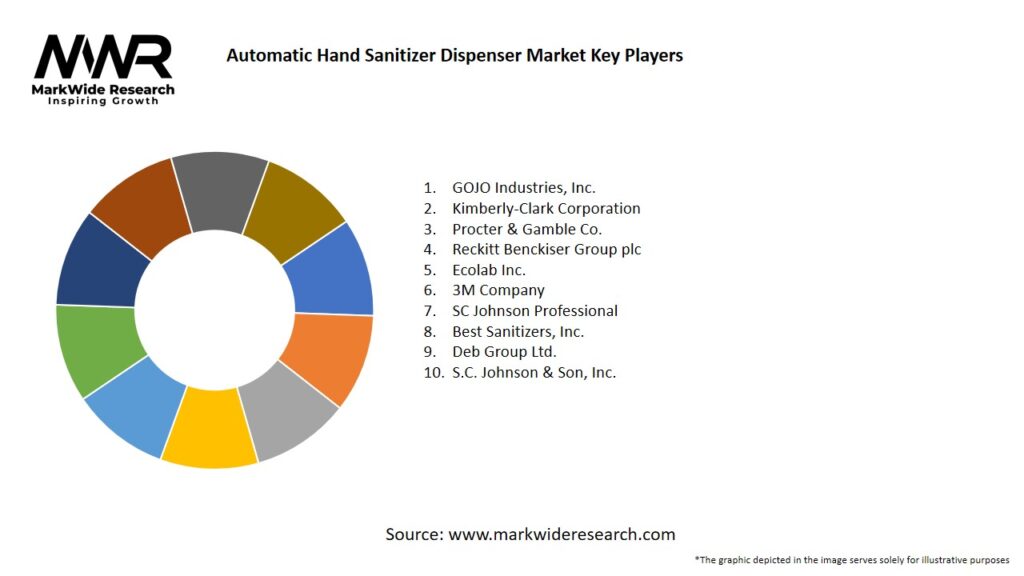

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Sensor-based, touchless dispensers accounted for over 90% of global unit sales in 2024, reflecting consumer preference for contactless interaction.

-

Healthcare and foodservice sectors represent the largest end-user segments, together contributing nearly 60% of market revenue.

-

Asia Pacific leads in volume due to high population density and government-mandated hygiene measures, while North America delivers the highest average selling price (ASP) per unit.

-

Refills—both proprietary and third-party—create recurring revenue streams that drive aftermarket growth.

-

Eco-friendly dispenser models using refillable cartridges and low-power electronics are gaining traction among sustainability-focused buyers.

Market Drivers

-

Heightened Hygiene Awareness: Global health crises have ingrained hand hygiene as a core infection-prevention practice in both public and private settings.

-

Regulatory Guidelines: Standards from WHO, CDC, and local health agencies recommend easy access to sanitizer dispensers in high-traffic areas, increasing mandatory installations.

-

Touchless Technology Preference: Organizations prioritize sensor-driven systems to reduce surface contamination and instill user confidence.

-

Facility Modernization: Businesses renovating or building new premises integrate touchless hygiene infrastructure as part of smart-building designs.

-

Recurring Refill Revenue: The need for compatible sanitizer cartridges and bulk refill fluids fuels aftermarket opportunities for dispenser manufacturers.

Market Restraints

-

Sensor Reliability Issues: Poorly calibrated or low-quality sensors can lead to mis-dispensing or failure to detect hands, eroding user satisfaction.

-

Upfront Costs: Automatic models are significantly more expensive than manual dispensers, which can deter cost-sensitive buyers and small businesses.

-

Maintenance Requirements: Battery replacements, occasional sensor cleaning, and pump servicing add to total cost of ownership.

-

Compatibility Constraints: Proprietary refill cartridges lock buyers into specific brands, raising concerns about long-term cost and supply availability.

-

Power Dependency: Mains-powered units require wiring and installation; battery-only models risk downtime if batteries are not replaced promptly.

Market Opportunities

-

IoT Integration: Embedding connectivity to send real-time alerts on refill levels and usage analytics can streamline facilities management.

-

Eco-Design Focus: Developing dispensers with recyclable plastics, solar-assist charging, and refillable tanks aligns with sustainability goals.

-

Emerging Markets: Rapid urbanization and expanding commercial infrastructure in Latin America, Middle East, and Africa open new growth corridors.

-

Customizable Aesthetics: Offering modular faceplates, color options, and branding opportunities can appeal to architects and retail chains.

