444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia system integration market represents a dynamic and rapidly evolving sector that encompasses the comprehensive process of bringing together various computing systems, software applications, and technologies into a unified, cohesive operational framework. This market has experienced substantial growth driven by digital transformation initiatives across multiple industries, with organizations increasingly recognizing the critical importance of seamless technology integration for operational efficiency and competitive advantage.

Digital transformation initiatives across Australian enterprises have accelerated significantly, with the system integration market experiencing robust expansion at a compound annual growth rate (CAGR) of 8.2%. The market encompasses diverse integration services including enterprise application integration, data integration, cloud integration, and business process integration, serving sectors ranging from healthcare and finance to manufacturing and government.

Australian organizations are increasingly adopting sophisticated integration solutions to address complex technological challenges, streamline operations, and enhance customer experiences. The market demonstrates strong momentum driven by cloud migration initiatives, IoT implementation, artificial intelligence adoption, and the growing need for real-time data analytics across business operations.

Key market characteristics include the rising demand for hybrid cloud integration solutions, increased focus on cybersecurity integration, and the growing importance of API-based integration platforms. The market serves diverse client segments from small and medium enterprises to large multinational corporations, each requiring tailored integration approaches to meet specific operational requirements and regulatory compliance standards.

The Australia system integration market refers to the comprehensive ecosystem of services, technologies, and solutions designed to connect disparate information systems, applications, and technologies within organizations across the Australian business landscape. This market encompasses the strategic planning, implementation, and management of integrated technology solutions that enable seamless data flow, process automation, and operational efficiency across diverse business functions.

System integration involves the complex process of linking together different computing systems and software applications physically or functionally to act as a coordinated whole. In the Australian context, this market addresses the unique challenges faced by organizations operating in a highly regulated environment while maintaining competitive positioning in the global marketplace.

Market participants include specialized system integration service providers, technology consultants, software vendors, and managed service providers who collaborate to deliver comprehensive integration solutions. These solutions range from simple point-to-point connections to complex enterprise-wide integration platforms that support real-time data exchange and automated business processes.

Australia’s system integration market demonstrates exceptional growth potential driven by accelerating digital transformation initiatives across key industry sectors. The market benefits from strong government support for technology adoption, robust telecommunications infrastructure, and a highly skilled technology workforce that supports complex integration projects.

Market dynamics indicate increasing demand for cloud-based integration solutions, with approximately 72% of Australian enterprises prioritizing hybrid cloud integration strategies. The market encompasses diverse service categories including application integration, data integration, process integration, and infrastructure integration, each addressing specific organizational requirements and technological challenges.

Key growth drivers include the rapid adoption of Software-as-a-Service (SaaS) applications, increasing regulatory compliance requirements, and the growing need for real-time business intelligence across organizations. The market demonstrates strong resilience and adaptability, with service providers continuously evolving their offerings to address emerging technologies and changing client requirements.

Competitive landscape features a mix of global technology leaders and specialized local service providers, creating a dynamic environment that fosters innovation and competitive pricing. The market shows strong potential for continued expansion, supported by ongoing digital transformation initiatives and increasing recognition of integration as a strategic business enabler.

Strategic market insights reveal several critical trends shaping the Australia system integration landscape. Organizations are increasingly prioritizing integration solutions that support remote work capabilities, enhance cybersecurity posture, and enable rapid scalability to address changing business requirements.

Market maturation indicators suggest increasing sophistication in client requirements, with organizations seeking comprehensive integration strategies rather than point solutions. This trend creates opportunities for service providers to develop long-term partnerships and deliver ongoing value through managed integration services.

Digital transformation acceleration serves as the primary driver for Australia’s system integration market, with organizations across all sectors recognizing the critical importance of integrated technology ecosystems for competitive advantage. The COVID-19 pandemic significantly accelerated digital adoption timelines, creating sustained demand for integration services that support remote work, digital customer engagement, and operational resilience.

Cloud migration initiatives represent another significant market driver, with Australian organizations increasingly adopting hybrid and multi-cloud strategies that require sophisticated integration solutions. These initiatives demand seamless connectivity between on-premises systems and cloud-based applications, creating substantial opportunities for integration service providers.

