444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia nutraceuticals market has experienced significant growth in recent years. Nutraceuticals are defined as products derived from food sources that provide additional health benefits beyond basic nutrition. These products are gaining popularity among consumers who are looking for natural and preventive healthcare solutions. The market in Australia is driven by factors such as increasing health consciousness, growing aging population, and a rise in chronic diseases. The country’s robust healthcare infrastructure and favorable government regulations also contribute to the market’s expansion.

Meaning

Nutraceuticals refer to food or food components that offer health benefits, including the prevention and treatment of diseases. These products contain bioactive compounds, such as vitamins, minerals, botanical extracts, and dietary fiber, which support overall well-being. Nutraceuticals are available in various forms, including capsules, tablets, powders, and functional foods.

Executive Summary

The Australia nutraceuticals market is witnessing steady growth, driven by the rising demand for natural health solutions. The market offers a wide range of products that cater to different health needs, including dietary supplements, functional foods, and beverages. The increasing awareness about preventive healthcare and the importance of a balanced diet contribute to the market’s growth. Market players are focusing on product innovation, strategic partnerships, and effective marketing strategies to gain a competitive edge in the industry.

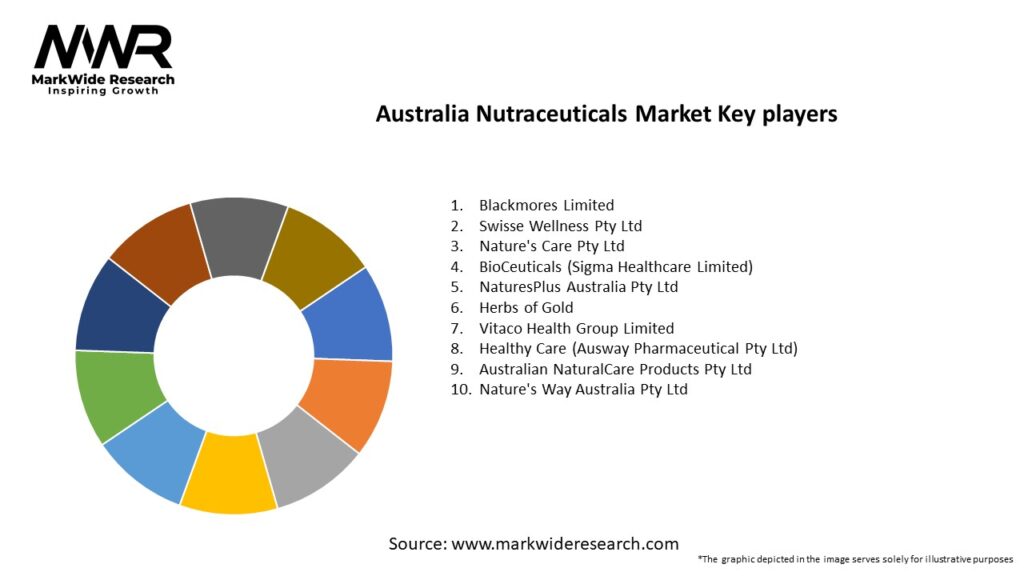

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia nutraceuticals market is characterized by dynamic factors that influence its growth and development. These include changing consumer preferences, technological advancements, regulatory updates, and competitive dynamics. Understanding and adapting to these dynamics are crucial for market players to sustain their growth and competitive advantage.

Regional Analysis

The Australia nutraceuticals market exhibits regional variations in terms of consumer preferences, product availability, and market demand. Major urban centers such as Sydney, Melbourne, and Brisbane account for a significant share of the market due to higher population density and consumer awareness. However, with the rising trend of health-consciousness spreading across regional areas, there is a growing market potential in smaller cities and rural regions.

Competitive Landscape

Leading Companies in the Australia Nutraceuticals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Australia nutraceuticals market can be segmented based on product type, distribution channel, and application.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the Australia nutraceuticals market. On one hand, the increased focus on health and wellness has driven the demand for nutraceutical products. Consumers have become more proactive about their immune health and overall well-being, leading to a surge in the purchase of dietary supplements and functional foods. However, the economic impact of the pandemic has resulted in some consumers reducing discretionary spending, affecting the sales of premium nutraceutical products. Additionally, disruptions in the supply chain and manufacturing processes have posed challenges for market players, although the industry has shown resilience in adapting to the changing market conditions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Australia nutraceuticals market is poised for steady growth in the coming years. The increasing health consciousness, aging population, and rising prevalence of chronic diseases will continue to drive market demand. With ongoing research and product development, the market will witness innovative formulations, new ingredients, and advanced delivery systems. Expanding distribution channels, targeted marketing strategies, and personalized nutrition offerings will further contribute to market growth. However, market players need to address challenges such as high product costs, regulatory compliance, and competition from pharmaceuticals to capitalize on the market’s potential.

Conclusion

The Australia nutraceuticals market is experiencing robust growth driven by factors such as increasing health awareness, aging population, and the rise in chronic diseases. The market offers a wide range of products, including dietary supplements, functional foods, and beverages, catering to diverse health needs. While the market presents lucrative opportunities, industry participants need to navigate challenges such as high product costs, regulatory compliance, and competition from pharmaceuticals. By focusing on product innovation, targeted marketing, and sustainability, market players can establish a strong foothold in the growing nutraceuticals market.

What is Nutraceuticals?

Nutraceuticals refer to products derived from food sources that offer health benefits, including the prevention and treatment of diseases. They encompass a wide range of products such as dietary supplements, functional foods, and herbal products.

What are the key players in the Australia Nutraceuticals Market?

Key players in the Australia Nutraceuticals Market include Blackmores, Swisse Wellness, and Herbalife, among others. These companies are known for their diverse product offerings that cater to various health and wellness needs.

What are the main drivers of growth in the Australia Nutraceuticals Market?

The main drivers of growth in the Australia Nutraceuticals Market include increasing consumer awareness of health and wellness, a growing aging population, and rising demand for preventive healthcare solutions. Additionally, the trend towards natural and organic products is also contributing to market expansion.

What challenges does the Australia Nutraceuticals Market face?

The Australia Nutraceuticals Market faces challenges such as regulatory hurdles, competition from pharmaceutical products, and consumer skepticism regarding product efficacy. These factors can hinder market growth and consumer trust.

What opportunities exist in the Australia Nutraceuticals Market?

Opportunities in the Australia Nutraceuticals Market include the development of innovative products targeting specific health issues, expansion into online retail channels, and increasing partnerships with healthcare professionals. These avenues can enhance market reach and consumer engagement.

What trends are shaping the Australia Nutraceuticals Market?

Trends shaping the Australia Nutraceuticals Market include the rise of personalized nutrition, the integration of technology in product development, and a focus on sustainability in sourcing ingredients. These trends reflect changing consumer preferences and the evolving landscape of health products.

Australia Nutraceuticals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Herbal Supplements, Probiotics |

| End User | Adults, Seniors, Athletes, Children |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Health Stores |

| Form | Tablets, Capsules, Powders, Liquids |

Leading Companies in the Australia Nutraceuticals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at