444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia mining logistics market plays a crucial role in supporting the country’s thriving mining industry. Mining logistics refers to the process of planning, organizing, and managing the transportation, storage, and distribution of mining products, equipment, and materials. It encompasses various activities such as sourcing, inventory management, transportation, and supply chain optimization. The market is characterized by the demand for efficient and cost-effective logistics solutions to ensure the smooth flow of resources from mining sites to end-users.

Meaning

Mining logistics is the backbone of the mining industry, ensuring the timely and efficient movement of raw materials, equipment, and finished products. It involves coordinating complex operations across different stages of the supply chain, including procurement, transportation, warehousing, and distribution. Effective mining logistics contribute to reducing costs, minimizing delays, improving safety, and optimizing overall operational efficiency.

Executive Summary

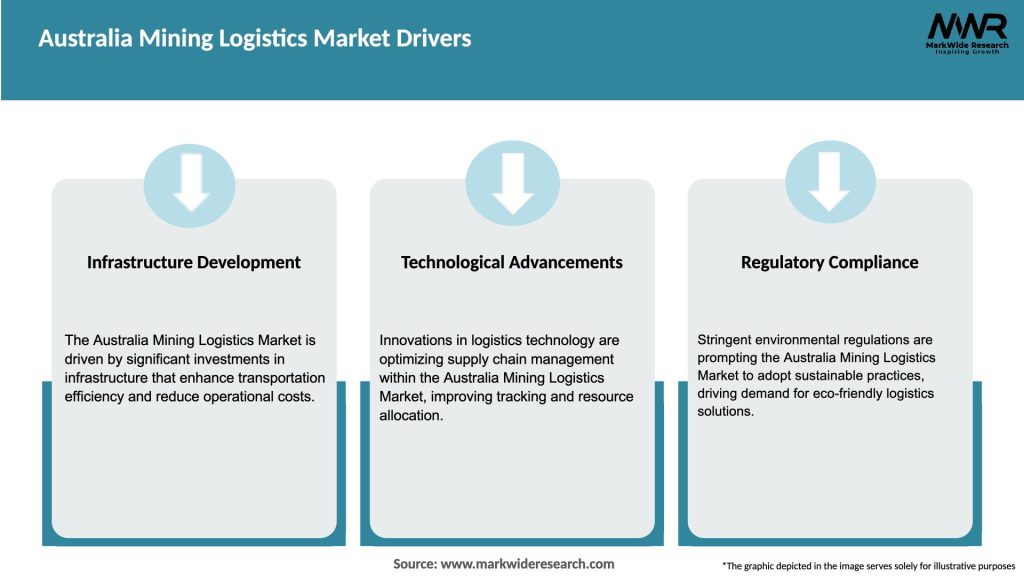

The Australia mining logistics market has experienced significant growth in recent years, driven by the country’s robust mining industry. The sector has witnessed substantial investments in infrastructure development, technological advancements, and process optimization to enhance the efficiency and reliability of mining logistics operations. The demand for mining logistics services has also been fueled by the increasing export of minerals to global markets, particularly to countries in Asia, such as China and India.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia mining logistics market is dynamic and influenced by various factors. The market dynamics include changing commodity prices, technological advancements, infrastructure development, government policies, and environmental considerations. These factors interact and shape the demand for mining logistics services, creating opportunities and challenges for industry participants.

Regional Analysis

The Australia mining logistics market exhibits regional variations due to the concentration of mining activities in specific areas. Western Australia, Queensland, and New South Wales are the major regions contributing to the country’s mining logistics sector. Western Australia, in particular, holds significant reserves of iron ore, and its mining logistics market is driven by the transportation of this commodity to export ports.

Competitive Landscape

Leading Companies in the Australia Mining Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

