444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Austria data center physical security market represents a critical component of the nation’s digital infrastructure landscape, encompassing comprehensive protection solutions for data storage facilities across the country. Physical security measures in Austrian data centers include advanced access control systems, surveillance technologies, environmental monitoring, and perimeter protection solutions designed to safeguard mission-critical digital assets.

Market dynamics in Austria reflect the country’s position as a strategic digital hub in Central Europe, with Vienna serving as a key connectivity point between Western and Eastern European markets. The sector demonstrates robust growth potential, driven by increasing digitalization initiatives, stringent data protection regulations, and growing awareness of cybersecurity threats that extend beyond digital boundaries to encompass physical infrastructure protection.

Austrian enterprises are increasingly recognizing that comprehensive data protection requires multi-layered security approaches combining both digital and physical safeguards. The market encompasses various security technologies including biometric access controls, intelligent video surveillance systems, environmental sensors, fire suppression systems, and integrated security management platforms. Growth projections indicate the market is expanding at a compound annual growth rate of 8.2%, reflecting strong demand across enterprise, colocation, and cloud service provider segments.

Regional positioning within the broader European market highlights Austria’s strategic importance as a data center destination, with Vienna’s neutral political status and robust telecommunications infrastructure attracting international investments. The market benefits from Austria’s stable regulatory environment, advanced telecommunications networks, and strategic location facilitating data flows across European markets.

The Austria data center physical security market refers to the comprehensive ecosystem of technologies, services, and solutions designed to protect data center facilities from physical threats, unauthorized access, environmental hazards, and infrastructure vulnerabilities. This market encompasses all hardware, software, and service components that ensure the physical integrity and operational continuity of data storage and processing facilities throughout Austria.

Physical security solutions in this context include multiple layers of protection ranging from perimeter security and access control to internal monitoring systems and emergency response capabilities. The market covers various technology categories including surveillance systems, access control mechanisms, environmental monitoring tools, fire suppression systems, power protection solutions, and integrated security management platforms that coordinate these diverse security elements.

Market participants include technology vendors, system integrators, security service providers, and consulting firms that collectively deliver comprehensive physical security solutions to data center operators, enterprises, government agencies, and cloud service providers operating within Austrian territory.

Austria’s data center physical security market demonstrates significant growth momentum driven by accelerating digital transformation initiatives, increasing regulatory compliance requirements, and heightened awareness of physical security risks in critical infrastructure environments. The market benefits from Austria’s strategic position as a European digital gateway and its reputation for political stability and regulatory predictability.

Key market drivers include the expansion of cloud computing services, growth in edge computing deployments, implementation of GDPR and other data protection regulations, and increasing sophistication of physical security threats targeting critical infrastructure. Enterprise adoption rates for advanced physical security solutions have increased by 34% over the past two years, reflecting growing recognition of integrated security approaches.

Technology trends shaping the market include the integration of artificial intelligence in surveillance systems, adoption of biometric access controls, implementation of IoT-based environmental monitoring, and development of predictive analytics for security incident prevention. The market also benefits from increasing convergence between physical and cybersecurity solutions, creating opportunities for comprehensive security platforms.

Competitive dynamics feature both international technology leaders and specialized regional providers, with market consolidation occurring through strategic partnerships and acquisitions. The market structure supports innovation while maintaining competitive pricing across various solution categories and deployment models.

Strategic market insights reveal several critical trends shaping Austria’s data center physical security landscape:

Digital transformation acceleration serves as the primary catalyst driving Austria’s data center physical security market expansion. Organizations across various sectors are migrating critical operations to digital platforms, creating substantial demand for robust physical protection of underlying infrastructure. This transformation encompasses cloud migration, digital service delivery, and data-driven business model adoption.

Regulatory compliance requirements significantly influence market growth, particularly implementation of GDPR and Austrian data protection laws that mandate comprehensive security measures for personal data processing facilities. Compliance-driven investments account for approximately 28% of total physical security spending in Austrian data centers, reflecting the critical importance of regulatory adherence.

Cybersecurity threat evolution extends beyond digital attacks to encompass physical infrastructure targeting, driving demand for integrated security approaches. Organizations recognize that comprehensive protection requires coordination between physical and digital security measures, creating opportunities for holistic security solutions.

