Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Active suspension adoption correlates strongly with vehicle powertrain electrification, as EVs benefit from separately packaged actuators that integrate easily with electric architectures.

-

Electromagnetic suspension systems are gaining traction for their rapid response times, compact packaging, and lower maintenance compared to hydraulic counterparts.

-

OEMs are increasingly leveraging over-the-air (OTA) software updates to refine suspension algorithms post-sale, optimizing performance across vehicle life cycles.

-

Integration of predictive road-preview features—using cameras and navigation data—allows suspension systems to adjust proactively for upcoming road irregularities, elevating ride quality and safety.

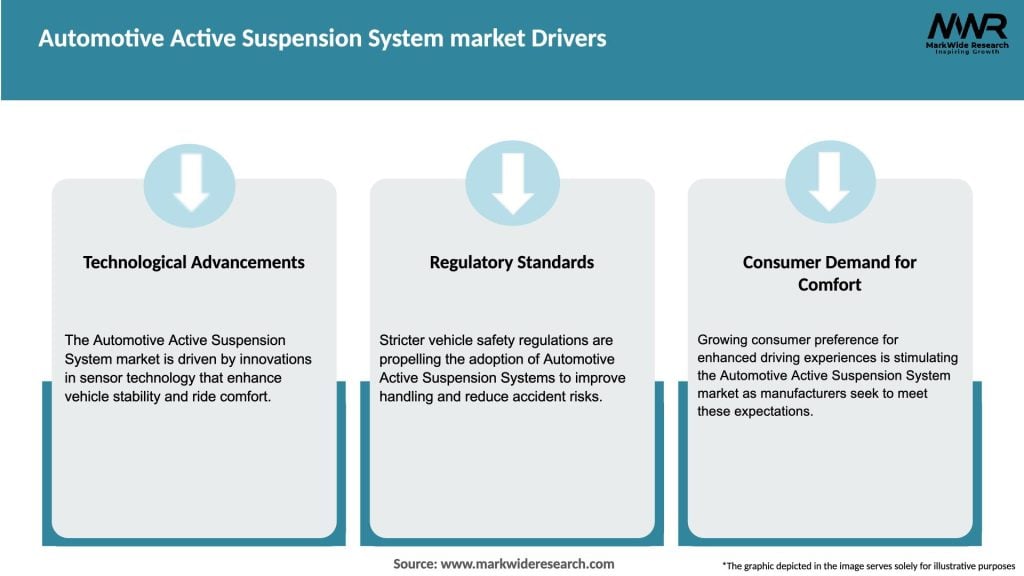

Market Drivers

Several factors are propelling the growth of the Automotive Active Suspension System market:

-

Rising Demand for Comfort and Performance: Consumers expect luxury-level ride comfort and handling even in mainstream vehicles, encouraging OEMs to adopt active suspension solutions.

-

Electrification Trend: Battery electric and hybrid vehicles leverage onboard electrical energy to power active actuators efficiently, eliminating the need for complex hydraulic circuits and enabling faster system response.

-

Advanced Safety Regulations: Stricter rollover and braking distance requirements push automakers to implement active systems that improve vehicle stability and reduce body motions during evasive maneuvers.

-

Autonomous Driving Requirements: Level 2+ and Level 3 autonomous vehicles require precise chassis control to ensure passenger comfort and sensor performance, increasing the necessity for active suspension integration.

-

Technological Advancements: Innovations in mechatronic actuators, high-speed processors, and real-time control software enable cost-effective, reliable active suspension platforms suitable for high-volume production.

Market Restraints

Despite promising demand, the market faces several challenges:

-

High System Costs: Active suspension components—actuators, high-precision sensors, and ECUs—add significant expense, which can deter adoption in cost-sensitive vehicle segments.

-

Complexity of Integration: Packaging active suspension hardware within tight wheel wells and coordinating with existing electronic stability control systems requires advanced engineering and extensive validation.

-

Maintenance and Reliability Concerns: Hydraulic active systems, in particular, may require periodic servicing and are susceptible to leaks, while electromagnetic variants face thermal management challenges.

-

Limited Aftermarket Support: Due to system complexity and safety-critical nature, aftermarket or retrofit active suspension options are scarce, restricting consumer access to upgrades.

Market Opportunities

The Automotive Active Suspension System market presents several avenues for growth and differentiation:

-

Modular Actuator Solutions: Development of compact, bolt-on electromechanical suspension modules that simplify integration and reduce development time for OEMs.

-

Software-Defined Tuning: Offering subscription-based ride modes and performance profiles via OTA updates enables recurring revenue streams and continuous product improvement.

-

Predictive Suspension Control: Utilizing forward-looking sensors (stereo cameras, LiDAR) and map data to anticipate road conditions and adjust suspension proactively, creating a new segment of intelligent systems.

-

Commercial Vehicle Applications: Extending active suspension benefits to buses and heavy trucks to reduce cargo sway, enhance braking stability, and improve driver comfort on long hauls.

-

Emerging Market Penetration: As production costs decline, active suspension features may trickle into mid-level models in India, Southeast Asia, and Latin America, tapping into growing vehicle demand.

