444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia education student loans market represents a fundamental pillar of the nation’s higher education financing system, enabling millions of students to access tertiary education opportunities. This comprehensive market encompasses government-backed loan schemes, private lending institutions, and innovative financial products designed to support educational aspirations across diverse academic disciplines. Market dynamics indicate substantial growth driven by increasing enrollment rates, rising education costs, and evolving policy frameworks that prioritize accessible higher education.

Government initiatives continue to shape market evolution through programs like the Higher Education Contribution Scheme (HECS) and various vocational education financing options. The market demonstrates robust expansion with student loan uptake increasing by approximately 8.2% annually over recent years, reflecting growing demand for flexible education financing solutions. Digital transformation has revolutionized application processes, making loan access more streamlined and efficient for prospective students.

Regional variations across Australian states reveal distinct patterns in loan utilization, with metropolitan areas showing higher adoption rates compared to rural regions. The market’s resilience during economic fluctuations underscores its essential role in maintaining educational accessibility and supporting workforce development initiatives nationwide.

The Australia education student loans market refers to the comprehensive ecosystem of financial products and services designed to provide students with funding for tertiary education, vocational training, and professional development programs. This market encompasses government-subsidized loan schemes, private lending options, income-contingent repayment systems, and specialized financing products tailored to diverse educational pathways and career objectives.

Core components include federal government loan programs administered through the Australian Taxation Office, private institutional lending, peer-to-peer financing platforms, and employer-sponsored education assistance programs. The market facilitates access to higher education by removing immediate financial barriers while establishing structured repayment mechanisms aligned with graduates’ earning capacity and career progression.

Stakeholder engagement involves educational institutions, government agencies, financial service providers, students, employers, and regulatory bodies working collaboratively to ensure sustainable financing solutions that support national education objectives and economic development priorities.

Strategic analysis reveals the Australia education student loans market as a dynamic sector experiencing significant transformation driven by technological innovation, policy reforms, and changing student demographics. Market penetration has reached approximately 72% of eligible students across various educational programs, demonstrating widespread adoption and acceptance of loan-based education financing.

Key growth drivers include expanding international student enrollment, increasing demand for vocational training, and government initiatives promoting lifelong learning. The market benefits from strong regulatory frameworks ensuring consumer protection while maintaining competitive lending practices. Digital platforms have enhanced accessibility, with online applications increasing by 65% over the past three years.

Competitive dynamics feature established government programs competing with innovative private sector solutions, creating diverse options for students with varying financial needs and career aspirations. Market consolidation trends indicate potential for strategic partnerships between traditional lenders and emerging fintech companies.

Future prospects remain positive, supported by Australia’s commitment to education excellence, workforce development, and economic competitiveness in global markets. The market’s evolution toward more personalized, flexible financing solutions positions it for sustained growth and enhanced student outcomes.

Market intelligence reveals several critical insights shaping the Australia education student loans landscape. Primary findings demonstrate the market’s resilience and adaptability in responding to evolving educational needs and economic conditions.

Economic factors serve as primary catalysts driving Australia education student loans market expansion. Rising education costs across universities and vocational institutions necessitate accessible financing solutions, making student loans essential for maintaining educational participation rates. Government policy initiatives emphasizing human capital development and workforce competitiveness further accelerate market growth through supportive regulatory frameworks and funding commitments.

Demographic trends significantly influence market dynamics, with increasing numbers of international students seeking Australian education experiences. The growing recognition of lifelong learning and professional development creates sustained demand for flexible financing options accommodating diverse career trajectories and educational pathways.

Technological advancement enhances market accessibility through streamlined application processes, improved risk assessment capabilities, and personalized loan products. Digital platforms enable efficient service delivery while reducing administrative costs and improving customer satisfaction levels.

Employment market conditions drive demand for specialized skills and qualifications, encouraging individuals to pursue additional education and training. Strong graduate employment outcomes and competitive salary levels support loan repayment capacity while justifying educational investments.

Social mobility aspirations motivate students from diverse backgrounds to access higher education opportunities, with loan programs removing financial barriers and promoting inclusive participation in tertiary education systems.