Business continuity requirements emphasize the critical importance of uninterrupted data center operations, driving investments in redundant security systems, environmental protection, and emergency response capabilities. The growing reliance on digital services makes data center downtime increasingly costly for businesses and their customers.

Insurance and risk management considerations influence security investment decisions, with comprehensive physical security measures often resulting in reduced insurance premiums and improved risk profiles for data center operators and their clients.

High implementation costs represent a significant barrier to market expansion, particularly for smaller data center operators and enterprises with limited security budgets. Advanced physical security solutions require substantial upfront investments in hardware, software, installation, and ongoing maintenance, creating financial challenges for some market participants.

Technical complexity in integrating multiple security systems poses implementation challenges, requiring specialized expertise and careful planning to ensure seamless operation across different technology platforms. Integration difficulties can lead to security gaps and operational inefficiencies if not properly managed.

Skills shortage in physical security expertise limits market growth potential, with demand for qualified security professionals exceeding available talent supply. This shortage affects both implementation quality and ongoing system management capabilities across the market.

Legacy system compatibility issues create obstacles for organizations seeking to upgrade existing security infrastructure, particularly in older data center facilities where retrofitting advanced security systems may require significant facility modifications.

Privacy concerns related to surveillance technologies and biometric data collection create regulatory and social challenges, requiring careful balance between security effectiveness and privacy protection in compliance with Austrian and European privacy laws.

Artificial intelligence integration presents substantial opportunities for market expansion through development of intelligent security systems capable of autonomous threat detection, predictive analytics, and automated response capabilities. AI-enhanced security solutions demonstrate 45% higher threat detection accuracy compared to traditional systems, creating compelling value propositions for data center operators.

Edge computing expansion creates new market segments requiring specialized physical security solutions for distributed computing environments. The proliferation of edge data centers and micro facilities generates demand for scalable, cost-effective security solutions adapted to smaller deployment scenarios.

Cloud service growth drives demand for enhanced physical security in colocation facilities and cloud service provider data centers, as organizations increasingly rely on third-party infrastructure for critical operations. This trend creates opportunities for security-as-a-service models and managed security solutions.

IoT integration opportunities enable development of comprehensive environmental monitoring and security management systems that leverage connected sensors and devices for enhanced situational awareness and automated response capabilities.

Sustainability initiatives create opportunities for energy-efficient security solutions that align with environmental goals while maintaining comprehensive protection capabilities. Green security technologies appeal to environmentally conscious organizations and support corporate sustainability objectives.

Supply chain dynamics in Austria’s data center physical security market reflect a combination of international technology providers and regional system integrators working collaboratively to deliver comprehensive solutions. The market benefits from Austria’s central European location, facilitating efficient distribution and support services across the region.

Technological evolution drives continuous market transformation through introduction of advanced capabilities including machine learning algorithms, cloud-based management platforms, and mobile security applications. Technology refresh cycles average 5-7 years for major security system components, creating ongoing replacement and upgrade opportunities.

Customer demand patterns show increasing preference for integrated security platforms that consolidate multiple protection functions into unified management systems. Organizations seek solutions that reduce operational complexity while enhancing security effectiveness and compliance capabilities.

Competitive pressures drive innovation and pricing optimization across the market, with vendors competing on technology capabilities, integration expertise, and total cost of ownership propositions. Market maturation leads to increased focus on service quality and customer support differentiation.

Regulatory influences shape market development through evolving compliance requirements and security standards that drive technology adoption and implementation practices. According to MarkWide Research analysis, regulatory compliance considerations influence 72% of security investment decisions in Austrian data centers.

Comprehensive market analysis methodology encompasses multiple research approaches including primary interviews with industry stakeholders, secondary research from authoritative sources, and quantitative analysis of market trends and projections. The research framework ensures accurate representation of market dynamics and future growth potential.

Primary research activities include structured interviews with data center operators, security technology vendors, system integrators, and end-user organizations to gather insights on market requirements, technology preferences, and investment priorities. Interview participants represent various market segments and organizational sizes to ensure comprehensive perspective coverage.

