444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia Taxi Market is a thriving industry that plays a crucial role in the country’s transportation sector. Taxis have been an integral part of Australia’s urban and regional transportation network for many years. They provide a convenient and reliable mode of transportation for both residents and tourists alike.

Meaning

Taxis, also known as cabs or taxis, are a form of public transportation that offers on-demand services to passengers. These vehicles can be hailed on the street or booked through phone calls or mobile applications. Taxis are driven by professional drivers who are licensed and regulated by local transportation authorities.

Executive Summary

The Australia Taxi Market has witnessed steady growth over the years, driven by factors such as increasing urbanization, rising disposable incomes, and the convenience offered by taxi services. The market is highly competitive, with several established players as well as new entrants vying for market share. The COVID-19 pandemic had a significant impact on the market, but it has shown signs of recovery in recent months.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia Taxi Market is dynamic and constantly evolving, influenced by various factors such as technological advancements, changing consumer preferences, and regulatory policies. The market dynamics are shaped by the interplay between market drivers, restraints, and opportunities.

Technological advancements, particularly the rise of ride-hailing applications, have disrupted the traditional taxi market. These platforms have introduced new business models, increased price transparency, and provided customers with more choices. Taxi operators have had to adapt to these changes by integrating technology into their operations and improving their service offerings.

Regulatory policies also play a significant role in shaping the market dynamics. Licensing requirements, fare regulations, and safety standards impact the entry barriers, pricing structures, and overall operational framework for taxi operators. Changes in regulations can create opportunities or challenges for market players, depending on how they align with the evolving market landscape.

Consumer preferences and behaviors are constantly evolving, influenced by factors such as convenience, price, and sustainability. The COVID-19 pandemic has further accelerated these shifts, with increased emphasis on hygiene and safety. Taxi operators need to understand and respond to these changing preferences to remain competitive in the market.

Regional Analysis

The Australia Taxi Market exhibits regional variations due to differences in population density, urbanization levels, and tourism activities. Major cities such as Sydney, Melbourne, Brisbane, Perth, and Adelaide have the highest demand for taxi services due to their larger populations and higher tourist footfall. These cities also have a more developed transportation infrastructure, making taxis a popular choice for both residents and visitors.

In regional areas with lower population densities, taxi services may be less frequent, and alternative transportation options such as private car ownership or ride-sharing may be more common. However, even in regional areas, taxis are still essential for certain transportation needs, such as airport transfers or travel to remote locations.

Regional variations also exist in terms of regulatory policies and licensing requirements. Local transportation authorities may impose specific regulations or fare structures, which can impact the operations and profitability of taxi businesses. Taxi operators need to navigate these regional nuances to effectively serve their target markets.

Competitive Landscape

Leading companies in the Australia Taxi Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

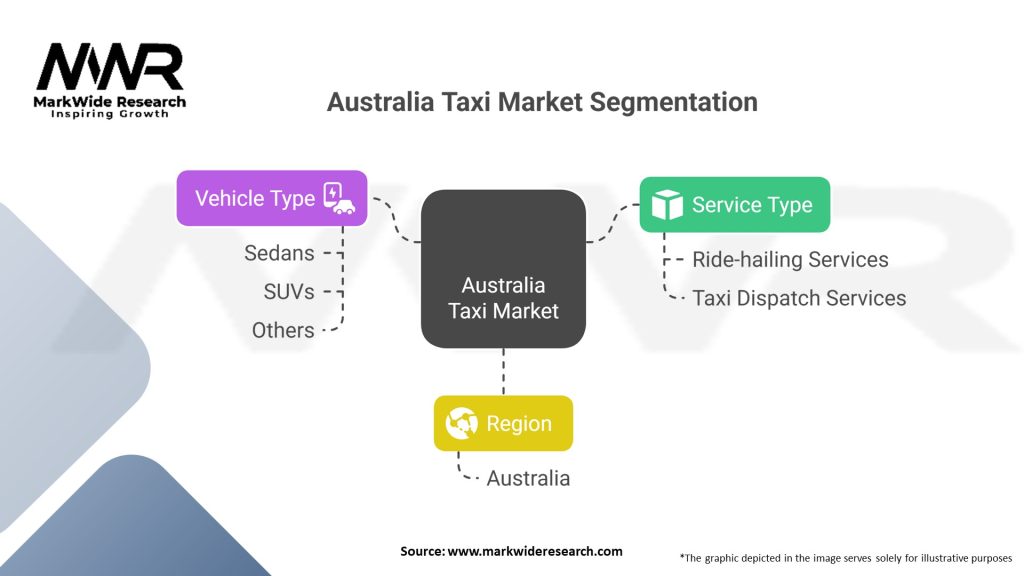

Segmentation

The Australia Taxi Market can be segmented based on various factors, including service type, vehicle type, and customer segment. These segments help in understanding the specific needs and preferences of different customer groups.

