444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia engineering plastics market represents a dynamic and rapidly evolving sector within the country’s manufacturing and industrial landscape. Engineering plastics have become indispensable materials across diverse industries, offering superior mechanical properties, chemical resistance, and thermal stability compared to conventional plastics. The Australian market demonstrates robust growth potential, driven by increasing demand from automotive, electronics, aerospace, and construction sectors.

Market dynamics indicate substantial expansion opportunities, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% over the forecast period. This growth trajectory reflects Australia’s strategic focus on advanced manufacturing capabilities and the increasing adoption of high-performance materials across critical applications. The market encompasses various polymer types including polyamides, polycarbonates, polyoxymethylene, and thermoplastic polyesters, each serving specific industrial requirements.

Regional distribution shows concentrated activity in major industrial hubs, with New South Wales and Victoria accounting for approximately 65% of market demand. The mining sector’s influence on material requirements, combined with Australia’s growing automotive manufacturing base, creates unique market conditions that differentiate it from other Asia-Pacific regions.

The Australia engineering plastics market refers to the comprehensive ecosystem encompassing the production, distribution, and application of high-performance polymer materials specifically designed for demanding industrial applications. These advanced materials exhibit exceptional mechanical strength, dimensional stability, and resistance to environmental factors, making them suitable for precision components and critical applications.

Engineering plastics distinguish themselves from commodity plastics through their superior performance characteristics, including enhanced temperature resistance, chemical inertness, and structural integrity under stress. In the Australian context, these materials serve as essential components in industries ranging from mining equipment manufacturing to aerospace component production, reflecting the country’s diverse industrial base and technological advancement requirements.

Strategic analysis reveals the Australia engineering plastics market as a cornerstone of the nation’s advanced manufacturing sector, characterized by steady growth and increasing technological sophistication. The market benefits from Australia’s robust industrial infrastructure, skilled workforce, and strategic geographic position within the Asia-Pacific region.

Key growth drivers include the expanding automotive sector, which accounts for approximately 28% of total engineering plastics consumption, and the burgeoning electronics industry. The mining sector’s continued modernization efforts contribute significantly to demand for high-performance materials capable of withstanding harsh operating conditions. Additionally, the construction industry’s shift toward lightweight, durable materials supports sustained market expansion.

Competitive landscape features a mix of international suppliers and domestic manufacturers, with market leadership concentrated among established polymer producers. Innovation focuses on developing materials with enhanced sustainability profiles while maintaining superior performance characteristics, aligning with Australia’s environmental regulations and corporate sustainability initiatives.

Market intelligence reveals several critical insights shaping the Australia engineering plastics landscape:

Primary growth catalysts propelling the Australia engineering plastics market include several interconnected factors that create sustained demand across multiple sectors. The automotive industry’s transformation toward electric vehicles and lightweight construction drives substantial material requirements, with engineering plastics offering optimal strength-to-weight ratios essential for modern vehicle design.

Industrial modernization across Australia’s manufacturing base necessitates advanced materials capable of meeting increasingly stringent performance requirements. The mining sector’s ongoing equipment upgrades create demand for materials that withstand corrosive environments, extreme temperatures, and mechanical stress. Additionally, the electronics industry’s rapid expansion, particularly in telecommunications infrastructure and consumer devices, requires precision-engineered components with excellent electrical properties.

Government initiatives supporting advanced manufacturing and technology development provide additional market stimulus. Investment in research and development facilities, combined with incentives for domestic production, encourages market expansion and technological innovation. The construction sector’s adoption of modern building techniques and materials further contributes to sustained demand growth.

Significant challenges facing the Australia engineering plastics market include cost pressures associated with high-performance materials and complex manufacturing processes. The premium pricing of engineering plastics compared to conventional materials can limit adoption in cost-sensitive applications, particularly among smaller manufacturers with limited budgets.

Supply chain vulnerabilities represent another critical constraint, as Australia’s geographic isolation and dependence on imported raw materials create potential disruption risks. Fluctuating petroleum prices directly impact polymer production costs, affecting market stability and pricing predictability. Additionally, the limited domestic production capacity for certain specialized grades creates dependency on international suppliers.