Market Dynamics

The Automotive Active Suspension System market is shaped by the following dynamics:

-

Supplier–OEM Collaborations: Tier-1 suppliers and automakers are co-developing platforms to tailor suspension performance to brand character, sharing risks and accelerating deployment.

-

Consolidation of Electronic Architectures: Consolidated vehicle ECUs and domain controllers reduce wiring complexity and leverage shared sensor networks, making active suspension integration more efficient.

-

Regulatory Harmonization: Alignment of safety standards across regions streamlines global product launches, allowing manufacturers to amortize development costs over larger volumes.

-

Shift to Electromechanical Actuation: Electromagnetic and electrohydraulic systems are increasingly favored over purely hydraulic setups due to faster response and simplified maintenance.

-

Growing Role of Data: Sensor fusion and machine-learning algorithms are optimizing damping strategies for varied driving scenarios, improving system adaptability without hardware changes.

Regional Analysis

Adoption and maturity levels differ across key geographies:

-

North America: High penetration in luxury and EV segments, supported by strong consumer appetite for performance SUVs and premium sedans; aftermarket education drives replacement demand.

-

Europe: Leading market for active suspension, driven by strict safety regulations, high EV adoption rates in countries like Norway and Germany, and the prominence of luxury brands.

-

Asia Pacific: Rapid growth in China as domestic OEMs introduce advanced suspension features on premium EV models; Japan and South Korea focus on mechatronic innovations.

-

Latin America: Nascent market with selective adoption in premium segments; cost sensitivity limits near-term growth, but rising incomes signal future potential.

-

Middle East & Africa: Premium off-road SUVs benefit from active suspension systems that improve ride comfort on rough terrains, though overall market remains niche due to price barriers.

Competitive Landscape

Leading Companies in the Automotive Active Suspension System Market:

- Continental AG

- ZF Friedrichshafen AG

- Magneti Marelli S.p.A. (CK Holdings Co., Ltd.)

- Tenneco Inc.

- BWI Group

- Thyssenkrupp AG

- Hitachi Automotive Systems, Ltd.

- Mando Corporation

- WABCO Holdings Inc.

- Schaeffler AG

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

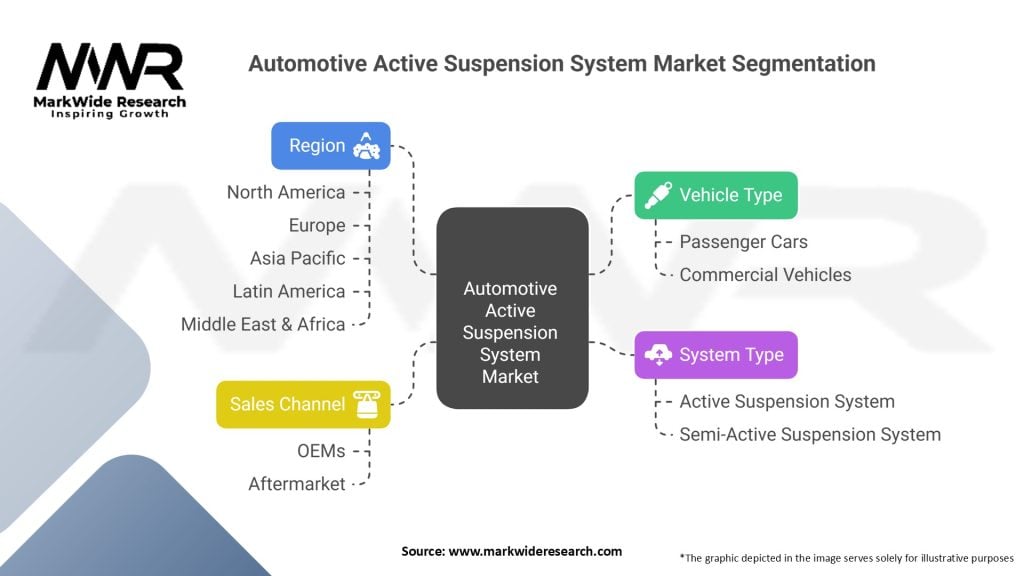

Segmentation

The market can be segmented as follows:

-

System Type: Electromechanical Active Suspension, Electrohydraulic Active Suspension, Electromagnetic Suspension

-

Vehicle Type: Passenger Cars, SUVs & Crossovers, Commercial Vehicles, Electric Vehicles

-

Sales Channel: OEM Fitment, Aftermarket Retrofit (Limited)

-

Component Type: Actuators, Electronic Control Units (ECUs), Sensors (Accelerometers, Suspension Position Sensors)

Category-wise Insights

-

Electromechanical Systems: Utilize electric motors and gear drives to adjust damper positions, offering fast response and easy integration with EV architectures.

-

Electrohydraulic Systems: Combine hydraulic actuators with electronically controlled valves, delivering high force capacity ideal for heavy vehicles but requiring complex fluid circuits.