Service Type

Vehicle Type

Customer Segment

Category-wise Insights

The Australia Taxi Market can be further analyzed based on different categories to gain deeper insights into market dynamics and trends.

Key Benefits for Industry Participants and Stakeholders

The Australia Taxi Market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis helps evaluate the strengths, weaknesses, opportunities, and threats of the Australia Taxi Market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the Australia Taxi Market:

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Australia Taxi Market. The imposition of lockdowns, travel restrictions, and social distancing measures led to a sharp decline in demand for taxi services. The reduced mobility of people, closure of tourist destinations, and limited business activities severely affected the market.

Taxi operators faced unprecedented challenges during the pandemic. Many experienced a drastic drop in revenue, with some operators suspending their services temporarily or permanently. The decline in international and domestic travel further contributed to the revenue loss.

However, as restrictions eased and vaccination efforts progressed, the market started to show signs of recovery. Taxi operators implemented stringent hygiene measures, such as sanitization protocols and contactless payment options, to ensure passenger safety. The resumption of business activities and gradual return of tourism also contributed to the market’s recovery.

Despite the challenges posed by the pandemic, the taxi industry has demonstrated resilience and adaptability. Operators have leveraged technology to meet changing customer expectations and provide safe transportation options. The pandemic has highlighted the importance of taxis as an essential mode of transportation, especially in times of crisis.

Key Industry Developments

The Australia Taxi Market has witnessed several key industry developments:

Analyst Suggestions

Based on market analysis and industry trends, analysts suggest the following strategies for taxi operators:

Future Outlook

The future outlook for the Australia Taxi Market is cautiously optimistic. Despite the challenges posed by the COVID-19 pandemic and the rise of ride-hailing services, the demand for taxis is expected to gradually recover as travel restrictions ease and economic activities resume.

Technological advancements will continue to shape the market, with increased integration of mobile applications, GPS tracking systems, and cashless payment options. Electric vehicle adoption is expected to accelerate, driven by sustainability goals and government incentives.

Taxi operators will need to adapt to changing consumer preferences and invest in customer-centric strategies. Providing personalized services, focusing on safety and hygiene, and diversifying service offerings can help operators differentiate themselves and attract a loyal customer base.Collaborations and partnerships will play a crucial role in the future of the taxi market, allowing operators to leverage the strengths of different stakeholders and provide comprehensive transportation solutions.

Conclusion

In conclusion, while the Australia Taxi Market faces challenges from competition and changing market dynamics, it continues to be an essential mode of transportation. By embracing technology, prioritizing customer service, adopting sustainable practices, and exploring strategic partnerships, taxi operators can position themselves for growth and success in the evolving market landscape.

What is Taxi?

Taxi refers to a vehicle for hire that transports passengers to their desired destinations, typically charging a fare based on distance traveled. In Australia, taxis are an essential part of the public transport system, providing services in urban and rural areas.

What are the key players in the Australia Taxi Market?

Key players in the Australia Taxi Market include companies such as Uber, Ola, and 13CABS, which offer various ride-hailing and taxi services. These companies compete on factors like pricing, service quality, and technology integration, among others.

What are the growth factors driving the Australia Taxi Market?

The Australia Taxi Market is driven by factors such as the increasing demand for convenient transportation options, urbanization leading to higher mobility needs, and advancements in mobile app technology that enhance user experience.

What challenges does the Australia Taxi Market face?

Challenges in the Australia Taxi Market include regulatory hurdles, competition from rideshare services, and fluctuating fuel prices that can impact operational costs. Additionally, maintaining service quality amidst growing demand is a significant concern.

What opportunities exist in the Australia Taxi Market?

Opportunities in the Australia Taxi Market include the potential for integrating electric vehicles to promote sustainability, expanding services to underserved areas, and leveraging data analytics for improved customer service and operational efficiency.

What trends are shaping the Australia Taxi Market?

Trends in the Australia Taxi Market include the rise of app-based ride-hailing services, increased focus on customer safety and hygiene, and the adoption of contactless payment methods. These trends are reshaping how consumers interact with taxi services.

Australia Taxi Market:

| Segmentation Details | Description |

|---|---|

| Service Type | Ride-hailing Services, Taxi Dispatch Services |

| Vehicle Type | Sedans, SUVs, Others |

| Region | Australia |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Taxi Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at