444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia trailer market represents a dynamic and rapidly evolving sector within the country’s transportation and logistics industry. Commercial trailers serve as the backbone of Australia’s freight movement, supporting everything from interstate commerce to local distribution networks. The market encompasses various trailer types including semi-trailers, rigid truck trailers, refrigerated trailers, and specialized transport solutions designed to meet diverse industry requirements.

Market dynamics indicate robust growth driven by expanding e-commerce activities, infrastructure development projects, and increasing demand for efficient freight solutions. The Australian trailer industry has experienced significant transformation with technological advancements including telematics integration, lightweight materials, and enhanced safety features becoming standard across premium trailer segments.

Regional distribution shows strong concentration in major metropolitan areas including Sydney, Melbourne, Brisbane, and Perth, where logistics hubs and manufacturing facilities drive consistent demand. According to MarkWide Research analysis, the market demonstrates steady growth momentum with increasing adoption of advanced trailer technologies and sustainable transport solutions gaining prominence across commercial fleet operations.

The Australia trailer market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of commercial trailers designed for freight transportation across Australian territories. This market includes various trailer configurations from standard box trailers to specialized equipment for transporting specific cargo types including refrigerated goods, hazardous materials, and oversized equipment.

Commercial trailers in the Australian context serve multiple industries including retail distribution, mining operations, agricultural transport, and construction logistics. The market encompasses both new trailer sales and the substantial used trailer segment, along with comprehensive aftermarket services including maintenance, parts supply, and fleet management solutions.

Trailer specifications in Australia must comply with stringent regulatory requirements including weight limits, safety standards, and environmental regulations that influence design and manufacturing processes throughout the industry.

Australia’s trailer market demonstrates remarkable resilience and growth potential driven by expanding logistics requirements and infrastructure development initiatives. The market benefits from strong economic fundamentals including robust mining sector activity, growing e-commerce penetration, and increasing interstate trade volumes that necessitate efficient freight transport solutions.

Key market segments include semi-trailers dominating long-haul applications, rigid trailers serving urban distribution networks, and specialized trailers catering to industry-specific requirements. The market shows increasing preference for technologically advanced trailers featuring GPS tracking, load monitoring systems, and fuel-efficient designs that reduce operational costs for fleet operators.

Competitive landscape features both established international manufacturers and local specialists offering customized solutions tailored to Australian operating conditions. Market participants focus on innovation strategies including lightweight construction, aerodynamic improvements, and integration of smart technologies to differentiate their offerings in an increasingly competitive environment.

Strategic insights reveal several critical factors shaping the Australian trailer market landscape:

Primary growth drivers propelling the Australia trailer market include expanding e-commerce activities that require sophisticated last-mile delivery solutions. The digital retail revolution has fundamentally transformed logistics requirements, creating demand for specialized trailers capable of handling diverse package sizes and delivery schedules efficiently.

Infrastructure development across Australia continues driving trailer demand through major construction projects, mining operations, and urban development initiatives. Government investments in transport infrastructure including highways, ports, and logistics facilities create sustained demand for heavy-duty trailers capable of supporting large-scale construction and resource extraction activities.

Economic growth in key sectors including agriculture, manufacturing, and retail distribution generates consistent trailer demand. The agricultural sector particularly drives demand for specialized trailers designed for grain transport, livestock movement, and equipment hauling during peak seasonal periods.

Technological advancement serves as a significant market driver with fleet operators increasingly seeking trailers equipped with advanced monitoring systems, fuel-efficient designs, and enhanced safety features that reduce operational costs and improve productivity across commercial operations.

Economic volatility represents a primary constraint affecting trailer market performance, with fluctuations in commodity prices, trade volumes, and business confidence directly impacting fleet investment decisions. Capital-intensive nature of trailer purchases makes the market sensitive to economic downturns and credit availability conditions.

Regulatory complexity creates challenges for market participants through evolving safety standards, environmental regulations, and compliance requirements that increase development costs and time-to-market for new trailer designs. Interstate regulatory variations add complexity for manufacturers serving multiple Australian markets.

Skilled labor shortages in manufacturing and maintenance sectors constrain market growth through limited production capacity and service capabilities. The specialized nature of trailer manufacturing requires experienced technicians and engineers, creating workforce challenges for industry participants.

Competition from alternative transport modes including rail freight and intermodal solutions provides competitive pressure on traditional road trailer applications, particularly for long-distance freight movement where cost efficiency becomes paramount for logistics operators.