Secondary research sources encompass industry publications, regulatory documents, technology specifications, and market reports from credible sources to validate primary research findings and provide broader market context. Data triangulation ensures research accuracy and reliability.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth trajectories, segment performance, and competitive dynamics. Market sizing methodologies consider various factors including technology adoption rates, replacement cycles, and new deployment patterns.

Quality assurance processes include data validation, expert review, and cross-verification of findings to ensure research accuracy and reliability. The methodology supports evidence-based conclusions and actionable market insights for stakeholders.

Vienna metropolitan area dominates Austria’s data center physical security market, accounting for approximately 58% of total market activity due to its concentration of major data centers, telecommunications infrastructure, and enterprise headquarters. The capital region benefits from excellent connectivity, political stability, and proximity to major European markets.

Salzburg and Innsbruck regions represent emerging growth areas driven by expansion of regional data center facilities and increasing enterprise digitalization initiatives. These markets demonstrate 12% annual growth rates in physical security investments, reflecting growing recognition of comprehensive security requirements.

Industrial centers including Linz and Graz show steady demand for data center physical security solutions, particularly in manufacturing and logistics sectors where operational continuity depends on reliable digital infrastructure. These regions focus on cost-effective security solutions that balance protection capabilities with budget constraints.

Border regions benefit from cross-border data flows and international connectivity requirements, creating demand for enhanced security measures that meet multiple regulatory frameworks. These areas often serve as gateways for international data traffic, requiring robust physical protection measures.

Rural and remote areas present opportunities for edge computing security solutions as digital services expand beyond urban centers. These markets require scalable, remotely manageable security systems adapted to distributed deployment scenarios with limited local technical support.

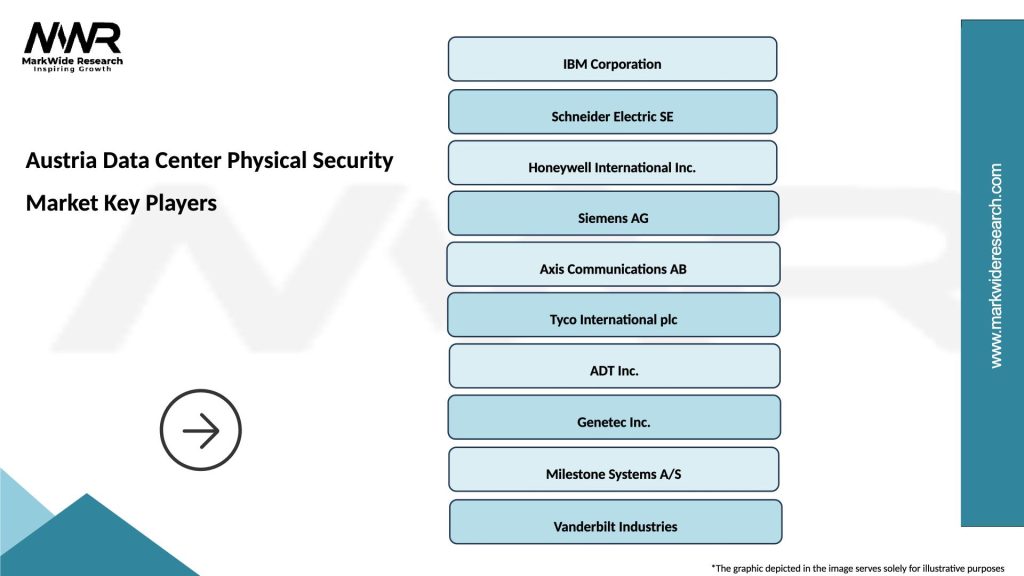

Market leadership in Austria’s data center physical security sector features a combination of international technology giants and specialized regional providers, each contributing unique capabilities and market expertise:

Competitive strategies focus on technology innovation, integration capabilities, and comprehensive service offerings that address complete data center security requirements. Market participants emphasize solution customization, regulatory compliance support, and ongoing maintenance services to differentiate their offerings.

Technology-based segmentation reveals diverse solution categories serving different aspects of data center physical security:

By Technology:

By Application:

By Deployment Model:

Access control systems represent the largest market segment, driven by stringent requirements for authorized personnel verification and comprehensive audit trail maintenance. Biometric authentication adoption has increased by 41% annually as organizations seek enhanced security beyond traditional card-based systems.

