444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia gluten free food market represents one of the most dynamic and rapidly expanding segments within the country’s food and beverage industry. Market dynamics indicate substantial growth driven by increasing consumer awareness of celiac disease, gluten sensitivity, and health-conscious dietary choices. The market encompasses a diverse range of products including gluten-free bread, pasta, cereals, snacks, and bakery items that cater to both medically necessary and lifestyle-driven consumption patterns.

Consumer adoption rates have accelerated significantly, with approximately 12% of Australian households regularly purchasing gluten-free products despite only 1% of the population being diagnosed with celiac disease. This disparity highlights the broader appeal of gluten-free foods among health-conscious consumers seeking perceived wellness benefits. Retail penetration has expanded beyond specialty health food stores to mainstream supermarkets, convenience stores, and online platforms, making gluten-free products more accessible to diverse consumer segments.

Product innovation continues to drive market evolution, with manufacturers investing heavily in improving taste, texture, and nutritional profiles of gluten-free alternatives. The market benefits from Australia’s strong agricultural foundation, particularly in alternative grains like quinoa, rice, and ancient grains, which serve as key ingredients in gluten-free product formulations. Premium positioning characterizes many gluten-free products, reflecting higher production costs and specialized manufacturing processes required to maintain gluten-free certification standards.

The Australia gluten free food market refers to the comprehensive ecosystem of food products, ingredients, and beverages that are specifically formulated, processed, and certified to contain less than 20 parts per million of gluten proteins. This market encompasses products designed for individuals with celiac disease, non-celiac gluten sensitivity, and consumers who choose gluten-free diets for perceived health benefits or lifestyle preferences.

Gluten-free certification in Australia follows strict regulatory standards established by Food Standards Australia New Zealand (FSANZ), ensuring products meet safety requirements for consumers with gluten-related disorders. The market includes naturally gluten-free foods such as fruits, vegetables, meats, and dairy products, as well as specially manufactured alternatives to traditional wheat-based products like bread, pasta, and baked goods.

Market participants range from multinational food corporations to specialized gluten-free manufacturers, artisanal bakeries, and emerging startups focused on innovative gluten-free formulations. The ecosystem also includes ingredient suppliers, testing laboratories, certification bodies, and distribution networks that support the entire value chain from production to consumer delivery.

Strategic analysis reveals the Australia gluten-free food market as a high-growth sector characterized by evolving consumer preferences, technological innovations, and expanding distribution channels. The market demonstrates resilience and consistent expansion, driven by both medical necessity and lifestyle choices among Australian consumers.

Key growth drivers include increasing diagnosis rates of celiac disease and gluten sensitivity, rising health consciousness, improved product quality, and enhanced availability across retail channels. Approximately 68% of gluten-free purchases are driven by health and wellness motivations rather than medical necessity, indicating significant market potential beyond the core celiac population.

Competitive landscape features a mix of established food manufacturers adapting their portfolios and specialized gluten-free companies capturing market share through innovation and targeted marketing. Product diversification has expanded beyond basic staples to include premium artisanal products, convenience foods, and restaurant-quality options that appeal to broader consumer segments.

Market challenges include higher production costs, supply chain complexities, and the need for continuous innovation to improve taste and texture profiles. However, growth projections remain positive, supported by demographic trends, increasing awareness, and ongoing product development initiatives that address consumer preferences for healthier, more convenient food options.

Consumer behavior analysis reveals distinct purchasing patterns and preferences that shape market dynamics across Australia’s gluten-free food sector:

Health awareness expansion serves as the primary catalyst driving Australia’s gluten-free food market growth. Increasing consumer education about gluten-related disorders, combined with broader wellness trends, has created substantial demand beyond the medically necessary consumer base. Medical professionals increasingly recommend gluten-free diets for various digestive issues, expanding the potential consumer population significantly.

