Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Aluminum alloys account for the largest share, used extensively in engine blocks, transmission cases, wheels, and body panels.

-

AHSS grades (e.g., dual-phase, martensitic steels) are seeing rapid adoption in safety-critical structures due to excellent crash performance.

-

Magnesium alloys, despite higher cost, are favored in dashboards, seat frames, and EV battery housings for extreme lightweighting.

-

Titanium alloys are limited to high-performance and luxury applications—such as exhaust systems and suspension components—owing to their premium price point.

-

Recycling and circular economy initiatives are driving investment in closed-loop alloy recovery and remelting processes.

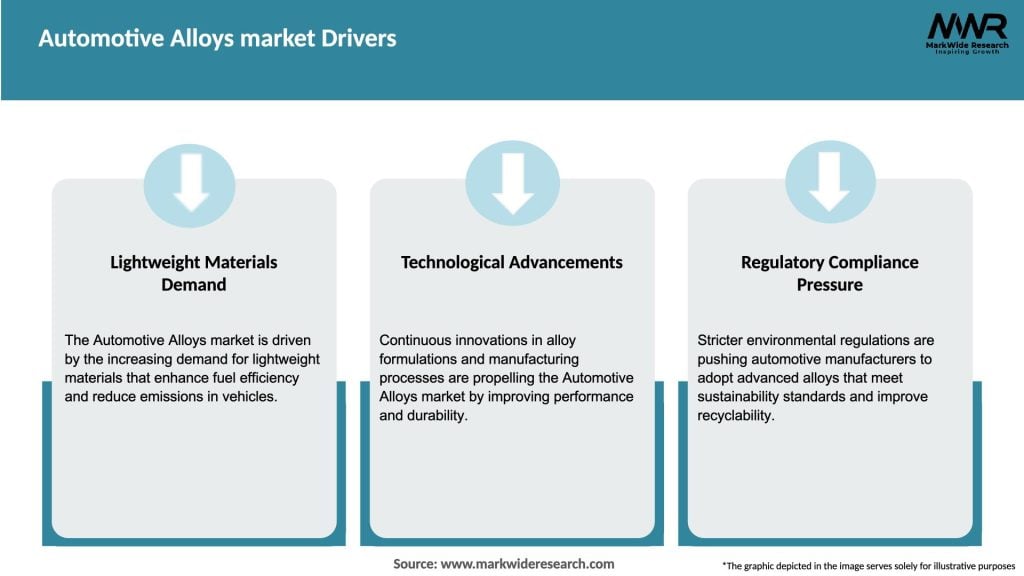

Market Drivers

-

Fuel Efficiency Regulations: Stringent CAFE standards in North America, EU CO₂ targets, and China’s fuel consumption norms compel OEMs to reduce vehicle curb weight.

-

Electric Vehicle Growth: EVs benefit disproportionately from lightweight materials, extending driving range and improving battery efficiency.

-

Consumer Demand: Buyers increasingly prioritize performance, handling, and ride comfort—attributes enhanced by reduced unsprung mass from alloy wheels and components.

-

Advanced Manufacturing: Innovations like high-pressure die casting, additive manufacturing, and powder metallurgy enable complex alloy parts with minimal waste.

-

Sustainability Goals: Automakers commit to carbon footprint reduction, and alloys’ recyclability aligns with circular economy and ESG commitments.

Market Restraints

-

High Material Costs: Premium alloys (magnesium, titanium) carry higher raw-material and processing expenses, limiting mass-market penetration.

-

Supply Chain Complexity: Alloy production involves critical raw materials (magnesium, rare earths) with volatile supply and geopolitical risks.

-

Corrosion Concerns: Certain alloys (magnesium) require protective coatings to prevent galvanic and environmental corrosion, adding processing steps.

-

Joining Challenges: Dissimilar-metal joining (e.g., aluminum-steel) demands specialized welding or adhesive techniques, complicating assembly.

-

Recycling Limitations: Alloy purity degrades over multiple remelts, requiring careful process control and separation technologies.

Market Opportunities

-

Next-Gen Aluminum Alloys: Development of 7xxx-series and recycled alloy grades offering higher strength and lower embodied energy.

-

Magnesium for EVs: Lightweight battery enclosures and structural modules in electric vehicles provide high-value applications.

-

Hybrid Alloy Components: Combining steel and aluminum in tailored blanks or bonded assemblies to optimize cost and performance.

