444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia industrial solar rooftop market represents a transformative segment within the nation’s renewable energy landscape, driven by increasing corporate sustainability commitments and favorable government policies. Industrial facilities across Australia are rapidly adopting solar rooftop solutions to reduce operational costs and achieve carbon neutrality goals. The market encompasses manufacturing plants, warehouses, distribution centers, and large commercial facilities that utilize rooftop space for solar panel installations.

Market dynamics indicate robust growth potential, with industrial solar installations experiencing a compound annual growth rate of 12.5% over recent years. This expansion is fueled by declining solar technology costs, improved energy storage solutions, and increasing electricity prices from traditional grid sources. Manufacturing sectors particularly benefit from solar rooftop systems due to their high energy consumption patterns and extensive roof space availability.

Government incentives and renewable energy targets continue to support market expansion, with Australia’s commitment to achieving net-zero emissions by 2050 creating substantial opportunities for industrial solar adoption. The market demonstrates strong regional variations, with Queensland and New South Wales leading in installation volumes due to favorable solar irradiance conditions and industrial concentration.

The Australia industrial solar rooftop market refers to the sector encompassing the design, installation, and maintenance of photovoltaic solar panel systems specifically mounted on industrial building rooftops across Australia. These systems convert sunlight into electricity for direct consumption by industrial facilities, with excess power potentially fed back into the grid or stored in battery systems.

Industrial solar rooftops typically involve large-scale installations ranging from hundreds of kilowatts to multiple megawatts in capacity, designed to meet the substantial energy demands of manufacturing, processing, and distribution facilities. The market includes various stakeholders such as solar panel manufacturers, system integrators, installation contractors, financing providers, and maintenance service companies.

Key characteristics of this market include customized system designs that accommodate industrial roof structures, integration with existing electrical infrastructure, and optimization for industrial energy consumption patterns. These installations often feature advanced monitoring systems, energy management platforms, and grid-tie capabilities to maximize operational efficiency and return on investment.

Australia’s industrial solar rooftop market has emerged as a critical component of the nation’s renewable energy transition, with industrial facilities increasingly recognizing the economic and environmental benefits of on-site solar generation. The market demonstrates strong momentum driven by cost reduction pressures and sustainability mandates across various industrial sectors.

Technology advancements in solar panel efficiency and energy storage solutions have significantly improved the value proposition for industrial solar installations. Modern systems achieve efficiency rates exceeding 22% while offering enhanced durability and longer operational lifespans. The integration of smart grid technologies and energy management systems further optimizes performance and grid interaction capabilities.

Market participants include established renewable energy companies, specialized solar installers, and emerging technology providers offering innovative financing and service models. The competitive landscape features both international players and domestic companies, with increasing focus on providing comprehensive energy solutions rather than standalone solar installations.

Regional distribution shows concentration in states with high industrial activity and favorable solar conditions, with Queensland capturing approximately 35% market share followed by New South Wales and Victoria. The market outlook remains positive with projected sustained growth driven by policy support, technology improvements, and increasing corporate renewable energy procurement.

Industrial adoption patterns reveal that manufacturing facilities represent the largest segment for solar rooftop installations, followed by warehousing and distribution centers. The market demonstrates strong correlation between facility size, energy consumption levels, and solar system capacity requirements.

Market maturation is evidenced by increasing standardization of installation processes, improved project financing mechanisms, and growing availability of specialized maintenance services. The emergence of digital platforms for system monitoring and optimization represents a significant trend toward intelligent energy management.

Economic incentives serve as primary market drivers, with industrial facilities seeking to reduce operational expenses through renewable energy adoption. Rising electricity costs from traditional grid sources create compelling business cases for solar rooftop investments, particularly for energy-intensive industrial operations.

Government policy support through renewable energy targets, tax incentives, and feed-in tariffs significantly influences market growth. The Australian Government’s commitment to achieving 82% renewable electricity by 2030 creates favorable regulatory environment for industrial solar adoption. State-level incentives and streamlined approval processes further accelerate market development.

Corporate sustainability mandates increasingly drive solar adoption as companies seek to meet environmental, social, and governance (ESG) commitments. Many multinational corporations operating in Australia have established renewable energy procurement targets, creating consistent demand for industrial solar solutions.

Technology cost reductions continue to improve project economics, with solar panel costs declining significantly over recent years while efficiency improvements enhance energy generation capabilities. Advanced inverter technologies and energy management systems provide additional value through optimized performance and grid integration benefits.