Demographic shifts contribute meaningfully to market expansion, particularly among millennials and Generation Z consumers who prioritize health-conscious food choices. These demographics demonstrate higher willingness to experiment with alternative diets and pay premium prices for products aligned with their wellness goals. Urban populations show particularly strong adoption rates, driven by higher disposable incomes and greater access to diverse product offerings.

Product innovation acceleration has addressed historical challenges related to taste, texture, and nutritional content of gluten-free alternatives. Manufacturers have invested significantly in research and development, creating products that closely mimic conventional counterparts while offering additional nutritional benefits. Technology advancement in food processing has enabled better ingredient combinations and improved manufacturing techniques.

Retail accessibility improvements have transformed market dynamics by making gluten-free products available through mainstream channels. Major supermarket chains now dedicate significant shelf space to gluten-free sections, while online platforms provide convenient access to specialized products. Supply chain optimization has reduced distribution costs and improved product freshness, enhancing overall consumer experience and market penetration.

Cost considerations remain a significant barrier to broader market adoption, as gluten-free products typically command premium pricing compared to conventional alternatives. Higher production costs stem from specialized ingredients, dedicated manufacturing facilities, rigorous testing requirements, and smaller production volumes that limit economies of scale. Price sensitivity among certain consumer segments restricts market penetration, particularly in lower-income demographics.

Taste and texture challenges continue to limit consumer acceptance despite significant improvements in product formulations. Many gluten-free alternatives still struggle to replicate the sensory experience of traditional wheat-based products, leading to consumer disappointment and reduced repeat purchases. Product consistency issues across different brands and batches create uncertainty among consumers seeking reliable alternatives.

Limited product variety in certain categories constrains market growth, particularly in specialized ethnic foods, artisanal products, and restaurant-style prepared foods. Consumers often face restricted choices compared to conventional product categories, limiting their ability to maintain diverse and satisfying diets. Innovation gaps exist in specific product segments where gluten-free alternatives remain underdeveloped or unavailable.

Supply chain complexities create challenges for manufacturers and retailers, including cross-contamination risks, specialized storage requirements, and limited supplier networks for gluten-free ingredients. Regulatory compliance demands significant resources for testing, certification, and documentation, particularly for smaller manufacturers entering the market. These operational challenges can limit product availability and increase costs throughout the value chain.

Export potential represents a substantial opportunity for Australian gluten-free food manufacturers, leveraging the country’s reputation for high-quality agricultural products and food safety standards. Growing international demand for gluten-free products, particularly in Asian markets, creates opportunities for Australian companies to expand beyond domestic boundaries. Premium positioning of Australian-made products can command favorable pricing in export markets.

Foodservice sector expansion offers significant growth potential as restaurants, cafes, and institutional food providers increasingly incorporate gluten-free options into their menus. Tourism industry growth creates demand for gluten-free dining options, while workplace catering and healthcare institutions recognize the need for inclusive menu offerings. This sector expansion requires specialized products designed for commercial food preparation.

Technology integration presents opportunities for enhanced consumer engagement through mobile applications, personalized nutrition platforms, and direct-to-consumer delivery services. Digital marketing strategies can effectively reach target demographics while building brand communities around gluten-free lifestyles. E-commerce platforms enable specialized manufacturers to reach niche consumer segments without traditional retail barriers.

Product category diversification remains largely untapped, with opportunities in frozen foods, beverages, confectionery, and ethnic cuisine adaptations. Functional foods combining gluten-free attributes with additional health benefits like probiotics, protein enhancement, or vitamin fortification appeal to health-conscious consumers. Sustainable packaging and environmentally friendly production methods align with consumer values and create differentiation opportunities.

Supply and demand equilibrium in Australia’s gluten-free food market reflects complex interactions between consumer preferences, production capabilities, and distribution networks. Demand patterns show consistent growth across most product categories, with particularly strong performance in convenience foods and premium artisanal products. Supply responses have generally kept pace with demand, though certain specialized products experience periodic shortages.

Competitive intensity has increased significantly as more manufacturers enter the market, leading to improved product quality and more competitive pricing strategies. Market consolidation trends emerge as larger food companies acquire specialized gluten-free brands to expand their portfolios and capture market share. This consolidation brings resources for innovation and distribution while potentially reducing product diversity.