-

Multifunctional Units: Combining sanitizer, soap, and even paper-towel dispensers in a single touchless station caters to restroom and lobby requirements.

Market Dynamics

-

Technology Evolution: Moving from basic infrared sensors to capacitive and ultrasonic detection improves reliability and reduces false triggers.

-

Channel Diversification: Direct-to-business sales coexist with e-commerce platforms, enabling both large orders and one-off consumer purchases.

-

OEM vs. Private Label: Retailers and facility-service providers are launching private-label dispensers, intensifying competition on cost and branding.

-

Consolidation Trends: Mergers among sanitizer and dispenser manufacturers aim to offer end-to-end hygiene solutions.

-

User Behavior Insights: Advanced analytics derived from dispenser usage patterns inform refill strategies, layout optimization, and hygiene compliance programs.

Regional Analysis

-

North America: High ASPs driven by healthcare and foodservice investments; growing smart-building integration.

-

Europe: Mature market with stringent hygiene regulations; demand for biodegradable cartridges and energy-efficient products.

-

Asia Pacific: Largest unit volumes; government-led public sanitation initiatives and rapid retail infrastructure growth.

-

Latin America: Emerging adoption in hospitality and transportation sectors; sensitivity to price and local manufacturing.

-

Middle East & Africa: Hospital and airport installations leading, with diversification into commercial office spaces underway.

Competitive Landscape

Leading Companies in the Automatic Hand Sanitizer Dispenser Market:

- GOJO Industries, Inc.

- Kimberly-Clark Corporation

- Procter & Gamble Co.

- Reckitt Benckiser Group plc

- Ecolab Inc.

- 3M Company

- SC Johnson Professional

- Best Sanitizers, Inc.

- Deb Group Ltd.

- S.C. Johnson & Son, Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

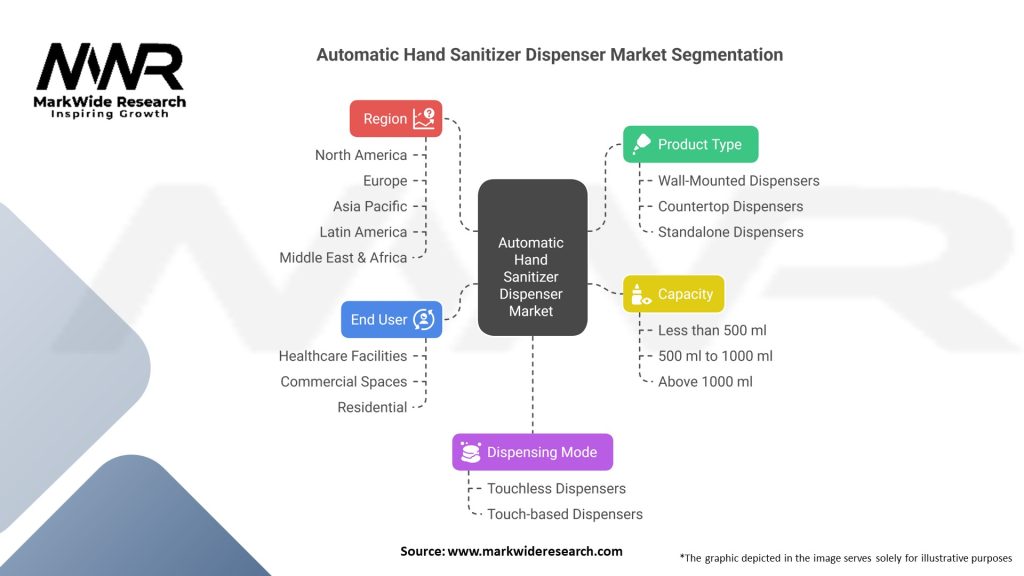

Segmentation

-

By Technology: Infrared, Capacitive, Ultrasonic

-

By Form Factor: Wall-Mounted, Freestanding, Countertop, Portable

-

By Power Source: Battery-Operated, Mains-Powered, Hybrid (Battery + Solar)

-

By End-User: Healthcare, Foodservice, Education, Retail, Transportation, Corporate Offices

Category-wise Insights

-

Infrared Dispensers: Widely used for their cost-effectiveness, but may false-trigger under bright ambient light.

-

Capacitive Dispensers: Offer finer detection and lower power consumption, suited to premium installations.

-

Ultrasonic Dispensers: Provide the most reliable sensing in varied environmental conditions, though at higher price points.

-

Freestanding Units: Ideal for retail and lobbies where wall mounting is impractical; require stable base designs.