Energy security considerations motivate industrial facilities to reduce grid dependence through on-site generation capabilities. Solar rooftop systems combined with energy storage provide backup power options and protection against grid outages, particularly valuable for critical manufacturing processes.

High upfront capital requirements represent a significant barrier for many industrial facilities, particularly smaller operations with limited access to project financing. Despite declining technology costs, the initial investment for large-scale industrial solar installations remains substantial, requiring careful financial planning and often external funding sources.

Roof structural limitations pose technical challenges for many existing industrial buildings, with older facilities potentially requiring costly structural reinforcements to support solar panel installations. Building age, roof condition, and load-bearing capacity assessments add complexity and potential costs to solar projects.

Grid connection complexities can create delays and additional expenses, particularly for large installations requiring utility coordination and infrastructure upgrades. Network capacity constraints in some regions may limit the ability to export excess solar generation, reducing project economics.

Regulatory uncertainties regarding future policy changes, tariff structures, and grid connection requirements create investment hesitation among some industrial operators. Changes in government incentives or electricity market regulations can significantly impact project viability and return on investment calculations.

Technical integration challenges arise when incorporating solar systems with existing industrial electrical infrastructure, particularly in facilities with complex power requirements or sensitive manufacturing processes. System design and installation must carefully consider operational continuity and safety requirements.

Energy storage integration presents substantial growth opportunities as battery technology costs continue declining while performance improves. Industrial facilities can achieve greater energy independence and optimize solar utilization through strategic storage deployment, creating new market segments for integrated solar-plus-storage solutions.

Corporate renewable energy procurement trends create opportunities for innovative financing and service models, including power purchase agreements, solar leasing, and energy-as-a-service offerings. These models reduce upfront capital requirements while providing predictable energy costs for industrial operators.

Digital transformation in energy management opens opportunities for advanced monitoring, predictive maintenance, and optimization services. Internet of Things (IoT) sensors, artificial intelligence, and machine learning applications can enhance system performance and create new revenue streams for service providers.

Industrial electrification trends, including electric vehicle fleets and process electrification, increase on-site electricity demand and improve solar project economics. Facilities transitioning from fossil fuel-based processes to electric alternatives create larger markets for solar installations.

Green building certifications and sustainability reporting requirements drive demand for renewable energy solutions. Industrial facilities seeking LEED certification, carbon neutrality, or other environmental credentials increasingly view solar installations as essential infrastructure investments.

Supply chain evolution significantly influences market dynamics, with increasing local manufacturing capabilities reducing import dependence and improving project economics. Australian solar panel and component production facilities enhance supply security while supporting domestic employment and reducing transportation costs.

Competitive intensity continues increasing as more companies enter the industrial solar market, driving innovation and cost reductions while improving service quality. Market consolidation trends see larger players acquiring specialized installers and service providers to offer comprehensive solutions.

Technology convergence creates dynamic interactions between solar generation, energy storage, electric vehicle charging, and smart building systems. Industrial facilities increasingly view solar installations as components of integrated energy ecosystems rather than standalone power generation assets.

Financing market maturation improves project accessibility through diverse funding options, including green bonds, sustainability-linked loans, and specialized renewable energy financing products. Financial institutions increasingly recognize industrial solar as low-risk, stable-return investments.

Regulatory evolution toward market-based mechanisms and grid modernization creates new opportunities while requiring adaptive business models. Virtual power plants, peer-to-peer energy trading, and demand response programs offer additional revenue streams for industrial solar installations.

Primary research methodology encompasses comprehensive stakeholder interviews with industrial facility managers, solar installation companies, technology providers, and policy makers across Australia’s major industrial regions. Direct engagement with market participants provides insights into adoption drivers, implementation challenges, and future investment plans.

Secondary research incorporates analysis of government databases, industry association reports, company financial statements, and regulatory filings to establish market sizing, growth trends, and competitive positioning. MarkWide Research analysts utilize multiple data sources to validate findings and ensure comprehensive market coverage.

Quantitative analysis involves statistical modeling of installation data, capacity additions, and investment flows to project market growth trajectories and identify emerging trends. Regional analysis considers state-level policy variations, solar irradiance patterns, and industrial concentration factors.

Qualitative assessment examines technology evolution, business model innovation, and regulatory developments that influence market dynamics beyond quantitative metrics. Expert interviews and industry workshops provide forward-looking perspectives on market evolution and emerging opportunities.

