444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia spine market represents a critical segment of the nation’s healthcare infrastructure, encompassing comprehensive solutions for spinal disorders, degenerative conditions, and trauma-related injuries. Australia’s aging population and increasing prevalence of lifestyle-related spinal conditions have created substantial demand for advanced spine care technologies and treatment modalities. The market demonstrates robust growth potential with expanding adoption of minimally invasive surgical techniques, innovative implant technologies, and comprehensive rehabilitation services.

Healthcare providers across Australia are increasingly investing in state-of-the-art spinal treatment facilities, driven by rising patient expectations and technological advancements. The market encompasses various segments including spinal implants, surgical instruments, diagnostic imaging systems, and therapeutic devices. Regional healthcare networks are expanding their spine care capabilities to address the growing demand from both urban and rural populations.

Market dynamics indicate strong growth momentum, with the sector experiencing approximately 6.2% annual growth driven by technological innovations and increasing healthcare investments. Government initiatives supporting healthcare infrastructure development and medical device accessibility have created favorable conditions for market expansion. The integration of digital health technologies and telemedicine solutions is further enhancing the accessibility and effectiveness of spine care services across the continent.

The Australia spine market refers to the comprehensive ecosystem of medical devices, technologies, services, and healthcare solutions specifically designed for the diagnosis, treatment, and management of spinal conditions within the Australian healthcare system. This market encompasses a broad spectrum of products and services including spinal implants, surgical instruments, diagnostic equipment, therapeutic devices, rehabilitation services, and associated healthcare technologies.

Spine care solutions within this market address various conditions ranging from degenerative disc disease and spinal stenosis to complex spinal deformities and trauma-related injuries. The market includes both invasive surgical interventions and non-invasive treatment modalities, reflecting the diverse needs of patients across different age groups and condition severities. Healthcare providers utilize these solutions to deliver comprehensive care pathways that optimize patient outcomes while managing healthcare costs effectively.

Market participants include medical device manufacturers, healthcare technology companies, surgical instrument providers, pharmaceutical companies, and healthcare service organizations. The market operates within Australia’s regulated healthcare environment, ensuring that all products and services meet stringent safety and efficacy standards established by the Therapeutic Goods Administration and other relevant regulatory bodies.

Australia’s spine market demonstrates exceptional growth potential driven by demographic trends, technological advancements, and evolving healthcare delivery models. The market benefits from a well-established healthcare infrastructure, strong regulatory framework, and increasing investment in medical technology innovation. Key growth drivers include the aging population, rising prevalence of spinal disorders, and growing adoption of minimally invasive surgical techniques.

Market segmentation reveals diverse opportunities across multiple categories including cervical, thoracic, and lumbar spine solutions. The adoption of robotic-assisted surgery and advanced imaging technologies is transforming treatment approaches, with approximately 38% of major hospitals now incorporating these technologies into their spine care programs. Patient outcomes continue to improve through the integration of personalized medicine approaches and evidence-based treatment protocols.

Competitive dynamics feature both established international medical device companies and emerging Australian healthcare technology firms. The market shows strong potential for continued expansion, supported by government healthcare initiatives and increasing private healthcare investments. Innovation trends focus on patient-specific solutions, enhanced surgical precision, and improved recovery outcomes, positioning Australia as a significant market for spine care advancement.

Strategic market analysis reveals several critical insights that define the Australia spine market landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Multiple factors contribute to the robust growth of Australia’s spine market, creating a favorable environment for sustained expansion. The primary market drivers reflect both demographic trends and technological advancement opportunities that support long-term market development.

Aging population dynamics represent the most significant driver, with Australia experiencing one of the world’s fastest aging populations. Degenerative spinal conditions naturally increase with age, creating sustained demand for comprehensive spine care solutions. The growing prevalence of lifestyle-related spinal disorders among younger demographics further expands the addressable market, driven by sedentary work environments and reduced physical activity levels.

Technological innovation continues to drive market growth through the development of advanced surgical techniques, improved implant materials, and enhanced diagnostic capabilities. Minimally invasive procedures offer reduced recovery times and improved patient outcomes, increasing the attractiveness of surgical interventions. The integration of artificial intelligence and machine learning technologies enhances surgical precision and treatment planning capabilities.

Healthcare infrastructure investment by both government and private sectors supports market expansion through facility upgrades, equipment acquisitions, and workforce development programs. Government healthcare initiatives focus on improving access to specialized care services, particularly in regional and remote areas. The emphasis on value-based healthcare models encourages adoption of innovative solutions that demonstrate improved patient outcomes and cost effectiveness.

