444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global automotive AHSS (Advanced High Strength Steel) market is poised for significant growth over the coming years. AHSS refers to steel grades that offer superior tensile strength, yield strength, and formability compared to conventional steel grades. The use of AHSS in automotive applications results in lighter and safer vehicles, improved fuel efficiency, and reduced emissions. These benefits have led to increased adoption of AHSS in the automotive industry, especially in high-performance vehicles.

According to the latest research report by Market Research Future (MRFR), the global automotive AHSS market is expected to reach a valuation of USD 25.3 billion by 2027, expanding at a CAGR of 14.8% during the forecast period (2020-2027). The rising demand for lightweight materials to improve fuel efficiency and meet stringent emission regulations is driving the growth of the market.

Meaning

Advanced High Strength Steel (AHSS) is a type of steel that offers high strength, good formability, and excellent corrosion resistance. AHSS has higher tensile strength and yield strength than conventional steel grades, making it ideal for automotive applications where safety and durability are critical factors.

AHSS is categorized into two types: dual-phase (DP) steel and transformation-induced plasticity (TRIP) steel. DP steel is a combination of soft and hard phases that offer good formability and high strength. TRIP steel, on the other hand, is a type of steel that exhibits high elongation and formability while maintaining high strength.

Executive Summary

The global automotive AHSS market is expected to grow at a CAGR of 14.8% during the forecast period (2020-2027) and reach a valuation of USD 25.3 billion by 2027. The rising demand for lightweight materials to improve fuel efficiency and meet stringent emission regulations is driving the growth of the market. AHSS offers high strength, good formability, and excellent corrosion resistance, making it ideal for automotive applications where safety and durability are critical factors.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

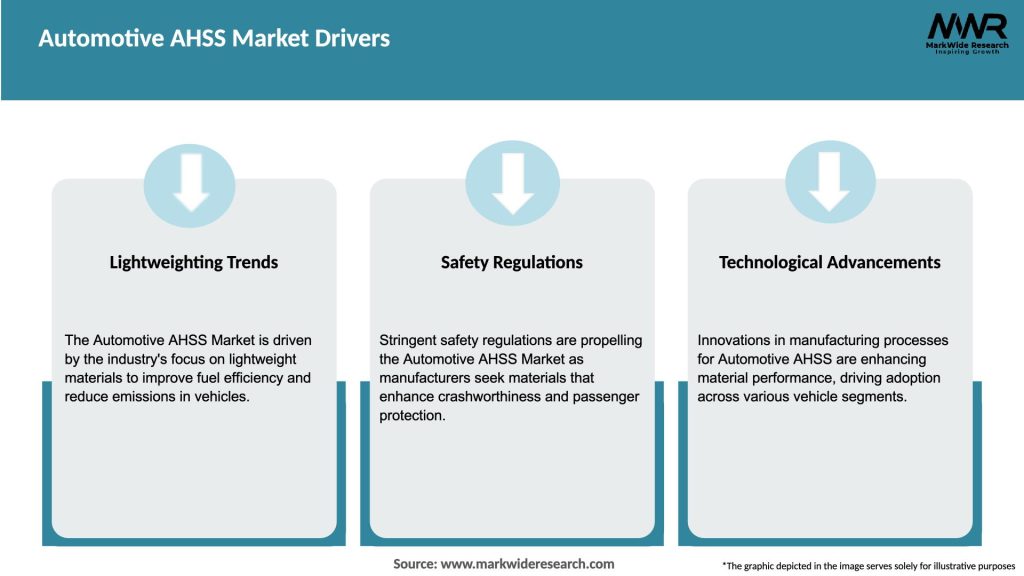

Market Drivers

Governments across the world are imposing stringent emission regulations to reduce the carbon footprint of vehicles. AHSS offers lightweighting solutions to reduce the weight of vehicles and improve fuel efficiency, thereby helping automakers to meet emission regulations. For instance, the European Union (EU) has set a target of reducing CO2 emissions from new cars by 37.5% by 2030, compared to 2021 levels.

The automotive industry is shifting towards lightweight materials to improve fuel efficiency and reduce emissions. AHSS offers high strength and good formability while being lightweight, making it an ideal material for automotive applications. According to the National Renewable Energy Laboratory (NREL), the use of lightweight materials in a midsize car can reduce fuel consumption by 5-7%

Market Restraints

The cost of AHSS is higher than conventional steel grades, which can act as a restraint on the growth of the market. The higher cost of AHSS is due to the complex manufacturing process and the use of specialized equipment. However, the long-term benefits of using AHSS, such as improved fuel efficiency and reduced emissions, outweigh the initial cost.

The availability of alternative lightweight materials such as aluminum and composites can pose a challenge to the growth of the automotive AHSS market. However, AHSS offers superior strength and durability compared to other lightweight materials, making it a preferred choice for automotive applications.

Market Opportunities

The shift towards electric vehicles presents an opportunity for the automotive AHSS market. The use of AHSS in electric vehicles can reduce the weight of the vehicle, thereby improving the range and battery life. Additionally, the use of AHSS in electric vehicles can improve crashworthiness, making them safer for occupants.

The growth of the automotive industry in emerging markets such as India and China presents an opportunity for the automotive AHSS market. The rising demand for automobiles in these countries, coupled with the increasing focus on safety and fuel efficiency, is expected to drive the demand for AHSS in the region.

Market Dynamics

The automotive AHSS market is highly dynamic, with several factors influencing its growth. The rising demand for lightweight materials to improve fuel efficiency and meet emission regulations is driving the growth of the market. The availability of alternative lightweight materials and the high cost of AHSS can act as a restraint on the growth of the market. However, the long-term benefits of using AHSS, such as improved safety and reduced emissions, outweigh the initial cost.

