444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia payment systems market represents a dynamic and rapidly evolving landscape that encompasses traditional banking infrastructure, digital payment platforms, and emerging fintech solutions. Australia’s payment ecosystem has undergone significant transformation over the past decade, driven by consumer demand for seamless, secure, and instant payment experiences. The market demonstrates robust growth with digital payment adoption rates reaching 78% among Australian consumers as of 2024.

Digital transformation has fundamentally reshaped how Australians conduct financial transactions, with contactless payments, mobile wallets, and real-time payment systems becoming integral components of daily commerce. The Reserve Bank of Australia (RBA) continues to play a pivotal role in modernizing payment infrastructure, supporting initiatives that enhance efficiency, security, and accessibility across the financial services sector.

Market dynamics indicate strong momentum toward cashless transactions, with electronic payment volumes experiencing sustained growth across retail, e-commerce, and business-to-business segments. The integration of artificial intelligence, blockchain technology, and advanced security protocols has positioned Australia as a regional leader in payment innovation, attracting significant investment from both domestic and international stakeholders.

The Australia payment systems market refers to the comprehensive ecosystem of financial infrastructure, technologies, platforms, and services that facilitate monetary transactions between individuals, businesses, and institutions across the Australian economy. This market encompasses traditional payment methods such as cash, cheques, and bank transfers, alongside modern digital solutions including credit and debit cards, mobile payments, digital wallets, cryptocurrency platforms, and real-time payment networks.

Payment systems serve as the critical backbone of economic activity, enabling the secure and efficient transfer of value across various channels and touchpoints. The Australian market specifically includes domestic payment networks, international payment gateways, merchant acquiring services, payment processing solutions, and regulatory compliance frameworks that govern financial transactions within the country’s jurisdiction.

Key components of the payment systems market include card networks, payment service providers, fintech companies, traditional banks, digital wallet providers, and emerging technologies such as buy-now-pay-later services and cryptocurrency exchanges that collectively create a comprehensive payment ecosystem serving millions of Australian consumers and businesses.

Australia’s payment systems market continues to experience unprecedented growth and innovation, driven by changing consumer preferences, technological advancement, and regulatory support for digital transformation. The market has witnessed accelerated adoption of contactless and mobile payment solutions, with tap-and-go transactions accounting for 95% of in-person card payments across the country.

Digital payment platforms have emerged as dominant forces, with major players including traditional banks, fintech startups, and international technology companies competing for market share. The introduction of the New Payments Platform (NPP) has revolutionized real-time payments, enabling instant transfers between bank accounts and supporting innovative overlay services that enhance user experience.

Market consolidation and strategic partnerships have characterized recent developments, as established financial institutions collaborate with technology providers to deliver comprehensive payment solutions. Regulatory frameworks continue to evolve, with the Australian Prudential Regulation Authority (APRA) and Australian Securities and Investments Commission (ASIC) implementing measures to ensure consumer protection while fostering innovation in the payments landscape.

Strategic analysis reveals several critical insights that define the current state and future trajectory of Australia’s payment systems market:

Consumer behavior transformation represents the primary driver of payment systems market growth in Australia. The shift toward digital-first lifestyles has accelerated demand for convenient, secure, and instant payment solutions that integrate seamlessly with daily activities. Smartphone penetration rates exceeding 91% among Australian adults have created a foundation for mobile payment adoption and digital wallet usage.

E-commerce expansion continues to fuel payment system innovation, as online retail growth demands sophisticated payment processing capabilities, fraud protection, and multi-channel integration. The COVID-19 pandemic significantly accelerated digital payment adoption, with many consumers permanently shifting away from cash transactions toward contactless and online payment methods.

Regulatory support from the Reserve Bank of Australia and other government agencies has created a favorable environment for payment innovation. The implementation of the Consumer Data Right and ongoing open banking initiatives are fostering competition and enabling new entrants to challenge traditional payment providers with innovative solutions.

Technological advancement in areas such as artificial intelligence, machine learning, and blockchain technology is enabling more sophisticated payment solutions with enhanced security, faster processing times, and improved user experiences. Infrastructure modernization efforts by major banks and payment processors are supporting the deployment of next-generation payment capabilities across the Australian market.

Regulatory compliance complexity presents significant challenges for payment system providers, particularly smaller fintech companies that must navigate evolving requirements while maintaining competitive operations. Compliance costs associated with anti-money laundering (AML), know-your-customer (KYC), and data protection regulations can create barriers to entry and limit innovation in certain market segments.