Several challenges impact the Australia spine market growth trajectory, requiring strategic approaches to address potential limitations. Understanding these restraints enables market participants to develop effective mitigation strategies and optimize their market positioning.

High treatment costs represent a significant barrier for many patients, particularly those requiring complex surgical interventions or extended rehabilitation programs. Insurance coverage limitations and out-of-pocket expenses can delay or prevent access to optimal treatment options. The cost of advanced medical technologies and specialized equipment creates financial pressures for healthcare providers, potentially limiting adoption rates in smaller facilities.

Skilled workforce shortages in specialized spine care disciplines constrain market growth potential. The complexity of modern spine surgery requires extensive training and experience, creating bottlenecks in service delivery capacity. Regional disparities in specialist availability limit access to advanced care options for patients in remote areas, despite telemedicine and mobile service initiatives.

Regulatory complexity and lengthy approval processes can delay the introduction of innovative technologies and treatment approaches. Clinical evidence requirements for new devices and procedures necessitate extensive research and validation studies, increasing development costs and time-to-market. The need for ongoing post-market surveillance and compliance monitoring adds operational complexity for market participants.

Significant opportunities exist within Australia’s spine market, driven by technological advancement, demographic trends, and evolving healthcare delivery models. These opportunities present pathways for market expansion and innovation development across multiple segments.

Digital health integration offers substantial opportunities for market growth through telemedicine platforms, remote monitoring systems, and AI-powered diagnostic tools. Personalized medicine approaches enable customized treatment plans based on individual patient characteristics, genetic factors, and lifestyle considerations. The development of patient-specific implants using 3D printing and advanced manufacturing technologies represents a high-growth opportunity segment.

Regional market expansion presents opportunities to extend spine care services to underserved areas through mobile clinics, satellite facilities, and telemedicine networks. Public-private partnerships can facilitate infrastructure development and service delivery improvements in regional and remote locations. The growing emphasis on preventive care and early intervention creates opportunities for diagnostic screening programs and wellness initiatives.

Research and development collaboration between healthcare providers, technology companies, and academic institutions drives innovation in treatment approaches and device development. Clinical trial participation positions Australia as a key market for testing and validating new spine care technologies. The integration of regenerative medicine and biologics into spine care protocols offers promising opportunities for market differentiation and growth.

Complex market dynamics shape the Australia spine market landscape, influenced by healthcare policy changes, technological evolution, and competitive pressures. Understanding these dynamics enables stakeholders to navigate market challenges and capitalize on emerging opportunities effectively.

Supply chain considerations play a crucial role in market dynamics, with global manufacturing dependencies affecting product availability and pricing. Local manufacturing initiatives are gaining momentum to reduce supply chain risks and support domestic economic development. The COVID-19 pandemic highlighted the importance of supply chain resilience and diversification strategies for critical medical devices and equipment.

Competitive intensity continues to increase as new market entrants challenge established players with innovative solutions and competitive pricing strategies. Market consolidation trends through mergers and acquisitions reshape the competitive landscape, creating larger, more integrated healthcare technology companies. The emergence of digital health startups introduces disruptive technologies that challenge traditional treatment approaches and business models.

Regulatory evolution adapts to accommodate new technologies while maintaining safety and efficacy standards. Adaptive regulatory pathways enable faster approval for breakthrough technologies that demonstrate significant clinical benefits. The harmonization of international standards facilitates global market access for Australian-developed innovations and streamlines regulatory compliance requirements.

Comprehensive research methodology underpins the analysis of Australia’s spine market, incorporating multiple data sources and analytical approaches to ensure accuracy and reliability. The methodology combines quantitative market analysis with qualitative insights from industry experts and healthcare professionals.

Primary research activities include structured interviews with key market participants, healthcare providers, and industry experts across Australia’s major metropolitan and regional markets. Survey methodologies capture quantitative data on market trends, adoption rates, and growth projections from diverse stakeholder groups. Clinical data analysis incorporates patient outcome studies and treatment effectiveness research to validate market trends and opportunities.

Secondary research sources encompass government healthcare databases, industry publications, regulatory filings, and academic research studies. Market intelligence platforms provide real-time data on competitive activities, product launches, and strategic developments. Financial analysis of public companies and private market transactions offers insights into market valuation trends and investment patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources and expert verification of key findings. Statistical modeling techniques support market sizing and growth projections based on historical trends and forward-looking indicators. The methodology incorporates scenario analysis to account for potential market disruptions and alternative growth trajectories.

