444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

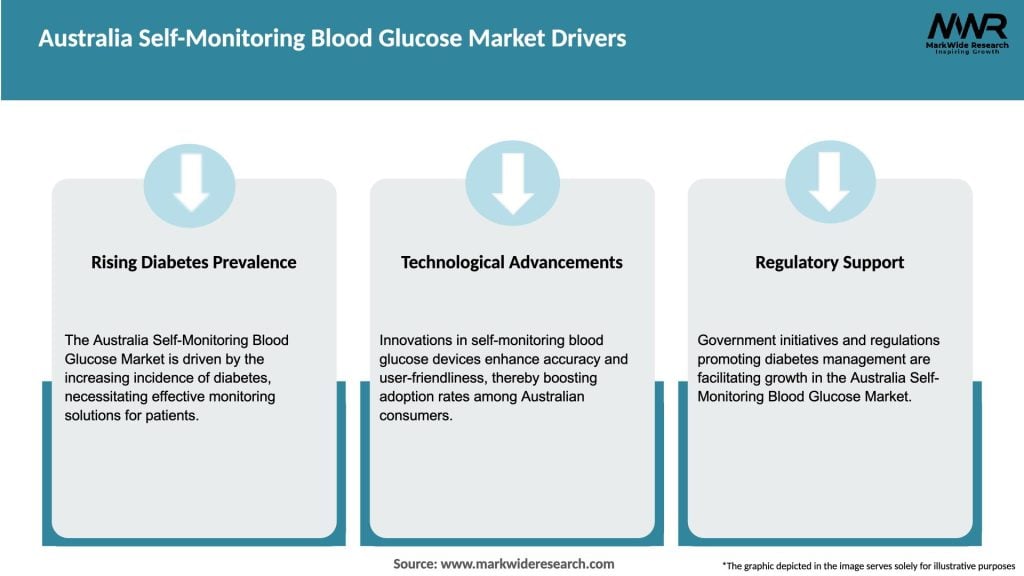

The Australia self-monitoring blood glucose market has witnessed significant growth in recent years, driven by factors such as the rising prevalence of diabetes, increasing awareness about the importance of blood glucose monitoring, and advancements in technology. Self-monitoring blood glucose (SMBG) refers to the process of regularly measuring and monitoring blood glucose levels by individuals with diabetes, enabling them to make informed decisions regarding their diet, medication, and lifestyle.

Meaning

Self-monitoring blood glucose is a vital component of diabetes management. It involves using a blood glucose meter to measure the concentration of glucose in the blood. The results obtained from these measurements provide valuable information to individuals with diabetes, allowing them to understand their blood glucose levels and take appropriate actions to maintain them within a target range. Regular monitoring helps in tracking the effectiveness of treatment plans, identifying patterns, and making adjustments as needed.

Executive Summary

The Australia self-monitoring blood glucose market has experienced robust growth over the years, primarily driven by the increasing prevalence of diabetes and the growing adoption of self-monitoring devices. This executive summary provides a concise overview of the market, highlighting key insights, market drivers, restraints, opportunities, and the competitive landscape. It also presents a glimpse of the impact of COVID-19 on the market and offers future outlook and analyst suggestions.

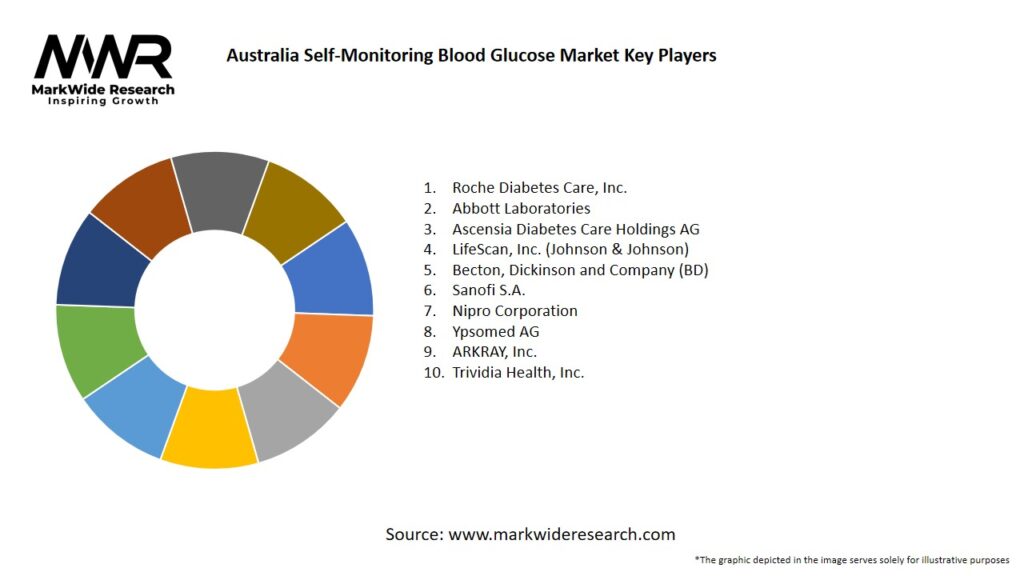

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia self-monitoring blood glucose market is characterized by dynamic factors that influence its growth and development. These dynamics include changing demographics, technological advancements, regulatory landscape, and evolving patient preferences. Understanding these dynamics is crucial for market players to make informed decisions and capitalize on emerging opportunities.

Regional Analysis

The self-monitoring blood glucose market in Australia exhibits regional variations, with differences in disease prevalence, healthcare infrastructure, and patient demographics. Major cities and urban areas typically have better access to healthcare facilities, leading to higher adoption of self-monitoring blood glucose devices. However, efforts are being made to bridge the gap and improve accessibility in rural and remote areas through government initiatives and telehealth services.