Emerging opportunities in the Australia trailer market center around technological innovation and sustainable transport solutions. The electric vehicle transition creates opportunities for developing electric-powered trailer systems and lightweight designs that complement emerging electric truck technologies.

Smart trailer technologies present significant growth opportunities through integration of IoT sensors, predictive maintenance systems, and autonomous features that enhance operational efficiency. Data analytics capabilities enable fleet operators to optimize routes, reduce fuel consumption, and improve asset utilization rates.

Specialized applications offer lucrative opportunities including temperature-controlled trailers for pharmaceutical and food distribution, heavy-haul trailers for mining equipment, and custom solutions for unique industry requirements. Niche markets often provide higher margins and stronger customer relationships.

Export potential exists for Australian trailer manufacturers to serve regional markets including Southeast Asia and Pacific Island nations where Australian engineering expertise and quality standards command premium positioning in international markets.

Supply chain dynamics significantly influence the Australian trailer market through raw material availability, component sourcing, and manufacturing capacity constraints. Steel prices and aluminum availability directly impact trailer production costs and pricing strategies across the industry.

Demand patterns show seasonal variations aligned with agricultural cycles, construction activity levels, and retail distribution requirements. Peak demand periods typically coincide with harvest seasons, holiday retail periods, and major infrastructure project timelines.

Technology adoption rates vary significantly across market segments, with large fleet operators leading adoption of advanced trailer technologies while smaller operators focus on cost-effective basic solutions. This technology gap creates opportunities for financing and leasing solutions that make advanced trailers accessible to smaller operators.

Competitive dynamics feature intense price competition in standard trailer segments while specialized applications offer opportunities for premium pricing and differentiated value propositions. Market consolidation trends continue as larger manufacturers acquire specialized capabilities and regional market access.

Comprehensive research approach employed for analyzing the Australia trailer market combines primary research through industry interviews, surveys, and field observations with extensive secondary research covering industry reports, government statistics, and trade association data.

Primary research activities include structured interviews with trailer manufacturers, fleet operators, dealers, and industry experts to gather insights on market trends, competitive dynamics, and future outlook. Survey methodologies capture quantitative data on purchasing patterns, technology preferences, and market sizing across different trailer segments.

Secondary research sources encompass government transportation statistics, industry association reports, trade publications, and economic indicators relevant to freight transportation and logistics sectors. Data validation processes ensure accuracy and reliability of market intelligence through cross-referencing multiple sources and expert verification.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and trend identification methodologies that provide comprehensive understanding of market dynamics and future growth potential across the Australian trailer industry.

New South Wales dominates the Australian trailer market with approximately 35% market share driven by Sydney’s position as a major logistics hub and the state’s extensive manufacturing base. Port activities and interstate freight movements generate substantial demand for semi-trailers and container transport solutions.

Victoria represents the second-largest regional market with 28% market share, benefiting from Melbourne’s role as a distribution center and the state’s diverse industrial base including automotive, food processing, and manufacturing sectors that require specialized trailer solutions.

Queensland accounts for approximately 20% market share with strong demand driven by mining operations, agricultural activities, and tourism-related logistics. The state’s resource extraction industries create demand for heavy-duty trailers and specialized transport equipment.

Western Australia holds 12% market share with demand concentrated around Perth and mining regions. The state’s mining sector drives demand for heavy-haul trailers and specialized equipment transport solutions, while agricultural activities support rural trailer markets.

South Australia and Tasmania together represent the remaining 5% market share, with demand patterns reflecting local agricultural, manufacturing, and distribution requirements specific to these regional markets.

