444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Automated algo trading, also known as algorithmic trading or black-box trading, is a rapidly growing segment in the financial industry. It involves the use of computer algorithms to execute trades in financial markets, such as stocks, bonds, commodities, and currencies. This technology-driven approach to trading has gained popularity due to its ability to execute trades at high speeds, analyze vast amounts of data, and make decisions based on predefined rules.

Meaning

Automated algo trading refers to the use of advanced computer algorithms to automate the trading process. These algorithms are designed to analyze market data, identify trading opportunities, and execute trades without human intervention. By leveraging complex mathematical models and historical data, algo trading systems can make split-second decisions and execute trades with precision.

Executive Summary

The automated algo trading market is experiencing significant growth, driven by technological advancements, increasing market liquidity, and the demand for efficient and cost-effective trading strategies. The market is characterized by the adoption of sophisticated trading platforms, artificial intelligence (AI) algorithms, and high-frequency trading techniques.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The automated algo trading market is driven by a combination of technological advancements, market forces, regulatory factors, and investor demand. Market participants are constantly innovating and refining their algorithmic trading strategies to stay competitive in the fast-paced financial industry.

The market dynamics are influenced by factors such as market liquidity, trading volumes, volatility, and technological capabilities. The increasing availability of high-quality market data, improved computing power, and advancements in AI and ML technologies are shaping the market landscape.

Moreover, the regulatory environment plays a crucial role in defining the boundaries and ensuring the integrity of automated algo trading practices. Regulators aim to strike a balance between promoting innovation and safeguarding market stability, fairness, and investor protection.

Regional Analysis

The adoption and growth of automated algo trading vary across regions. Developed financial markets such as the United States, the United Kingdom, and Japan have been at the forefront of embracing algorithmic trading. These regions benefit from mature market infrastructures, regulatory frameworks, and advanced technological capabilities.

Emerging economies, including China, India, and Brazil, are witnessing an increasing adoption of automated algo trading. As these markets continue to develop and modernize their financial systems, market participants are leveraging algorithmic trading to improve trading efficiency and attract global investors.

The regulatory landscape also varies across regions, with some jurisdictions implementing strict regulations to monitor and control algorithmic trading activities. It is essential for market participants to understand and comply with regional regulatory requirements when engaging in automated algo trading.

Competitive Landscape

Leading companies in the Automated Algo Trading Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

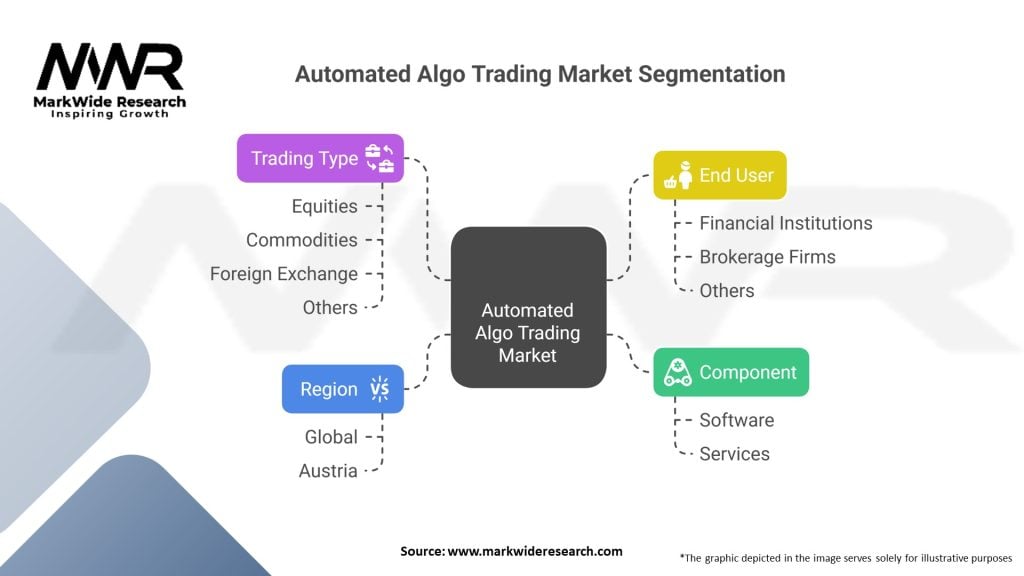

Segmentation

The automated algo trading market can be segmented based on various factors, including the type of market participants, trading strategies, asset classes, and regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the automated algo trading market. The volatility and uncertainty caused by the pandemic led to increased market activity and heightened demand for algorithmic trading strategies.

