to address environmental sustainability.

-

Electric Vehicle Adaptations: Development of belts for secondary cooling pumps and accessory drives in electric powertrains.

-

Regional Manufacturing Hubs: Localization of production in high-growth markets to reduce lead times and logistics costs.

-

Premium Aftermarket Offerings: Value-added services such as belt-and-tensioner kits and extended warranties to differentiate from low-cost imports.

Market Dynamics

-

Vertical Integration: Tier-1 suppliers are expanding upstream into raw material compounding to secure supply and control quality.

-

Collaborative R&D: Joint development programs between OEMs, material suppliers, and research institutes accelerate innovation.

-

Digital Catalogs and E-Commerce: Online platforms streamline aftermarket belt selection, ordering, and inventory management.

-

Tiered Product Lines: Suppliers offer entry-level, mid-range, and premium belts to address diverse price and performance needs.

-

Regulatory Harmonization: Global alignment of performance and durability standards simplifies certification for multi-region supply.

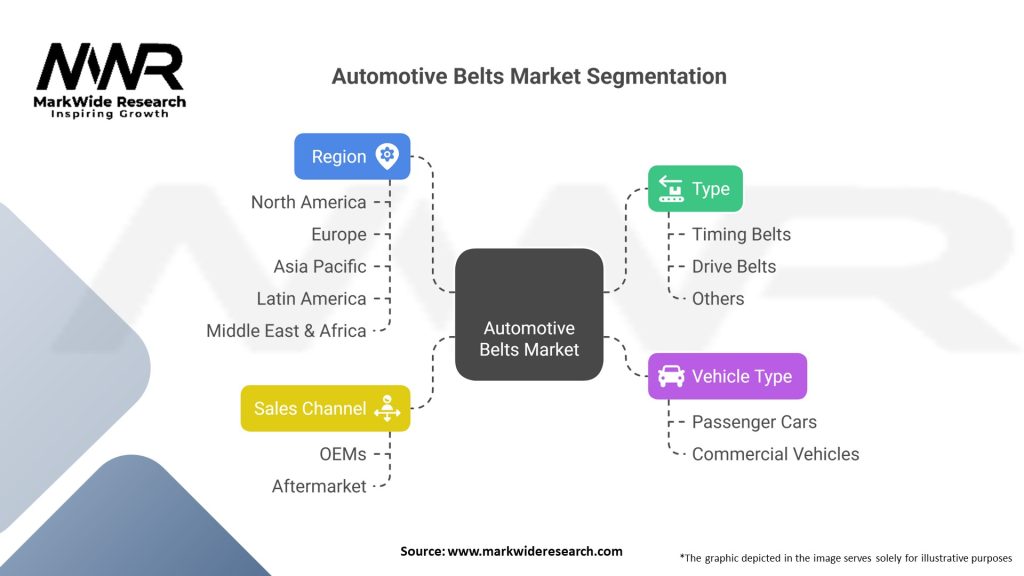

Regional Analysis

-

Asia Pacific: Largest market share driven by China, India, and Southeast Asia’s robust vehicle assembly and aftermarket networks.

-

Europe: Mature market with strict quality and environmental standards; high adoption of premium OEM belts in passenger and commercial vehicles.

-

North America: Strong aftermarket distribution infrastructure; growing demand for hybrid-compatible belts as electrification increases.

-

Latin America: Expanding light-vehicle fleet and rising replacement needs stimulate aftermarket growth; local manufacturing capacity is growing.

-

Middle East & Africa: Emerging belt market tied to fleet maintenance in commercial and agricultural vehicles; supply chains improving.

Competitive Landscape

Leading Companies in the Automotive Belts Market:

- Continental AG

- Gates Corporation

- Mitsuboshi Belting Ltd.

- Bando Chemical Industries, Ltd.

- Hutchinson SA

- Dayco Products, LLC

- Sumitomo Riko Company Limited

- CRP Industries Inc.

- Megadyne Group

- Optibelt GmbH

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

-

By Belt Type: Timing Belts, Serpentine Belts, V-Belts, Hybrid/Starter-Generator Belts

-

By Material: EPDM, HNBR, Neoprene, Aramid-Reinforced, Glass-Fiber Reinforced

-

By Application: Engine Timing, Accessory Drive, Hybrid Powertrain, Industrial Aftermarket

-

By End User: OEM, Aftermarket, Fleet Maintenance Services

Category-wise Insights

-

Timing Belts: Glass-fiber and aramid cords boost tensile strength and thermal resistance for longer OEM intervals.