Data validation processes ensure accuracy through cross-referencing multiple sources, conducting follow-up interviews, and applying sensitivity analysis to key assumptions. Regular market monitoring and stakeholder feedback mechanisms maintain research currency and relevance.

Queensland dominates the Australian industrial solar rooftop market with approximately 35% market share, benefiting from excellent solar irradiance conditions, substantial manufacturing base, and supportive state government policies. The region’s food processing, mining services, and logistics industries drive consistent demand for large-scale solar installations.

New South Wales represents the second-largest market with 28% share, supported by the state’s industrial diversity and proximity to major population centers. Manufacturing facilities in the Hunter Valley and Illawarra regions, along with Sydney’s industrial areas, contribute significantly to solar adoption rates.

Victoria accounts for approximately 20% of market activity, with strong growth in automotive manufacturing, food processing, and logistics sectors. The state’s renewable energy targets and industrial energy efficiency programs support continued market expansion despite less favorable solar conditions compared to northern states.

Western Australia captures 12% market share, primarily driven by mining services, resource processing, and manufacturing industries. The state’s abundant solar resources and industrial concentration around Perth create favorable conditions for continued growth.

South Australia and Tasmania represent emerging markets with combined 5% share, showing increasing activity in specialized manufacturing and food processing sectors. These regions benefit from strong renewable energy policies and growing industrial recognition of solar benefits.

Market leadership is distributed among several key players offering comprehensive industrial solar solutions, from system design and installation to ongoing maintenance and optimization services. The competitive environment features both international renewable energy companies and specialized Australian providers.

Competitive differentiation increasingly focuses on service quality, system performance guarantees, and comprehensive energy management solutions rather than purely cost-based competition. Companies are developing specialized expertise in industrial applications and building long-term customer relationships.

By Technology: The market segments into crystalline silicon systems, thin-film technologies, and emerging bifacial panels, with crystalline silicon maintaining 85% market dominance due to proven performance and cost-effectiveness for industrial applications.

By Capacity Range: Installations are categorized into small-scale (100kW-500kW), medium-scale (500kW-2MW), and large-scale (above 2MW) systems, with medium-scale installations representing the fastest-growing segment at 15% annual growth.

By Industry Vertical: Manufacturing leads with 45% market share, followed by warehousing and logistics at 25%, food processing at 15%, and other industrial applications comprising the remainder.

By Installation Type: Rooftop-mounted systems dominate at 90% market share, with ground-mounted and carport installations serving specialized applications where roof space is insufficient or unsuitable.

By Ownership Model: Direct ownership accounts for 60% of installations, while power purchase agreements and leasing arrangements represent 40% and growing as financing options expand.

Manufacturing Facilities represent the largest category, driven by high energy consumption patterns and extensive roof space availability. Food processing, automotive, and chemical manufacturing lead adoption due to operational cost pressures and sustainability commitments.

Warehouse and Distribution Centers show rapid growth as e-commerce expansion drives facility construction and operators seek competitive advantages through reduced operational costs. These facilities often feature ideal roof conditions for solar installations.

Industrial Parks and multi-tenant facilities present unique opportunities for shared solar installations and community energy projects. These developments often incorporate solar as standard infrastructure to attract environmentally conscious tenants.

Mining Services and resource processing facilities in regional areas utilize solar to reduce grid dependence and operational costs. Remote locations often benefit from solar-plus-storage systems for enhanced energy security.

Cold Storage and refrigeration facilities represent a specialized high-growth category due to continuous energy requirements and operational cost sensitivity. Solar installations help offset substantial electricity consumption from cooling systems.

Industrial Facility Owners benefit from reduced electricity costs, improved energy security, and enhanced sustainability credentials. Solar installations provide predictable energy costs over 20-25 year system lifespans while supporting corporate environmental commitments.

Solar Installation Companies access a growing market with substantial project sizes and long-term service opportunities. Industrial clients often require ongoing maintenance and optimization services, creating recurring revenue streams beyond initial installations.

Technology Providers benefit from increasing demand for specialized industrial applications, driving innovation in system design, monitoring capabilities, and integration solutions. The market supports premium pricing for high-performance, reliable systems.

Financial Institutions find attractive investment opportunities in industrial solar projects, which typically offer stable returns and strong security through underlying industrial operations. Green financing products align with sustainability mandates and regulatory requirements.

Government and Regulators achieve renewable energy targets and economic development objectives through industrial solar growth. The sector supports job creation, technology development, and reduced carbon emissions while enhancing energy security.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration emerges as a dominant trend with industrial facilities increasingly adopting smart energy management systems that optimize solar generation, storage, and consumption patterns. Advanced analytics and machine learning applications enhance system performance while reducing operational costs.

