444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Australia Student Loan Market plays a pivotal role in the education financing landscape, serving as a crucial financial vehicle for students pursuing higher education. This sector provides essential support to learners by offering loans that cover tuition fees, living expenses, and other educational costs. With its significant impact on the accessibility of education, the Australia Student Loan Market is a key player in shaping the academic journey of countless individuals.

Meaning: The Australia Student Loan Market involves the provision of financial assistance to students, enabling them to pursue higher education. These loans cater to various educational expenses, ensuring that aspiring students have the means to access quality education. The market is characterized by diverse loan products tailored to meet the unique needs of students at different academic levels.

Executive Summary: Experiencing consistent growth, the Australia Student Loan Market is a dynamic sector influenced by factors such as educational policies, economic conditions, and the evolving needs of students. It serves as a crucial facilitator for academic aspirations, offering financial avenues to make education accessible. An exploration of key insights, market drivers, and challenges is essential for stakeholders to navigate this landscape effectively.

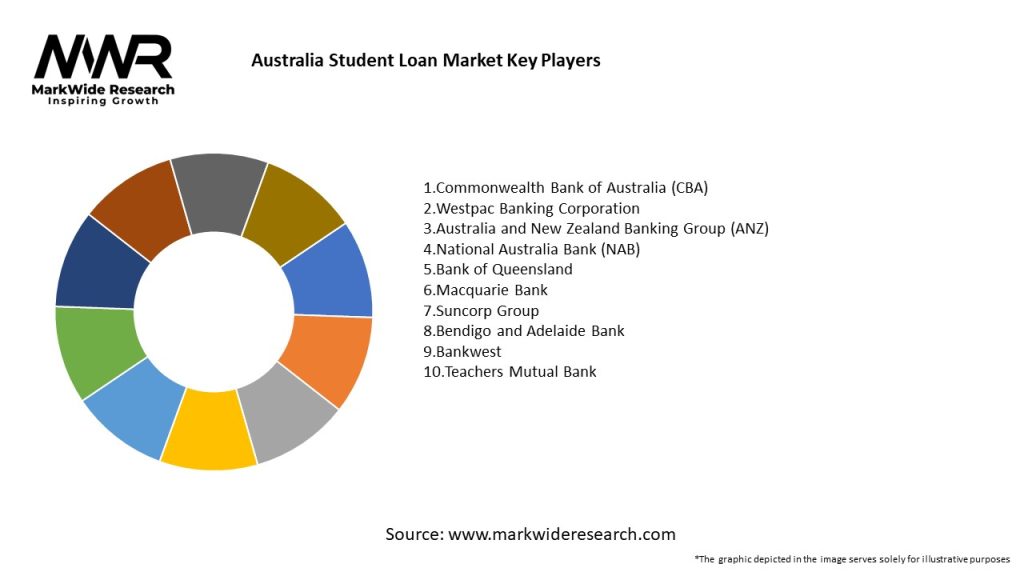

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Australia Student Loan Market operates within a dynamic framework influenced by educational, economic, and regulatory dynamics. Understanding these multifaceted forces is crucial for stakeholders to adapt, innovate, and contribute to the market’s evolution.

Regional Analysis:

Competitive Landscape:

Leading Companies for Australia Student Loan Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

Category-wise Insights:

Key Benefits for Borrowers and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The Australia Student Loan Market is poised for continued growth, driven by the increasing demand for higher education, government support, and evolving educational trends. Innovations in loan products, digital transformation, and collaborative efforts between financial institutions and educational entities will play a pivotal role in shaping the future of the market. The industry’s resilience in navigating economic uncertainties and its commitment to financial inclusion will be key determinants of long-term success.

Conclusion: As a cornerstone of educational accessibility, the Australia Student Loan Market fulfills a critical role in empowering individuals to pursue their academic aspirations. While presenting opportunities for borrowers to achieve career advancement, it also requires stakeholders to navigate challenges such as economic uncertainties and evolving educational landscapes. By embracing innovation, fostering community engagement, and staying attuned to economic indicators, the industry can continue to be a driving force behind educational empowerment, contributing to the intellectual and professional growth of individuals across Australia.

Australia Student Loan Market

| Segmentation Details | Description |

|---|---|

| Loan Type | Federal Loans, Private Loans, Consolidation Loans, Income-Driven Repayment Loans |

| Borrower Type | Undergraduate Students, Graduate Students, Parents, Non-Traditional Students |

| Repayment Plan | Standard Repayment, Graduated Repayment, Extended Repayment, Income-Based Repayment |

| Loan Purpose | Tuition Fees, Living Expenses, Study Materials, Other |

Leading Companies for Australia Student Loan Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at