Technical barriers include the complexity of processing engineering plastics, which requires specialized equipment and expertise. Many manufacturers face challenges in adapting existing production lines to handle high-performance materials, necessitating significant capital investments. Environmental regulations, while driving innovation, also impose additional compliance costs and processing requirements that can constrain market growth.

Emerging opportunities within the Australia engineering plastics market present substantial potential for growth and innovation. The renewable energy sector’s expansion creates demand for materials capable of withstanding outdoor exposure and mechanical stress in wind turbines, solar panel components, and energy storage systems. This sector alone represents a growing market segment with 15% annual expansion potential.

Advanced manufacturing initiatives supported by government investment programs offer opportunities for domestic production expansion and technology development. The establishment of specialized manufacturing facilities could reduce import dependency while creating high-value employment opportunities. Additionally, the growing emphasis on circular economy principles opens avenues for recycling and reprocessing technologies.

Export potential to neighboring Asia-Pacific markets presents significant opportunities, leveraging Australia’s quality reputation and strategic location. The medical device sector’s growth, accelerated by aging population demographics, creates demand for biocompatible engineering plastics. Furthermore, aerospace industry development, including space technology initiatives, requires specialized materials with exceptional performance characteristics.

Complex interactions between supply and demand factors shape the Australia engineering plastics market’s evolution. Raw material availability and pricing fluctuations create dynamic conditions that influence manufacturer decisions and end-user adoption patterns. The market demonstrates resilience through diversified application bases, with growth in one sector often compensating for temporary declines in others.

Technological advancement drives continuous market evolution, with new polymer formulations and processing techniques expanding application possibilities. According to MarkWide Research analysis, innovation cycles typically span 3-5 years, during which new materials gain market acceptance and achieve commercial viability. This dynamic creates opportunities for early adopters while challenging existing market participants to maintain competitiveness.

Competitive pressures intensify as international suppliers expand their Australian presence, while domestic manufacturers seek to capture greater market share through specialization and customer service excellence. Price competition remains significant, particularly in high-volume applications, driving efficiency improvements and cost optimization initiatives across the supply chain.

Comprehensive analysis of the Australia engineering plastics market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry participants, including manufacturers, distributors, and end-users, through structured interviews and surveys designed to capture current market conditions and future expectations.

Secondary research encompasses extensive review of industry publications, government statistics, trade association reports, and company financial statements. This approach provides historical context and validates primary research findings through triangulation of data sources. Market sizing and forecasting utilize econometric modeling techniques that account for macroeconomic factors and industry-specific variables.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure consistency and reliability. The methodology incorporates both quantitative and qualitative elements, providing comprehensive insights into market dynamics, competitive positioning, and growth opportunities. Regular updates maintain research currency and relevance to evolving market conditions.

Geographic distribution of the Australia engineering plastics market reveals distinct regional patterns reflecting industrial concentration and economic activity. New South Wales leads market consumption with approximately 38% market share, driven by Sydney’s manufacturing base and proximity to major ports facilitating import activities. The state’s diverse industrial sectors, including automotive, electronics, and aerospace, create sustained demand for high-performance materials.

Victoria accounts for roughly 27% of national demand, with Melbourne serving as a major manufacturing hub for automotive and industrial equipment. The state’s strong engineering tradition and skilled workforce support advanced manufacturing applications requiring specialized materials. Queensland contributes approximately 18% of market activity, primarily through mining-related applications and growing aerospace sector involvement.

Western Australia represents a unique market segment, with mining industry requirements driving demand for specialized engineering plastics capable of withstanding harsh operating conditions. South Australia’s automotive manufacturing legacy continues to influence material requirements, while Tasmania and Northern Territory contribute smaller but growing market shares. Regional variations in application focus create opportunities for specialized suppliers and customized solutions.