Energy Storage Convergence shows accelerating adoption as battery costs decline and performance improves. Industrial facilities are increasingly viewing solar-plus-storage as integrated solutions rather than separate technologies, enabling greater energy independence and grid services participation.

Sustainability Reporting requirements drive systematic adoption of renewable energy solutions as companies face increasing pressure to demonstrate environmental performance. Solar installations provide quantifiable carbon reduction benefits that support corporate sustainability goals and stakeholder expectations.

Financing Innovation continues evolving with new models including energy-as-a-service, green bonds, and sustainability-linked loans. These mechanisms reduce upfront capital requirements while aligning financing costs with environmental performance metrics.

Technology Convergence sees solar installations increasingly integrated with electric vehicle charging infrastructure, building management systems, and industrial process optimization. This holistic approach maximizes energy efficiency and operational benefits.

Major Corporate Commitments have accelerated market growth, with several multinational manufacturers announcing comprehensive renewable energy procurement programs for their Australian operations. These commitments create predictable demand for large-scale industrial solar installations.

Technology Partnerships between solar providers and industrial automation companies are developing integrated solutions that optimize energy consumption patterns with solar generation profiles. These collaborations enhance system value and operational efficiency.

Grid Modernization Initiatives by Australian utilities are improving integration capabilities for industrial solar installations. Smart inverter requirements and virtual power plant programs create new opportunities for system optimization and grid services revenue.

Manufacturing Expansion in Australian solar component production reduces import dependence while supporting local employment. Several international manufacturers have established or expanded Australian operations to serve the growing domestic market.

Regulatory Streamlining efforts by state governments are reducing approval timeframes and compliance costs for industrial solar projects. Standardized connection processes and pre-approved system designs accelerate project development and reduce costs.

Strategic Focus should prioritize comprehensive energy solutions rather than standalone solar installations. MWR analysis indicates that industrial customers increasingly value integrated approaches that address multiple energy needs through combined solar, storage, and energy management systems.

Market Entry strategies should emphasize regional specialization and industry vertical expertise. Companies can achieve competitive advantages by developing deep understanding of specific industrial sectors and their unique energy requirements and operational constraints.

Technology Investment priorities should focus on digital platforms, monitoring systems, and predictive maintenance capabilities. These technologies differentiate service offerings while creating recurring revenue opportunities beyond initial installation projects.

Partnership Development with industrial automation companies, energy management providers, and financing institutions can enhance market positioning and service capabilities. Strategic alliances enable comprehensive solution delivery while sharing development costs and risks.

Geographic Expansion should consider emerging industrial regions and specialized facility types. While established markets offer immediate opportunities, developing expertise in niche applications and regional markets can provide sustainable competitive advantages.

Market trajectory indicates sustained growth driven by continuing cost reductions, technology improvements, and strengthening policy support. The convergence of favorable economics, environmental imperatives, and technology capabilities creates robust foundation for long-term expansion.

Technology evolution will likely focus on system integration, performance optimization, and grid interaction capabilities. Advanced inverters, energy management systems, and predictive analytics will become standard components of industrial solar installations, enhancing value and operational benefits.

Market maturation is expected to bring increased standardization, improved financing options, and enhanced service capabilities. As the market develops, specialized service providers and comprehensive solution offerings will likely emerge to serve diverse industrial requirements.

Policy environment projections suggest continued government support through renewable energy targets and climate commitments. Australia’s net-zero emissions goal by 2050 provides long-term policy certainty that supports sustained investment in industrial renewable energy solutions.

Growth projections indicate the market will maintain strong expansion with annual growth rates exceeding 10% over the next decade. MarkWide Research forecasts that industrial solar adoption will accelerate as technology costs continue declining while performance and reliability improve, making solar installations increasingly attractive for diverse industrial applications across Australia.

Australia’s industrial solar rooftop market represents a dynamic and rapidly expanding sector within the nation’s renewable energy landscape. The convergence of favorable solar resources, supportive government policies, declining technology costs, and increasing corporate sustainability commitments creates a robust foundation for sustained market growth.

Key success factors for market participants include developing comprehensive solution capabilities, building industry-specific expertise, and establishing strong service and support networks. The market rewards companies that can deliver reliable, high-performance systems while providing ongoing optimization and maintenance services.

