444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Water treatment chemicals are substances used to treat water to make it safe for various applications. These chemicals help in removing impurities, contaminants, and microorganisms from water, ensuring its quality and suitability for different purposes. The water treatment chemicals market in Australia has witnessed significant growth in recent years due to the increasing demand for clean and safe water across various industries and the growing need for water conservation.

Meaning

Water treatment chemicals refer to a wide range of chemical substances used to treat water and improve its quality. These chemicals play a crucial role in eliminating harmful impurities, disinfecting water, and preventing the growth of bacteria and other microorganisms. By using water treatment chemicals, industries and municipalities can ensure that the water they use meets the required standards and regulations.

Executive Summary

The Australia water treatment chemicals market has experienced substantial growth in recent years, driven by the increasing awareness about water quality and the need for effective water treatment solutions. The market offers a wide range of chemicals, including coagulants, flocculants, disinfectants, corrosion inhibitors, pH adjusters, and others, catering to the diverse requirements of industries and municipalities. With advancements in technology and the growing emphasis on sustainable water management practices, the market is expected to witness further expansion in the coming years.

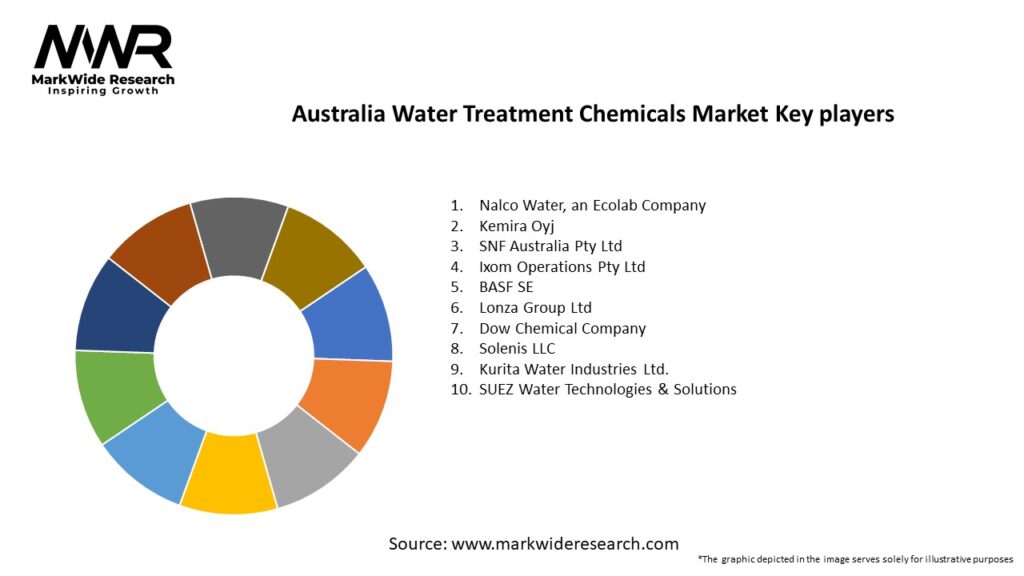

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia water treatment chemicals market is driven by several dynamic factors that shape its growth and prospects. These factors include regulatory developments, technological advancements, market competition, customer preferences, and industry collaborations. Understanding and effectively responding to these dynamics is crucial for industry participants to stay competitive and capitalize on the emerging opportunities in the market.

Regional Analysis

The water treatment chemicals market in Australia exhibits regional variations in terms of demand and consumption patterns. The major regions contributing to the market growth include New South Wales, Victoria, Queensland, Western Australia, and South Australia. These regions are characterized by significant industrial activities, population centers, and water resource availability, driving the demand for water treatment chemicals.

Competitive Landscape

Leading Companies in the Australia Water Treatment Chemicals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

