444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia vanilla flavor market represents a dynamic and evolving segment within the broader food and beverage industry, characterized by increasing consumer demand for natural and premium flavor profiles. Market dynamics indicate robust growth driven by expanding applications across confectionery, bakery, dairy, and beverage sectors. The Australian market demonstrates a strong preference for high-quality vanilla extracts and natural vanilla flavoring solutions, with premium vanilla products experiencing particularly strong demand growth of approximately 8.2% annually.

Consumer preferences in Australia have shifted significantly toward authentic vanilla experiences, driving manufacturers to invest in superior extraction processes and sustainable sourcing practices. The market encompasses various vanilla flavor formats including liquid extracts, powder forms, vanilla paste, and synthetic vanilla alternatives, each serving distinct application requirements across the food manufacturing landscape.

Regional distribution shows concentrated demand in major metropolitan areas including Sydney, Melbourne, Brisbane, and Perth, where food processing facilities and artisanal producers drive substantial vanilla flavor consumption. The market benefits from Australia’s strong culinary culture and increasing consumer sophistication regarding flavor authenticity and quality standards.

The Australia vanilla flavor market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of vanilla-based flavoring products specifically within the Australian territory. This market includes natural vanilla extracts derived from vanilla beans, synthetic vanillin compounds, and various vanilla flavor preparations designed for commercial and consumer applications across multiple food and beverage categories.

Market scope extends beyond traditional vanilla extract to include innovative vanilla flavor delivery systems, organic vanilla products, and specialized vanilla formulations tailored for specific industrial applications. The definition encompasses both imported vanilla raw materials and domestically processed vanilla flavor products, reflecting Australia’s position as both an importer of vanilla beans and a processor of finished vanilla flavor solutions.

Strategic analysis reveals the Australia vanilla flavor market as a mature yet continuously evolving sector experiencing steady growth driven by premiumization trends and expanding application diversity. Key market drivers include increasing consumer demand for natural ingredients, growing artisanal food production, and expanding commercial bakery operations, with natural vanilla products commanding approximately 72% market preference among quality-conscious consumers.

Market segmentation demonstrates strong performance across multiple categories, with liquid vanilla extracts maintaining dominant market position while vanilla powder and paste segments show accelerated growth rates. The competitive landscape features both international flavor houses and domestic specialty producers, creating a diverse supplier ecosystem that serves various market segments from industrial-scale food manufacturers to boutique confectionery operations.

Future projections indicate sustained market expansion supported by Australia’s robust food processing industry, increasing export opportunities for premium vanilla products, and growing consumer willingness to pay premium prices for authentic vanilla flavor experiences. Innovation trends focus on sustainable sourcing, organic certification, and development of specialized vanilla flavor profiles for emerging food categories.

Market intelligence reveals several critical insights shaping the Australia vanilla flavor landscape:

Consumer demand evolution serves as the primary catalyst driving Australia vanilla flavor market expansion. Premiumization trends significantly influence purchasing decisions, with consumers increasingly willing to invest in high-quality vanilla products that deliver superior flavor experiences. This shift toward premium vanilla solutions drives approximately 65% of market growth in the natural vanilla segment.

Food industry expansion creates substantial demand for vanilla flavoring across multiple sectors. The growing Australian bakery industry, expanding confectionery market, and increasing dairy product innovation all contribute to sustained vanilla flavor consumption. Commercial food production growth, particularly in the artisanal and specialty food segments, generates consistent demand for diverse vanilla flavor solutions.

Health consciousness among Australian consumers drives preference for natural vanilla extracts over synthetic alternatives. Clean label trends encourage food manufacturers to specify natural vanilla ingredients, supporting market growth for premium vanilla products. Additionally, the increasing popularity of home baking and cooking, accelerated by lifestyle changes, creates robust consumer demand for retail vanilla products.

Export opportunities for Australian-processed vanilla products contribute to market expansion, with growing international recognition of Australian food quality standards creating new revenue streams for domestic vanilla flavor producers.

Price volatility represents a significant challenge for the Australia vanilla flavor market, with natural vanilla bean prices subject to global supply fluctuations and weather-related disruptions in major producing regions. Cost pressures from volatile raw material prices create challenges for manufacturers in maintaining consistent pricing strategies and profit margins.

Supply chain complexity poses ongoing challenges, particularly given Australia’s dependence on imported vanilla beans from Madagascar, Indonesia, and other producing regions. Logistics constraints and international shipping disruptions can impact product availability and increase operational costs for vanilla flavor processors.