Regional market distribution across Australia reveals significant variations in spine care accessibility, technology adoption, and growth potential. New South Wales and Victoria dominate the market landscape, accounting for approximately 58% of total spine care services, driven by large metropolitan populations and concentrated healthcare infrastructure.

Sydney and Melbourne serve as primary hubs for advanced spine care technologies and specialized treatment centers. These metropolitan areas benefit from world-class medical facilities, research institutions, and high concentrations of spine care specialists. Queensland demonstrates strong growth potential, with approximately 18% market share, supported by population growth and healthcare infrastructure investments along the eastern seaboard.

Western Australia and South Australia represent emerging opportunities for market expansion, with growing populations and increasing healthcare investments. Regional centers such as Perth, Adelaide, and Brisbane are developing specialized spine care capabilities to serve their respective catchment areas. The Northern Territory and Tasmania present unique challenges due to geographic isolation but offer opportunities for innovative service delivery models.

Rural and remote areas face significant challenges in accessing specialized spine care services, creating opportunities for telemedicine solutions and mobile service delivery models. Government initiatives supporting rural healthcare infrastructure development aim to reduce regional disparities in care access. The integration of digital health technologies enables remote consultation and follow-up care, improving service accessibility across vast geographic distances.

Australia’s spine market features a diverse competitive landscape combining established international medical device companies with emerging local innovators. The competitive environment demonstrates dynamic growth with companies competing across multiple dimensions including technology innovation, clinical outcomes, and cost effectiveness.

Competitive strategies focus on clinical differentiation, technological innovation, and comprehensive service support. Market leaders invest heavily in research and development, clinical education, and surgeon training programs. The emergence of Australian-based companies introduces local innovation and specialized solutions tailored to domestic market needs.

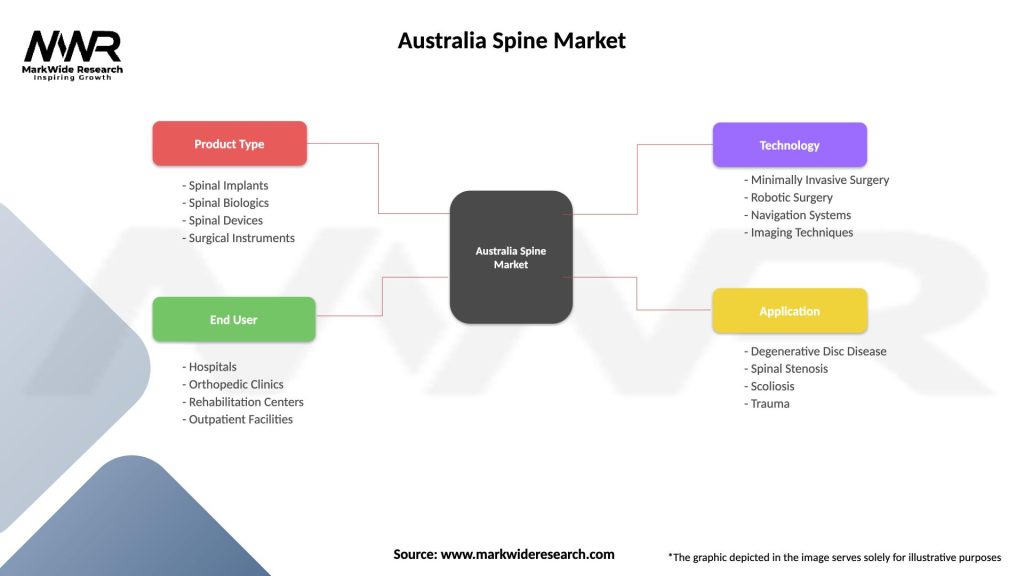

Market segmentation analysis reveals diverse opportunities across multiple dimensions, enabling targeted strategies for different market segments and customer needs. The Australia spine market demonstrates clear segmentation patterns based on technology type, application area, and end-user categories.

By Technology:

By Application:

By End User:

Spinal fusion devices represent the dominant category within Australia’s spine market, driven by high prevalence of degenerative conditions and proven clinical outcomes. Lumbar fusion procedures account for the largest share, with approximately 45% of all spinal surgeries involving lumbar spine treatment. Cervical fusion demonstrates steady growth, particularly in treating disc herniation and cervical spondylosis conditions.

Non-fusion technologies show accelerating adoption rates as surgeons and patients seek motion-preserving alternatives to traditional fusion procedures. Artificial disc replacement gains acceptance for appropriate patient populations, offering potential advantages in maintaining spinal mobility. Dynamic stabilization systems provide intermediate solutions between fusion and conservative treatment approaches.

