444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The group health insurance market in Australia is a significant segment of the country’s insurance industry, providing coverage for medical expenses to groups of individuals, typically employees of organizations. Group health insurance plans offer comprehensive coverage for healthcare services, including hospitalization, outpatient care, prescription drugs, and preventive services. These plans are often provided by employers as part of their employee benefits package, aiming to attract and retain talent while promoting employee health and well-being.

Meaning

Group health insurance refers to a type of health insurance coverage provided to a group of individuals, such as employees of a company, members of an association, or members of a professional organization. These plans offer collective coverage for medical expenses, spreading the risk across a larger pool of individuals and typically providing more affordable premiums compared to individual health insurance policies. Group health insurance plans may be fully funded by the employer, partially funded with contributions from both the employer and employees, or voluntary, where employees can opt-in and pay the premiums themselves.

Executive Summary

The group health insurance market in Australia is witnessing steady growth driven by several factors, including rising healthcare costs, increasing awareness of the importance of health insurance, regulatory reforms, and the growing emphasis on employee health and wellness. Employers recognize the value of offering comprehensive health benefits to attract and retain talent, enhance employee satisfaction and productivity, and demonstrate their commitment to employee well-being. As a result, the demand for group health insurance plans continues to grow, presenting opportunities for insurers to innovate and tailor offerings to meet the evolving needs of employers and employees.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The group health insurance market in Australia operates in a dynamic environment shaped by various internal and external factors, including economic conditions, regulatory changes, technological advancements, and consumer behavior. These dynamics influence market trends, competitive dynamics, and strategic decisions among insurers, employers, and employees, highlighting the need for agility, innovation, and adaptation to stay competitive and meet evolving customer needs.

Regional Analysis

The group health insurance market in Australia exhibits regional variations influenced by factors such as population demographics, industry composition, economic activity, and regulatory frameworks. Major metropolitan areas, including Sydney, Melbourne, Brisbane, and Perth, present significant opportunities for insurers due to their concentration of businesses, workforce demographics, and demand for employee benefits. Regional disparities in healthcare access, affordability, and infrastructure also influence the uptake of group health insurance plans across different regions of Australia.

Competitive Landscape

Leading Companies in Australia Group Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

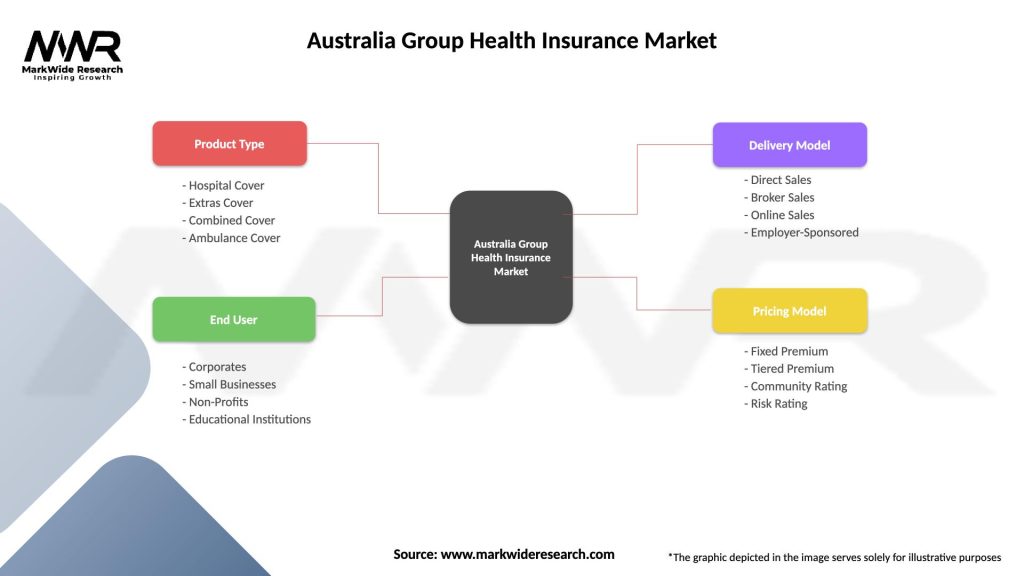

Segmentation

The group health insurance market in Australia can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The group health insurance market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the group health insurance market in Australia:

Understanding these factors through a SWOT analysis helps insurers, employers, and policymakers identify strategic priorities, capitalize on growth opportunities, address challenges, and navigate the dynamic landscape of the group health insurance market in Australia.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the group health insurance market in Australia, influencing consumer behavior, healthcare utilization patterns, and insurer responses:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the group health insurance market in Australia is characterized by opportunities for growth, innovation, and market expansion:

Conclusion

The group health insurance market in Australia is a vital component of the country’s healthcare system, providing essential coverage for employees, families, and employer groups. With the increasing focus on employee health and wellness, digital transformation, and regulatory reforms, the market presents significant opportunities for insurers to innovate, differentiate, and meet the evolving needs of employers and employees. By embracing wellness initiatives, digital technologies, and customer-centric approaches, insurers can drive growth, improve outcomes, and contribute to the health and well-being of individuals and communities across Australia.

What is Group Health Insurance?

Group Health Insurance refers to a health coverage plan that provides benefits to a group of people, typically employees of a company or members of an organization. This type of insurance often offers lower premiums and broader coverage options compared to individual plans.

What are the key players in the Australia Group Health Insurance Market?

Key players in the Australia Group Health Insurance Market include Medibank, Bupa Australia, and HCF. These companies offer a range of health insurance products tailored to group needs, including corporate health plans and employee benefits, among others.

What are the growth factors driving the Australia Group Health Insurance Market?

The growth of the Australia Group Health Insurance Market is driven by increasing healthcare costs, a growing awareness of health and wellness among employees, and the rising demand for comprehensive employee benefits packages. Additionally, the shift towards preventive healthcare is influencing group insurance offerings.

What challenges does the Australia Group Health Insurance Market face?

The Australia Group Health Insurance Market faces challenges such as regulatory changes, rising claims costs, and competition from alternative health coverage options. These factors can impact pricing strategies and the sustainability of insurance providers.

What opportunities exist in the Australia Group Health Insurance Market?

Opportunities in the Australia Group Health Insurance Market include the expansion of digital health solutions, the integration of telehealth services, and the increasing focus on mental health coverage. These trends can enhance the value of group health plans and attract more clients.

What trends are shaping the Australia Group Health Insurance Market?

Trends shaping the Australia Group Health Insurance Market include a growing emphasis on personalized health plans, the adoption of wellness programs, and the use of technology for claims processing and customer engagement. These innovations are transforming how group health insurance is delivered and managed.

Australia Group Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hospital Cover, Extras Cover, Combined Cover, Ambulance Cover |

| End User | Corporates, Small Businesses, Non-Profits, Educational Institutions |

| Delivery Model | Direct Sales, Broker Sales, Online Sales, Employer-Sponsored |

| Pricing Model | Fixed Premium, Tiered Premium, Community Rating, Risk Rating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Australia Group Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at