Synthetic competition from lower-cost vanillin alternatives creates price pressure on natural vanilla products, particularly in price-sensitive market segments. Economic sensitivity during challenging economic periods may drive some consumers and manufacturers toward more affordable synthetic vanilla options.

Regulatory compliance requirements for food additives and flavoring agents create additional operational costs and complexity for vanilla flavor producers, particularly smaller manufacturers with limited regulatory expertise and resources.

Innovation potential in vanilla flavor applications presents substantial growth opportunities across emerging food categories. Plant-based food products represent a rapidly expanding market segment where vanilla flavoring plays crucial roles in taste enhancement and consumer acceptance. The growing alternative protein market creates new applications for specialized vanilla flavor solutions.

Export market development offers significant opportunities for Australian vanilla flavor producers to leverage the country’s reputation for high-quality food products. Asian markets particularly present growth potential, with increasing demand for premium vanilla products in developing economies and growing food processing industries.

Sustainable sourcing initiatives create opportunities for companies that invest in ethical vanilla supply chains and transparent sourcing practices. Direct trade relationships with vanilla producing regions can provide competitive advantages through quality control and supply security while supporting sustainable farming practices.

Technology integration in vanilla extraction and processing offers opportunities for efficiency improvements and product innovation. Advanced extraction techniques and flavor enhancement technologies can create superior vanilla products with improved shelf stability and flavor intensity.

Competitive dynamics within the Australia vanilla flavor market reflect a balance between established international suppliers and emerging domestic producers. Market consolidation trends show larger flavor houses acquiring specialized vanilla producers to expand their product portfolios and market reach, while independent producers focus on niche segments and premium products.

Supply-demand equilibrium demonstrates seasonal variations influenced by global vanilla bean harvests and local demand patterns from food manufacturers. Inventory management becomes critical for vanilla flavor suppliers managing price volatility and ensuring consistent product availability for commercial customers.

Technology adoption across the vanilla flavor supply chain enhances processing efficiency and product quality. Quality assurance systems and traceability technologies become increasingly important for meeting consumer expectations and regulatory requirements, with approximately 78% of premium vanilla suppliers implementing advanced quality monitoring systems.

Market maturation drives differentiation strategies among vanilla flavor suppliers, with companies developing specialized products for specific applications and customer segments. Value-added services including technical support, custom formulations, and supply chain solutions become key competitive differentiators.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with vanilla flavor producers, food manufacturers, distributors, and industry experts across Australia’s major food processing regions. This approach provides firsthand insights into market trends, challenges, and opportunities from key industry stakeholders.

Secondary research encompasses analysis of industry publications, trade association reports, government statistics, and company financial disclosures to establish market baselines and identify growth patterns. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and identify growth opportunities. Segmentation analysis examines market performance across different product categories, application sectors, and geographic regions to provide detailed market understanding.

Competitive intelligence gathering includes analysis of major market participants, their product offerings, pricing strategies, and market positioning to provide comprehensive competitive landscape insights for strategic decision-making.

New South Wales dominates the Australia vanilla flavor market, accounting for approximately 38% of national consumption, driven by Sydney’s concentration of food processing facilities and the state’s large population base. Manufacturing hubs in the greater Sydney region and Newcastle support substantial vanilla flavor demand from commercial bakeries, confectionery producers, and dairy manufacturers.

Victoria represents the second-largest regional market with approximately 32% market share, supported by Melbourne’s thriving food scene and the state’s strong agricultural processing industry. Artisanal food producers throughout Victoria drive demand for premium vanilla products, while large-scale manufacturers contribute to consistent volume consumption.

Queensland demonstrates strong growth potential with expanding food processing capabilities and increasing population centers. Brisbane and Gold Coast regions show particular strength in vanilla flavor consumption, supported by growing tourism-related food service demand and expanding retail bakery operations.

Western Australia and South Australia represent smaller but strategically important regional markets, with Perth and Adelaide serving as distribution centers for vanilla flavor products. Regional specialization in wine and specialty food production creates unique demand patterns for premium vanilla flavoring solutions.