Competitive Landscape

Leading companies in the Australia Self-Monitoring Blood Glucose Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

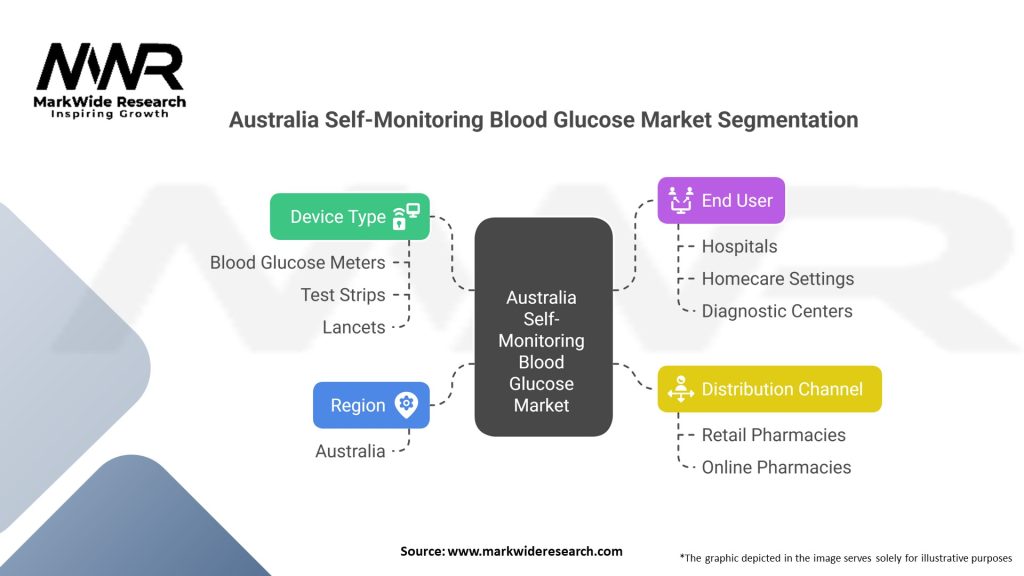

Segmentation

The self-monitoring blood glucose market in Australia can be segmented based on product type, distribution channel, and end user. Product types include blood glucose meters, test strips, lancets, and continuous glucose monitoring systems. Distribution channels encompass retail pharmacies, online pharmacies, and hospital pharmacies. End users of self-monitoring blood glucose devices include individuals with diabetes, hospitals, and clinics.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the self-monitoring blood glucose market in Australia. The disruption in healthcare services, restricted movement, and economic uncertainties have affected the market dynamics. However, the increased focus on preventive healthcare and the adoption of telehealth solutions have provided opportunities for remote monitoring and virtual consultations, driving the demand for self-monitoring blood glucose devices.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Australia self-monitoring blood glucose market looks promising, with a positive growth trajectory. Factors such as the increasing prevalence of diabetes, technological advancements, and the focus on preventive healthcare are expected to drive market growth. The adoption of AI, ML, and remote monitoring solutions will continue to transform the market, offering personalized and comprehensive diabetes management options.

Conclusion

The Australia self-monitoring blood glucose market has experienced substantial growth and presents significant opportunities for industry participants. The increasing prevalence of diabetes, advancements in technology, and growing awareness about self-monitoring devices are driving market expansion. However, challenges such as high costs and limited reimbursement policies need to be addressed. By embracing innovation, focusing on affordability, and improving access to self-monitoring blood glucose devices, industry participants can contribute to better diabetes management and improve the quality of life for individuals with diabetes in Australia.

What is Self-Monitoring Blood Glucose?

Self-Monitoring Blood Glucose refers to the process by which individuals with diabetes measure their blood glucose levels using portable devices. This practice is essential for managing diabetes effectively and helps in making informed decisions regarding diet, medication, and lifestyle.

What are the key players in the Australia Self-Monitoring Blood Glucose Market?

Key players in the Australia Self-Monitoring Blood Glucose Market include Abbott Laboratories, Roche Diabetes Care, and Ascensia Diabetes Care, among others. These companies are known for their innovative glucose monitoring devices and solutions.

What are the growth factors driving the Australia Self-Monitoring Blood Glucose Market?

The growth of the Australia Self-Monitoring Blood Glucose Market is driven by the increasing prevalence of diabetes, rising health awareness, and advancements in glucose monitoring technology. Additionally, the demand for home healthcare solutions is contributing to market expansion.

What challenges does the Australia Self-Monitoring Blood Glucose Market face?

The Australia Self-Monitoring Blood Glucose Market faces challenges such as the high cost of advanced monitoring devices and the need for regular calibration. Furthermore, there is a growing concern regarding the accuracy of some devices, which can affect patient trust.

What opportunities exist in the Australia Self-Monitoring Blood Glucose Market?

Opportunities in the Australia Self-Monitoring Blood Glucose Market include the development of smart glucose monitoring devices and integration with mobile health applications. These innovations can enhance user experience and improve diabetes management.

What trends are shaping the Australia Self-Monitoring Blood Glucose Market?

Trends in the Australia Self-Monitoring Blood Glucose Market include the shift towards continuous glucose monitoring systems and the increasing use of telehealth services. These trends reflect a broader movement towards personalized healthcare and remote patient monitoring.

Australia Self-Monitoring Blood Glucose Market:

| Segmentation Details | Description |

|---|---|

| Device Type | Blood Glucose Meters, Test Strips, Lancets |

| End User | Hospitals, Homecare Settings, Diagnostic Centers |

| Distribution Channel | Retail Pharmacies, Online Pharmacies |

| Region | Australia |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Self-Monitoring Blood Glucose Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at