Future opportunities will likely emerge from technology integration, financing innovation, and expanding industrial applications. As the market matures, successful participants will be those who adapt to evolving customer needs while maintaining focus on performance, reliability, and comprehensive service delivery.

The Australia industrial solar rooftop market is positioned for continued expansion as industrial facilities increasingly recognize solar installations as essential infrastructure investments that deliver economic, environmental, and operational benefits while supporting long-term sustainability objectives.

What is Industrial Solar Rooftop?

Industrial Solar Rooftop refers to the installation of solar panels on the rooftops of industrial buildings to harness solar energy for electricity generation. This technology is increasingly adopted to reduce energy costs and carbon footprints in various industrial sectors.

What are the key players in the Australia Industrial Solar Rooftop Market?

Key players in the Australia Industrial Solar Rooftop Market include companies like SunPower, Trina Solar, and Canadian Solar, which provide solar panel solutions and installation services. These companies are known for their innovative technologies and extensive market reach, among others.

What are the growth factors driving the Australia Industrial Solar Rooftop Market?

The Australia Industrial Solar Rooftop Market is driven by factors such as the increasing demand for renewable energy, government incentives for solar adoption, and the rising cost of traditional energy sources. Additionally, businesses are seeking sustainable solutions to enhance their corporate social responsibility.

What challenges does the Australia Industrial Solar Rooftop Market face?

Challenges in the Australia Industrial Solar Rooftop Market include high initial installation costs, regulatory hurdles, and the need for adequate space on rooftops. Additionally, fluctuations in government policies can impact market stability.

What opportunities exist in the Australia Industrial Solar Rooftop Market?

Opportunities in the Australia Industrial Solar Rooftop Market include advancements in solar technology, such as energy storage solutions, and the potential for increased adoption among small to medium-sized enterprises. The growing focus on sustainability also presents avenues for new market entrants.

What trends are shaping the Australia Industrial Solar Rooftop Market?

Trends in the Australia Industrial Solar Rooftop Market include the integration of smart technologies for energy management and the rise of community solar projects. Additionally, there is a growing emphasis on energy efficiency and carbon neutrality among industrial players.

Australia Industrial Solar Rooftop Market

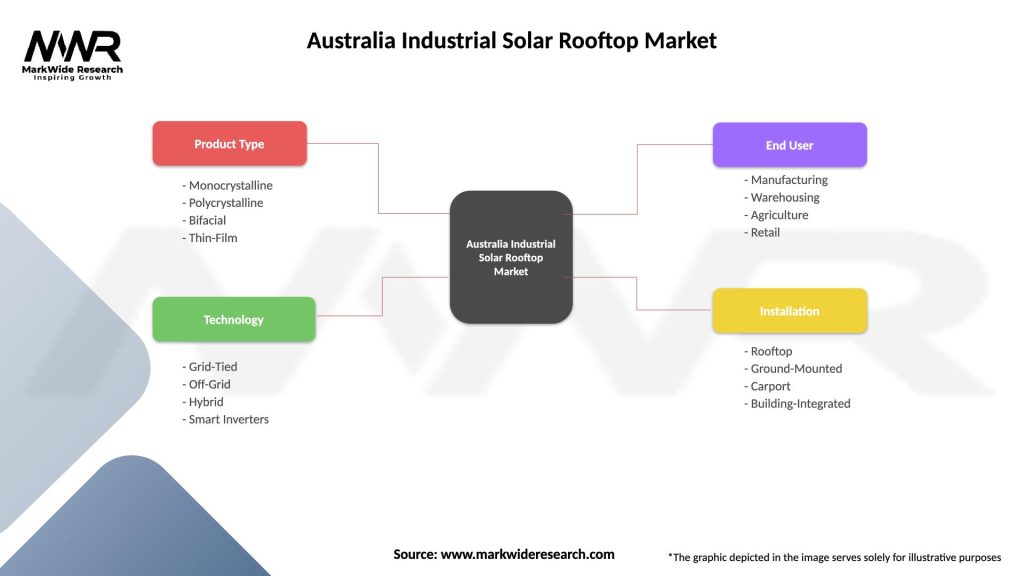

| Segmentation Details | Description |

|---|---|

| Product Type | Monocrystalline, Polycrystalline, Bifacial, Thin-Film |

| Technology | Grid-Tied, Off-Grid, Hybrid, Smart Inverters |

| End User | Manufacturing, Warehousing, Agriculture, Retail |

| Installation | Rooftop, Ground-Mounted, Carport, Building-Integrated |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Industrial Solar Rooftop Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at