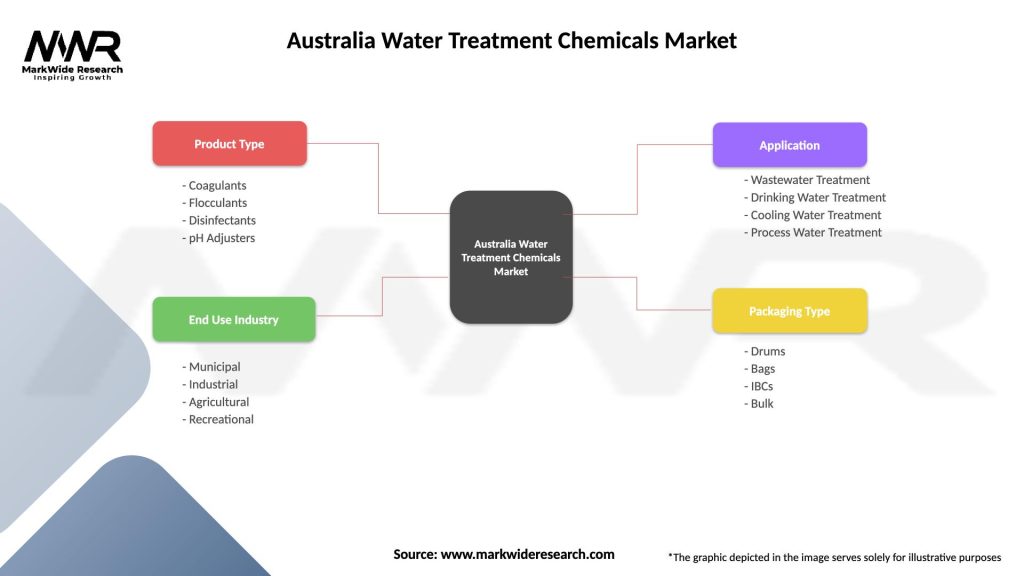

Segmentation

The Australia Water Enhancer Market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the Australia water treatment chemicals market can derive several benefits from their involvement in the industry. These benefits include:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides insights into the internal and external factors that can impact the water treatment chemicals market in Australia.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the water treatment chemicals market in Australia. The crisis highlighted the importance of clean and safe water for public health and hygiene. While the pandemic caused disruptions in the industrial sector, resulting in a temporary decline in demand for water treatment chemicals, the market quickly rebounded as industries resumed operations and focused on maintaining water quality standards. The increased emphasis on hygiene and sanitation has further driven the demand for water treatment chemicals, particularly disinfectants and antimicrobial agents.

Key Industry Developments

Analyst Suggestions

Based on the analysis of the Australia water treatment chemicals market, the following suggestions can be made:

Future Outlook

The future of the Australia water treatment chemicals market looks promising, with several factors driving its growth. The increasing demand for clean and safe water, stringent water quality regulations, advancements in water treatment technologies, and the focus on sustainable water management practices will shape the market’s trajectory. The market is expected to witness further consolidation, with key players expanding their product portfolios and strengthening their market presence through strategic partnerships and acquisitions. The adoption of digital technologies and the development of green and sustainable chemicals will continue to be key trends in the market, ensuring its long-term sustainability and growth.

Conclusion

The water treatment chemicals market in Australia plays a vital role in ensuring the availability of clean and safe water for various industries and municipalities. The market offers a wide range of chemicals that help in removing impurities, disinfecting water, and preventing the growth of harmful microorganisms. While the market faces challenges related to cost, regulations, and environmental concerns, it also presents significant opportunities driven by growing demand, technological advancements, and the focus on sustainable water management. Industry participants need to stay updated with market dynamics, invest in research and development, foster collaborations, and align their strategies with customer demands and regulatory requirements to thrive in this competitive market.

What is Water Treatment Chemicals?

Water treatment chemicals are substances used to treat water for various applications, including drinking water purification, wastewater treatment, and industrial processes. They help in removing contaminants, controlling corrosion, and ensuring water quality.

What are the key players in the Australia Water Treatment Chemicals Market?

Key players in the Australia Water Treatment Chemicals Market include Orica Limited, Ecolab Inc., and BASF SE, among others. These companies provide a range of chemicals for water treatment applications across various industries.

What are the drivers of growth in the Australia Water Treatment Chemicals Market?

The growth of the Australia Water Treatment Chemicals Market is driven by increasing water scarcity, stringent regulations on water quality, and the rising demand for clean water in industrial and municipal sectors. Additionally, advancements in treatment technologies are contributing to market expansion.

What challenges does the Australia Water Treatment Chemicals Market face?

The Australia Water Treatment Chemicals Market faces challenges such as fluctuating raw material prices, environmental regulations, and the need for continuous innovation in treatment processes. These factors can impact the operational efficiency of companies in the market.

What opportunities exist in the Australia Water Treatment Chemicals Market?

Opportunities in the Australia Water Treatment Chemicals Market include the development of eco-friendly chemicals, the expansion of wastewater treatment facilities, and the increasing adoption of advanced treatment technologies. These trends are expected to enhance market growth in the coming years.

What trends are shaping the Australia Water Treatment Chemicals Market?

Trends shaping the Australia Water Treatment Chemicals Market include the growing focus on sustainability, the integration of digital technologies in water management, and the rising demand for customized treatment solutions. These trends are influencing how companies approach water treatment challenges.

Australia Water Treatment Chemicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Coagulants, Flocculants, Disinfectants, pH Adjusters |

| End Use Industry | Municipal, Industrial, Agricultural, Recreational |

| Application | Wastewater Treatment, Drinking Water Treatment, Cooling Water Treatment, Process Water Treatment |

| Packaging Type | Drums, Bags, IBCs, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Water Treatment Chemicals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at