Cybersecurity concerns continue to impact market growth, as increasing sophistication of cyber threats requires substantial investment in security infrastructure and ongoing monitoring capabilities. Data breach incidents and fraud attempts can undermine consumer confidence in digital payment systems, potentially slowing adoption rates for new technologies and services.

Legacy system integration challenges affect many established financial institutions that must balance modernization efforts with maintaining existing infrastructure. The complexity and cost of upgrading core banking systems can delay the implementation of new payment capabilities and limit competitive responsiveness to market changes.

Market saturation in certain payment segments, particularly traditional card payments, is creating intense competition and pressure on profit margins. Interchange fee regulations and pricing pressures from merchants and consumers are constraining revenue growth opportunities for some payment service providers.

Emerging technology integration presents substantial opportunities for payment system innovation, particularly in areas such as artificial intelligence, machine learning, and blockchain applications. Smart contract capabilities and decentralized finance (DeFi) solutions are creating new possibilities for automated payments, programmable money, and innovative financial products that could transform traditional payment paradigms.

Cross-border payment optimization represents a significant growth opportunity, as Australian businesses and consumers increasingly engage in international commerce. Real-time international transfers, competitive foreign exchange rates, and transparent fee structures could capture substantial market share from traditional correspondent banking networks.

Small business payment solutions offer considerable potential for market expansion, as micro and small enterprises seek affordable, easy-to-implement payment processing capabilities. Embedded payment solutions that integrate directly into business software and e-commerce platforms could streamline operations and reduce transaction costs for smaller merchants.

Financial inclusion initiatives create opportunities to serve underbanked populations and remote communities through innovative payment solutions. Digital identity verification and alternative credit assessment methods could enable broader access to payment services while maintaining appropriate risk management standards.

Competitive intensity within Australia’s payment systems market has reached unprecedented levels, with traditional banks, fintech startups, and international technology companies vying for market share across multiple segments. Innovation cycles are accelerating as companies race to introduce new features, improve user experiences, and capture emerging payment opportunities before competitors.

Partnership strategies have become increasingly important, as companies recognize the benefits of collaboration over pure competition in certain areas. Strategic alliances between banks and fintech companies are creating comprehensive payment ecosystems that leverage the strengths of each partner while addressing market demands more effectively than standalone solutions.

Consumer expectations continue to evolve rapidly, with demands for instant payments, seamless integration, and personalized experiences driving continuous innovation requirements. User interface design and customer experience optimization have become critical differentiators in an increasingly crowded marketplace where functional capabilities are becoming commoditized.

Regulatory evolution is creating both challenges and opportunities, as government agencies balance the need for consumer protection with support for innovation and competition. Policy developments regarding cryptocurrency regulation, open banking expansion, and data privacy requirements are shaping strategic decisions across the payment systems industry.

Comprehensive market analysis for the Australia payment systems market employs a multi-faceted research approach combining quantitative data collection, qualitative insights, and industry expert consultations. Primary research involves direct engagement with payment service providers, financial institutions, merchants, and consumers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of regulatory filings, industry reports, transaction data, and public financial statements from major market participants. Data validation processes ensure accuracy and reliability of information through cross-referencing multiple sources and verification with industry experts and regulatory authorities.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop comprehensive insights into market dynamics and future projections. Segmentation analysis examines payment methods, user demographics, transaction types, and geographic distribution to provide detailed market understanding.

Stakeholder interviews with executives from leading payment companies, regulatory officials, and industry analysts provide qualitative context for quantitative findings. Technology assessment evaluates emerging payment innovations, infrastructure developments, and competitive positioning to inform strategic recommendations and market outlook projections.

New South Wales dominates Australia’s payment systems market, accounting for approximately 35% of total transaction volumes due to its concentration of financial services companies, major retailers, and high population density. Sydney’s financial district serves as the primary hub for payment innovation, hosting headquarters of major banks, fintech companies, and international payment processors.

Victoria represents the second-largest regional market, with Melbourne’s technology sector driving significant innovation in payment solutions and fintech development. The state’s strong manufacturing and retail sectors create substantial demand for business-to-business payment solutions and merchant services.