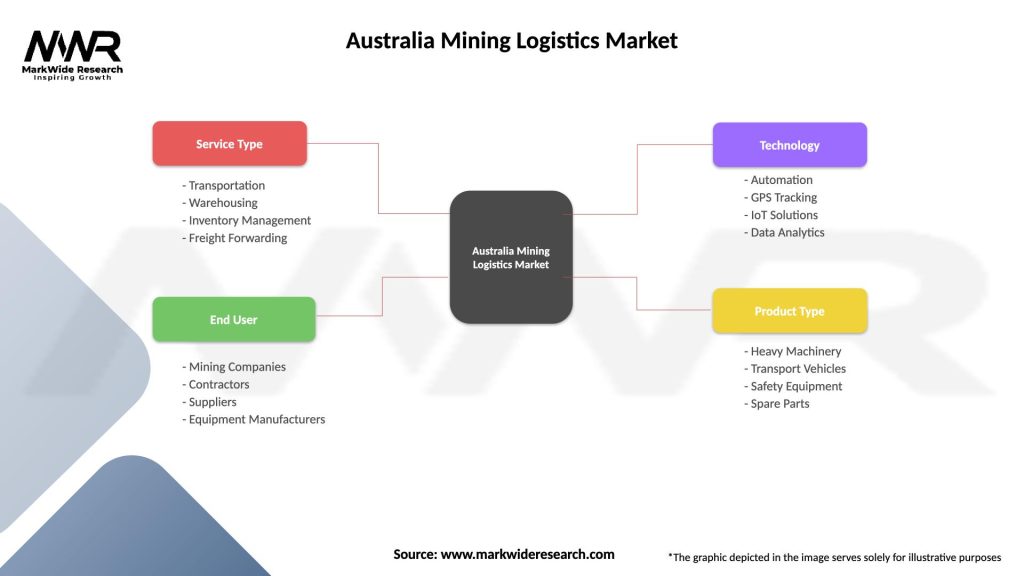

Segmentation

The Australia mining logistics market can be segmented based on various criteria, including transportation mode, service type, and mineral commodity. The transportation mode segment includes road, rail, sea, and air transport. Service types encompass transportation, warehousing, inventory management, and value-added services. Mineral commodities such as iron ore, coal, gold, and lithium can be considered as additional segmentation factors.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Australia mining logistics market. The initial lockdowns and travel restrictions disrupted mining operations and logistics activities, leading to supply chain disruptions and delays in the transportation of mining materials. However, the mining industry demonstrated resilience and adapted to the challenges by implementing strict safety protocols, adopting remote work arrangements, and leveraging technology to mitigate the impact of the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Australia mining logistics market is poised for continued growth in the coming years. The sector is expected to benefit from ongoing investments in infrastructure development, technological advancements, and sustainable practices. The increasing global demand for minerals, particularly from Asia, will drive the export-oriented mining industry, thereby creating opportunities for efficient logistics services. However, challenges related to infrastructure, commodity price fluctuations, and regulatory compliance will require continuous attention and innovative solutions to ensure the long-term success of the mining logistics sector.

Conclusion

The Australia mining logistics market plays a vital role in supporting the country’s thriving mining industry. The sector is driven by the growing demand for efficient transportation and supply chain solutions to meet the export needs of mineral resources. The market offers significant opportunities for stakeholders to leverage technological advancements, promote sustainability, and enhance collaboration. By addressing challenges related to infrastructure, commodity price fluctuations, and regulatory compliance, the mining logistics sector can contribute to the continued growth and success of the Australian mining industry.

What is Australia Mining Logistics?

Australia Mining Logistics refers to the processes and systems involved in the transportation, storage, and management of materials and equipment used in the mining industry within Australia. This includes the movement of raw materials, finished products, and the logistics of supply chain management specific to mining operations.

What are the key players in the Australia Mining Logistics Market?

Key players in the Australia Mining Logistics Market include companies such as Toll Group, Linfox, and DB Schenker, which provide comprehensive logistics solutions tailored for the mining sector. These companies focus on optimizing supply chains and enhancing operational efficiency, among others.

What are the main drivers of the Australia Mining Logistics Market?

The main drivers of the Australia Mining Logistics Market include the increasing demand for minerals and resources, advancements in logistics technology, and the need for efficient supply chain management. Additionally, the growth of mining operations in remote areas necessitates improved logistics solutions.

What challenges does the Australia Mining Logistics Market face?

The Australia Mining Logistics Market faces challenges such as infrastructure limitations, regulatory compliance issues, and fluctuating fuel prices. These factors can impact the efficiency and cost-effectiveness of logistics operations in the mining sector.

What opportunities exist in the Australia Mining Logistics Market?

Opportunities in the Australia Mining Logistics Market include the integration of digital technologies for better tracking and management of logistics, the expansion of sustainable practices, and the potential for partnerships between logistics providers and mining companies. These trends can enhance operational efficiency and reduce environmental impact.

What trends are shaping the Australia Mining Logistics Market?

Trends shaping the Australia Mining Logistics Market include the adoption of automation and AI in logistics operations, increased focus on sustainability, and the use of data analytics for optimizing supply chains. These innovations are driving efficiency and improving decision-making in the mining logistics sector.

Australia Mining Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Inventory Management, Freight Forwarding |

| End User | Mining Companies, Contractors, Suppliers, Equipment Manufacturers |

| Technology | Automation, GPS Tracking, IoT Solutions, Data Analytics |

| Product Type | Heavy Machinery, Transport Vehicles, Safety Equipment, Spare Parts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Mining Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at