444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Endpoint Detection and Response (EDR) market in Australia is a vital segment of the country’s cybersecurity landscape, offering advanced solutions to detect, investigate, and mitigate cyber threats targeting endpoints. With the increasing frequency and sophistication of cyber attacks, organizations across Australia are investing in robust EDR solutions to protect their digital assets and safeguard against data breaches and security incidents.

Meaning

Endpoint Detection and Response (EDR) solutions encompass a range of cybersecurity tools and technologies designed to monitor, detect, and respond to threats targeting endpoints within an organization’s network. These solutions provide real-time visibility into endpoint activities, enabling security teams to identify and neutralize advanced threats, including malware, ransomware, and insider attacks. In the context of Australia, EDR solutions play a critical role in strengthening the cybersecurity posture of organizations across various industries.

Executive Summary

The Australia Endpoint Detection and Response (EDR) market are witnessing significant growth driven by the escalating cyber threat landscape, regulatory compliance requirements, and the increasing adoption of digital transformation initiatives. As organizations strive to enhance their cybersecurity resilience and mitigate the risks posed by cyber threats, the demand for advanced EDR solutions continues to surge. This report provides an in-depth analysis of the market dynamics, key trends, competitive landscape, and future outlook of the EDR market in Australia.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia Endpoint Detection and Response (EDR) market operate within a dynamic landscape shaped by evolving cyber threats, regulatory developments, technological advancements, and market trends. These dynamics influence market growth, competitive dynamics, and strategic decision-making among industry participants.

Regional Analysis

The Australia Endpoint Detection and Response (EDR) market exhibit unique regional characteristics influenced by factors such as regulatory environment, industry verticals, technological adoption, and cybersecurity landscape. Key regions within Australia, including Sydney, Melbourne, Brisbane, Perth, and Canberra, contribute to the overall market dynamics and growth trajectory.

Competitive Landscape

Leading Companies in the Australia Endpoint Detection and Response Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

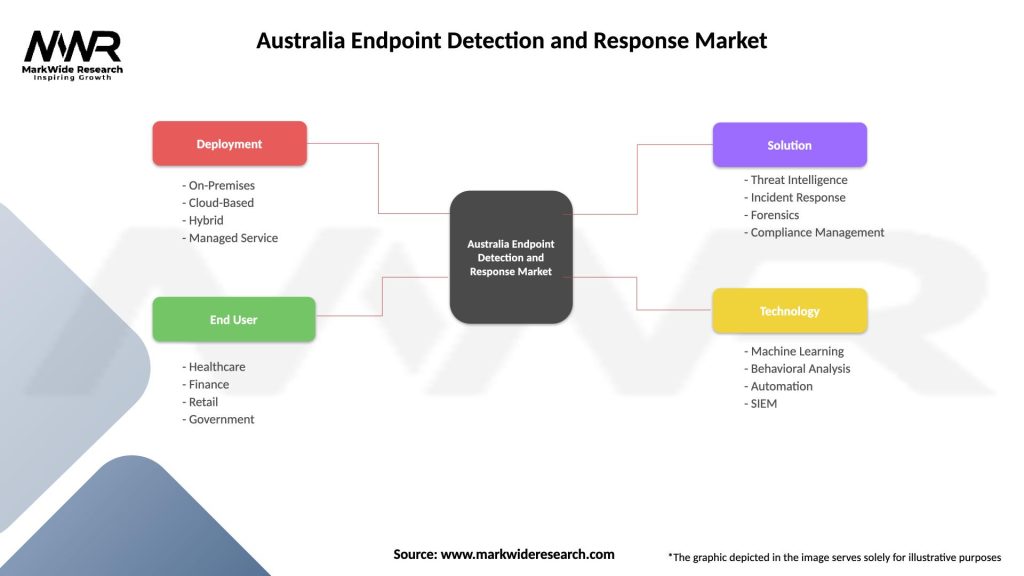

Segmentation

The Australia Endpoint Detection and Response (EDR) market can be segmented based on various factors, including deployment mode, organization size, industry vertical, and geographic region. Granular segmentation enables vendors to tailor their products and services to meet the specific needs and preferences of different customer segments, driving market penetration and revenue growth.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Australia Endpoint Detection and Response (EDR) market offer several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis provides a comprehensive assessment of the strengths, weaknesses, opportunities, and threats facing the Australia Endpoint Detection and Response (EDR) market:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of Endpoint Detection and Response (EDR) solutions in Australia as organizations transition to remote work and digital operations. The sudden shift to remote work has expanded the attack surface for cyber threats, prompting organizations to invest in advanced EDR technologies to secure distributed endpoints and remote workforce.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Australia Endpoint Detection and Response (EDR) market is highly promising, driven by factors such as the evolving cyber threat landscape, regulatory compliance mandates, digital transformation initiatives, and technological advancements. As organizations continue to prioritize endpoint security and invest in advanced EDR solutions, the market is expected to witness sustained growth and innovation in the coming years.

Conclusion

In conclusion, the Australia Endpoint Detection and Response (EDR) market represents a critical component of the country’s cybersecurity ecosystem, offering advanced solutions to detect, investigate, and mitigate cyber threats targeting endpoints. With the increasing frequency and sophistication of cyber attacks, organizations across Australia are investing in robust EDR solutions to protect their digital assets and safeguard against data breaches and security incidents. By embracing technological innovations, fostering industry collaborations, and prioritizing cybersecurity best practices, organizations can enhance their resilience to cyber threats and safeguard their critical assets effectively.

What is Endpoint Detection and Response?

Endpoint Detection and Response (EDR) refers to a set of security tools and processes designed to detect, investigate, and respond to threats on endpoint devices. EDR solutions provide real-time monitoring and analysis of endpoint activities to enhance cybersecurity measures.

What are the key players in the Australia Endpoint Detection and Response Market?

Key players in the Australia Endpoint Detection and Response Market include CrowdStrike, SentinelOne, and Sophos, among others. These companies offer various EDR solutions that cater to different industries and organizational needs.

What are the growth factors driving the Australia Endpoint Detection and Response Market?

The growth of the Australia Endpoint Detection and Response Market is driven by increasing cyber threats, the rise of remote work, and the need for compliance with data protection regulations. Organizations are investing in EDR solutions to enhance their security posture and protect sensitive information.

What challenges does the Australia Endpoint Detection and Response Market face?

The Australia Endpoint Detection and Response Market faces challenges such as the complexity of threat landscapes, the shortage of skilled cybersecurity professionals, and the high costs associated with implementing advanced EDR solutions. These factors can hinder adoption rates among smaller organizations.

What opportunities exist in the Australia Endpoint Detection and Response Market?

Opportunities in the Australia Endpoint Detection and Response Market include the growing demand for managed security services, advancements in artificial intelligence for threat detection, and the increasing focus on cybersecurity awareness among businesses. These trends are likely to drive innovation and investment in EDR technologies.

What trends are shaping the Australia Endpoint Detection and Response Market?

Trends shaping the Australia Endpoint Detection and Response Market include the integration of machine learning for enhanced threat detection, the shift towards cloud-based EDR solutions, and the emphasis on automated response capabilities. These innovations are helping organizations respond more effectively to security incidents.

Australia Endpoint Detection and Response Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Service |

| End User | Healthcare, Finance, Retail, Government |

| Solution | Threat Intelligence, Incident Response, Forensics, Compliance Management |

| Technology | Machine Learning, Behavioral Analysis, Automation, SIEM |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Endpoint Detection and Response Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at