Regulatory compliance requirements across industries such as finance, healthcare, and government drive consistent demand for integration solutions that ensure data security, audit trails, and regulatory reporting capabilities. The Australian Prudential Regulation Authority (APRA) and other regulatory bodies continue to emphasize the importance of robust technology governance, supporting market growth.

Data analytics and business intelligence requirements fuel demand for integration solutions that enable real-time data consolidation and analysis. Organizations seek to leverage data assets for competitive advantage, requiring integration platforms that support advanced analytics and machine learning capabilities.

Customer experience enhancement initiatives drive integration investments as organizations strive to deliver seamless, omnichannel customer experiences. This requires integration of customer relationship management systems, e-commerce platforms, mobile applications, and communication channels to create unified customer journeys.

Implementation complexity represents a significant restraint for the Australia system integration market, as organizations often underestimate the technical challenges and resource requirements associated with comprehensive integration projects. Complex legacy system architectures, diverse technology stacks, and intricate business processes can create substantial implementation barriers.

Skills shortage in specialized integration technologies poses ongoing challenges for market growth, with demand for qualified integration architects, developers, and project managers consistently exceeding supply. This skills gap can lead to project delays, increased costs, and reduced quality outcomes for integration initiatives.

Budget constraints particularly affect small and medium enterprises, which may lack the financial resources to invest in comprehensive integration solutions. Economic uncertainty and competing technology priorities can limit integration spending, particularly for non-critical business functions.

Security concerns related to data integration and system connectivity create hesitation among organizations, particularly in highly regulated industries. Concerns about data breaches, unauthorized access, and compliance violations can slow integration project approval and implementation timelines.

Change management challenges within organizations can impede successful integration implementations, as employees may resist new processes and technologies. Inadequate change management strategies can lead to poor user adoption and reduced return on integration investments.

Artificial intelligence integration presents substantial opportunities for market expansion, as organizations seek to incorporate AI and machine learning capabilities into their existing technology ecosystems. Integration service providers can capitalize on this trend by developing specialized AI integration competencies and solution frameworks.

Internet of Things (IoT) integration represents a rapidly growing opportunity segment, with Australian organizations increasingly deploying IoT devices across manufacturing, agriculture, and smart city initiatives. These deployments require sophisticated integration solutions to manage device connectivity, data processing, and analytics capabilities.

Industry 4.0 initiatives in manufacturing and industrial sectors create significant opportunities for integration service providers to support smart factory implementations, predictive maintenance systems, and supply chain optimization solutions. These initiatives require complex integration of operational technology and information technology systems.

Government digital transformation programs offer substantial market opportunities, with federal and state governments investing heavily in digital service delivery and operational modernization. These initiatives require extensive integration of legacy systems with modern digital platforms and citizen-facing applications.

Sustainability and ESG integration solutions represent emerging opportunities as organizations seek to integrate environmental, social, and governance data into their business operations. This includes carbon footprint tracking, sustainability reporting, and supply chain transparency initiatives that require comprehensive data integration capabilities.

Market dynamics in Australia’s system integration sector reflect the interplay between technological advancement, business requirements, and regulatory influences. The market demonstrates strong momentum driven by increasing recognition of integration as a strategic business enabler rather than a purely technical function.

Competitive intensity continues to increase as global technology leaders expand their Australian presence while local service providers enhance their capabilities and service offerings. This competition drives innovation, improves service quality, and creates more favorable pricing conditions for clients across market segments.

Technology evolution significantly impacts market dynamics, with emerging technologies such as edge computing, 5G networks, and quantum computing creating new integration requirements and opportunities. Service providers must continuously adapt their capabilities to address these evolving technological landscapes.

Client sophistication levels are increasing, with organizations developing more mature understanding of integration requirements and expected outcomes. This trend drives demand for specialized expertise, proven methodologies, and measurable business value from integration investments.

