444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Australia Organic Food Market represents a rapidly growing segment of the food industry, characterized by the production, distribution, and consumption of organic food products. Organic food is produced using environmentally sustainable practices, without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs). With increasing consumer awareness of health, sustainability, and food quality, the demand for organic food in Australia has been steadily rising, driven by factors such as growing health consciousness, environmental concerns, and preference for natural and wholesome food products.

Meaning: The Australia Organic Food Market encompasses a diverse range of food products, including fruits, vegetables, grains, dairy products, meat, poultry, eggs, and packaged foods, produced using organic farming methods and certified by regulatory bodies. Organic food is cultivated and processed without the use of synthetic chemicals, antibiotics, growth hormones, or genetically modified organisms (GMOs), promoting soil health, biodiversity, and environmental sustainability. Consumers choose organic food for its perceived health benefits, nutritional value, and ethical production practices, contributing to the market’s growth and expansion.

Executive Summary: The Australia Organic Food Market is experiencing robust growth, driven by increasing consumer demand for natural, organic, and sustainably produced food products. Key market trends include the expansion of organic farming acreage, diversification of product offerings, and adoption of organic certification standards. Industry players are focusing on product innovation, distribution channel expansion, and marketing initiatives to capitalize on emerging opportunities and meet evolving consumer preferences for organic food.

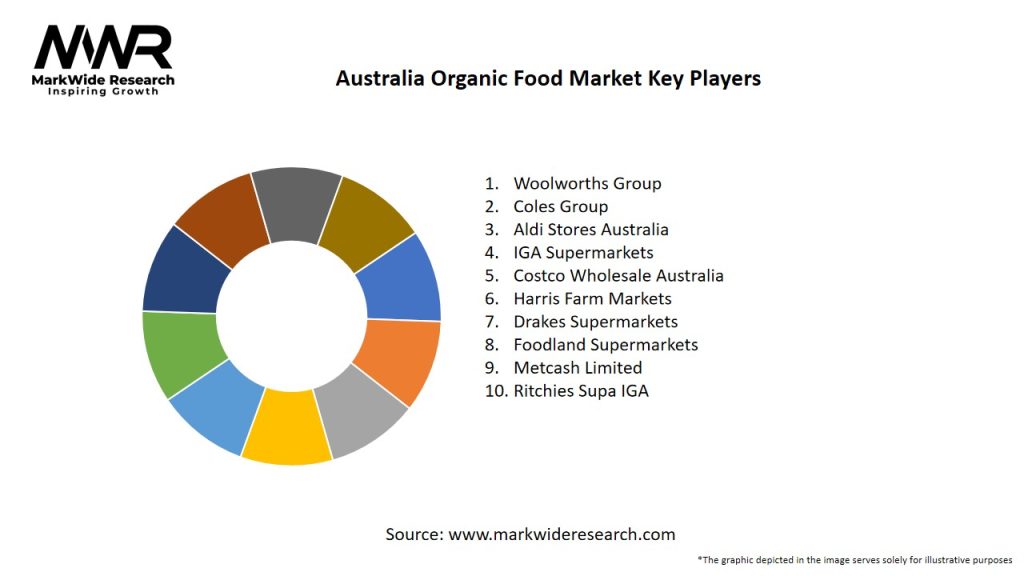

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Australia Organic Food Market operates within a dynamic ecosystem shaped by consumer preferences, regulatory frameworks, industry trends, and competitive forces. Market participants must navigate these dynamics, adapt to changing market conditions, and leverage strategic opportunities to sustain growth, enhance competitiveness, and meet evolving consumer demands effectively.

Regional Analysis: Regional variations in consumer demographics, lifestyle preferences, urbanization rates, and income levels influence organic food consumption patterns and market dynamics across Australia. Major metropolitan areas, coastal regions, and affluent suburbs tend to exhibit higher demand for organic food products, driven by factors such as health consciousness, environmental awareness, and premium purchasing power.

Competitive Landscape:

Leading Companies in Australia Organic Food Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Australia Organic Food Market can be segmented based on product type, distribution channel, certification status, and consumer demographics. Common product categories include organic fruits and vegetables, dairy products, meat and poultry, grains and cereals, packaged foods, and beverages. Distribution channels range from supermarkets, health food stores, and farmers’ markets to online retailers and direct-to-consumer models.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis of the Australia Organic Food Market provides insights into its strengths, weaknesses, opportunities, and threats, guiding strategic planning and risk management efforts:

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic has had a significant impact on the Australia Organic Food Market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Australia Organic Food Market is promising, driven by sustained consumer demand, regulatory support, technological innovations, and market innovations. Key growth drivers include health and wellness trends, environmental sustainability initiatives, digital transformation, and export opportunities. Industry stakeholders must adapt to changing market dynamics, embrace innovation, and collaborate effectively to capitalize on emerging opportunities, overcome challenges, and foster long-term growth and sustainability in the organic food sector.

Conclusion: The Australia Organic Food Market represents a vibrant and dynamic sector of the food industry, characterized by increasing consumer demand for natural, organic, and sustainably produced food products. With growing awareness of health, wellness, and environmental sustainability, organic food offers significant opportunities for industry participants and stakeholders. By embracing innovation, sustainability, and consumer-centric strategies, organic food stakeholders can thrive in this evolving market landscape, contribute to a healthier and more sustainable food system, and meet the diverse needs and preferences of Australian consumers.

What is Organic Food?

Organic food refers to products that are grown and processed without the use of synthetic fertilizers, pesticides, or genetically modified organisms. This category includes fruits, vegetables, dairy, and meat that meet specific organic standards.

What are the key players in the Australia Organic Food Market?

Key players in the Australia Organic Food Market include companies like Australian Organic, Whole Foods Market, and Bio-Dynamic Food. These companies are known for their commitment to organic farming practices and sustainable sourcing, among others.

What are the main drivers of growth in the Australia Organic Food Market?

The main drivers of growth in the Australia Organic Food Market include increasing consumer awareness of health benefits, a rising demand for sustainable food sources, and a growing trend towards organic farming practices among local producers.

What challenges does the Australia Organic Food Market face?

Challenges in the Australia Organic Food Market include higher production costs, limited availability of organic ingredients, and competition from conventional food products that may be cheaper and more accessible.

What opportunities exist in the Australia Organic Food Market?

Opportunities in the Australia Organic Food Market include expanding online sales channels, increasing product variety to cater to diverse consumer preferences, and potential growth in export markets for organic products.

What trends are shaping the Australia Organic Food Market?

Trends shaping the Australia Organic Food Market include the rise of plant-based diets, increased transparency in food sourcing, and innovations in organic farming techniques that enhance sustainability and yield.

Australia Organic Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fruits, Vegetables, Dairy, Grains |

| Distribution Channel | Supermarkets, Online Retail, Farmers’ Markets, Specialty Stores |

| End User | Households, Restaurants, Cafes, Health Stores |

| Certification | USDA Organic, Australian Certified Organic, Bio-Dynamic, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Australia Organic Food Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at