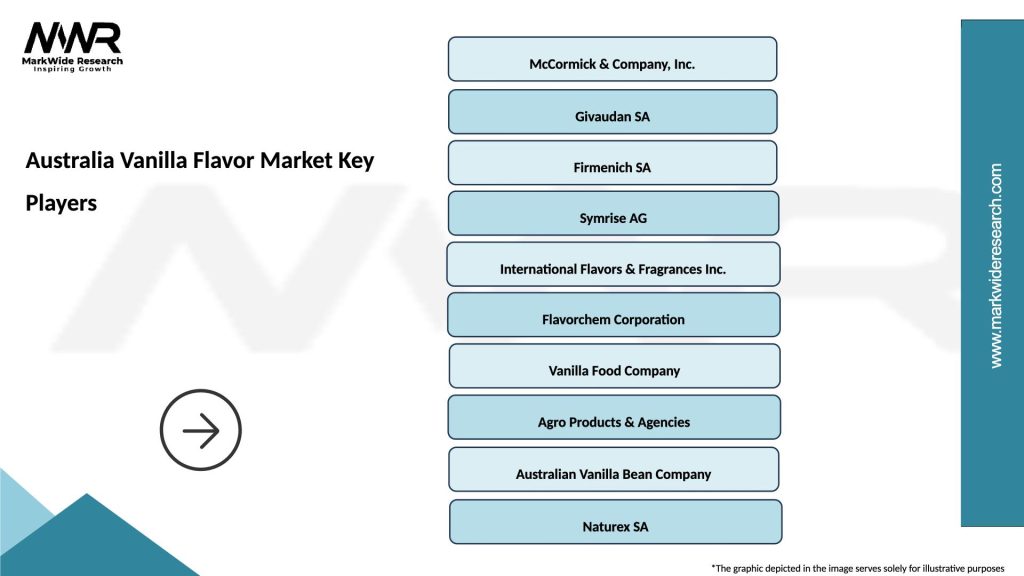

Market leadership in the Australia vanilla flavor sector features a diverse mix of international flavor companies and specialized domestic producers:

Competitive strategies focus on product differentiation through quality enhancement, sustainable sourcing practices, and specialized application development. Market positioning varies from cost-competitive synthetic vanilla suppliers to premium natural vanilla specialists targeting quality-conscious customers.

Innovation leadership drives competitive advantage through development of new vanilla flavor formats, improved extraction processes, and specialized formulations for emerging food categories. Supply chain excellence becomes increasingly important for maintaining competitive positioning in volatile vanilla markets.

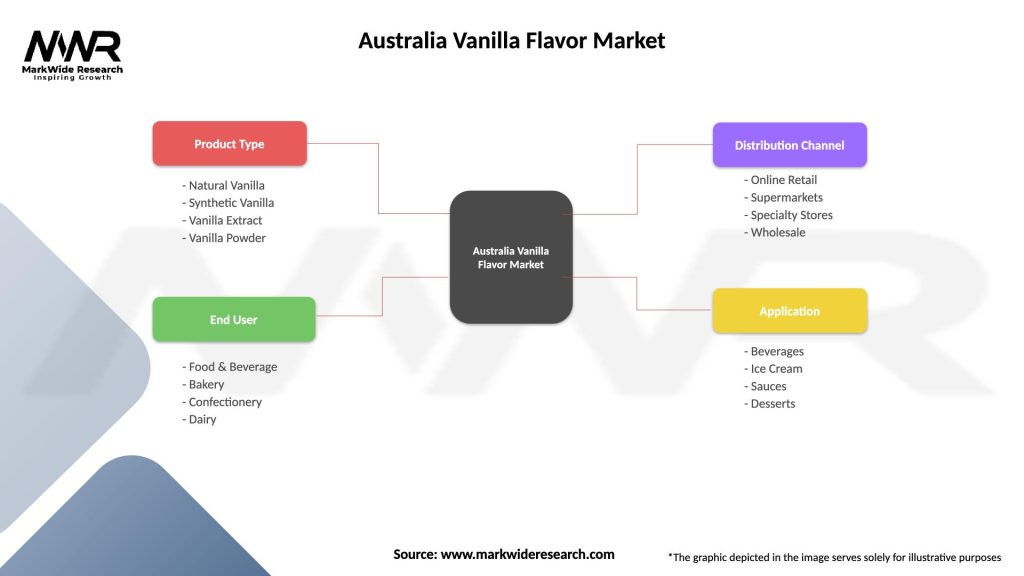

Product Type Segmentation:

Application Segmentation:

End-User Segmentation:

Natural Vanilla Extract Category maintains market leadership through superior flavor profile and consumer preference for authentic ingredients. Premium positioning allows natural vanilla extracts to command significant price premiums while maintaining strong demand growth, particularly among quality-conscious food manufacturers and artisanal producers.