Partnership ecosystems are becoming increasingly important, with successful integration projects often requiring collaboration between multiple technology vendors, service providers, and consulting organizations. These partnerships enable comprehensive solution delivery while managing complexity and risk for client organizations.

Comprehensive market research for the Australia system integration market employs multiple data collection and analysis methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative analysis with qualitative assessments to provide a complete market perspective.

Primary research activities include structured interviews with key market participants, including system integration service providers, technology vendors, end-user organizations, and industry experts. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics affecting the Australian market.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, company financial statements, and technology trend analyses. This research provides historical context, market sizing data, and trend validation to support primary research findings.

Market segmentation analysis employs statistical modeling techniques to identify key market segments, growth patterns, and competitive positioning across different service categories, industry verticals, and geographic regions within Australia.

Validation processes include cross-referencing multiple data sources, expert review panels, and statistical verification methods to ensure research accuracy and reliability. The methodology emphasizes objectivity and comprehensive coverage of all relevant market aspects.

Regional market distribution across Australia reveals significant concentration in major metropolitan areas, with Sydney and Melbourne accounting for approximately 68% of total market activity. These cities benefit from large concentrations of enterprise clients, technology service providers, and skilled professionals supporting complex integration projects.

Sydney market dynamics demonstrate strong growth driven by financial services, telecommunications, and government sector integration initiatives. The city’s position as Australia’s financial capital creates substantial demand for sophisticated integration solutions supporting regulatory compliance, risk management, and customer experience enhancement.

Melbourne’s market characteristics reflect diverse industry representation including manufacturing, healthcare, education, and professional services. The city’s strong technology ecosystem and innovation focus support growing demand for advanced integration solutions incorporating artificial intelligence and automation capabilities.

Brisbane and Perth represent emerging growth markets with increasing integration activity driven by resources sector digitization, government modernization initiatives, and growing technology startup ecosystems. These markets show strong potential for continued expansion as regional economic development accelerates.

Regional market opportunities exist across smaller metropolitan and rural areas, where organizations are increasingly recognizing the importance of technology integration for competitive positioning. Government initiatives supporting regional digital transformation create additional growth opportunities for service providers.

Market leadership in Australia’s system integration sector features a diverse mix of global technology giants, specialized integration service providers, and emerging local players. The competitive landscape demonstrates healthy competition that drives innovation and service quality improvements across the market.

Competitive differentiation strategies include industry specialization, technology expertise, service delivery models, and pricing approaches. Successful providers demonstrate strong capabilities in project management, change management, and ongoing support services that ensure successful integration outcomes.

Market consolidation trends indicate increasing merger and acquisition activity as larger providers seek to enhance capabilities and market coverage while smaller specialists look for growth opportunities and resource access.

Service type segmentation reveals distinct market categories with varying growth rates and client requirements. Application integration services represent the largest segment, driven by the proliferation of SaaS applications and the need for seamless data exchange between business systems.

By Service Type:

By Industry Vertical:

By Organization Size:

Application integration services demonstrate the strongest growth momentum, with approximately 45% market share driven by increasing SaaS adoption and the need for seamless business process automation. Organizations prioritize application integration to eliminate data silos and improve operational efficiency across departments and business functions.

Cloud integration solutions represent the fastest-growing category, with demand increasing at 12.5% annually as organizations accelerate cloud migration initiatives. Hybrid cloud architectures require sophisticated integration capabilities to maintain data consistency and business process continuity across diverse technology environments.

Data integration services show consistent growth driven by increasing focus on data analytics and business intelligence capabilities. Organizations recognize data as a strategic asset requiring comprehensive integration to support decision-making, customer insights, and operational optimization initiatives.

API management solutions emerge as a critical category supporting modern integration architectures, with organizations increasingly adopting API-first strategies for system connectivity. This approach enables greater flexibility, scalability, and maintainability in complex integration environments.

Industry-specific integration solutions demonstrate strong growth potential, with healthcare, financial services, and government sectors showing particular demand for specialized integration capabilities that address unique regulatory and operational requirements.

Operational efficiency improvements represent the primary benefit for organizations investing in system integration solutions, with typical implementations delivering 25-40% efficiency gains through process automation and data streamlining. These improvements translate directly to cost savings and enhanced competitive positioning.

