444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Australia Meat Products Market encompasses a diverse range of meat-based products, including beef, pork, poultry, and lamb, catering to domestic consumption and export markets. Meat products hold a significant place in Australian cuisine and culture, with a strong emphasis on quality, safety, and sustainability. The market reflects evolving consumer preferences, dietary trends, and regulatory standards, driving innovation and competition among industry players to meet the demands of discerning consumers.

Meaning: The Australia Meat Products Market refers to the production, processing, distribution, and consumption of various meat-based products, including fresh and processed meats, cured meats, sausages, and value-added meat products. These products serve as essential sources of protein, nutrients, and flavor in the Australian diet, contributing to culinary diversity, gastronomic traditions, and economic growth in the country.

Executive Summary: The Australia Meat Products Market is characterized by robust demand for high-quality, ethically sourced meats, reflecting consumer preferences for natural, organic, and sustainably produced food products. Key market trends include the rise of alternative proteins, increased focus on animal welfare and environmental sustainability, and growing export opportunities in Asian markets. Industry stakeholders prioritize product innovation, supply chain efficiency, and market differentiation to maintain competitiveness and meet evolving consumer expectations.

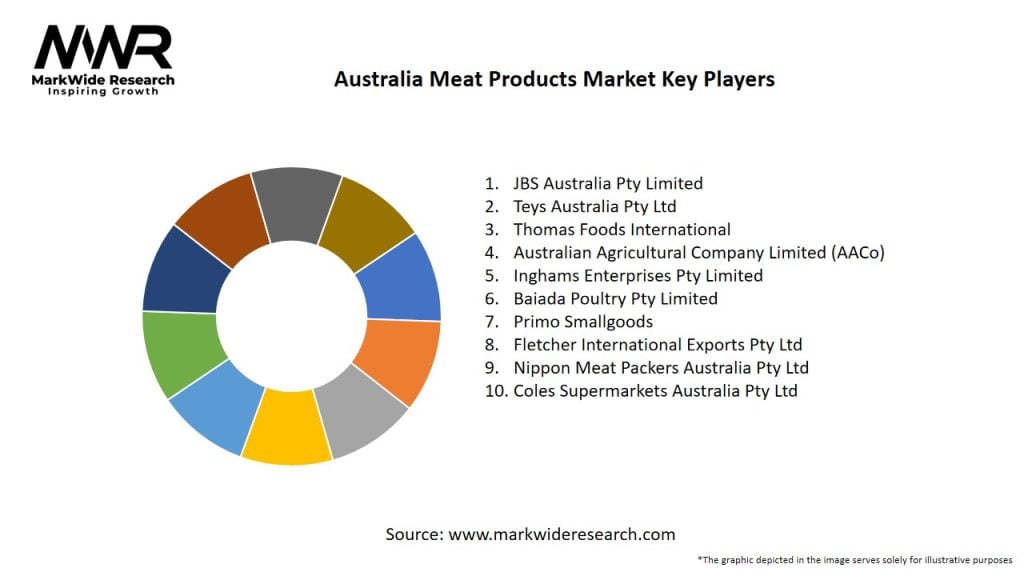

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Australia Meat Products Market operates in a dynamic environment shaped by changing consumer preferences, regulatory frameworks, technological advancements, and global trade dynamics. Industry stakeholders must adapt to market trends, anticipate consumer demands, and address sustainability challenges to sustain growth, profitability, and competitiveness in the long term.

Regional Analysis: Regional variations in meat consumption, production practices, culinary traditions, and demographic trends influence market dynamics and demand patterns across Australia. Urban areas with higher population densities, cultural diversity, and affluent consumer segments may exhibit greater demand for a variety of meat products, including premium cuts, specialty meats, and gourmet offerings.

Competitive Landscape:

Leading Companies in Australia Meat Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