Market leadership in the Australia engineering plastics sector features a combination of international corporations and specialized domestic suppliers, each contributing unique strengths to the competitive environment:

Competitive strategies emphasize technical service capabilities, customized solutions, and sustainable material development. Market participants invest heavily in research and development to maintain technological leadership while building strong customer relationships through technical support and application development services.

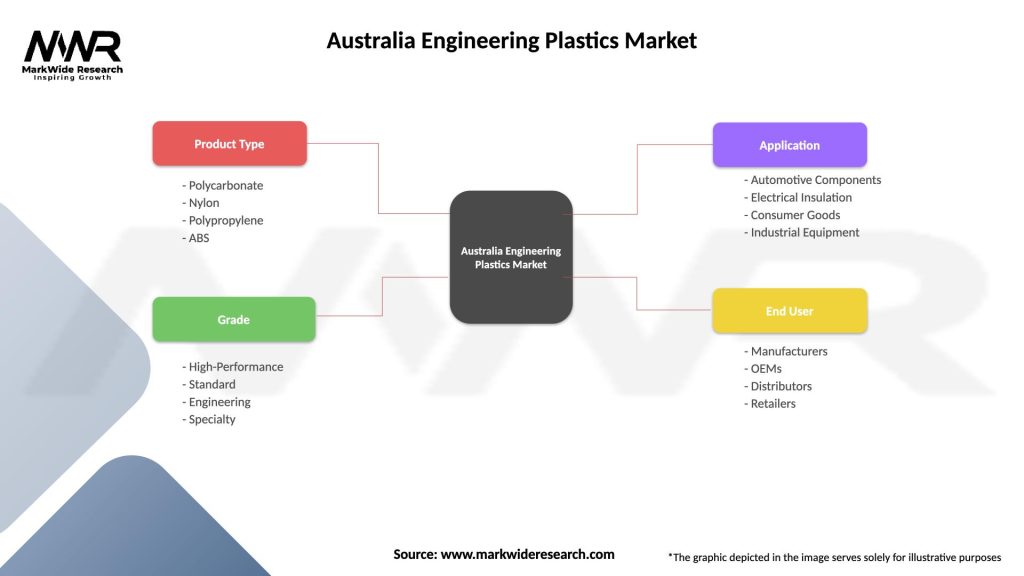

Market segmentation analysis reveals distinct categories based on material type, application, and end-use industry, each exhibiting unique growth patterns and requirements:

By Material Type:

By Application:

Automotive applications represent the largest category within the Australia engineering plastics market, driven by industry trends toward lightweight construction and improved fuel efficiency. Modern vehicles incorporate engineering plastics in engine components, transmission parts, and body panels, with material selection based on specific performance requirements including temperature resistance, chemical compatibility, and dimensional stability.

Electronics sector demand focuses on materials offering excellent electrical insulation properties, dimensional precision, and flame resistance. The growing telecommunications infrastructure and consumer electronics manufacturing create sustained demand for specialized grades capable of meeting stringent performance and safety requirements. This sector shows annual growth rates of 8.5%, reflecting Australia’s expanding technology manufacturing base.

Industrial machinery applications require materials capable of withstanding mechanical stress, chemical exposure, and temperature variations. Mining equipment manufacturing, a significant sector in Australia, demands specialized engineering plastics for components exposed to abrasive conditions and corrosive environments. The construction industry’s adoption of advanced materials for building systems and infrastructure projects contributes additional demand growth.

Manufacturers benefit from engineering plastics through improved product performance, reduced weight, and enhanced design flexibility. These materials enable the production of complex geometries and integrated functions that would be difficult or impossible to achieve with traditional materials. Cost benefits emerge through reduced assembly requirements, improved durability, and lower maintenance needs.

End-users gain significant advantages including improved product reliability, extended service life, and enhanced performance characteristics. The automotive industry achieves fuel efficiency improvements through weight reduction, while electronics manufacturers benefit from superior electrical properties and dimensional stability. Industrial equipment operators experience reduced maintenance costs and improved operational reliability.