Enhanced decision-making capabilities result from integrated data environments that provide real-time visibility into business operations, customer behavior, and market conditions. Organizations benefit from improved analytics capabilities that support strategic planning and tactical operational adjustments.

Improved customer experiences emerge from integrated systems that enable seamless interactions across multiple touchpoints and channels. Integration solutions support omnichannel strategies that enhance customer satisfaction and loyalty while reducing service delivery costs.

Regulatory compliance benefits include automated reporting, audit trail maintenance, and data governance capabilities that reduce compliance risks and administrative overhead. These benefits are particularly valuable in highly regulated industries such as finance and healthcare.

Scalability advantages enable organizations to adapt quickly to changing business requirements, market conditions, and growth opportunities. Integrated systems provide the flexibility needed to support business expansion and operational evolution.

Risk mitigation benefits include improved data security, system reliability, and business continuity capabilities. Integration solutions often incorporate redundancy, backup, and recovery features that enhance overall organizational resilience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Low-code and no-code integration platforms are gaining significant traction, enabling business users to create and manage integration workflows without extensive technical expertise. This trend democratizes integration capabilities while reducing implementation timelines and costs for organizations across various sectors.

Edge computing integration represents an emerging trend as organizations deploy processing capabilities closer to data sources and end users. This approach requires new integration strategies that support distributed architectures while maintaining data consistency and security standards.

Microservices architecture adoption continues to accelerate, with organizations breaking down monolithic applications into smaller, more manageable components. This architectural shift requires sophisticated integration capabilities to manage communication and data exchange between numerous microservices.

Real-time integration demand increases as organizations seek to eliminate batch processing delays and enable immediate response to business events. Stream processing and event-driven architectures are becoming standard requirements for modern integration solutions.

Sustainability integration emerges as organizations seek to incorporate environmental and social governance metrics into their business operations. This trend creates demand for integration solutions that support carbon footprint tracking, supply chain transparency, and sustainability reporting requirements.

Industry-specific integration platforms show growing popularity as organizations recognize the benefits of solutions designed specifically for their sector requirements. These platforms incorporate industry best practices, regulatory compliance features, and specialized functionality that generic integration tools cannot provide.

Strategic partnerships between major technology vendors and local service providers are reshaping the competitive landscape, creating comprehensive solution offerings that combine global technology leadership with local market expertise and customer relationships.

Acquisition activity continues to consolidate the market, with larger service providers acquiring specialized integration capabilities and client portfolios to enhance their market positioning and service offerings. MarkWide Research analysis indicates increasing merger and acquisition activity across the sector.

Government initiatives supporting digital transformation and cybersecurity enhancement create substantial market opportunities while establishing new requirements for integration solution security and compliance capabilities.

Technology platform evolution includes the introduction of artificial intelligence and machine learning capabilities into integration platforms, enabling automated data mapping, intelligent routing, and predictive maintenance capabilities.

Industry certification programs are emerging to address skills shortage challenges, with technology vendors and educational institutions collaborating to develop specialized training programs for integration professionals.

Cloud-native integration solutions continue to gain market share as organizations prioritize scalability, flexibility, and cost-effectiveness over traditional on-premises integration infrastructure.

Investment prioritization should focus on developing capabilities in emerging technology areas such as artificial intelligence integration, IoT connectivity, and edge computing solutions. Organizations that establish early expertise in these areas will capture significant market share as demand accelerates.

Skills development initiatives represent critical success factors for market participants, with organizations needing to invest heavily in training and certification programs to address the ongoing shortage of qualified integration professionals. Partnership with educational institutions and technology vendors can accelerate capability development.

Industry specialization strategies offer significant opportunities for differentiation and premium pricing, with organizations that develop deep expertise in specific sectors able to command higher margins and build stronger client relationships than generalist providers.

Geographic expansion into regional markets presents growth opportunities for established providers, particularly as government initiatives and economic development programs increase technology adoption outside major metropolitan areas.