Minimally invasive surgical instruments experience rapid growth as healthcare providers adopt less invasive treatment approaches. Endoscopic spine surgery equipment shows particular promise for reducing patient recovery times and hospital stays. Robotic-assisted surgery systems gain traction in major hospitals, with adoption rates increasing approximately 25% annually among leading spine centers.

Biologics and regenerative medicine represent emerging high-growth categories with significant potential for market expansion. Bone graft substitutes and growth factors demonstrate improving clinical outcomes and reduced complications compared to traditional autograft procedures. Stem cell therapies and tissue engineering approaches show promise for future market development, pending regulatory approval and clinical validation.

Healthcare providers benefit from advanced spine care technologies through improved patient outcomes, reduced complication rates, and enhanced operational efficiency. Minimally invasive procedures enable shorter hospital stays and faster patient recovery, optimizing resource utilization and patient satisfaction. Advanced imaging and navigation systems improve surgical precision and reduce revision surgery rates.

Patients experience significant benefits through access to innovative treatment options, reduced recovery times, and improved long-term outcomes. Personalized treatment approaches enable customized care plans that address individual patient needs and preferences. Telemedicine capabilities expand access to specialist consultation and follow-up care, particularly beneficial for regional and remote patients.

Medical device manufacturers gain access to a sophisticated healthcare market with strong demand for innovative solutions and willingness to adopt advanced technologies. Regulatory environment supports innovation while maintaining high safety standards, facilitating market entry for breakthrough technologies. Clinical research opportunities enable validation of new products and treatment approaches in a well-regulated environment.

Healthcare systems benefit from improved cost-effectiveness through better patient outcomes, reduced complications, and optimized resource allocation. Value-based care models align incentives for quality improvement and cost management. Population health management approaches enable proactive identification and treatment of spinal conditions before they require complex interventions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally invasive surgery continues to gain momentum as the dominant trend in Australia’s spine market, with adoption rates increasing significantly across major healthcare facilities. Endoscopic procedures and percutaneous techniques offer reduced tissue trauma, shorter recovery times, and improved patient satisfaction. Robotic-assisted surgery integration accelerates, with major hospitals investing in advanced surgical platforms that enhance precision and outcomes.

Personalized medicine approaches transform spine care through genetic testing, biomarker analysis, and customized treatment protocols. 3D printing technology enables patient-specific implants and surgical guides, improving fit and reducing complications. Artificial intelligence applications in diagnostic imaging and surgical planning enhance decision-making and treatment optimization.

Value-based healthcare models reshape market dynamics by emphasizing outcomes over volume, encouraging adoption of technologies that demonstrate clear clinical and economic benefits. Bundled payment systems incentivize comprehensive care coordination and cost management. Patient-reported outcome measures gain importance in evaluating treatment effectiveness and guiding clinical decisions.

Digital health integration expands rapidly through telemedicine platforms, mobile health applications, and remote monitoring systems. Virtual reality applications support patient education and surgical training programs. Blockchain technology emerges for secure health data management and supply chain transparency, addressing growing concerns about data security and product authenticity.

Recent industry developments demonstrate the dynamic nature of Australia’s spine market, with significant investments in technology innovation, facility expansion, and service enhancement. Major hospital networks continue expanding their spine care capabilities through equipment acquisitions and specialist recruitment programs.

Regulatory approvals for innovative spine technologies accelerate market access for breakthrough devices and treatment approaches. The Therapeutic Goods Administration streamlines approval processes for devices demonstrating significant clinical benefits. Clinical trial activities increase as Australia becomes a preferred location for international spine technology validation studies.

Strategic partnerships between healthcare providers, technology companies, and research institutions drive innovation and market development. Public-private collaborations support infrastructure development and service expansion initiatives. International companies establish local operations and manufacturing facilities to better serve the Australian market and reduce supply chain dependencies.

Investment activities in spine care startups and emerging technologies increase, with venture capital and private equity firms recognizing market opportunities. Merger and acquisition activities reshape the competitive landscape as companies seek to expand their market presence and technology portfolios. Government funding supports research and development initiatives focused on spine care innovation and accessibility improvement.

Market participants should prioritize investment in minimally invasive technologies and digital health solutions to capitalize on evolving treatment preferences and healthcare delivery models. MarkWide Research analysis indicates that companies focusing on patient-centric innovations and value-based care solutions will achieve superior market positioning and growth outcomes.

Regional expansion strategies should emphasize telemedicine capabilities and mobile service delivery models to address geographic access challenges. Partnerships with regional healthcare providers can facilitate market penetration and service delivery optimization. Investment in workforce development and training programs supports sustainable growth and service quality improvement.