-

Portable Dispensers: Battery-powered bottles and desktop models address personal and small-business use cases.

Key Benefits for Industry Participants and Stakeholders

-

Reduced Infection Risk: Touchless operation minimizes pathogen transfer among users.

-

Enhanced Compliance: Consistent dosing and visible placement drive higher hand-hygiene adherence.

-

Cost Predictability: Metered dispensing controls sanitizer usage and lowers overall consumption.

-

Operational Efficiency: Remote-monitoring solutions reduce manual inspections for refills and maintenance.

-

Brand Reinforcement: Customizable dispensers and visible hygiene stations improve customer trust and corporate image.

SWOT Analysis

Strengths:

-

Strong infection-control credentials; wide end-user acceptance.

-

Metered dispensing enhances cost control.

-

Proven touchless technology builds user confidence.

Weaknesses:

-

Higher upfront CAPEX than manual dispensers.

-

Maintenance requirements for batteries and sensors.

-

Dependency on proprietary refill systems.

Opportunities:

-

Integration into smart-building and IoT platforms.

-

Expansion into underserved emerging markets.

-

Development of eco-friendly and refillable-tank models.

Threats:

-

Market entry of low-cost, unbranded counterfeits.

-

Declining perceived urgency as infection waves subside.

-

Regulatory shifts on sanitizer formulations impacting compatibility.

Market Key Trends

-

Integration with Building Management Systems: Automated alerts for refill needs tied into facility dashboards.

-

Eco-Refill Initiatives: Programs encouraging bulk refill stations to reduce plastic waste.

-

Subscription Models: “Sanitizer-as-a-Service” bundles dispenser, sanitizer supply, and maintenance.

-

Design-Forward Dispensers: Sleek, minimalistic units that complement modern interiors in hospitality and retail.

-

Contact-Tracing Analytics: Aggregated usage data correlated with foot-traffic patterns to inform safety protocols.

Covid-19 Impact

The pandemic catalyzed unprecedented demand, prompting rapid deployment of automatic dispensers in schools, offices, and transportation hubs. Supply-chain disruptions led manufacturers to diversify component sourcing and ramp up local production. As vaccination rates climbed, institutions selectively maintained or upgraded dispenser networks, integrating them into broader health-and-safety strategies rather than removing them. The result is a sustained baseline demand well above pre-2020 levels.

Key Industry Developments

-

GOJO introduced the PURELL® SMARTLINK™ dispenser, offering RFID-based cartridge tracking and cloud analytics.

-

Essity unveiled Tork Vision Cleaning™, a sensor-driven monitoring solution that tracks dispenser fill levels alongside restroom traffic.

-

Deb Group launched SensorFlow™ Eco, a solar-assist dispenser requiring zero battery replacements for two years.

-

Kimberly-Clark Professional partnered with Cisco, enabling networked dispensers to feed usage data into workplace-management platforms.

Analyst Suggestions

-

Prioritize Sensor Quality: Invest in robust detection technologies to minimize false dispenses and downtime.

-

Adopt Open-Platform Connectivity: Support standard IoT protocols (e.g., MQTT, BACnet) to integrate seamlessly with facility systems.

-

Expand Refillable Designs: Reduce plastic waste and customer lock-in by offering refill-tank compatible models.

-

Offer Flexible Commercial Models: Combine purchase, rental, and subscription options to cater to diverse budget profiles.

-

Educate Buyers on TCO: Demonstrate total cost of ownership benefits—reduced sanitizer waste, labor savings, and infection-control ROI.

Future Outlook

The Automatic Hand Sanitizer Dispenser market is expected to maintain elevated growth through 2030, underpinned by continued hygiene vigilance and the rollout of smarter, greener dispensing systems. As buildings become more connected and sustainability mandates tighten, dispensers that deliver data-driven maintenance alerts and minimize plastic use will command premium positioning. Emerging use cases—such as integration with access-control turnstiles and attendance systems—could further embed dispensers within facility-management ecosystems, ensuring their relevance in a post-pandemic world.

Conclusion

In conclusion, the Automatic Hand Sanitizer Dispenser market has evolved from a reactive health-crisis measure into a foundational element of modern hygiene protocols. Stakeholders who focus on reliable sensing, seamless connectivity, and sustainable design will lead the next wave of innovation. By aligning product development with evolving regulations, user expectations, and facility-management needs, manufacturers and service providers can secure long-term growth in an increasingly hygiene-conscious global marketplace.