444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia luxury residential real estate market has witnessed significant growth in recent years. As one of the most sought-after destinations for high-net-worth individuals (HNWIs) and foreign investors, Australia offers a range of luxury properties that cater to the discerning tastes of affluent buyers. From sprawling waterfront mansions to sophisticated penthouses with stunning city views, the luxury real estate market in Australia provides a wide array of options for those seeking opulence and exclusivity.

Meaning

Luxury residential real estate refers to properties that offer superior quality, exceptional amenities, and unique features that set them apart from the average housing market. These properties are typically characterized by their high price range, prime locations, architectural excellence, and high-end finishes. The term “luxury” in the real estate context goes beyond the physical attributes of a property and encompasses the lifestyle, prestige, and status associated with owning such a residence.

Executive Summary

The Australia luxury residential real estate market has experienced robust growth over the past few years, driven by strong demand from both domestic and international buyers. The country’s stable economy, attractive lifestyle, and high living standards make it an appealing destination for luxury property investments. The market offers a diverse range of luxury homes, including beachfront villas, urban penthouses, and rural estates, catering to the preferences of affluent buyers.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

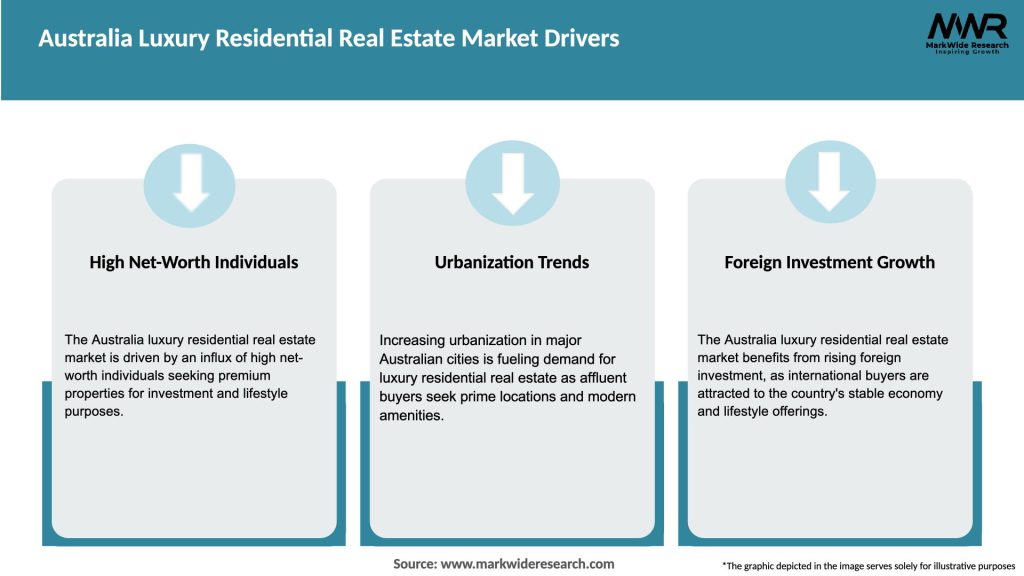

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia luxury residential real estate market is driven by a combination of factors, including economic conditions, lifestyle preferences, regulatory policies, and global market trends. The market dynamics are influenced by the interplay between demand and supply, buyer demographics, investment patterns, and buyer sentiments. Developers, real estate agents, and investors need to closely monitor these dynamics to make informed decisions and capitalize on the market opportunities.

Regional Analysis

The luxury residential real estate market in Australia is primarily concentrated in key cities and regions known for their desirability and economic prominence. Sydney, with its iconic harbor and vibrant city life, is a prime location for luxury properties, attracting both local and international buyers. Melbourne, renowned for its arts and culture, also offers a thriving luxury real estate market. Brisbane, with its warm climate and growing economy, presents opportunities for luxury waterfront properties. Other regions, such as the Gold Coast, Perth, and Adelaide, are emerging as attractive destinations for luxury property investments, offering unique lifestyle propositions and potential capital appreciation.