Financial constraints present significant challenges within the Australia education student loans market, particularly concerning long-term debt burden concerns among prospective students. Economic uncertainty and employment market volatility create hesitation regarding loan commitments, especially among students pursuing fields with uncertain career prospects or lower earning potential.

Regulatory complexity surrounding loan terms, repayment conditions, and eligibility criteria can create confusion and barriers to access, particularly for first-generation university students and those from disadvantaged backgrounds. Administrative burden associated with application processes and ongoing compliance requirements may discourage participation.

Interest rate fluctuations and changing government policies create uncertainty regarding long-term loan costs and repayment obligations. Students may delay educational decisions pending policy clarification or more favorable lending conditions.

Competition from alternative financing methods, including employer sponsorship, scholarships, and family funding, reduces reliance on traditional loan products. Some students prefer avoiding debt altogether, seeking alternative pathways to education and career development.

Credit assessment challenges for students with limited credit history or irregular income sources can restrict access to private lending options, limiting financing alternatives for specific demographic groups or educational programs.

Emerging opportunities within the Australia education student loans market center on technological innovation and product diversification. Fintech integration enables development of sophisticated risk assessment tools, personalized loan products, and enhanced customer experience platforms that differentiate market participants and improve service delivery.

International expansion presents substantial growth potential as Australia’s education sector attracts increasing numbers of foreign students seeking world-class academic programs. Specialized loan products targeting international students’ unique needs and circumstances create new revenue streams and market segments.

Partnership opportunities between educational institutions, employers, and financial service providers enable innovative financing solutions that align educational outcomes with workforce requirements. Corporate sponsorship programs and industry-specific loan products address skills shortages while supporting student career development.

Vocational education growth offers significant expansion potential as government initiatives promote technical skills development and alternative career pathways. Specialized financing for trade qualifications, professional certifications, and industry-specific training programs addresses evolving workforce needs.

Digital transformation enables development of comprehensive financial wellness platforms that combine loan services with budgeting tools, career guidance, and financial literacy resources, creating value-added service offerings that enhance customer relationships and market positioning.

Competitive forces shape the Australia education student loans market through interaction between government programs, traditional financial institutions, and emerging fintech companies. Market equilibrium reflects balance between accessibility objectives and financial sustainability requirements, with regulatory oversight ensuring consumer protection while maintaining competitive dynamics.

Supply-side factors include lending capacity, risk appetite, and regulatory compliance capabilities among market participants. Government funding commitments and policy stability influence market confidence and long-term planning capabilities for both lenders and borrowers.

Demand-side dynamics encompass student enrollment trends, career aspirations, and economic conditions affecting education investment decisions. Consumer behavior increasingly favors flexible, transparent loan products with favorable repayment terms and comprehensive support services.

Market intermediaries including education advisors, financial counselors, and online platforms play crucial roles in connecting students with appropriate financing solutions while providing guidance on loan selection and management strategies.

External influences such as economic cycles, employment market conditions, and international education trends create volatility and opportunity within the market ecosystem. MarkWide Research analysis indicates that market participants must maintain adaptability and innovation focus to navigate changing conditions successfully.

Comprehensive analysis of the Australia education student loans market employs multi-faceted research approaches combining quantitative data analysis, qualitative stakeholder interviews, and industry expert consultations. Primary research involves direct engagement with students, educational institutions, lenders, and government agencies to gather firsthand insights regarding market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and regulatory filings to establish comprehensive market understanding. Statistical analysis of enrollment data, loan performance metrics, and economic indicators provides quantitative foundation for market assessment.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and statistical verification methods. Market modeling techniques project future trends based on historical patterns, policy developments, and economic forecasts.

Stakeholder consultation includes structured interviews with industry leaders, policy makers, and market participants to gather qualitative insights regarding market dynamics, competitive positioning, and strategic priorities. Focus groups with students and recent graduates provide consumer perspective on loan products and services.

Analytical frameworks incorporate economic modeling, competitive analysis, and trend identification methodologies to develop comprehensive market intelligence and strategic recommendations for industry participants and stakeholders.