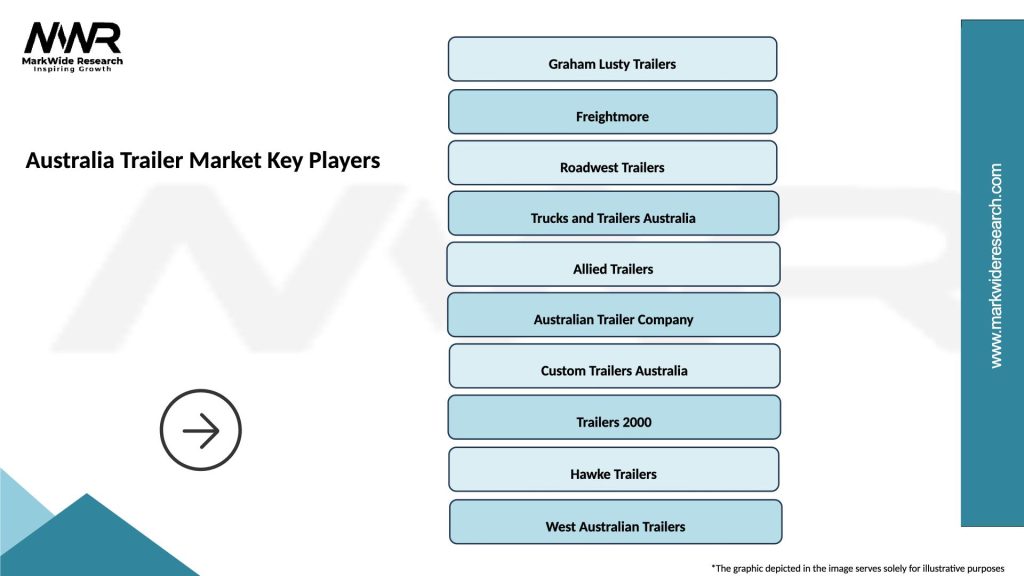

Market leadership in the Australia trailer market features a mix of international manufacturers and local specialists offering diverse product portfolios:

Competitive strategies focus on technological innovation, customization capabilities, and comprehensive service offerings that differentiate manufacturers in an increasingly competitive market environment.

By Trailer Type:

By Application:

Semi-trailer segment demonstrates strongest growth momentum with increasing demand for fuel-efficient designs and advanced technology integration. Aerodynamic improvements and lightweight materials drive adoption among long-haul operators seeking operational cost reductions and environmental compliance.

Refrigerated trailer category shows robust expansion driven by growing cold-chain requirements in food distribution and pharmaceutical logistics. Temperature control technology advancement and energy efficiency improvements make these specialized trailers increasingly attractive for fleet operators.

Rigid trailer segment benefits from urban delivery growth and last-mile logistics expansion. Compact designs and enhanced maneuverability features address increasing demand for city-friendly transport solutions that navigate congested urban environments effectively.

Specialized trailer categories including tank trailers and heavy-haul solutions serve niche markets with higher margins and customization requirements. These segments offer premium pricing opportunities for manufacturers capable of delivering tailored solutions meeting specific industry standards and regulations.

Fleet operators benefit from advanced trailer technologies that reduce operational costs through improved fuel efficiency, enhanced safety features, and predictive maintenance capabilities. Total cost of ownership improvements justify premium investments in technologically advanced trailer solutions.

Manufacturers gain competitive advantages through innovation leadership, customization capabilities, and comprehensive service offerings that create customer loyalty and premium pricing opportunities. Technology integration enables differentiation in increasingly competitive market segments.

Logistics companies achieve operational efficiency improvements through optimized trailer designs, real-time monitoring capabilities, and enhanced cargo protection features. Service quality enhancements support customer satisfaction and business growth objectives.

End customers benefit from improved delivery reliability, reduced transportation costs, and enhanced cargo security through advanced trailer technologies. Supply chain efficiency improvements translate to better service levels and competitive pricing across various industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trend transforms trailer operations through integration of IoT sensors, GPS tracking, and predictive analytics that enable real-time monitoring and optimization of fleet performance. Data-driven insights help operators reduce costs and improve service quality across commercial applications.

Sustainability initiatives drive adoption of lightweight materials, aerodynamic designs, and alternative fuel compatibility that reduce environmental impact while improving operational efficiency. Carbon footprint reduction becomes increasingly important for fleet operators serving environmentally conscious customers.

Customization demand increases as businesses seek specialized trailer solutions tailored to specific operational requirements. Modular designs and flexible configurations enable manufacturers to serve diverse market segments efficiently while maintaining cost-effectiveness.

Service integration becomes a key differentiator with manufacturers offering comprehensive maintenance, financing, and fleet management services alongside trailer sales. Total solution approaches create stronger customer relationships and recurring revenue opportunities for industry participants.

Recent developments in the Australia trailer market include significant investments in manufacturing capacity expansion and technology integration initiatives. Major manufacturers are establishing advanced production facilities equipped with automated manufacturing systems and quality control technologies.

Strategic partnerships between trailer manufacturers and technology companies accelerate development of smart trailer solutions featuring advanced telematics, predictive maintenance, and autonomous capabilities. These collaboration initiatives combine manufacturing expertise with cutting-edge technology development.

Regulatory updates including revised safety standards and environmental requirements drive product development initiatives across the industry. Compliance investments focus on meeting evolving regulatory requirements while maintaining competitive positioning in the market.