Regional Analysis

The Asia-Pacific region dominates the global automotive AHSS market, owing to the presence of major automotive manufacturers in the region. The region is expected to witness significant growth during the forecast period, driven by the rising demand for lightweight materials and the shift towards electric vehicles. Europe and North America are also significant markets for automotive AHSS, owing to the stringent emission regulations in these regions.

Competitive Landscape

Leading Companies in the Automotive AHSS Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global automotive AHSS market is segmented on the basis of type, application, and region.

By Type:

By Application:

By Region:

Category-wise Insights

DP steel is the most widely used type of AHSS in automotive applications, owing to its excellent combination of strength and formability. DP steel offers high tensile strength, good formability, and excellent crashworthiness, making it ideal for automotive applications such as body-in-white and chassis.

TRIP steel is a type of AHSS that offers high elongation and formability while maintaining high strength. TRIP steel is used in automotive applications such as crash boxes, bumpers, and door reinforcements, owing to its high energy absorption capacity and excellent crashworthiness.

Key Benefits for Industry Participants and Stakeholders

The use of AHSS in automotive applications can help automakers to meet stringent emission regulations and improve fuel efficiency. AHSS also offers superior strength and durability compared to conventional steel grades, making vehicles safer for occupants.

The growing demand for AHSS presents an opportunity for steel manufacturers to expand their market presence. Steel manufacturers can focus on product innovation and strategic partnerships to cater to the increasing demand for AHSS.

Suppliers of AHSS can benefit from the growing demand for lightweight materials in the automotive industry. Suppliers can offer customized solutions to meet the specific requirements of automakers and expand their customer base.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The shift towards electric vehicles presents a significant opportunity for the automotive AHSS market. The use of AHSS in electric vehicles can reduce the weight of the vehicle, thereby improving the range and battery life. Additionally, the use of AHSS in electric vehicles can improve crashworthiness, making them safer for occupants.

The automotive industry is shifting towards lightweight materials to improve fuel efficiency and reduce emissions. AHSS offers high strength and good formability while being lightweight, making it an ideal material for automotive applications.

Covid-19 Impact

The Covid-19 pandemic has impacted the global automotive industry, leading to a decline in demand for automobiles. However, the long-term prospects of the automotive industry remain positive, with governments implementing measures to revive the industry. The demand for lightweight materials, including AHSS, is expected to increase in the post-pandemic period, driven by the increasing focus on sustainability and fuel efficiency.

Key Industry Developments

Analyst Suggestions

Players in the automotive AHSS market should focus on product innovation to cater to the specific requirements of automakers. Customized solutions can help players to expand their customer base and gain a competitive edge.

Strategic partnerships can help players to expand their market presence and cater to the increasing demand for AHSS in the automotive industry. Players can collaborate with automakers and suppliers to offer integrated solutions.

Future Outlook

The global automotive AHSS market is expected to witness significant growth during the forecast period, driven by the rising demand for lightweight materials and the shift towards electric vehicles. AHSS offers high strength, good formability, and excellent corrosion resistance, making it ideal for automotive applications. The Asia -Pacific region is expected to dominate the market, owing to the presence of major automotive manufacturers in the region. Steel manufacturers are expected to focus on product innovation and strategic partnerships to expand their market presence and cater to the increasing demand for AHSS.

Conclusion

The global automotive AHSS market is poised for significant growth during the forecast period, driven by the rising demand for lightweight materials and the shift towards electric vehicles. AHSS offers high strength, good formability, and excellent corrosion resistance, making it ideal for automotive applications. The Asia-Pacific region dominates the market, owing to the presence of major automotive manufacturers in the region. Steel manufacturers are expected to focus on product innovation and strategic partnerships to expand their market presence and cater to the increasing demand for AHSS. The long-term benefits of using AHSS, such as improved fuel efficiency and reduced emissions, outweigh the initial cost, making it a preferred choice for automotive applications.

What is Automotive AHSS?

Automotive AHSS refers to advanced high-strength steel used in the automotive industry to enhance vehicle safety and performance. It is characterized by its superior strength-to-weight ratio, making it ideal for structural components in vehicles.

What are the key players in the Automotive AHSS Market?

Key players in the Automotive AHSS Market include ArcelorMittal, Tata Steel, and SSAB, which are known for their innovative steel solutions and extensive product offerings for automotive applications, among others.

What are the growth factors driving the Automotive AHSS Market?

The growth of the Automotive AHSS Market is driven by increasing demand for lightweight materials to improve fuel efficiency and reduce emissions. Additionally, the rising focus on vehicle safety standards and the need for enhanced crash performance are significant factors.

What challenges does the Automotive AHSS Market face?

The Automotive AHSS Market faces challenges such as the high cost of production and the complexity of manufacturing processes. Additionally, competition from alternative materials like aluminum and composites poses a challenge to market growth.

What opportunities exist in the Automotive AHSS Market?

Opportunities in the Automotive AHSS Market include the increasing adoption of electric vehicles, which require advanced materials for battery protection and structural integrity. Furthermore, innovations in steel processing technologies present avenues for market expansion.

What trends are shaping the Automotive AHSS Market?

Trends in the Automotive AHSS Market include the development of new steel grades with improved properties and the integration of smart manufacturing technologies. Additionally, sustainability initiatives are driving the use of recycled materials in steel production.

Automotive AHSS Market:

| Segmentation | Details |

|---|---|

| Product Type | Dual Phase Steel, Martensitic Steel, Boron Steel, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Application | Body-in-White, Chassis, Powertrain, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive AHSS Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at