Geographic distribution across Australia reveals distinct regional patterns in education student loan utilization and market development. New South Wales maintains the largest market share at approximately 32% of total loan volume, driven by high concentration of universities and international students in Sydney and surrounding metropolitan areas.

Victoria represents the second-largest regional market with 28% market share, benefiting from Melbourne’s status as an education hub and strong government support for vocational training programs. The state’s diverse educational offerings and robust employment market support sustained loan demand.

Queensland demonstrates rapid growth with 18% market share, reflecting expanding university sector and increasing international student enrollment. The state’s focus on tourism, mining, and agriculture creates demand for specialized educational programs and associated financing solutions.

Western Australia accounts for 12% of market activity, with loan demand driven by mining industry workforce requirements and Perth’s growing education sector. Resource sector employment opportunities support strong graduate earning potential and loan repayment capacity.

South Australia, Tasmania, Northern Territory, and Australian Capital Territory collectively represent 10% of market share, with unique characteristics reflecting local economic conditions, educational institutions, and demographic factors. Rural and remote area access improvements have increased participation rates across these regions.

Market leadership within the Australia education student loans sector reflects combination of government programs and private sector innovation. Competitive positioning varies based on target segments, product offerings, and service delivery capabilities.

Market segmentation within the Australia education student loans sector reflects diverse student needs, educational pathways, and financing requirements. Primary segmentation categories enable targeted product development and service delivery optimization.

By Loan Type:

By Education Level:

By Student Type:

Government loan programs demonstrate exceptional performance and market dominance, with HECS-HELP maintaining 78% of undergraduate financing due to favorable terms, income-contingent repayment, and broad institutional acceptance. These programs provide stability and accessibility while supporting government education policy objectives.

Private lending solutions show increasing sophistication and market penetration, particularly among international students and specialized programs not covered by government schemes. Innovation focus on digital delivery, personalized terms, and value-added services differentiates private sector offerings.

Vocational education financing experiences rapid growth as government initiatives promote technical skills development and alternative career pathways. Industry partnerships and employer sponsorship programs enhance loan product attractiveness and graduate employment outcomes.

International student loans represent high-growth segment driven by Australia’s reputation for quality education and favorable immigration policies. Specialized products addressing currency risk, visa requirements, and employment restrictions create competitive advantages for market participants.

Postgraduate financing reflects increasing demand for advanced qualifications and professional development, with loan products adapted to longer study periods, research requirements, and career transition needs.

Educational institutions benefit from increased enrollment capacity and student diversity through accessible financing options. Revenue stability improves as loan programs guarantee tuition payments while reducing collection risks and administrative burden associated with direct student billing.

Students gain access to quality education opportunities regardless of immediate financial capacity, enabling career advancement and personal development. Income-contingent repayment systems align loan obligations with earning capacity, reducing financial stress and default risk.

Lenders access stable, government-backed revenue streams with predictable risk profiles and regulatory protection. Market growth provides expansion opportunities while serving important social objectives related to education access and workforce development.

Government agencies achieve education policy objectives through market-based mechanisms that promote efficiency and competition while maintaining oversight and consumer protection. Economic benefits include enhanced workforce skills, innovation capacity, and international competitiveness.

Employers benefit from improved workforce quality, specialized skills availability, and reduced training costs as loan programs enable employees to pursue relevant education and professional development opportunities.

Society gains from increased social mobility, reduced inequality, and enhanced economic productivity through broader access to higher education and skills development programs supported by comprehensive financing solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Australia education student loans market, with artificial intelligence and machine learning technologies enabling sophisticated risk assessment, personalized product recommendations, and streamlined application processes. Mobile-first approaches cater to younger demographics while improving accessibility and user engagement.

Sustainability focus drives development of green financing options for environmental studies, renewable energy programs, and sustainability-focused career paths. ESG considerations influence lending decisions and product development as institutions align with broader social responsibility objectives.

Flexible repayment models gain popularity through income-share agreements, outcome-based financing, and graduated payment structures that adapt to individual career trajectories and earning patterns. These innovations address concerns about traditional debt structures while maintaining lender returns.