Market consolidation continues with acquisitions and mergers creating larger, more capable organizations with enhanced product portfolios and geographic coverage. These consolidation trends reshape competitive dynamics and market structure across the Australian trailer industry.

Strategic recommendations for market participants include prioritizing technology integration initiatives that differentiate products and create competitive advantages. Investment priorities should focus on IoT capabilities, predictive maintenance systems, and fuel efficiency improvements that deliver measurable value to fleet operators.

Market expansion strategies should consider regional specialization opportunities and export market development in Asia-Pacific regions where Australian quality standards and engineering expertise command premium positioning. Geographic diversification reduces dependence on domestic market fluctuations.

Service capability development represents a critical success factor with comprehensive maintenance, financing, and fleet management services creating recurring revenue streams and stronger customer relationships. Service excellence becomes increasingly important for competitive differentiation.

According to MWR analysis, companies should focus on sustainable innovation initiatives that address environmental concerns while improving operational efficiency. Long-term success requires balancing immediate market demands with future sustainability requirements and technological advancement opportunities.

Growth projections for the Australia trailer market indicate continued expansion driven by infrastructure development, e-commerce growth, and fleet modernization requirements. The market is expected to maintain steady growth momentum with increasing adoption of advanced technologies and sustainable transport solutions.

Technology evolution will accelerate with autonomous features, electric powertrains, and advanced materials becoming standard across premium trailer segments. Innovation cycles are shortening as competitive pressures drive rapid technology adoption and product development initiatives.

Market structure evolution will likely feature continued consolidation with larger manufacturers gaining market share through acquisition strategies and capacity expansion initiatives. Competitive dynamics will increasingly favor companies with comprehensive product portfolios and advanced technology capabilities.

Regulatory environment will continue evolving with stricter safety standards, environmental requirements, and technology mandates shaping product development priorities. Compliance capabilities will become increasingly important for maintaining market access and competitive positioning across the Australian trailer industry.

Australia trailer market demonstrates robust fundamentals with strong growth potential driven by expanding logistics requirements, technological advancement, and infrastructure development initiatives. The market benefits from diverse demand sources including e-commerce expansion, mining activities, agricultural transport, and construction logistics that provide stability and growth opportunities.

Competitive landscape features both challenges and opportunities with international competition intensifying while technology integration creates differentiation possibilities for innovative manufacturers. Success factors include technology leadership, customization capabilities, service excellence, and sustainable innovation that address evolving customer requirements and regulatory standards.

Future prospects remain positive with continued market expansion expected across multiple segments and applications. Strategic positioning focusing on advanced technologies, comprehensive service offerings, and sustainable solutions will determine long-term success in this dynamic and evolving market environment that continues adapting to changing transportation and logistics requirements across Australia.

What is a trailer?

A trailer is a non-motorized vehicle designed to be towed by a motor vehicle, used for transporting goods, equipment, or passengers. In the context of the Australia Trailer Market, trailers can vary in type, including utility trailers, enclosed trailers, and car haulers.

What are the key players in the Australia Trailer Market?

Key players in the Australia Trailer Market include companies such as Bega Trailers, BNT Trailers, and Australian Trailer Manufacturers, among others. These companies are known for their diverse range of trailer products catering to various industries.

What are the growth factors driving the Australia Trailer Market?

The Australia Trailer Market is driven by factors such as the increasing demand for transportation solutions in logistics and construction, the growth of e-commerce requiring efficient delivery systems, and the rise in recreational vehicle usage among consumers.

What challenges does the Australia Trailer Market face?

Challenges in the Australia Trailer Market include regulatory compliance regarding safety standards, competition from alternative transportation methods, and fluctuations in raw material prices affecting production costs.

What opportunities exist in the Australia Trailer Market?

Opportunities in the Australia Trailer Market include the potential for innovation in trailer design and technology, the expansion of electric and hybrid trailers, and the growing trend of outdoor recreational activities that increase demand for specialized trailers.

What trends are shaping the Australia Trailer Market?

Trends in the Australia Trailer Market include the increasing adoption of lightweight materials for better fuel efficiency, the integration of smart technology for tracking and safety, and a shift towards sustainable manufacturing practices to reduce environmental impact.

Australia Trailer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flatbed, Enclosed, Utility, Car Hauler |

| End User | Construction, Agriculture, Logistics, Recreational |

| Material | Aluminum, Steel, Composite, Fiberglass |

| Size | Lightweight, Medium, Heavy-duty, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Trailer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at