444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia oil and gas market is a significant contributor to the country’s economy, playing a crucial role in its energy sector. Australia is known for its vast reserves of oil and natural gas, both onshore and offshore. The market encompasses exploration, production, refining, and distribution activities related to oil and gas resources. With a strong emphasis on technological advancements and sustainable practices, Australia’s oil and gas industry has witnessed substantial growth over the years.

Meaning

The Australia oil and gas market refers to the sector responsible for the extraction, production, and distribution of oil and natural gas resources in the country. It involves various stakeholders, including oil and gas companies, exploration and production companies, refineries, pipeline operators, and service providers. The market plays a crucial role in meeting the energy demands of Australia and contributes significantly to the nation’s economic growth.

Executive Summary

The Australia oil and gas market has experienced robust growth in recent years, driven by factors such as increased exploration and production activities, technological advancements, and favorable government policies. The market is characterized by a highly competitive landscape, with several key players operating in the sector. While the industry has faced challenges due to the Covid-19 pandemic, it has shown resilience and adaptability. Looking ahead, the market is expected to continue its growth trajectory, supported by emerging opportunities and industry developments.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

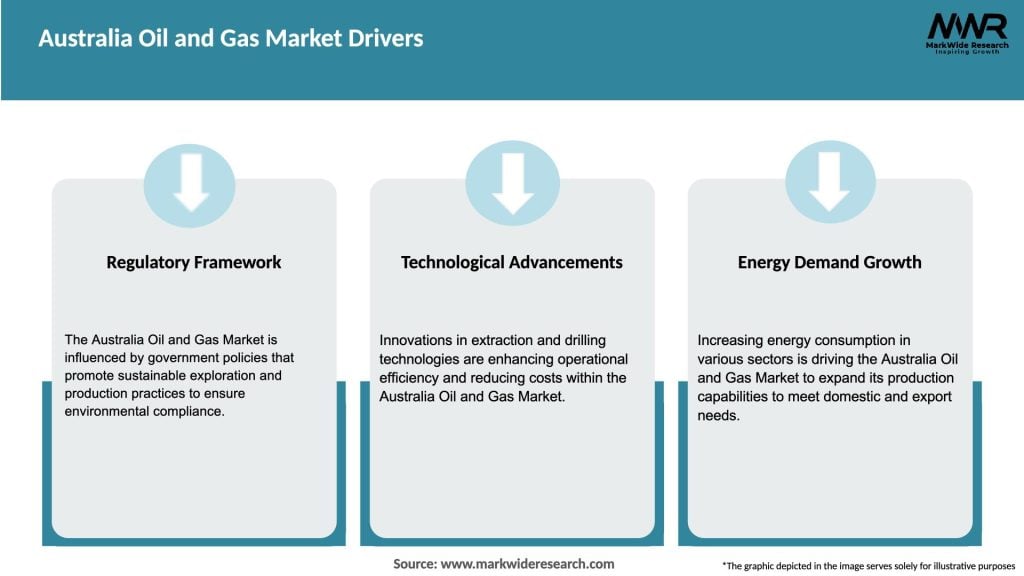

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia oil and gas market is characterized by dynamic and interconnected factors that influence its growth and performance. These dynamics include economic factors, technological advancements, regulatory frameworks, environmental concerns, and geopolitical factors. The market is influenced by both global trends and domestic factors specific to Australia. Continuous monitoring and adaptation to these dynamics are essential for market participants to remain competitive and capitalize on emerging opportunities.

Regional Analysis

The Australia oil and gas market exhibits regional variations in terms of resource availability, infrastructure development, and industry activities. The major oil and gas regions in Australia include Western Australia, the Northern Territory, Queensland, and the Bass Strait region. Western Australia, in particular, is known for its significant oil and gas reserves and plays a vital role in the country’s energy production. Regional analysis helps stakeholders understand the specific characteristics and potential of each region, enabling targeted investments and strategic decision-making.

Competitive Landscape

Leading companies in the Australia Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

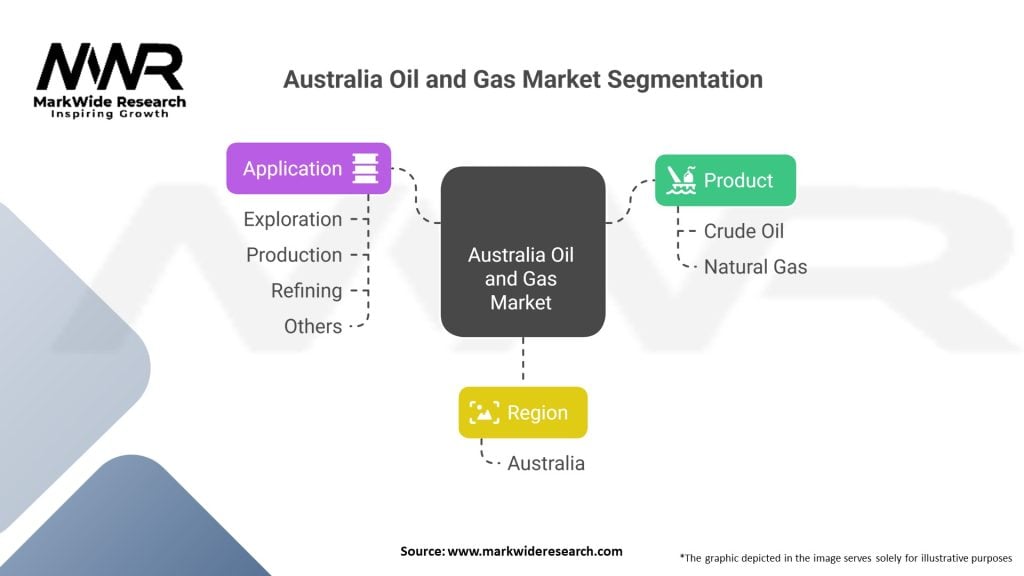

Segmentation

The Australia oil and gas market can be segmented based on various parameters, including:

Segmentation helps industry participants and stakeholders analyze specific market segments, identify growth opportunities, and devise targeted strategies for each segment.