Competitive Landscape

Leading Companies in the Australia Luxury Residential Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The luxury residential real estate market in Australia can be segmented based on property types, locations, and buyer demographics. Property types include waterfront mansions, urban penthouses, country estates, and luxury apartments. Locations can be categorized into major cities, coastal regions, and rural areas. Buyer demographics may vary based on nationality, age group, and lifestyle preferences. Understanding these segments enables developers and real estate professionals to tailor their offerings to specific target markets and meet the unique demands of luxury buyers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the Australia luxury residential real estate market can enjoy several benefits, including:

SWOT Analysis

The SWOT analysis of the Australia luxury residential real estate market is as follows:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The Australia luxury residential real estate market is subject to various key trends that shape the preferences and behaviors of buyers and investors. These trends include:

Covid-19 Impact

The COVID-19 pandemic had a notable impact on the Australia luxury residential real estate market. Initially, the market experienced a slowdown due to travel restrictions, uncertainty, and economic downturn. However, as the situation stabilized, the market rebounded, with increased demand from domestic buyers and expatriates returning to Australia. The pandemic highlighted the value of luxury properties as safe havens and long-term investments. It also accelerated trends like remote working and lifestyle-oriented living, with buyers seeking spacious homes and properties with dedicated home offices, outdoor spaces, and recreational amenities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Australia luxury residential real estate market remains optimistic. The country’s economic stability, desirable lifestyle, and growing demand from domestic and international buyers position it as an attractive market for luxury property investments. However, ongoing monitoring of market dynamics, changing buyer preferences, and evolving regulatory policies will be crucial for industry participants to adapt and seize emerging opportunities.

Conclusion

The Australia luxury residential real estate market continues to thrive, driven by strong demand from affluent buyers seeking prestigious and exclusive properties. With prime locations, high-end amenities, and diverse property offerings, the market caters to the discerning tastes of luxury buyers. While facing challenges such as affordability constraints and regulatory uncertainties, the market presents numerous opportunities, including emerging markets, sustainable luxury, and innovative marketing strategies. By staying abreast of key industry developments, market trends, and buyer preferences, industry participants can navigate this competitive landscape and capitalize on the growing demand for luxury residential properties in Australia.

What is Australia Luxury Residential Real Estate?

Australia Luxury Residential Real Estate refers to high-end residential properties that offer premium features, locations, and amenities, catering to affluent buyers and investors. This segment includes luxury homes, penthouses, and estates in desirable areas across Australia.

Who are the key players in the Australia Luxury Residential Real Estate Market?

Key players in the Australia Luxury Residential Real Estate Market include companies like Sotheby’s International Realty, Ray White, and LJ Hooker, which specialize in high-end properties. These firms provide services ranging from property sales to luxury property management, among others.

What are the main drivers of the Australia Luxury Residential Real Estate Market?

The main drivers of the Australia Luxury Residential Real Estate Market include increasing demand from foreign investors, a growing affluent population, and the appeal of Australia’s lifestyle and climate. Additionally, urban development and infrastructure improvements contribute to market growth.

What challenges does the Australia Luxury Residential Real Estate Market face?

Challenges in the Australia Luxury Residential Real Estate Market include regulatory changes affecting foreign investment, fluctuations in the economy, and potential oversupply in certain luxury segments. These factors can impact property values and buyer confidence.

What opportunities exist in the Australia Luxury Residential Real Estate Market?

Opportunities in the Australia Luxury Residential Real Estate Market include the potential for growth in eco-friendly luxury developments, increased interest in regional properties, and the rise of technology-driven real estate solutions. These trends can attract new buyers and investors.

What trends are shaping the Australia Luxury Residential Real Estate Market?

Trends shaping the Australia Luxury Residential Real Estate Market include a focus on sustainability, smart home technology integration, and a shift towards urban living. Buyers are increasingly seeking properties that offer both luxury and environmental consciousness.

Australia Luxury Residential Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Single-Family Homes, Condominiums, Townhouses, Villas |

| Buyer Profile | High-Net-Worth Individuals, Investors, Foreign Buyers, Retirees |

| Price Tier | Premium, Ultra-Premium, Mid-Range, Entry-Level |

| Sales Channel | Direct Sales, Real Estate Agencies, Online Platforms, Auctions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Luxury Residential Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at