Supply chain participants including distributors and processors benefit from stable demand growth and opportunities for value-added services. Technical service capabilities and application development support create competitive advantages and strengthen customer relationships. The growing market provides expansion opportunities for specialized suppliers and service providers throughout the value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives represent the most significant trend shaping the Australia engineering plastics market, with manufacturers and end-users increasingly prioritizing environmentally responsible materials. This trend drives development of bio-based polymers, recycling technologies, and circular economy approaches that reduce environmental impact while maintaining performance standards.

Digitalization and Industry 4.0 technologies influence material requirements and manufacturing processes, creating demand for smart materials with integrated sensing capabilities and advanced processing techniques. The adoption of additive manufacturing technologies opens new applications for engineering plastics while enabling rapid prototyping and customized solutions.

Lightweighting trends across multiple industries drive demand for high-strength, low-density materials that reduce overall system weight without compromising performance. This trend particularly impacts automotive and aerospace applications, where weight reduction directly translates to improved efficiency and reduced environmental impact. MWR data indicates that lightweighting applications show growth rates exceeding 12% annually.

Recent developments in the Australia engineering plastics market reflect ongoing innovation and market expansion efforts. Major suppliers have announced capacity expansion plans and new product introductions designed to meet evolving customer requirements. Investment in local technical service capabilities enhances customer support and application development activities.

Strategic partnerships between international suppliers and Australian manufacturers facilitate technology transfer and market development. These collaborations often focus on developing specialized materials for unique Australian applications, particularly in mining and resource extraction industries. Joint ventures and licensing agreements expand local production capabilities while reducing import dependency.

Technology advancements include development of new polymer grades with enhanced performance characteristics, improved processing capabilities, and reduced environmental impact. Research initiatives focus on developing materials specifically suited to Australian conditions, including high UV resistance for outdoor applications and enhanced chemical resistance for mining environments.

Strategic recommendations for market participants emphasize the importance of developing strong technical service capabilities and customer relationships. Companies should invest in application development expertise and local technical support to differentiate their offerings and build competitive advantages. Focus on specialized applications where performance requirements justify premium pricing can improve profitability and market position.

Supply chain diversification represents a critical success factor, with companies advised to develop multiple supplier relationships and consider local production opportunities where economically viable. Investment in inventory management and logistics capabilities can help mitigate supply chain disruptions and improve customer service levels.

Innovation focus should prioritize sustainability and performance enhancement, with particular attention to developing materials that meet evolving regulatory requirements and customer expectations. Collaboration with research institutions and technology partners can accelerate development timelines and reduce innovation risks. According to MarkWide Research analysis, companies investing in sustainable material development show revenue growth rates 25% higher than industry averages.

Long-term prospects for the Australia engineering plastics market remain positive, supported by continued industrial growth and increasing adoption of high-performance materials across diverse applications. The market is expected to maintain steady growth momentum, with particular strength in automotive, electronics, and renewable energy sectors driving sustained demand expansion.

Technological evolution will continue to create new application opportunities and improve material performance characteristics. The development of smart materials, bio-based polymers, and advanced recycling technologies will shape future market dynamics. Integration of digital technologies in manufacturing processes will enhance efficiency and enable new product development approaches.

Market maturation is expected to bring increased specialization and segmentation, with suppliers focusing on specific application areas or customer segments to build competitive advantages. The growing emphasis on sustainability will drive innovation in material development and processing technologies, creating opportunities for companies that successfully address environmental concerns while maintaining performance standards.

The Australia engineering plastics market represents a dynamic and growing sector with substantial opportunities for expansion and innovation. Strong industrial demand, technological advancement, and increasing adoption of high-performance materials create favorable conditions for sustained market growth. While challenges including import dependency and cost pressures exist, the market’s fundamental drivers remain robust and supportive of continued expansion.

Success factors for market participants include technical expertise, customer service excellence, and strategic positioning in high-growth application areas. Companies that invest in innovation, sustainability, and local capabilities are best positioned to capitalize on emerging opportunities and build competitive advantages. The market’s evolution toward greater specialization and performance requirements creates opportunities for differentiation and value creation throughout the supply chain, making the Australia engineering plastics market an attractive sector for continued investment and development.