Category-wise Insights

Category-wise insights enable a comprehensive understanding of specific aspects of the Australia oil and gas market and provide valuable information for industry participants and stakeholders.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders can leverage these benefits by strategically positioning themselves, embracing innovation, and adapting to market trends.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides a comprehensive assessment of the Australia oil and gas market’s internal and external factors:

Strengths:

Weaknesses:

Opportunities:

Threats:

A SWOT analysis helps industry participants identify their strengths and weaknesses, capitalize on opportunities, and mitigate potential threats.

Market Key Trends

Understanding key trends helps market participants stay ahead of the curve and adapt their strategies to meet evolving market demands.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Australia oil and gas market, as it has on the global energy industry. The pandemic resulted in a sharp decline in oil and gas demand, disruptions in supply chains, and price volatility. Lockdowns, travel restrictions, and reduced economic activity led to a decrease in energy consumption, affecting the market’s performance.

However, the industry demonstrated resilience and adaptability during this challenging period. Oil and gas companies implemented cost-cutting measures, optimized operations, and accelerated digital transformation to navigate the crisis. The pandemic also highlighted the importance of energy security and the need for sustainable and resilient energy systems.

As economies recover and restrictions ease, the Australia oil and gas market is gradually rebounding. The resumption of economic activities, the reopening of international borders, and the increasing global energy demand are expected to drive market recovery and growth.

Key Industry Developments

These industry developments indicate the market’s commitment to sustainability, technological advancement, and collaboration to create a more resilient and efficient oil and gas sector in Australia.

Analyst Suggestions

These suggestions aim to guide industry participants in navigating the evolving landscape and positioning themselves for long-term success.

Future Outlook

The future outlook for the Australia oil and gas market is promising, despite the challenges and uncertainties it faces. The industry is expected to witness steady growth, driven by factors such as increasing energy demand, investments in LNG projects, technological advancements, and sustainability initiatives.

The market will likely continue its transition towards natural gas and renewable energy sources, with a focus on decarbonization and environmental sustainability. Investments in offshore resources, infrastructure development, and international collaborations are expected to create new opportunities for growth and expansion.

However, the market will need to address challenges such as volatile oil and gas prices, regulatory complexities, and competition from renewable energy sources. Adaptation to changing market dynamics, embracing innovation, and ensuring environmental responsibility will be crucial for long-term success.

Conclusion

In conclusion, the Australia oil and gas market is a dynamic and vital sector that plays a significant role in the country’s economy and energy security. With its abundant reserves of oil and natural gas, both onshore and offshore, Australia has established itself as a major player in the global energy market. The industry has witnessed growth and transformation driven by technological advancements, favorable government policies, and a growing focus on sustainability.

While the market faces challenges such as price volatility, regulatory complexities, and competition from renewable energy sources, it also presents numerous opportunities for industry participants. The development of offshore resources, investment in renewable energy, technological innovation, and infrastructure development are key areas where the market can expand and thrive.Furthermore, the industry’s response to the Covid-19 pandemic has showcased its resilience and adaptability. As economies recover and energy demand rebounds, the Australia oil and gas market is poised for recovery and growth.

To navigate the evolving landscape, industry participants are advised to embrace sustainability, invest in technology, diversify their energy portfolios, collaborate for innovation, and adapt to regulatory changes. These strategies will enable them to stay competitive, drive operational efficiency, and meet the changing demands of the market.Looking ahead, the future outlook for the Australia oil and gas market is promising. As the industry continues to evolve, incorporating cleaner energy sources and sustainable practices, it will contribute to Australia’s energy transition and support the country’s economic development in a responsible and environmentally conscious manner.

What is Oil and Gas?

Oil and gas refer to natural resources that are extracted from the earth and used primarily for energy production, transportation, and heating. These resources are crucial for various industries, including manufacturing, power generation, and petrochemicals.

What are the key players in the Australia Oil and Gas Market?

Key players in the Australia Oil and Gas Market include Woodside Petroleum, Santos, and Origin Energy, among others. These companies are involved in exploration, production, and distribution of oil and gas resources across the country.

What are the main drivers of the Australia Oil and Gas Market?

The main drivers of the Australia Oil and Gas Market include increasing energy demand, advancements in extraction technologies, and the country’s rich natural resources. Additionally, the growing need for energy security and economic growth further fuels market expansion.

What challenges does the Australia Oil and Gas Market face?

The Australia Oil and Gas Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating global oil prices. These factors can impact investment decisions and operational costs for companies in the sector.

What opportunities exist in the Australia Oil and Gas Market?

Opportunities in the Australia Oil and Gas Market include the potential for new offshore discoveries, investment in renewable energy integration, and advancements in carbon capture technologies. These factors can enhance sustainability and operational efficiency in the sector.

What trends are shaping the Australia Oil and Gas Market?

Trends shaping the Australia Oil and Gas Market include a shift towards cleaner energy sources, increased automation in extraction processes, and a focus on reducing carbon emissions. Companies are also exploring digital technologies to optimize operations and improve safety.

Australia Oil and Gas Market:

| Segmentation Details | Description |

|---|---|

| Product | Crude Oil, Natural Gas |

| Application | Exploration, Production, Refining, Others |

| Region | Australia |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at