Consumer education efforts by manufacturers, health organizations, and advocacy groups continue to expand market awareness and drive adoption rates. Medical community support through healthcare provider recommendations and nutritionist endorsements legitimizes gluten-free diets beyond celiac disease treatment. These educational initiatives create more informed consumers who make deliberate purchasing decisions.

Regulatory environment stability provides confidence for long-term investment in the sector, while ongoing refinements to labeling requirements and certification standards enhance consumer trust. Industry collaboration through trade associations and research partnerships accelerates innovation and addresses common challenges like ingredient sourcing and manufacturing best practices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Australia’s gluten-free food market dynamics. Primary research includes consumer surveys, industry interviews, and focus groups conducted across major Australian metropolitan areas to capture diverse demographic perspectives and purchasing behaviors.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to establish market trends and competitive positioning. Data triangulation methods validate findings across multiple sources, ensuring consistency and reliability of market insights and projections.

Quantitative analysis utilizes statistical modeling to identify correlations between market drivers, consumer behaviors, and sales performance across different product categories and geographic regions. Qualitative assessment provides deeper understanding of consumer motivations, brand perceptions, and emerging trends that influence purchasing decisions.

Industry expert consultation includes interviews with manufacturers, retailers, nutritionists, and regulatory specialists to gain professional perspectives on market challenges and opportunities. Continuous monitoring of market developments ensures research findings remain current and relevant to evolving industry conditions and consumer preferences.

New South Wales dominates the Australian gluten-free food market, accounting for approximately 35% of national consumption, driven by Sydney’s large population and high concentration of health-conscious consumers. The state benefits from extensive retail infrastructure, diverse product availability, and strong presence of both domestic and international gluten-free brands. Premium product segments perform particularly well in affluent Sydney suburbs and coastal regions.

Victoria represents the second-largest regional market with roughly 28% market share, centered around Melbourne’s cosmopolitan food culture and strong café society. The state shows high adoption rates for artisanal and specialty gluten-free products, supported by a vibrant restaurant scene that increasingly accommodates gluten-free dining preferences. Innovation hubs in Melbourne foster development of new gluten-free product concepts and brands.

Queensland demonstrates strong growth potential with 18% of national market share, driven by population growth and increasing health awareness among residents. Brisbane and Gold Coast markets show particular strength in convenience and ready-to-eat gluten-free products. Tourism influence creates demand for gluten-free options in hospitality and foodservice sectors throughout the state.

Western Australia accounts for approximately 12% of market share, with Perth showing concentrated demand for premium gluten-free products. The state’s geographic isolation creates opportunities for local manufacturers while presenting distribution challenges for eastern states producers. Mining industry workforce demographics contribute to demand for convenient, shelf-stable gluten-free products.

South Australia and Tasmania together represent 7% of national consumption, with Adelaide and Hobart markets showing steady growth in gluten-free adoption. These markets demonstrate strong preference for locally-produced and artisanal gluten-free products, supporting regional manufacturers and specialty food producers.

Market leadership in Australia’s gluten-free food sector features a diverse mix of multinational corporations, specialized gluten-free manufacturers, and emerging innovative brands competing across various product categories and price points.

Competitive strategies vary significantly, with multinational companies leveraging distribution networks and marketing resources while specialized manufacturers focus on product innovation and quality differentiation. Brand positioning ranges from premium artisanal products to accessible mainstream alternatives, creating multiple market segments with distinct competitive dynamics.

Product category segmentation reveals distinct market dynamics and growth patterns across the Australia gluten-free food market:

By Product Type:

By Distribution Channel:

By Consumer Type:

Bakery products represent the most challenging yet potentially rewarding category within Australia’s gluten-free market. Consumer expectations for bread, pastries, and baked goods remain exceptionally high, requiring manufacturers to achieve taste and texture profiles that closely match wheat-based alternatives. Recent innovations in flour blending and fermentation techniques have significantly improved product quality, leading to increased consumer acceptance and repeat purchases.