Employer integration creates opportunities for workplace education financing, professional development loans, and career transition support programs. Corporate partnerships enable specialized products addressing industry-specific skills requirements and workforce development needs.

International student focus intensifies as Australia competes globally for education market share, with specialized loan products addressing visa requirements, currency considerations, and post-graduation employment pathways.

Recent developments within the Australia education student loans market demonstrate ongoing evolution and adaptation to changing educational and economic conditions. Government initiatives have expanded loan program eligibility, improved repayment terms, and enhanced support services for vulnerable student populations.

Technology partnerships between traditional lenders and fintech companies have accelerated digital transformation, enabling faster application processing, improved risk assessment, and enhanced customer experience. API integration allows seamless connection between educational institutions and lending platforms.

Regulatory updates have strengthened consumer protection measures while maintaining market competitiveness and innovation incentives. New disclosure requirements and standardized comparison tools help students make informed financing decisions.

International agreements facilitate cross-border education financing and student mobility programs, supporting Australia’s position as a leading education destination. Bilateral arrangements with key countries streamline loan processes for foreign students.

Industry consolidation trends include strategic acquisitions, partnership formations, and platform integrations that create economies of scale and enhanced service capabilities. MWR analysis suggests continued consolidation activity as market participants seek competitive advantages through expanded capabilities and market reach.

Strategic recommendations for Australia education student loans market participants emphasize innovation, customer focus, and sustainable growth strategies. Technology investment should prioritize artificial intelligence, machine learning, and data analytics capabilities that enable personalized service delivery and improved risk management.

Product development opportunities exist in flexible repayment structures, outcome-based financing models, and specialized solutions for emerging educational needs. Market participants should consider income-share agreements, employer partnership programs, and international student-focused products as growth drivers.

Digital transformation initiatives must balance efficiency gains with human touch elements that address complex student needs and circumstances. Omnichannel approaches combining digital convenience with personal support create competitive advantages and customer loyalty.

Partnership strategies with educational institutions, employers, and government agencies enable market expansion while serving broader social objectives. Collaborative approaches can address skills gaps, workforce development needs, and social mobility goals.

Risk management practices should incorporate economic volatility, policy changes, and demographic shifts into planning processes. Diversification strategies across student segments, educational levels, and geographic regions provide stability and growth opportunities.

Long-term prospects for the Australia education student loans market remain positive, supported by continued government commitment to education access, growing international student demand, and evolving workforce development needs. Market evolution will likely emphasize technology integration, product innovation, and enhanced customer experience as key differentiators.

Growth projections indicate sustained expansion at approximately 6.5% annually over the next five years, driven by increasing education participation rates, vocational training emphasis, and international student growth. MarkWide Research forecasts suggest particular strength in postgraduate financing and professional development loan segments.

Technological advancement will continue reshaping market dynamics through artificial intelligence, blockchain applications, and integrated financial wellness platforms. Digital-native solutions will become standard expectations rather than competitive advantages, requiring continuous innovation and adaptation.

Policy developments may introduce new loan programs, modify existing terms, or create alternative financing mechanisms that address affordability concerns while maintaining market sustainability. Regulatory evolution will likely focus on consumer protection, transparency, and outcome measurement.

International competitiveness will drive continued market development as Australia seeks to maintain its position as a preferred education destination. Strategic positioning in emerging markets and specialized educational niches will create new growth opportunities for market participants.

The Australia education student loans market represents a mature, dynamic sector that plays a crucial role in supporting the nation’s education objectives and economic competitiveness. Market fundamentals remain strong, with government backing, established infrastructure, and growing demand creating favorable conditions for sustained growth and development.

Key success factors include technological innovation, customer-centric service delivery, and strategic partnerships that address evolving educational needs and student expectations. Market participants must balance accessibility objectives with financial sustainability while adapting to changing demographic patterns and economic conditions.

Future opportunities lie in international expansion, product innovation, and digital transformation initiatives that enhance market efficiency and customer satisfaction. The sector’s evolution toward more flexible, personalized financing solutions positions it well for continued relevance and growth in Australia’s education landscape.

What is Australia Education Student Loans?