Partnership ecosystem development becomes increasingly important as integration projects require diverse expertise and capabilities. Successful providers will build comprehensive partner networks that enable end-to-end solution delivery while managing complexity and risk.

Security integration capabilities must be prioritized given increasing cybersecurity threats and regulatory requirements. Organizations that can demonstrate strong security expertise and compliance capabilities will have significant competitive advantages in client selection processes.

Market growth projections indicate continued strong expansion over the next five years, with the Australia system integration market expected to maintain robust growth rates exceeding 8% annually. This growth will be driven by accelerating digital transformation initiatives, emerging technology adoption, and increasing recognition of integration as a strategic business enabler.

Technology evolution will significantly impact market dynamics, with artificial intelligence, machine learning, and automation capabilities becoming standard features in integration platforms. Organizations that adapt quickly to these technological advances will capture disproportionate market share and client mindshare.

Industry transformation across sectors such as healthcare, education, and government will create substantial new market opportunities as these traditionally conservative sectors accelerate their digital transformation initiatives. MarkWide Research projects particularly strong growth in government and healthcare integration services.

Competitive landscape evolution will likely include further consolidation as larger providers acquire specialized capabilities and smaller providers seek scale and resources to compete effectively. This consolidation will create opportunities for innovative new entrants to establish market positions in emerging technology areas.

Client sophistication increases will drive demand for more strategic, consultative approaches to integration services, with organizations seeking partners who can provide business value beyond technical implementation. This trend favors providers with strong business consulting capabilities and industry expertise.

Regional market development will accelerate as digital transformation initiatives expand beyond major metropolitan areas, creating opportunities for service providers to establish presence in previously underserved markets while supporting national economic development objectives.

Australia’s system integration market demonstrates exceptional growth potential driven by accelerating digital transformation initiatives, emerging technology adoption, and increasing recognition of integration as a strategic business enabler. The market benefits from strong fundamentals including robust technology infrastructure, skilled workforce, and supportive regulatory environment that create favorable conditions for continued expansion.

Market dynamics reflect healthy competition between global technology leaders and specialized local providers, driving innovation and service quality improvements that benefit client organizations across all sectors. The increasing sophistication of client requirements creates opportunities for providers to develop deeper partnerships and deliver greater business value through comprehensive integration solutions.

Future success in the Australia system integration market will require continuous adaptation to evolving technology landscapes, investment in skills development, and strategic focus on emerging opportunities in artificial intelligence, IoT, and industry-specific solutions. Organizations that can demonstrate clear business value, strong security capabilities, and deep industry expertise will capture the greatest market opportunities in this dynamic and rapidly growing sector.

What is System Integration?

System integration refers to the process of linking together different computing systems and software applications to act as a coordinated whole. This is essential in various sectors, including telecommunications, manufacturing, and information technology, to enhance efficiency and data flow.