Pasta and grain products demonstrate strong performance due to successful ingredient innovations utilizing rice, quinoa, and legume-based formulations. Nutritional enhancement through protein-rich ingredients appeals to health-conscious consumers seeking functional benefits beyond gluten avoidance. This category benefits from relatively simple preparation methods and versatile meal applications that integrate easily into existing cooking routines.

Snack foods show exceptional growth potential as manufacturers develop products that compete directly with conventional snacks on taste and convenience. Premium positioning allows for higher margins while appealing to consumers seeking healthier snacking alternatives. Innovation in flavoring and texture creates differentiation opportunities in this competitive category.

Prepared and convenience foods represent an emerging high-growth segment addressing busy lifestyles and increasing demand for ready-to-eat options. Frozen food innovations have overcome previous quality limitations, while shelf-stable products provide convenience for consumers with limited access to fresh gluten-free alternatives. This category requires significant investment in product development and specialized packaging solutions.

Manufacturers benefit from premium pricing opportunities and strong consumer loyalty once product quality meets expectations. The gluten-free market offers differentiation from commodity food products and creates barriers to entry through specialized knowledge and manufacturing requirements. Innovation opportunities allow companies to develop proprietary formulations and build competitive advantages through superior taste and texture profiles.

Retailers gain from higher margin products and the ability to attract health-conscious consumer segments seeking specialized products. Gluten-free sections create destination shopping experiences that increase overall basket size and customer loyalty. Private label opportunities enable retailers to capture additional value while providing affordable alternatives to premium branded products.

Consumers benefit from expanding product variety, improved quality, and increasing accessibility through mainstream retail channels. Health outcomes improve for individuals with gluten-related disorders, while lifestyle consumers gain access to products aligned with their wellness goals. Competitive market dynamics drive continuous improvement in taste, texture, and nutritional profiles.

Healthcare providers benefit from improved patient compliance with gluten-free dietary recommendations due to better product availability and quality. Nutritional counseling becomes more effective when patients have access to satisfying alternatives that support long-term dietary adherence. The expanding market provides more options for creating balanced, enjoyable gluten-free meal plans.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement significantly influences product development across Australia’s gluten-free food market, with consumers increasingly demanding products made from recognizable, natural ingredients. Ingredient transparency has become a key differentiator, driving manufacturers to simplify formulations and eliminate artificial additives, preservatives, and complex chemical names from product labels.

Plant-based integration creates convergence between gluten-free and vegan dietary trends, opening new market opportunities for products that address multiple dietary restrictions simultaneously. Protein enhancement through legumes, nuts, and seeds appeals to consumers seeking functional nutrition benefits beyond gluten avoidance, particularly among fitness-conscious demographics.

Artisanal and craft positioning gains momentum as consumers seek premium, small-batch products that offer unique flavors and superior quality compared to mass-produced alternatives. Local sourcing stories and traditional production methods create emotional connections with consumers willing to pay premium prices for authentic, high-quality products.

Convenience innovation drives development of grab-and-go products, meal kits, and ready-to-eat options that fit busy lifestyles without compromising dietary requirements. Packaging advancement focuses on portion control, freshness preservation, and sustainable materials that align with environmental consciousness among target consumers.

Digital engagement through social media, mobile apps, and online communities builds brand loyalty and provides platforms for consumer education, recipe sharing, and lifestyle content that extends beyond product sales to create comprehensive brand experiences.

Manufacturing technology advancement has revolutionized gluten-free food production through improved mixing techniques, fermentation processes, and ingredient binding methods that enhance texture and taste profiles. MarkWide Research analysis indicates these technological improvements have contributed to significant quality improvements across most product categories, leading to higher consumer satisfaction and repeat purchase rates.

Supply chain optimization initiatives have addressed historical challenges related to ingredient sourcing, cross-contamination prevention, and distribution efficiency. Major manufacturers have invested in dedicated gluten-free production facilities and specialized logistics networks to ensure product integrity and reduce costs throughout the value chain.