Vanilla Powder Segment demonstrates robust growth driven by applications requiring dry vanilla flavoring, including protein powders, baking mixes, and specialty food formulations. Convenience factors and extended shelf life make vanilla powder attractive for manufacturers seeking operational efficiency and product stability.

Organic Vanilla Category shows accelerated growth with approximately 15% annual expansion driven by health-conscious consumers and organic food manufacturers. Certification requirements create barriers to entry while supporting premium pricing for qualified suppliers.

Synthetic Vanillin Segment maintains significant market presence through cost advantages and consistent supply availability. Industrial applications and price-sensitive food categories continue to support synthetic vanilla demand despite growing preference for natural alternatives.

Specialty Vanilla Products including vanilla paste and flavored vanilla extracts represent emerging growth categories driven by culinary innovation and consumer sophistication regarding vanilla applications and flavor experiences.

Food Manufacturers benefit from diverse vanilla flavor options enabling product differentiation and quality enhancement across multiple food categories. Supply flexibility allows manufacturers to optimize costs while maintaining desired flavor profiles, with access to both premium natural vanilla and cost-effective synthetic alternatives based on application requirements.

Vanilla Suppliers enjoy stable demand from Australia’s robust food processing industry and growing export opportunities. Market diversification across multiple application segments reduces dependency on single market categories while premium product positioning supports healthy profit margins.

Retailers benefit from strong consumer demand for vanilla products, particularly premium natural vanilla extracts that command higher margins. Category growth in home baking and cooking creates consistent retail vanilla sales with opportunities for private label development.

Consumers gain access to diverse vanilla flavor options ranging from affordable synthetic alternatives to premium natural extracts. Quality improvements and increased availability of specialty vanilla products enhance culinary experiences and support growing interest in home food preparation.

Export Markets provide Australian vanilla processors with opportunities to leverage the country’s reputation for food quality and safety standards, creating additional revenue streams and market expansion possibilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization Movement continues driving consumer preference toward high-quality natural vanilla products, with approximately 68% of consumers willing to pay premium prices for authentic vanilla flavor experiences. Artisanal food production growth supports demand for specialty vanilla products and unique flavor profiles.

Sustainability Focus influences purchasing decisions across both consumer and commercial segments, with ethical sourcing becoming a key differentiator for vanilla suppliers. Traceability systems and direct trade relationships gain importance as consumers seek transparency in vanilla supply chains.

Clean Label Trends drive food manufacturers toward natural vanilla ingredients, reducing demand for synthetic alternatives in premium food categories. Ingredient simplification efforts support natural vanilla extract adoption across multiple food applications.

Innovation in Applications expands vanilla usage beyond traditional categories into plant-based foods, functional beverages, and specialty dietary products. Flavor customization trends create opportunities for specialized vanilla formulations tailored to specific applications and consumer preferences.

E-commerce Growth transforms vanilla product distribution, enabling direct-to-consumer sales for specialty vanilla producers and expanding market access for premium products. Digital marketing strategies become increasingly important for vanilla brand building and consumer education.

Supply Chain Innovation initiatives focus on improving vanilla bean sourcing efficiency and quality control throughout the import process. Technology integration in vanilla processing enhances extraction yields and product consistency while reducing operational costs.

Product Development activities emphasize creation of specialized vanilla formulations for emerging food categories and specific application requirements. Organic certification expansion among vanilla suppliers responds to growing demand for certified organic vanilla products.

Strategic Partnerships between vanilla suppliers and food manufacturers create collaborative product development opportunities and supply chain optimization. Direct sourcing relationships with vanilla producing regions improve quality control and supply security.

Market Expansion efforts by Australian vanilla companies target Asian export markets and premium food service segments. Brand development initiatives focus on establishing Australian vanilla products as premium quality offerings in international markets.

Regulatory Compliance enhancements ensure vanilla products meet evolving food safety standards and labeling requirements. Quality assurance system improvements support consistent product quality and customer satisfaction across all market segments.

Strategic positioning recommendations emphasize the importance of quality differentiation and premium market focus for Australian vanilla suppliers. MarkWide Research analysis suggests that companies investing in superior vanilla extraction processes and sustainable sourcing practices will achieve competitive advantages in the evolving market landscape.

Market diversification strategies should include expansion into emerging application segments such as plant-based foods and functional beverages where vanilla plays crucial flavor enhancement roles. Innovation investment in specialized vanilla formulations can create new revenue streams and reduce dependence on traditional market segments.