-

Additive Manufacturing: 3D-printed alloy prototypes and low-volume parts for rapid design iteration in high-end models.

-

Circular Supply Chains: Investments in automated sorting and electro-magnetic separation to reclaim alloy scrap with minimal energy input.

Market Dynamics

-

Collaborative R&D: Consortia between OEMs, material suppliers, and academia to co-develop proprietary alloy chemistries and production methods.

-

Vertical Integration: Tier-1 suppliers acquiring alloy foundries to secure upstream capacity and quality control.

-

Regional Localization: Establishing alloy production hubs near automotive clusters (e.g., Germany, Michigan, China) to reduce lead times.

-

Customization Trends: OEMs demanding color-matched, texture-controlled surface finishes directly from alloy casting processes.

-

Digital Twins: Virtual modeling of alloy solidification and microstructure evolution enables optimization of process parameters and reduces trial-and-error.

Regional Analysis

-

North America: Strong R&D in AHSS and aluminum casting; EV programs drive demand for lightweight alloys.

-

Europe: Leadership in advanced steel grades and aluminum-steel hybrid structures; stringent EU CO₂ regulations accelerate adoption.

-

Asia Pacific: China dominates volume production of aluminum and steel alloys; India’s emerging auto sector presents growth potential.

-

Latin America: Moderate growth; reliance on imported high-end alloys but opportunities in local steel alloy upgrades.

-

Middle East & Africa: Nascent market; potential in export of alloy components to global automotive hubs due to favorable energy costs.

Competitive Landscape

Leading Companies in the Automotive Alloys Market:

- ArcelorMittal S.A.

- Novelis Inc.

- Norsk Hydro ASA

- Thyssenkrupp AG

- Constellium SE

- Kobe Steel, Ltd.

- Aleris Corporation

- UACJ Corporation

- AMG Advanced Metallurgical Group N.V.

- Materion Corporation

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

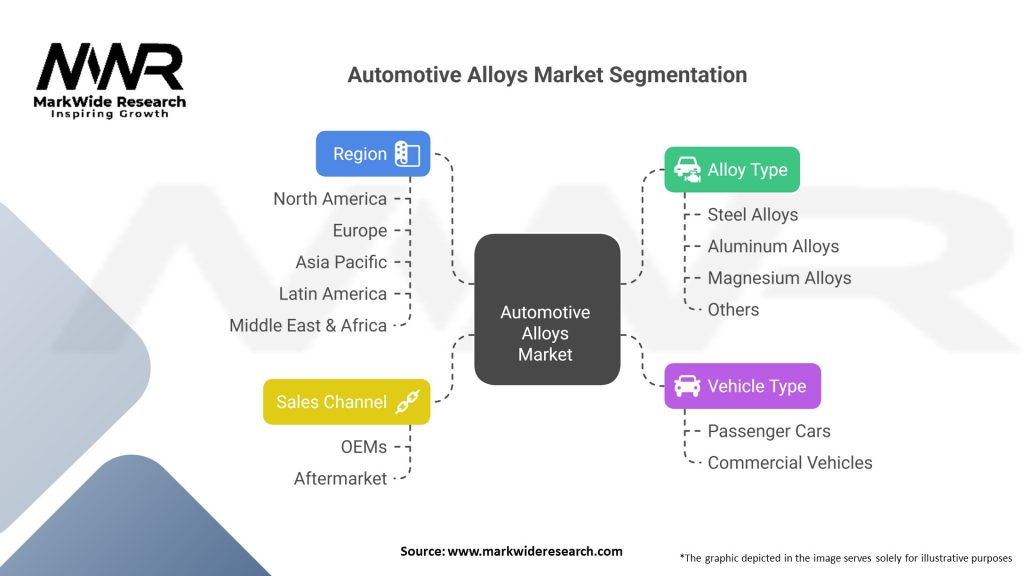

Segmentation

-

By Alloy Type: Aluminum, Steel (AHSS), Magnesium, Titanium

-

By Product Form: Sheets & Foils, Castings, Forgings, Extrusions

-

By Application: Body & Chassis, Engine & Drivetrain, Wheels, Interior Components

-

By Vehicle Type: Passenger Cars, Commercial Vehicles, Electric & Hybrid Vehicles

Category-wise Insights

-

Aluminum Sheets & Foils: Predominantly for body panels and heat exchangers; recycled content alloys gain traction.