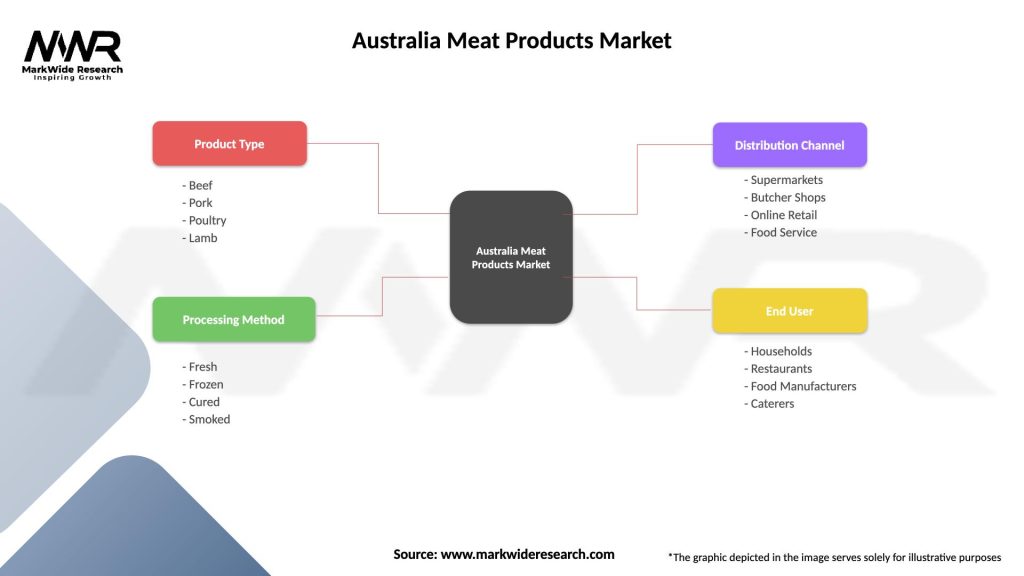

Segmentation: The Australia Meat Products Market can be segmented based on various factors such as meat type, processing methods, distribution channels, and consumer preferences. Segmentation enables industry stakeholders to target specific market segments, tailor product offerings, and optimize marketing strategies to meet diverse consumer needs and preferences effectively.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the Australia Meat Products Market’s strengths, weaknesses, opportunities, and threats, guiding strategic decision-making and risk management efforts:

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic has affected the Australia Meat Products Market in several ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The Australia Meat Products Market is poised for continued growth and evolution, driven by consumer demand for quality, variety, and sustainability in meat products. Key trends such as premiumization, health and wellness, convenience, and ethical sourcing will shape market dynamics, product innovation, and industry strategies in the years ahead, presenting opportunities for industry stakeholders to adapt, innovate, and thrive in a rapidly changing marketplace.

Conclusion: The Australia Meat Products Market represents a dynamic and resilient sector within the food industry, offering a wide range of meat-based products to meet diverse consumer preferences, dietary needs, and culinary trends. By embracing innovation, sustainability, and consumer-centric strategies, industry participants can navigate challenges, capitalize on opportunities, and sustain long-term growth, delivering value-added meat products that resonate with the evolving tastes and lifestyles of Australian consumers.

What is Australia Meat Products?

Australia Meat Products refers to a variety of food items derived from livestock, including beef, pork, lamb, and poultry, which are processed and packaged for consumption. These products are integral to the Australian food industry and are known for their quality and safety standards.

What are the key companies in the Australia Meat Products Market?

Key companies in the Australia Meat Products Market include JBS Australia, Australian Agricultural Company, and Teys Australia, which are prominent players in meat processing and distribution. These companies focus on various segments such as beef, lamb, and pork production, among others.

What are the growth factors driving the Australia Meat Products Market?

The Australia Meat Products Market is driven by increasing consumer demand for high-quality protein sources, a growing trend towards convenience foods, and the expansion of export markets. Additionally, health-conscious consumers are seeking leaner meat options, influencing product offerings.

What challenges does the Australia Meat Products Market face?

The Australia Meat Products Market faces challenges such as fluctuating livestock prices, stringent regulations regarding food safety, and competition from plant-based alternatives. These factors can impact profitability and market dynamics.

What opportunities exist in the Australia Meat Products Market?

Opportunities in the Australia Meat Products Market include the rising popularity of premium and organic meat products, as well as the potential for innovation in meat processing technologies. Additionally, expanding into international markets presents growth potential for Australian meat producers.

What trends are shaping the Australia Meat Products Market?

Trends in the Australia Meat Products Market include a shift towards sustainable and ethically sourced meat, increased consumer interest in traceability, and the adoption of new processing technologies. These trends are influencing consumer preferences and industry practices.

Australia Meat Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beef, Pork, Poultry, Lamb |

| Processing Method | Fresh, Frozen, Cured, Smoked |

| Distribution Channel | Supermarkets, Butcher Shops, Online Retail, Food Service |

| End User | Households, Restaurants, Food Manufacturers, Caterers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Australia Meat Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at