Queensland demonstrates rapid growth in digital payment adoption, particularly in tourism and hospitality sectors that require flexible, multi-currency payment capabilities. Brisbane’s emerging fintech ecosystem is contributing to payment innovation, while regional areas are benefiting from improved digital payment infrastructure.

Western Australia shows unique characteristics due to its mining and resources sector, which generates demand for specialized payment solutions supporting large-value transactions and international trade. Perth’s financial services sector is adapting to serve both traditional industries and emerging technology companies requiring modern payment capabilities.

South Australia, Tasmania, Northern Territory, and Australian Capital Territory collectively represent smaller but growing segments of the payment systems market, with increasing adoption of digital payment solutions driven by government initiatives and improving telecommunications infrastructure.

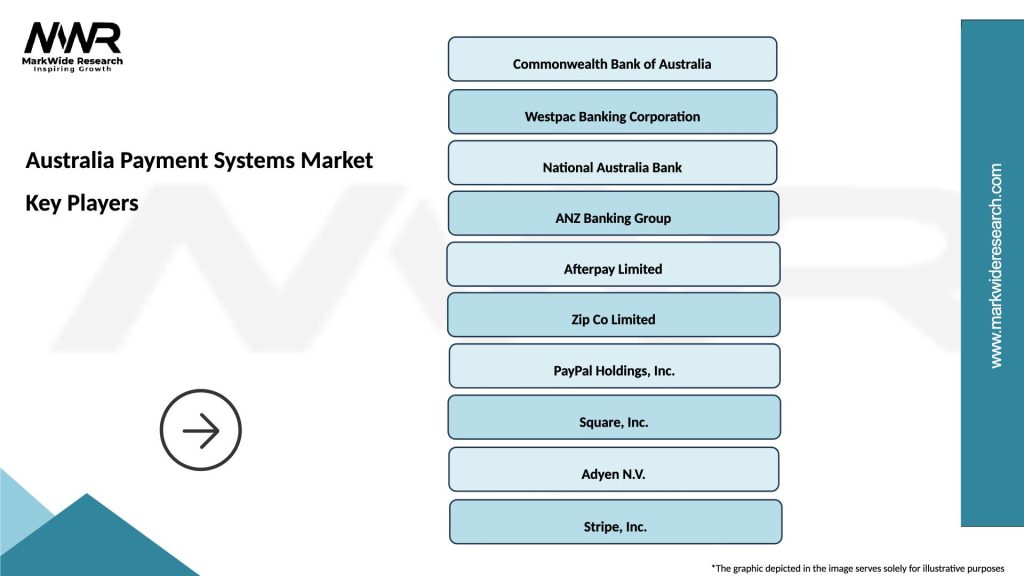

Major market participants in Australia’s payment systems market include established financial institutions, emerging fintech companies, and international technology providers competing across multiple segments:

Competitive strategies focus on technology innovation, customer experience enhancement, and strategic partnerships to capture market share and defend against new entrants. Market consolidation trends are evident as larger players acquire smaller fintech companies to expand capabilities and accelerate innovation timelines.

By Payment Method:

By End-User:

By Transaction Type:

Card Payment Systems continue to dominate transaction volumes, with contactless payments representing the preferred method for in-person transactions. Tap-and-go adoption has reached saturation levels in urban areas, while rural regions are experiencing continued growth as payment terminal infrastructure expands. Credit card usage remains strong for larger purchases and online transactions, while debit cards are preferred for everyday spending.

Digital Wallet Solutions are experiencing rapid growth, particularly among younger demographics who prefer smartphone-based payment methods. Apple Pay, Google Pay, and Samsung Pay have achieved significant market penetration, while domestic solutions are competing by offering additional features such as loyalty program integration and personalized offers.

Real-time Payment Systems built on the NPP infrastructure are transforming expectations for payment speed and convenience. PayID services that enable payments using email addresses or phone numbers are simplifying the user experience and driving adoption of instant payment capabilities across consumer and business segments.

Buy-Now-Pay-Later Services have captured substantial market share, particularly in e-commerce and retail sectors targeting younger consumers. Regulatory scrutiny is increasing as these services mature, with potential impacts on growth rates and business models as responsible lending requirements are clarified and enforced.

Cryptocurrency Payment Solutions are emerging as a niche but growing segment, with increasing merchant acceptance and regulatory clarity supporting mainstream adoption. Stablecoin payments and central bank digital currency developments could significantly impact this category’s future growth trajectory.