-

Serpentine Belts: Multi-rib profiles deliver smooth power distribution to multiple accessories; easier replacement supports the aftermarket.

-

V-Belts: Predominantly used in heavy-duty and off-highway vehicles where high torque capacity is required.

-

Hybrid Belts: Designed for higher RPM and frequent start-stop cycles in mild-hybrid and full-hybrid electric vehicles.

Key Benefits for Industry Participants and Stakeholders

-

Recurring Aftermarket Revenues: Regular replacement cycles ensure steady sales volumes beyond initial vehicle production.

-

Brand Differentiation: Premium belt materials and extended warranties enhance supplier reputation among OEMs and repair shops.

-

Operational Efficiency: Lightweight, low-tension designs contribute to improved fuel economy and reduced CO₂ emissions.

-

Predictive Maintenance: Sensor-equipped belts help fleets avoid unexpected downtime and costly repairs.

-

Local Market Adaptation: Region-specific product variations (e.g., heat-resistant compounds for hot climates) boost competitiveness.

SWOT Analysis

Strengths

-

Essential consumable with predictable replacement cycle

-

Technological advancements in materials and coatings

Weaknesses

-

Vulnerability to raw material price volatility

-

Competition from alternative drive technologies (chains, electric motors)

Opportunities

-

Smart belts with condition monitoring

-

Sustainable, bio-based polymer development

Threats

-

Rapid shift toward electric vehicles reducing belt applications in pure EVs

-

Economic downturns affecting vehicle production and aftermarket spending

Market Key Trends

-

Condition Monitoring: Growing interest in belts fitted with RFID or IoT sensors for real-time wear and tension tracking.

-

High-Temperature Performance: Adoption of HNBR and fluoroelastomer cords in turbocharged and direct-injection engines.

-

Lightweight Composite Materials: Hybrid reinforcement fibers combined with advanced elastomers to reduce mass without sacrificing strength.

-

Digital Aftermarket Platforms: E-catalogs and mobile apps enabling technicians to identify and order the correct belt quickly.

-

Sustainability Initiatives: Development of recyclable belt formulations and take-back programs for end-of-life disposal.

Covid-19 Impact

Lockdowns and reduced driving lowered belt wear temporarily, impacting replacement demand in 2020–2021. However, stimulus-driven vehicle purchases and a surge in personal vehicle usage post-pandemic restored aftermarket volumes. Suppliers have since diversified production to mitigate future supply chain disruptions and accelerate digital sales channels.

Key Industry Developments

-

Acquisition Activity: Major tire and rubber conglomerates acquiring specialty belt manufacturers to broaden product portfolios.

-

Joint Ventures: Collaborative agreements between OEMs and material science firms to co-develop belts for next-generation hybrid systems.

-

New Plant Openings: Regional manufacturing expansions in India and Mexico to serve growing local demand and reduce lead times.

-

Digital Innovations: Launch of mobile diagnostic tools that interface with sensor-enabled belts to recommend replacement intervals.

Analyst Suggestions

-

Diversify Material Sourcing: Secure alternative suppliers and invest in synthetic rubber R&D to mitigate price volatility.

-

Accelerate Sensor Integration: Partner with IoT providers to retrofit belts with diagnostics for fleet and connected-car applications.

-

Expand Aftermarket Services: Offer technical training, bundled belt-and-tensioner kits, and digital ordering platforms to capture more service business.

-

Monitor EV Transition: Develop specialized belts for EV ancillary systems (cooling pumps, air-conditioning compressors) to maintain relevance as pure-electric adoption grows.

Future Outlook

The Automotive Belts market will continue to evolve with powertrain electrification and material innovations. While pure battery-electric vehicles may reduce belt usage in engine timing, opportunities will emerge in hybrid systems and accessories for thermal management in EVs. Suppliers who invest in smart belt technologies, sustainable materials, and digital aftermarket solutions will be well positioned to capture growth in both OEM and aftermarket segments.

Conclusion

Automotive belts remain a critical component of vehicle power transmission systems, with a stable aftermarket and ongoing OEM demand. As the industry shifts toward electrification and stricter efficiency standards, belt technologies must adapt through advanced materials, smart diagnostics, and sustainable practices. Stakeholders who embrace innovation, diversify supply chains, and deepen aftermarket engagement will secure long-term success in a changing automotive landscape.