444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Australia Forex cards market serves as a vital component of the financial ecosystem, facilitating seamless international transactions and currency management for individuals, businesses, and travelers. Forex cards, also known as travel cards or currency cards, offer Australians a convenient and secure means of dealing with foreign exchange. These prepaid cards are designed to enhance flexibility, cost-effectiveness, and ease of use when handling multiple currencies.

Meaning: Forex cards, short for foreign exchange cards, are prepaid payment cards enabling users to load multiple currencies onto a single card. Australians widely utilize these cards for international travel, online transactions in foreign currencies, and as a practical tool for managing currency exposure. Forex cards offer advantages such as competitive exchange rates, reduced transaction fees, and enhanced security compared to traditional forms of currency exchange.

Executive Summary: The Australia Forex cards market has experienced significant growth, driven by factors such as the country’s globalized business landscape, increasing international travel, and the surge in online cross-border transactions. These versatile financial instruments provide users with the ability to transact in multiple currencies without the need for physical cash. Understanding the key market insights, drivers, and emerging trends is essential for both consumers and financial institutions participating in this dynamic market.

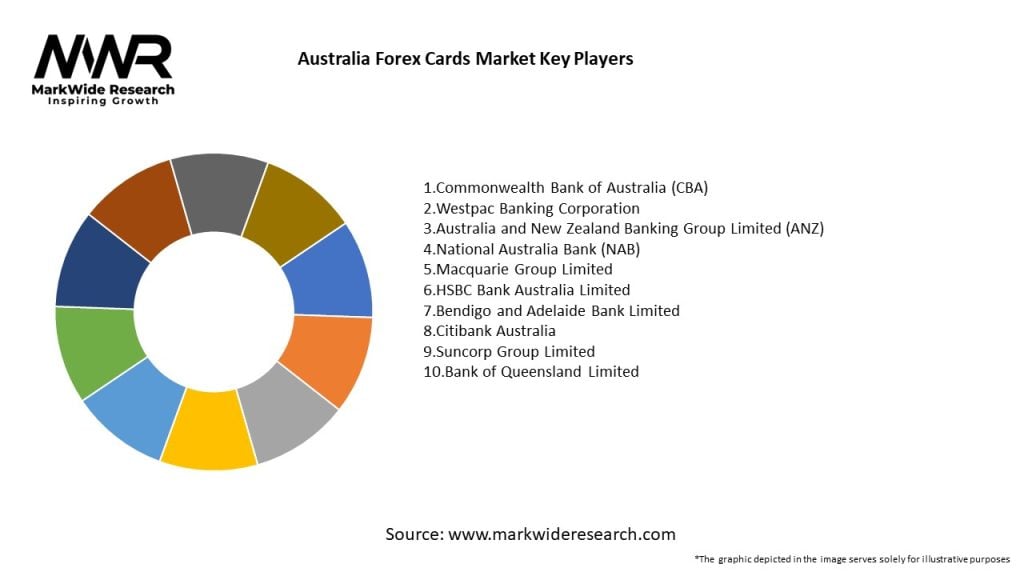

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Australia Forex cards market operates in a dynamic environment influenced by factors such as economic conditions, travel trends, technological advancements, and regulatory changes. Understanding these dynamics is crucial for financial institutions and card issuers to adapt their offerings and strategies to meet evolving consumer needs.

Regional Analysis: Regional variations within the Australia Forex cards market may be influenced by factors such as travel patterns, economic activities, and cultural preferences. Financial institutions should tailor their marketing and product strategies to cater to the unique requirements of different regions within Australia.

Competitive Landscape:

Leading Companies in the Australia Forex Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Australia Forex cards market can be segmented based on various factors, including card types (travel cards, business cards), currency offerings, and targeted user segments (individuals, businesses, frequent travelers). Tailoring Forex card offerings to specific user needs can enhance market competitiveness.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides an overview of the Australia Forex cards market’s strengths, weaknesses, opportunities, and threats.

Understanding these factors through a SWOT analysis allows financial institutions to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate potential threats in the Australia Forex cards market.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has had a notable impact on the Australia Forex cards market, influencing travel patterns, international business activities, and consumer behavior.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Australia Forex cards market is characterized by ongoing technological innovations, strategic partnerships, and a focus on meeting the evolving needs of consumers and businesses engaged in international transactions.

Conclusion: The Australia Forex cards market continues to evolve as a key component of the financial landscape, providing individuals and businesses with efficient and secure solutions for international transactions. As technology advances, travel patterns change, and consumer preferences shift, financial institutions have the opportunity to innovate, differentiate, and contribute to the growth and transformation of the Forex cards market. By staying responsive to market dynamics, embracing technological advancements, and prioritizing customer-centric solutions, stakeholders in the Australia Forex cards market are well-positioned for a dynamic and promising future.

What is Forex Cards?

Forex cards, also known as travel cards or prepaid currency cards, are financial instruments that allow travelers to load multiple currencies onto a single card for use abroad. They provide a convenient and secure way to manage foreign currency expenses while traveling.

What are the key players in the Australia Forex Cards Market?

The Australia Forex Cards Market features several key players, including Commonwealth Bank, ANZ, and Westpac, which offer a variety of forex card options tailored for travelers. These companies compete on features such as exchange rates, fees, and customer service, among others.

What are the growth factors driving the Australia Forex Cards Market?

The growth of the Australia Forex Cards Market is driven by increasing international travel, the rising demand for secure payment methods, and the convenience of managing multiple currencies. Additionally, the expansion of online travel services has further fueled the adoption of forex cards.

What challenges does the Australia Forex Cards Market face?

The Australia Forex Cards Market faces challenges such as fluctuating exchange rates, competition from digital wallets, and regulatory compliance issues. These factors can impact the profitability and attractiveness of forex cards for consumers.

What opportunities exist in the Australia Forex Cards Market?

Opportunities in the Australia Forex Cards Market include the potential for product innovation, such as enhanced digital features and integration with mobile payment systems. Additionally, targeting niche markets like business travelers and expatriates can lead to increased adoption.

What trends are shaping the Australia Forex Cards Market?

Trends in the Australia Forex Cards Market include the growing preference for contactless payments, the integration of advanced technology for real-time currency conversion, and the increasing focus on customer-centric services. These trends are reshaping how consumers use forex cards while traveling.

Australia Forex Cards Market

| Segmentation Details | Description |

|---|---|

| Card Type | Prepaid Cards, Virtual Cards, Reloadable Cards, Single Currency Cards |

| Target Customer | Travelers, Students, Business Professionals, Expatriates |

| Distribution Channel | Online Platforms, Retail Outlets, Banks, Travel Agencies |

| Currency Offered | USD, EUR, GBP, AUD |

Leading Companies in the Australia Forex Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at