Financial Institutions benefit from payment system modernization through improved operational efficiency, reduced processing costs, and enhanced customer satisfaction. Digital transformation enables banks to offer competitive payment solutions while maintaining regulatory compliance and risk management standards. Revenue diversification opportunities arise from value-added services, data analytics, and partnership arrangements with fintech companies.

Merchants and Retailers gain access to comprehensive payment acceptance capabilities that improve customer experience and increase sales conversion rates. Integrated payment solutions streamline operations, reduce administrative overhead, and provide valuable transaction data for business intelligence and customer relationship management.

Consumers enjoy enhanced convenience, security, and choice in payment methods, with improved user experiences and faster transaction processing. Cost savings result from competitive pricing, reduced fees, and access to alternative payment methods that may offer better terms than traditional options.

Technology Providers benefit from growing demand for payment infrastructure, security solutions, and innovative payment applications. Market expansion opportunities exist for companies that can deliver scalable, secure, and user-friendly payment technologies that meet evolving market requirements.

Regulatory Authorities achieve improved oversight capabilities, enhanced consumer protection, and better financial system stability through modernized payment infrastructure and comprehensive transaction monitoring capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Embedded Payment Integration is transforming how payment capabilities are delivered to consumers and businesses, with payment functionality being built directly into software applications, e-commerce platforms, and business management systems. API-driven architectures enable seamless integration of payment processing into existing workflows, reducing friction and improving user experiences.

Artificial Intelligence and Machine Learning applications are enhancing fraud detection, risk assessment, and personalization capabilities across payment systems. Predictive analytics enable proactive fraud prevention, while AI-powered customer service solutions improve support quality and reduce operational costs for payment service providers.

Sustainability and Environmental Considerations are influencing payment system development, with companies focusing on reducing carbon footprints through digital-first strategies and energy-efficient infrastructure. Paperless transactions and digital receipt systems are becoming standard features as environmental consciousness grows among consumers and businesses.

Biometric Authentication technologies are being integrated into payment systems to enhance security while maintaining user convenience. Fingerprint, facial recognition, and voice authentication methods are replacing traditional passwords and PINs, providing stronger security with improved user experiences.

Real-time Data Analytics capabilities are enabling payment providers to offer value-added services such as spending insights, budgeting tools, and personalized financial recommendations. Data monetization strategies are creating new revenue streams while providing enhanced value to customers through actionable financial intelligence.

Reserve Bank of Australia initiatives continue to shape the payment systems landscape, with ongoing development of the New Payments Platform and exploration of central bank digital currency (CBDC) possibilities. Policy consultations regarding payment system regulation and competition are influencing strategic decisions across the industry.

Major bank partnerships with fintech companies are accelerating innovation and expanding service offerings, with traditional institutions leveraging startup agility while providing established infrastructure and regulatory expertise. Acquisition activity has increased as larger players seek to acquire innovative technologies and talent.

International expansion efforts by Australian payment companies are creating global growth opportunities, while international providers are establishing stronger presences in the Australian market. Cross-border collaboration is improving international payment capabilities and reducing transaction costs for Australian businesses and consumers.

Regulatory technology (RegTech) solutions are being implemented to improve compliance efficiency and reduce regulatory burden for payment service providers. Automated reporting and monitoring systems are enabling better regulatory oversight while reducing operational costs for market participants.

Cryptocurrency integration developments include major payment processors adding digital currency acceptance capabilities and traditional banks exploring cryptocurrency custody and trading services. Regulatory clarity improvements are supporting mainstream adoption of digital currency payment solutions.

MarkWide Research analysis indicates that payment system providers should prioritize investment in artificial intelligence and machine learning capabilities to remain competitive in an increasingly sophisticated market environment. Advanced analytics will become essential for fraud prevention, customer experience optimization, and operational efficiency improvements.

Strategic partnerships between traditional financial institutions and fintech companies should focus on complementary strengths rather than competitive overlap, creating comprehensive payment ecosystems that serve diverse customer needs. Collaboration frameworks that enable rapid innovation while maintaining regulatory compliance will be critical for success.

Customer experience optimization should remain a primary focus, with emphasis on seamless integration, personalization, and omnichannel consistency across all payment touchpoints. User interface design and customer journey mapping will become increasingly important differentiators in a crowded marketplace.