Video surveillance technologies demonstrate rapid growth through integration of artificial intelligence and analytics capabilities that enable proactive threat detection and automated response. Modern surveillance systems provide 24/7 monitoring capabilities with intelligent alert generation and incident documentation.

Environmental monitoring solutions gain importance as data centers face increasing pressure to maintain optimal operating conditions while preventing equipment damage and service disruptions. These systems provide real-time visibility into temperature, humidity, power quality, and other critical environmental factors.

Integrated security platforms show the highest growth potential as organizations seek to consolidate multiple security functions into unified management systems. These platforms reduce operational complexity while improving security effectiveness through coordinated response capabilities.

Fire protection systems remain critical components of data center security, with advanced suppression technologies designed to protect sensitive electronic equipment while ensuring personnel safety. Modern systems utilize clean agent suppression technologies that minimize equipment damage during fire incidents.

Data center operators benefit from comprehensive physical security solutions through reduced risk exposure, improved regulatory compliance, enhanced operational efficiency, and increased customer confidence. Advanced security systems provide detailed audit trails and incident documentation supporting compliance requirements and insurance claims.

Enterprise customers gain assurance that their critical data and applications are protected by multi-layered security measures that address various threat scenarios. Physical security investments protect against data breaches, service disruptions, and regulatory penalties that could result from inadequate protection measures.

Technology vendors benefit from growing market demand for innovative security solutions that address evolving threat landscapes and regulatory requirements. The market supports sustained revenue growth through initial system sales, ongoing maintenance contracts, and periodic technology upgrades.

System integrators capitalize on increasing demand for comprehensive security implementations that require specialized expertise in design, installation, and configuration. Integration projects often lead to long-term service relationships and additional business opportunities.

Insurance providers benefit from reduced risk exposure when data centers implement comprehensive physical security measures, potentially leading to lower claim frequencies and improved underwriting results. Effective security measures demonstrate risk management commitment that supports favorable insurance terms.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming Austria’s data center physical security market, with AI-powered systems providing enhanced threat detection, predictive analytics, and automated response capabilities. AI adoption rates in security systems have grown by 52% over the past 18 months, reflecting strong market acceptance of intelligent security technologies.

Cloud-based security management gains traction as organizations seek scalable, remotely accessible security platforms that reduce on-site infrastructure requirements while providing comprehensive monitoring and control capabilities. Cloud platforms enable centralized management of distributed security systems across multiple facilities.

Biometric authentication expansion continues accelerating as organizations implement multi-factor authentication systems that combine various biometric modalities for enhanced security. Advanced biometric systems provide higher accuracy and reduced false positive rates compared to traditional access control methods.

IoT sensor integration enables comprehensive environmental monitoring and predictive maintenance capabilities that enhance both security and operational efficiency. Connected sensors provide real-time data on various environmental conditions and equipment status indicators.

Mobile security management becomes increasingly important as security personnel require remote access to monitoring systems and control capabilities. Mobile applications enable real-time alerts, video access, and system control from any location with internet connectivity.

Technology partnerships between international security vendors and Austrian system integrators strengthen local market presence and service capabilities. These collaborations combine global technology expertise with regional market knowledge and customer relationships.

Regulatory compliance initiatives drive development of specialized security solutions that address Austrian and European data protection requirements. Vendors increasingly focus on compliance-ready solutions that simplify regulatory adherence for data center operators.

Sustainability programs influence security technology development, with vendors introducing energy-efficient solutions that reduce environmental impact while maintaining comprehensive protection capabilities. Green security technologies appeal to environmentally conscious organizations.

Skills development programs emerge through collaboration between technology vendors, educational institutions, and industry associations to address the growing demand for qualified security professionals. These programs combine theoretical knowledge with practical implementation experience.

Innovation investments by major technology providers focus on next-generation security capabilities including quantum-resistant encryption, advanced analytics, and autonomous security systems. MWR research indicates that innovation spending has increased by 31% among leading security technology vendors.

Investment prioritization should focus on integrated security platforms that combine multiple protection functions into unified management systems, providing operational efficiency and comprehensive threat coverage. Organizations should evaluate solutions based on total cost of ownership rather than initial acquisition costs.