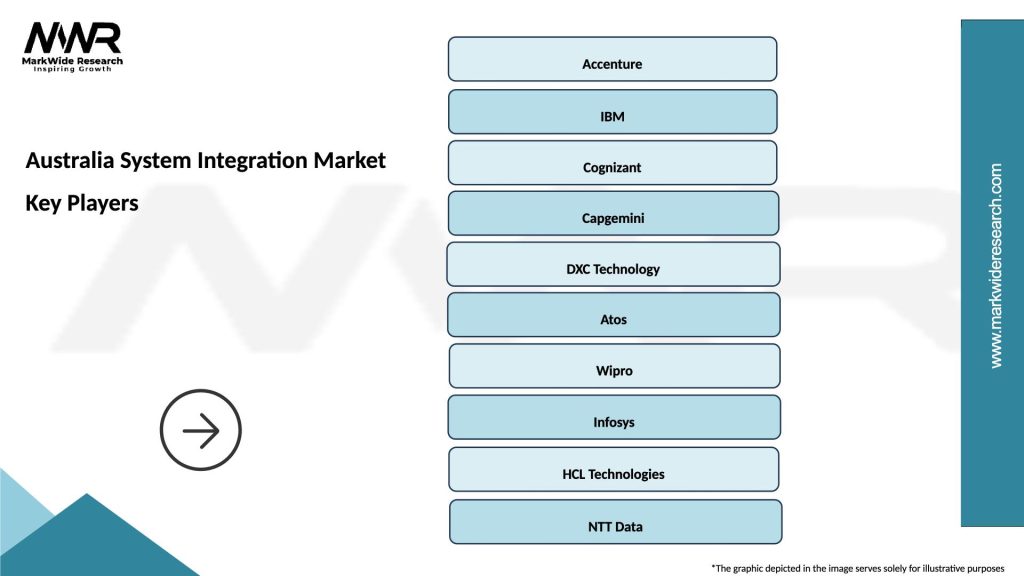

What are the key players in the Australia System Integration Market?

Key players in the Australia System Integration Market include companies like Accenture, IBM, and Capgemini, which provide a range of integration services across various industries such as finance, healthcare, and logistics, among others.

What are the main drivers of growth in the Australia System Integration Market?

The main drivers of growth in the Australia System Integration Market include the increasing demand for automation, the need for improved operational efficiency, and the rise of cloud computing solutions that require seamless integration across platforms.

What challenges does the Australia System Integration Market face?

Challenges in the Australia System Integration Market include the complexity of integrating legacy systems with modern technologies, data security concerns, and the shortage of skilled professionals in the integration field.

What opportunities exist in the Australia System Integration Market?

Opportunities in the Australia System Integration Market include the growing adoption of Internet of Things (IoT) technologies, the expansion of smart city initiatives, and the increasing focus on digital transformation across various sectors.

What trends are shaping the Australia System Integration Market?

Trends shaping the Australia System Integration Market include the rise of artificial intelligence and machine learning in integration processes, the shift towards microservices architecture, and the increasing emphasis on cybersecurity measures in integration solutions.

Australia System Integration Market

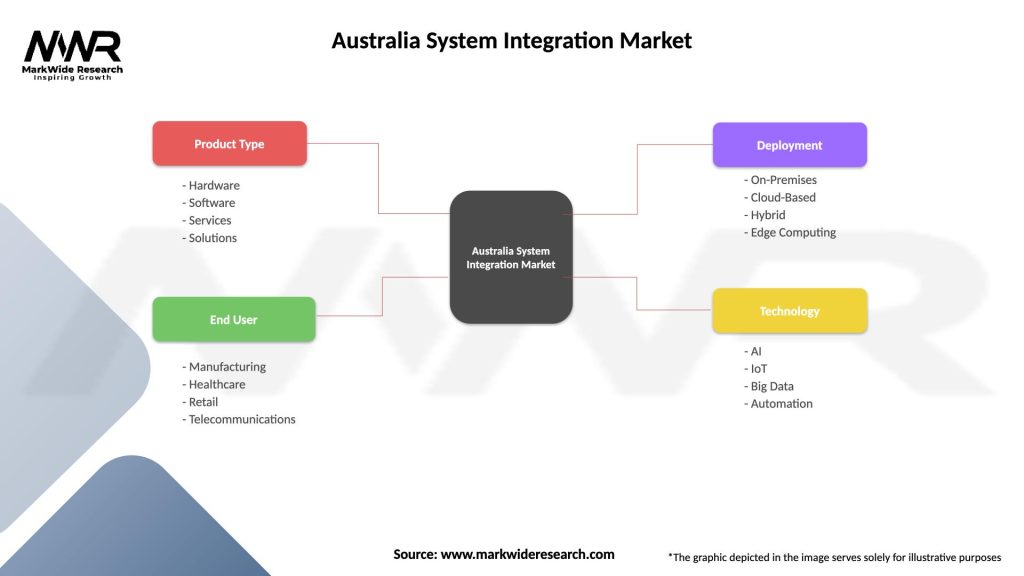

| Segmentation Details | Description |

|---|---|

| Product Type | Hardware, Software, Services, Solutions |

| End User | Manufacturing, Healthcare, Retail, Telecommunications |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

| Technology | AI, IoT, Big Data, Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia System Integration Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at