Australia Education Student Loans refer to financial assistance programs designed to help students cover the costs of their education, including tuition fees, living expenses, and other related costs. These loans are typically offered by government bodies and private financial institutions to support students in pursuing higher education.

What are the key players in the Australia Education Student Loans Market?

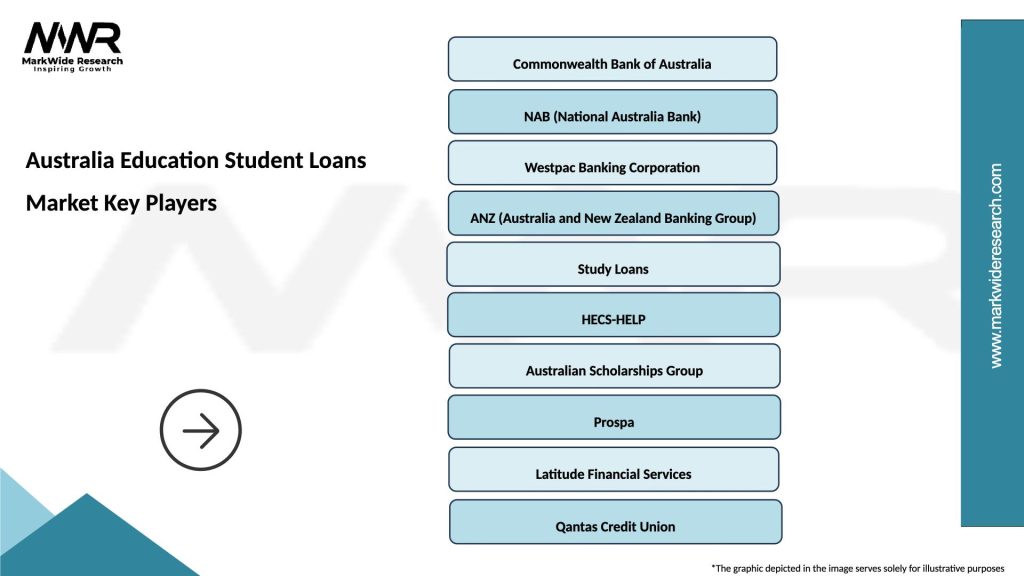

Key players in the Australia Education Student Loans Market include the Australian Government, which provides various loan schemes, as well as private lenders like ANZ and Commonwealth Bank. These institutions offer a range of loan products tailored to meet the needs of students, among others.

What are the main drivers of the Australia Education Student Loans Market?

The main drivers of the Australia Education Student Loans Market include the increasing demand for higher education, rising tuition costs, and the growing number of international students seeking education in Australia. Additionally, government initiatives aimed at making education more accessible contribute to market growth.

What challenges does the Australia Education Student Loans Market face?

Challenges in the Australia Education Student Loans Market include rising levels of student debt, regulatory changes affecting loan terms, and economic fluctuations that may impact borrowers’ ability to repay loans. These factors can create uncertainty for both lenders and students.

What opportunities exist in the Australia Education Student Loans Market?

Opportunities in the Australia Education Student Loans Market include the potential for innovative loan products that cater to diverse student needs, partnerships between educational institutions and financial providers, and the expansion of digital platforms for loan management. These developments can enhance accessibility and user experience.

What trends are shaping the Australia Education Student Loans Market?

Trends shaping the Australia Education Student Loans Market include the increasing use of technology for loan applications and management, a focus on flexible repayment options, and the rise of alternative funding sources such as income-share agreements. These trends reflect changing consumer preferences and the evolving landscape of education financing.

Australia Education Student Loans Market

| Segmentation Details | Description |

|---|---|

| Loan Type | Federal Loans, Private Loans, Consolidation Loans, Refinancing Loans |

| Borrower Type | Undergraduate Students, Graduate Students, Parents, International Students |

| Interest Rate Type | Fixed Rate, Variable Rate, Hybrid Rate, Discounted Rate |

| Repayment Plan | Standard Repayment, Income-Driven Repayment, Graduated Repayment, Extended Repayment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Education Student Loans Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at