-

Electromagnetic Suspensions: Employ linear motors or magnetorheological fluids to vary damping characteristics instantaneously, balancing performance with minimal energy consumption.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Ride Comfort: Superior isolation from road irregularities and reduced body motions improve passenger comfort, a key differentiator in luxury and EV segments.

-

Improved Handling and Safety: Active stabilization minimizes body roll and pitch, reducing lap times on performance models and enhancing stability during emergency maneuvers.

-

Energy Efficiency: Optimized damping strategies can contribute to marginal gains in energy consumption, particularly relevant for range-sensitive EVs.

-

Brand Differentiation: Unique suspension tuning and ride modes support automaker brand identity, from sporty to chauffeur-oriented settings.

-

Data Monetization: Field data collected through suspension sensors can feed into predictive maintenance services and ride quality analytics, offering additional business models.

SWOT Analysis

Strengths

-

Clear performance advantage over passive and semi-active suspensions

-

Alignment with electrification and ADAS trends

-

Potential for OTA updates and continuous improvement

Weaknesses

-

High component and development costs

-

System complexity and maintenance requirements

-

Limited aftermarket support restricts broader consumer access

Opportunities

-

Expansion into commercial and off-highway vehicle segments

-

Development of plug-and-play retrofit modules for premium pre-owned markets

-

Integration with predictive control using V2X and road-preview data

Threats

-

Competition from advanced passive architectures (air springs, adaptive dampers)

-

Durability concerns in extreme climates or harsh operating environments

-

Supply chain vulnerabilities affecting actuator and semiconductor availability

Market Key Trends

-

Predictive Road Preview: Integration of forward-looking sensors (cameras, radar) and map data to adjust suspension ahead of road irregularities—reducing jounce and improving comfort.

-

Integration with ADAS: Coordinated control with emergency braking and steering assist systems to maintain chassis stability during evasive maneuvers.

-

Shared EV Platforms: Standardized active suspension modules across multiple EV models reduce costs through economies of scale.

-

Lightweighting Initiatives: Development of compact, aluminum- or composite-based actuators to offset added mass and improve overall vehicle efficiency.

-

Software-First Architecture: Emphasis on software-driven ride tuning, enabling customizable ride profiles and subscription-based feature unlocks post-sale.

Covid-19 Impact

The Covid-19 pandemic temporarily disrupted supply chains and vehicle production, delaying some active suspension deployments. However, the accelerated shift toward electrification during recovery phases renewed OEM focus on integrating advanced chassis technologies into EV portfolios. As consumer priorities evolved to value health and comfort, features such as advanced suspension systems gained renewed importance in purchase considerations, particularly in luxury and performance segments.

Key Industry Developments

-

Strategic Partnerships: Collaborations between automotive OEMs and suspension specialists—such as BMW’s partnership with ZF—to co-develop next-generation active systems for flagship EV models.

-

Technology Demonstrators: Prototype vehicles showcasing fully active chassis control combining suspension, steering, and braking to deliver “magic carpet” ride experiences.

-

Regulatory Engagement: Industry consortia working with safety regulators to define performance benchmarks and testing protocols for active suspension systems.

-

OTA Calibration Trials: Field trials enabling remote fine-tuning of damping algorithms based on real-world usage data, shortening development cycles and enhancing customer feedback loops.

Analyst Suggestions

-

Emphasize Electromechanical Solutions: Prioritize development of electromechanical active suspension modules for EVs, leveraging existing electrical architectures and minimizing hydraulic complexity.

-

Expand into Commercial Fleets: Adapt active suspension features to heavy-duty trucks and buses to improve payload stability and driver comfort, targeting fleet operators with total cost-of-ownership benefits.

-

Collaborate on Predictive Control: Partner with mapping and sensor providers to integrate road-preview capabilities, creating a truly intelligent suspension that anticipates and adapts to driving conditions.

-

Educate Consumers: Launch marketing campaigns that clearly communicate the tangible benefits—comfort, safety, and performance—of active suspension, addressing potential cost-benefit concerns.

Future Outlook

The Automotive Active Suspension System market is expected to grow at a double-digit CAGR over the next decade, driven by widespread EV adoption, regulatory emphasis on vehicle safety, and consumer appetite for premium driving experiences. Technological convergence—combining active suspension with ADAS, predictive control, and vehicle-to-everything (V2X) connectivity—will usher in fully integrated chassis control systems that dynamically manage all aspects of ride and handling. As production costs decline and architectures standardize across model lineups, active suspension will migrate from flagship models into mainstream segments, reshaping industry expectations around ride comfort and dynamic performance.

Conclusion

Active suspension systems represent a transformative leap in vehicle dynamics, offering a harmonious blend of comfort, safety, and control that passive systems cannot match. Amidst the automotive industry’s shift toward electrification and autonomy, these systems will play an essential role in ensuring passenger well-being and enhancing sensor performance for ADAS functions. While challenges around cost, complexity, and integration persist, ongoing innovations in electromechanical actuation, predictive algorithms, and modular architectures promise to broaden active suspension accessibility. Stakeholders who invest in scalable, software-driven solutions and strategic partnerships will secure leadership in defining the future of vehicle ride and handling across all segments.