Cybersecurity investment must keep pace with evolving threat landscapes, with particular attention to emerging risks associated with new payment technologies and increased transaction volumes. Proactive security measures and incident response capabilities will be essential for maintaining customer trust and regulatory compliance.

Regulatory engagement should be proactive and collaborative, with industry participants contributing to policy development processes to ensure balanced outcomes that support innovation while protecting consumers. Compliance automation technologies should be implemented to reduce regulatory burden and improve reporting accuracy.

Australia’s payment systems market is positioned for continued growth and innovation over the next five years, with digital payment adoption expected to reach near-universal levels across urban populations. Emerging technologies including artificial intelligence, blockchain, and Internet of Things applications will create new payment possibilities and business models that could fundamentally transform the industry landscape.

Central bank digital currency developments may introduce new competitive dynamics and regulatory considerations, potentially affecting existing payment providers while creating opportunities for innovative service offerings. Cross-border payment optimization will become increasingly important as Australian businesses expand internationally and consumers engage in global commerce.

Market consolidation trends are expected to continue, with larger players acquiring specialized fintech companies to expand capabilities and accelerate innovation timelines. Partnership ecosystems will become more sophisticated, enabling comprehensive payment solutions that integrate multiple providers’ strengths while maintaining competitive positioning.

Regulatory evolution will continue to shape market development, with potential changes to interchange fee structures, open banking requirements, and cryptocurrency regulations affecting strategic decisions across the industry. Consumer protection measures may become more stringent, particularly for alternative payment methods and emerging technologies.

MWR projections indicate that payment transaction volumes will continue growing at healthy rates, driven by economic growth, digital adoption, and new use cases enabled by technological innovation. Revenue diversification through value-added services and data analytics will become increasingly important for payment providers seeking sustainable competitive advantages.

Australia’s payment systems market represents a dynamic and rapidly evolving ecosystem that continues to transform how individuals and businesses conduct financial transactions. The market demonstrates strong fundamentals with robust digital adoption rates, supportive regulatory frameworks, and continuous technological innovation driving growth across multiple segments.

Key success factors for market participants include investment in advanced technologies, strategic partnerships, customer experience optimization, and proactive regulatory engagement. Competitive differentiation will increasingly depend on the ability to deliver seamless, secure, and personalized payment experiences while maintaining operational efficiency and regulatory compliance.

Future growth opportunities exist in emerging technologies, cross-border payments, financial inclusion initiatives, and value-added services that leverage transaction data for enhanced customer insights. Market challenges including cybersecurity threats, regulatory complexity, and intense competition will require strategic responses and continuous adaptation to maintain competitive positioning.

The Australia payment systems market outlook remains positive, with continued innovation, growing transaction volumes, and expanding use cases supporting sustained growth and development across the industry ecosystem.

What is Australia Payment Systems?

Australia Payment Systems refer to the various methods and technologies used for processing financial transactions in Australia, including credit and debit cards, mobile payments, and online banking systems.

What are the key players in the Australia Payment Systems Market?

Key players in the Australia Payment Systems Market include Commonwealth Bank, Westpac, and ANZ, which provide a range of payment solutions and services, among others.

What are the main drivers of growth in the Australia Payment Systems Market?

The main drivers of growth in the Australia Payment Systems Market include the increasing adoption of digital payment methods, the rise of e-commerce, and advancements in payment technology, which enhance consumer convenience.

What challenges does the Australia Payment Systems Market face?

The Australia Payment Systems Market faces challenges such as cybersecurity threats, regulatory compliance issues, and the need for continuous technological innovation to meet consumer expectations.

What opportunities exist in the Australia Payment Systems Market?

Opportunities in the Australia Payment Systems Market include the expansion of contactless payment options, the integration of blockchain technology, and the growth of fintech startups offering innovative payment solutions.

What trends are shaping the Australia Payment Systems Market?

Trends shaping the Australia Payment Systems Market include the increasing use of mobile wallets, the shift towards real-time payments, and the growing emphasis on user-friendly interfaces and security features.

Australia Payment Systems Market

| Segmentation Details | Description |

|---|---|

| Payment Type | Credit Card, Debit Card, Mobile Payment, Digital Wallet |

| End User | Retail, E-commerce, Hospitality, Transportation |

| Technology | Contactless, EMV, NFC, QR Code |

| Service Type | Payment Processing, Fraud Detection, Gateway Services, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Payment Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at