What is Engineering Plastics?

Engineering plastics are a group of plastic materials that have superior mechanical and thermal properties compared to standard plastics. They are commonly used in applications such as automotive components, electrical housings, and industrial machinery due to their strength and durability.

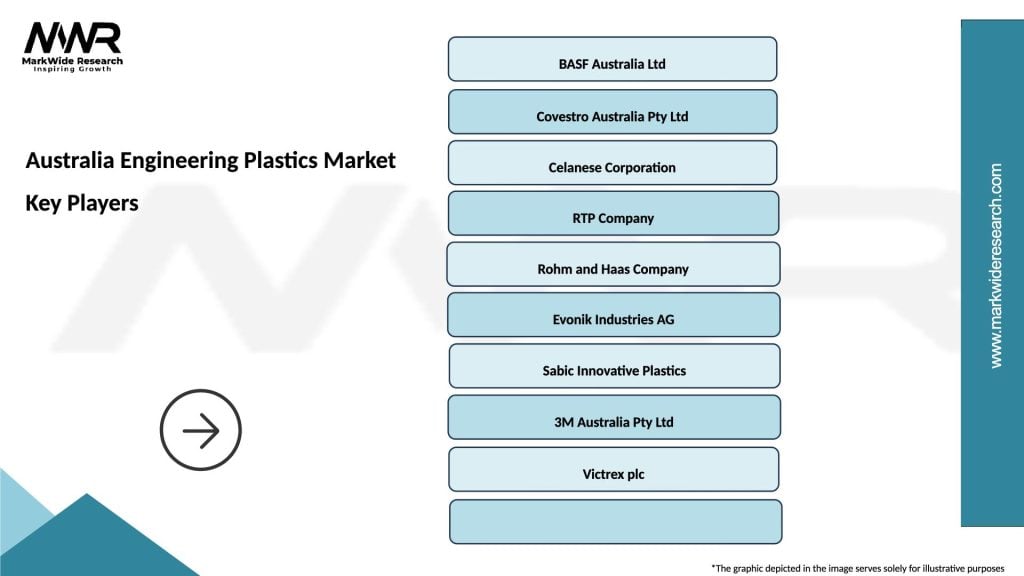

What are the key players in the Australia Engineering Plastics Market?

Key players in the Australia Engineering Plastics Market include BASF, DuPont, and SABIC, which are known for their innovative solutions and extensive product portfolios in engineering plastics. These companies focus on various applications, including automotive, aerospace, and consumer goods, among others.

What are the growth factors driving the Australia Engineering Plastics Market?

The Australia Engineering Plastics Market is driven by the increasing demand for lightweight materials in the automotive and aerospace industries, as well as the growing need for high-performance materials in electronics. Additionally, advancements in manufacturing technologies are enhancing the capabilities of engineering plastics.

What challenges does the Australia Engineering Plastics Market face?

The Australia Engineering Plastics Market faces challenges such as the high cost of raw materials and the environmental impact of plastic waste. Additionally, competition from alternative materials like metals and ceramics can hinder market growth.

What opportunities exist in the Australia Engineering Plastics Market?

Opportunities in the Australia Engineering Plastics Market include the development of bio-based engineering plastics and the expansion of applications in the medical and packaging sectors. The push for sustainability is also driving innovation in this market.

What trends are shaping the Australia Engineering Plastics Market?

Trends in the Australia Engineering Plastics Market include the increasing adoption of recycled materials and the integration of smart technologies in plastic products. Furthermore, there is a growing focus on lightweighting in automotive design to improve fuel efficiency.

Australia Engineering Plastics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polycarbonate, Nylon, Polypropylene, ABS |

| Grade | High-Performance, Standard, Engineering, Specialty |

| Application | Automotive Components, Electrical Insulation, Consumer Goods, Industrial Equipment |

| End User | Manufacturers, OEMs, Distributors, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Engineering Plastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at