Technology development priorities should focus on artificial intelligence integration, personalized medicine approaches, and enhanced surgical precision systems. Clinical evidence generation remains critical for market acceptance and reimbursement approval. Regulatory compliance and quality management systems require ongoing investment to maintain market access and competitive advantage.

Strategic positioning should emphasize differentiated value propositions that address specific market needs and customer preferences. Collaboration opportunities with research institutions and healthcare providers can accelerate innovation and market development. Supply chain resilience and local manufacturing capabilities become increasingly important for sustainable market participation.

Australia’s spine market demonstrates exceptional growth potential over the next decade, driven by demographic trends, technological advancement, and healthcare system evolution. Market expansion is projected to continue at a robust pace, with growth rates expected to reach approximately 7.1% annually through 2030. Innovation acceleration in minimally invasive technologies and personalized medicine approaches will drive market transformation.

Technology integration will reshape spine care delivery through artificial intelligence, robotics, and digital health platforms. Telemedicine adoption is expected to reach 75% of spine care providers by 2028, significantly improving access to specialist consultation and follow-up care. Regenerative medicine and biologics will gain mainstream acceptance, offering new treatment options for previously challenging conditions.

Market consolidation trends will continue as companies seek scale advantages and comprehensive solution portfolios. Regional service expansion will address geographic access disparities through innovative delivery models and technology solutions. Value-based care adoption will accelerate, with approximately 60% of spine procedures expected to operate under value-based contracts by 2030.

Investment opportunities will focus on breakthrough technologies, digital health solutions, and service delivery innovations. MWR projections indicate that companies successfully integrating technology innovation with clinical excellence will capture disproportionate market share and growth opportunities. The market’s evolution toward precision medicine and patient-centric care models will create new competitive dynamics and success factors.

Australia’s spine market represents a dynamic and rapidly evolving healthcare segment with exceptional growth potential and innovation opportunities. The convergence of demographic trends, technological advancement, and healthcare system transformation creates a favorable environment for sustained market expansion and development.

Key success factors for market participants include technology innovation, clinical excellence, and strategic positioning to address evolving patient needs and healthcare delivery requirements. Investment priorities should focus on minimally invasive technologies, digital health integration, and value-based care solutions that demonstrate clear clinical and economic benefits.

Market outlook remains highly positive, with strong growth momentum expected to continue through the next decade. Strategic opportunities exist across multiple segments, from advanced surgical technologies to comprehensive service delivery models. Companies that successfully navigate the evolving regulatory environment, invest in innovation, and build strong clinical partnerships will achieve superior market positioning and growth outcomes in Australia’s expanding spine care market.

What is Spine?

Spine refers to the complex structure of bones, muscles, and nerves that support the body and protect the spinal cord. It plays a crucial role in movement and overall health, with various conditions affecting its function and integrity.

What are the key players in the Australia Spine Market?

Key players in the Australia Spine Market include Medtronic, Stryker, and NuVasive, which are known for their innovative spinal implants and surgical solutions. These companies focus on advancements in minimally invasive techniques and spinal fusion technologies, among others.

What are the growth factors driving the Australia Spine Market?

The Australia Spine Market is driven by an aging population, increasing prevalence of spinal disorders, and advancements in surgical techniques. Additionally, the rising demand for minimally invasive surgeries is contributing to market growth.

What challenges does the Australia Spine Market face?

The Australia Spine Market faces challenges such as high surgical costs and the risk of complications associated with spinal surgeries. Furthermore, the availability of skilled professionals and regulatory hurdles can also impact market dynamics.

What opportunities exist in the Australia Spine Market?

Opportunities in the Australia Spine Market include the development of innovative spinal devices and the expansion of telemedicine for pre- and post-operative care. Additionally, increasing awareness about spinal health presents avenues for growth.

What trends are shaping the Australia Spine Market?

Trends in the Australia Spine Market include the rise of robotic-assisted surgeries and the integration of advanced imaging technologies. There is also a growing focus on personalized medicine and patient-specific implants to enhance surgical outcomes.

Australia Spine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spinal Implants, Spinal Biologics, Spinal Devices, Surgical Instruments |

| End User | Hospitals, Orthopedic Clinics, Rehabilitation Centers, Outpatient Facilities |

| Technology | Minimally Invasive Surgery, Robotic Surgery, Navigation Systems, Imaging Techniques |

| Application | Degenerative Disc Disease, Spinal Stenosis, Scoliosis, Trauma |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Spine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at