Technology roadmap planning requires consideration of emerging capabilities including artificial intelligence, machine learning, and predictive analytics that will define next-generation security systems. Early adoption of these technologies can provide competitive advantages and improved security effectiveness.

Vendor selection criteria should emphasize local support capabilities, regulatory compliance expertise, and integration experience with existing infrastructure. Strong vendor partnerships ensure successful implementation and ongoing system optimization.

Skills development investments in security personnel training and certification programs will become increasingly important as technology complexity grows. Organizations should budget for ongoing education and professional development to maintain security effectiveness.

Compliance strategy alignment with evolving regulatory requirements ensures long-term system viability and reduces the risk of costly modifications. Proactive compliance planning supports sustainable security investments and operational continuity.

Market growth projections indicate sustained expansion driven by continued digitalization, regulatory compliance requirements, and evolving security threats. MarkWide Research forecasts suggest the market will maintain strong growth momentum with increasing adoption of advanced security technologies across various data center segments.

Technology evolution will continue emphasizing intelligent, automated security systems that reduce operational requirements while enhancing protection capabilities. Future systems will leverage artificial intelligence, machine learning, and predictive analytics to provide proactive threat prevention and response.

Market consolidation may occur as larger technology providers acquire specialized vendors to expand their solution portfolios and market reach. This consolidation could lead to more comprehensive integrated platforms while potentially reducing vendor diversity.

Edge computing expansion will create new market segments requiring specialized security solutions adapted to distributed computing environments. These deployments will drive demand for scalable, remotely manageable security systems with lower total cost of ownership.

Sustainability initiatives will increasingly influence technology selection and implementation decisions, with organizations seeking security solutions that align with environmental objectives while maintaining comprehensive protection capabilities. Green security technologies will become standard requirements rather than optional features.

Austria’s data center physical security market demonstrates robust growth potential driven by digital transformation acceleration, regulatory compliance requirements, and evolving security threat landscapes. The market benefits from Austria’s strategic position as a European digital hub, political stability, and advanced telecommunications infrastructure that attract international data center investments.

Technology innovation continues reshaping the market through integration of artificial intelligence, biometric authentication, IoT sensors, and cloud-based management platforms that enhance security effectiveness while reducing operational complexity. Organizations increasingly recognize the importance of comprehensive physical security measures that complement cybersecurity initiatives to provide holistic protection for critical digital infrastructure.

Future success in this market will depend on vendors’ ability to deliver integrated solutions that address evolving customer requirements, regulatory compliance needs, and emerging technology capabilities. The market outlook remains positive, with sustained growth expected across various segments and deployment models as Austria continues strengthening its position as a leading European data center destination.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access control, and environmental controls to ensure the safety and integrity of sensitive data.

What are the key players in the Austria Data Center Physical Security Market?

Key players in the Austria Data Center Physical Security Market include companies like Schneider Electric, IBM, and Cisco, which provide various security solutions and technologies. These companies focus on enhancing physical security through advanced monitoring systems and access management solutions, among others.

What are the main drivers of the Austria Data Center Physical Security Market?

The main drivers of the Austria Data Center Physical Security Market include the increasing frequency of cyber threats, the growing need for data protection regulations, and the expansion of cloud computing services. These factors compel organizations to invest in robust physical security measures to safeguard their data centers.

What challenges does the Austria Data Center Physical Security Market face?

Challenges in the Austria Data Center Physical Security Market include the high costs associated with implementing advanced security technologies and the complexity of integrating these systems with existing infrastructure. Additionally, the evolving nature of security threats requires continuous updates and training, which can strain resources.

What opportunities exist in the Austria Data Center Physical Security Market?

Opportunities in the Austria Data Center Physical Security Market include the adoption of innovative technologies such as AI and IoT for enhanced security monitoring and response. Furthermore, the increasing demand for colocation services presents a chance for security providers to offer tailored solutions to meet specific client needs.

What trends are shaping the Austria Data Center Physical Security Market?

Trends shaping the Austria Data Center Physical Security Market include the integration of smart technologies for real-time monitoring and the rise of biometric access controls. Additionally, there is a growing emphasis on sustainability and energy efficiency in security solutions, reflecting broader environmental concerns.

Austria Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Equipment |

| Technology | Biometric Authentication, Video Analytics, Cloud-Based Security, RFID Solutions |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Austria Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at