-

AHSS Steel: Used in B-pillars, door beams, and crash structures; balances formability and strength.

-

Magnesium Castings: Ideal for instrument panels, steering columns, and seat frames; require advanced coatings.

-

Titanium Forgings: Niche use in high-performance exhaust systems and suspension linkages, valued for corrosion resistance.

Key Benefits for Industry Participants and Stakeholders

-

Weight Reduction: Alloy substitution can cut vehicle mass by up to 20%, translating into fuel savings and lower emissions.

-

Performance Enhancement: Increased stiffness and fatigue resistance improve handling dynamics and component lifespan.

-

Regulatory Compliance: Lightweight alloys help meet CO₂ and CAFE targets cost-effectively compared to powertrain downsizing alone.

-

Sustainability Credentials: High recyclability rates bolster circular economy claims and ESG reporting.

-

Design Freedom: Advanced alloy processes (casting, extrusion) enable complex geometries and integrated functions, reducing assembly steps.

SWOT Analysis

Strengths

-

Proven lightweighting benefits with mature supply chains for aluminum and steel.

-

Strong recyclability and circular economy alignment.

Weaknesses

-

Higher costs and supply volatility for magnesium and titanium.

-

Joining and corrosion challenges with dissimilar metals.

Opportunities

-

Expansion in EV platforms demanding extreme weight savings.

-

Innovation in high-strength recycled alloy grades.

Threats

-

Price fluctuations in metal commodities.

-

Emerging composite materials (carbon fiber) offering alternative lightweight solutions.

Market Key Trends

-

Recycled Content Alloys: OEM mandates on post-consumer recycled aluminum to lower carbon footprint.

-

Multimaterial Architectures: Integration of alloys with composites and polymers for targeted performance.

-

Digital Process Control: AI-driven monitoring of casting and rolling operations to ensure alloy consistency.

-

Surface Engineering: Nano-coatings on alloys to enhance durability, corrosion resistance, and aesthetic finishes.

-

Electrification Synergy: Alloy battery housings, motor mounts, and thermal management components tailored for EV requirements.

Covid-19 Impact

The pandemic temporarily disrupted global alloy supply chains, causing raw material shortages and lead-time extensions. However, stimulus-driven automotive production rebounds in key markets (China, US, Europe) have swiftly restored demand for alloy components. Additionally, OEMs accelerated investment in lightweight materials to meet aggressive post-Covid sustainability goals.

Key Industry Developments

-

JV Announcements: Partnerships between automakers and alloy producers to build dedicated lightweight materials plants near assembly lines.

-

New Alloy Grades: Launch of next-generation high-strength, formable aluminum alloys (e.g., AA7xxx series) and third-generation AHSS steels.

-

Circular Partnerships: Agreements between scrap processors and OEMs to ensure high-quality recycled alloy feedstock.

-

Additive Trials: Pilot 3D-printing projects for magnesium and aluminum components in low-volume, high-complexity models.

Analyst Suggestions

-

Strengthen Supply Security: Diversify raw-material sourcing and invest in scrap recovery to mitigate commodity price swings.

-

Co-Develop Materials: Engage early with alloy suppliers to tailor chemistries for proprietary part designs and performance targets.

-

Invest in Joining Technologies: Adopt advanced welding and adhesive bonding methods to enable multimaterial assemblies.

-

Scale Circular Programs: Implement closed-loop recycling and refabrication systems to secure sustainable alloy supply and reduce carbon footprint.

Future Outlook

The Automotive Alloys market is set for sustained growth as light-weighting remains a cornerstone of powertrain efficiency and vehicle design innovation. Emerging EV and autonomous vehicle platforms will push alloy performance requirements further, opening opportunities for novel alloy chemistries and processing technologies. Continuous improvement in recycling methods and digital process controls will enhance alloy quality and supply chain resilience, reinforcing the critical role of alloys in the next generation of sustainable mobility.

Conclusion

Alloys will continue to play a pivotal role in transforming automotive engineering, balancing the needs for lightweight construction, structural integrity, and sustainability. Stakeholders that invest in R&D, secure circular supply chains, and adopt advanced manufacturing processes will lead the charge in meeting evolving regulatory and consumer demands. As the industry pivots toward electrification and net-zero commitments, the strategic deployment of automotive alloys will be essential for realizing high-performance, eco-efficient vehicles of the future.