Retail partnership expansion has transformed market accessibility, with major supermarket chains dedicating increased shelf space to gluten-free products and developing comprehensive private label ranges. Online platform integration provides consumers with convenient access to specialized products while enabling smaller manufacturers to reach national markets without traditional distribution barriers.

International collaboration has increased through joint ventures, licensing agreements, and technology sharing between Australian manufacturers and global gluten-free specialists. These partnerships accelerate innovation, improve production efficiency, and create opportunities for export market expansion, particularly in the growing Asian gluten-free market.

Certification standardization efforts have streamlined compliance processes while maintaining rigorous safety standards, reducing barriers for new market entrants and improving consumer confidence in product claims and labeling accuracy.

Product innovation focus should prioritize taste and texture improvements while maintaining clean label principles that resonate with health-conscious consumers. Investment in research and development remains critical for manufacturers seeking to differentiate their products and build sustainable competitive advantages in an increasingly crowded marketplace.

Distribution strategy expansion should encompass both traditional retail channels and emerging online platforms to maximize market reach and consumer accessibility. Foodservice sector engagement presents significant growth opportunities for manufacturers willing to develop products specifically designed for commercial food preparation and restaurant applications.

Consumer education initiatives should continue to build awareness of gluten-free benefits while addressing misconceptions about taste, nutrition, and value propositions. Brand building efforts must focus on creating emotional connections with consumers through storytelling, community engagement, and lifestyle positioning that extends beyond functional product benefits.

Supply chain resilience requires continued investment in specialized sourcing relationships, quality control systems, and risk management strategies to ensure consistent product availability and quality standards. Sustainability integration should address packaging, sourcing, and production methods to align with growing environmental consciousness among target consumers.

Market segmentation strategies should recognize distinct consumer groups with different motivations, preferences, and price sensitivities to optimize product positioning and marketing approaches for maximum effectiveness and return on investment.

Growth trajectory for Australia’s gluten-free food market remains strongly positive, supported by demographic trends, increasing health awareness, and continuous product innovation. MWR projections indicate sustained expansion across most product categories, with particularly strong performance expected in convenience foods, premium artisanal products, and functional nutrition segments.

Technology integration will continue transforming market dynamics through improved manufacturing processes, personalized nutrition platforms, and direct-to-consumer delivery models that enhance convenience and consumer engagement. Artificial intelligence applications in product development and consumer behavior analysis will enable more targeted innovation and marketing strategies.

International expansion opportunities will grow as Australian manufacturers leverage their reputation for quality and food safety to enter emerging markets, particularly in Asia where gluten-free awareness is increasing rapidly. Export growth potential could reach 15-20% annually in key target markets over the next five years.

Market maturation will likely lead to consolidation among smaller players while creating opportunities for specialized manufacturers to establish strong niche positions. Premium segment growth is expected to outpace mainstream categories as consumers become more sophisticated in their product preferences and quality expectations.

Regulatory evolution may introduce new standards for functional claims, sustainability requirements, and international trade facilitation that will shape competitive dynamics and market structure. Companies that proactively adapt to these changes will be best positioned for long-term success in the evolving marketplace.

The Australia gluten free food market represents a dynamic and rapidly evolving sector with substantial growth potential driven by health consciousness, product innovation, and expanding consumer acceptance. Market fundamentals remain strong, supported by both medical necessity and lifestyle-driven demand that creates a diverse and resilient consumer base.

Competitive dynamics continue to intensify as more manufacturers enter the market, leading to improved product quality, expanded variety, and more competitive pricing strategies that benefit consumers. Innovation leadership will remain critical for companies seeking to establish sustainable competitive advantages in this premium market segment.

Future success will depend on manufacturers’ ability to balance quality improvements with cost management while expanding distribution channels and building strong brand relationships with increasingly sophisticated consumers. The market’s evolution toward mainstream acceptance creates both opportunities and challenges that require strategic adaptation and continuous investment in product development and consumer engagement initiatives.