During the initial phases of the pandemic, automated algo trading systems helped market participants navigate rapidly changing market conditions and execute trades efficiently. The speed and precision of algorithmic trading proved beneficial in managing risks and capitalizing on short-term market opportunities.

Moreover, the pandemic accelerated the adoption of remote trading and cloud-based solutions, enabling traders to access algorithmic trading platforms and execute trades from anywhere. This shift towards remote trading has further boosted the demand for automated algo trading systems.

However, the pandemic also highlighted certain vulnerabilities in algorithmic trading systems. Extreme market volatility and disruptions in liquidity posed challenges for algorithmic trading strategies, leading to significant losses for some market participants.

The Covid-19 pandemic has underscored the importance of robust risk management protocols, scenario analysis, and stress testing for algorithmic trading systems. Market participants have been adapting their algorithms and risk management strategies to account for potential black swan events and extreme market conditions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the automated algo trading market looks promising, driven by technological advancements, increasing market liquidity, and growing demand for efficient and cost-effective trading strategies. The integration of AI and ML technologies will continue to enhance algorithmic trading capabilities, enabling market participants to make data-driven decisions, automate trading processes, and adapt to changing market conditions.

The expansion into alternative asset classes, such as cryptocurrencies and derivatives, will open up new opportunities for algorithmic trading. The rise of retail algo traders, fueled by the democratization of algorithmic trading tools, will further contribute to the growth of the market.

However, market participants must address challenges related to technological complexity, regulatory scrutiny, and risk management. Striking a balance between innovation and risk control will be crucial for sustainable growth in the automated algo trading market.

Conclusion

In conclusion, the automated algo trading market is experiencing significant growth and transformation. This technology-driven approach to trading has revolutionized the financial industry, providing market participants with speed, efficiency, and data-driven decision-making capabilities. Algorithmic trading systems analyze vast amounts of data, execute trades at high speeds, and mitigate risks, resulting in improved trading performance and cost reduction.

Looking ahead, the future of the automated algo trading market appears promising. The integration of advanced technologies, the expansion into alternative asset classes, and the growing demand for customization indicate a continued upward trajectory. Market participants must stay agile, adapt to changing market conditions, and prioritize risk management to thrive in this dynamic landscape.

In summary, automated algo trading has reshaped the financial industry, offering market participants efficient and data-driven trading solutions. With ongoing technological advancements and market developments, the automated algo trading market is poised for further growth and evolution, driving the future of trading in the global financial ecosystem.

What is Automated Algo Trading?

Automated Algo Trading refers to the use of computer algorithms to execute trading strategies in financial markets. This approach allows for high-frequency trading, real-time data analysis, and the ability to capitalize on market inefficiencies.

Who are the key players in the Automated Algo Trading market?

Key players in the Automated Algo Trading market include firms like Citadel Securities, Jane Street, and Two Sigma, which leverage advanced algorithms and quantitative analysis to optimize trading strategies, among others.

What are the main drivers of growth in the Automated Algo Trading market?

The growth of the Automated Algo Trading market is driven by factors such as the increasing volume of trades, advancements in technology, and the demand for faster execution and reduced transaction costs in trading.

What challenges does the Automated Algo Trading market face?

Challenges in the Automated Algo Trading market include regulatory scrutiny, the risk of algorithmic errors, and the need for continuous adaptation to changing market conditions and competition.

What opportunities exist in the Automated Algo Trading market?

Opportunities in the Automated Algo Trading market include the integration of artificial intelligence for improved decision-making, the expansion into emerging markets, and the development of more sophisticated trading strategies.

What trends are shaping the Automated Algo Trading market?

Trends in the Automated Algo Trading market include the rise of machine learning algorithms, increased use of big data analytics, and a growing focus on ethical trading practices and compliance with regulations.

Automated Algo Trading Market:

| Segmentation Details | Description |

|---|---|

| Component | Software, Services |

| Trading Type | Equities, Commodities, Foreign Exchange, Others |

| End User | Financial Institutions, Brokerage Firms, Others |

| Region | Global (Including Austria) |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Automated Algo Trading Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at