Supply chain optimization remains critical for managing vanilla price volatility and ensuring consistent product availability. Direct relationships with vanilla producing regions and strategic inventory management can provide competitive advantages during supply disruptions.

Export market development offers significant growth potential for Australian vanilla processors, particularly in Asian markets where demand for premium food ingredients continues expanding. Brand building initiatives should emphasize Australian food quality standards and processing expertise.

Technology adoption in vanilla processing and quality control can improve operational efficiency and product consistency while supporting premium positioning strategies. Digital marketing investments become increasingly important for reaching target customers and building brand awareness.

Market projections indicate continued growth for the Australia vanilla flavor market, driven by sustained consumer demand for premium natural ingredients and expanding food industry applications. Growth trajectory analysis suggests the market will maintain steady expansion with natural vanilla segments outperforming synthetic alternatives.

Innovation trends will likely focus on sustainable sourcing solutions, advanced extraction technologies, and specialized vanilla formulations for emerging food categories. MWR forecasts indicate that companies investing in these areas will capture disproportionate market growth and profitability.

Consumer preferences evolution toward premium, authentic, and sustainably sourced vanilla products will continue shaping market dynamics. Quality standards expectations will likely increase, creating opportunities for suppliers that can consistently deliver superior vanilla flavor experiences.

Export opportunities for Australian vanilla products are expected to expand significantly, supported by growing international recognition of Australian food quality and processing capabilities. Regional market development in Asia-Pacific regions presents substantial growth potential for established Australian vanilla suppliers.

Technology integration throughout the vanilla supply chain will enhance efficiency, quality control, and traceability capabilities. Digital transformation initiatives will likely improve customer relationships and market access for vanilla suppliers of all sizes.

The Australia vanilla flavor market represents a mature yet dynamic sector characterized by strong consumer preference for quality, growing application diversity, and expanding export opportunities. Market fundamentals remain robust, supported by Australia’s sophisticated food industry, quality-conscious consumers, and reputation for food safety excellence.

Strategic opportunities exist for vanilla suppliers that focus on premium positioning, sustainable sourcing, and innovation in emerging food categories. Competitive success will increasingly depend on quality differentiation, supply chain excellence, and ability to serve diverse market segments from industrial food manufacturers to artisanal producers.

Future growth prospects remain positive, with natural vanilla products expected to outperform synthetic alternatives as consumer preferences continue evolving toward authentic, premium ingredients. Market expansion through export development and new application segments will provide additional growth avenues for established Australian vanilla companies.

The vanilla flavor market in Australia is well-positioned for continued expansion, offering opportunities for both established players and new entrants that can deliver superior products and innovative solutions to meet evolving customer needs across diverse food and beverage applications.

What is Vanilla Flavor?

Vanilla flavor refers to the taste and aroma derived from vanilla beans, primarily used in food and beverage applications. It is a popular flavoring agent in desserts, ice creams, and baked goods, enhancing the overall sensory experience.

What are the key companies in the Australia Vanilla Flavor Market?

Key companies in the Australia Vanilla Flavor Market include Pure Vanilla, Heilala Vanilla, and McCormick & Company, among others. These companies are known for their high-quality vanilla products and innovative flavor solutions.

What are the growth factors driving the Australia Vanilla Flavor Market?

The growth of the Australia Vanilla Flavor Market is driven by increasing consumer demand for natural flavors, the rise in gourmet food trends, and the expanding use of vanilla in various applications such as confectionery and beverages.

What challenges does the Australia Vanilla Flavor Market face?

The Australia Vanilla Flavor Market faces challenges such as fluctuating vanilla bean prices, supply chain disruptions, and the impact of climate change on vanilla cultivation. These factors can affect availability and production costs.

What opportunities exist in the Australia Vanilla Flavor Market?

Opportunities in the Australia Vanilla Flavor Market include the growing trend towards organic and natural products, the expansion of the food and beverage industry, and the increasing popularity of plant-based diets that utilize vanilla flavoring.

What trends are shaping the Australia Vanilla Flavor Market?

Trends shaping the Australia Vanilla Flavor Market include the rising consumer preference for premium and artisanal products, innovations in flavor extraction technologies, and the increasing incorporation of vanilla in health-focused food products.

Australia Vanilla Flavor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Vanilla, Synthetic Vanilla, Vanilla Extract, Vanilla Powder |

| End User | Food & Beverage, Bakery, Confectionery, Dairy |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Wholesale |

| Application | Beverages, Ice Cream, Sauces, Desserts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Vanilla Flavor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at