What is Gluten Free Food?

Gluten Free Food refers to products that do not contain gluten, a protein found in wheat, barley, and rye. These foods are essential for individuals with celiac disease or gluten sensitivity, and they include a variety of grains, fruits, vegetables, and specially processed products.

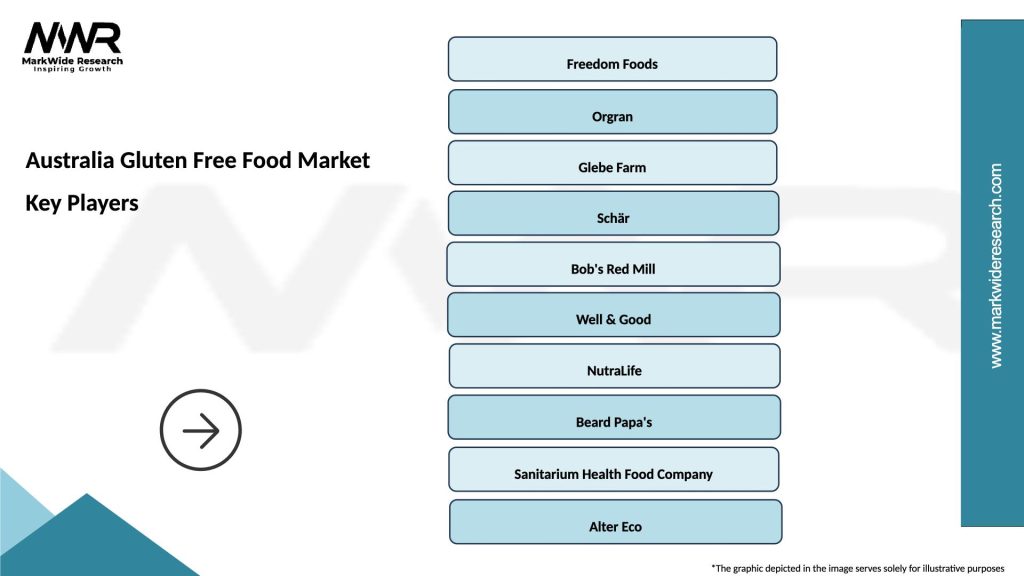

What are the key companies in the Australia Gluten Free Food Market?

Key companies in the Australia Gluten Free Food Market include Freedom Foods, Orgran, and Well & Good, among others. These companies offer a range of gluten-free products, including snacks, cereals, and baked goods.

What are the growth factors driving the Australia Gluten Free Food Market?

The growth of the Australia Gluten Free Food Market is driven by increasing awareness of gluten-related disorders, a rising trend towards healthier eating, and the expanding availability of gluten-free products in retail and online channels.

What challenges does the Australia Gluten Free Food Market face?

Challenges in the Australia Gluten Free Food Market include the higher cost of gluten-free products compared to their gluten-containing counterparts and the risk of cross-contamination during food processing. Additionally, consumer skepticism about the health benefits of gluten-free diets can hinder market growth.

What opportunities exist in the Australia Gluten Free Food Market?

Opportunities in the Australia Gluten Free Food Market include the potential for product innovation, such as the development of new gluten-free snacks and meals, and the growing demand for gluten-free options in restaurants and food service establishments.

What trends are shaping the Australia Gluten Free Food Market?

Trends shaping the Australia Gluten Free Food Market include the rise of plant-based gluten-free products, increased focus on clean label ingredients, and the popularity of online shopping for gluten-free foods. Consumers are also seeking more diverse and flavorful gluten-free options.

Australia Gluten Free Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Breads, Snacks, Pasta, Cereals |

| Distribution Channel | Supermarkets, Health Food Stores, Online Retail, Specialty Shops |

| End User | Individuals, Restaurants, Cafes, Bakeries |

| Packaging Type | Bags, Boxes, Tins, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Gluten Free Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at