444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia direct current power system market represents a transformative segment within the nation’s evolving energy infrastructure landscape. Direct current (DC) power systems are experiencing unprecedented growth across Australia, driven by the increasing adoption of renewable energy sources, electric vehicle infrastructure expansion, and the modernization of industrial facilities. The market encompasses various applications including data centers, telecommunications, renewable energy integration, and electric vehicle charging stations.

Market dynamics indicate robust expansion with the sector experiencing a 12.4% CAGR over recent years. This growth trajectory reflects Australia’s commitment to sustainable energy solutions and the inherent advantages of DC power systems in terms of efficiency and reliability. The integration of solar photovoltaic systems, battery energy storage, and electric vehicle charging infrastructure continues to drive demand for sophisticated DC power solutions across residential, commercial, and industrial sectors.

Technological advancement in power electronics, energy storage systems, and smart grid technologies has significantly enhanced the viability and performance of DC power systems. Australian businesses and government entities are increasingly recognizing the operational efficiency gains of up to 15-20% achievable through DC power implementation compared to traditional alternating current systems.

The Australia direct current power system market refers to the comprehensive ecosystem of technologies, products, and services that enable the generation, transmission, distribution, and utilization of direct current electrical power across various applications throughout Australia. Direct current power systems maintain constant voltage polarity and provide unidirectional current flow, making them particularly suitable for modern electronic devices, renewable energy integration, and energy storage applications.

DC power systems encompass a wide range of components including power converters, inverters, battery management systems, charging infrastructure, and distribution equipment. These systems are designed to optimize energy efficiency, reduce conversion losses, and provide reliable power delivery for critical applications. The market includes both low-voltage DC systems typically used in telecommunications and data centers, as well as high-voltage DC systems employed in renewable energy transmission and industrial applications.

System integration capabilities allow DC power solutions to seamlessly interface with existing electrical infrastructure while providing enhanced monitoring, control, and management functionalities. The market encompasses both standalone DC systems and hybrid AC-DC configurations that maximize operational flexibility and energy efficiency across diverse application scenarios.

Australia’s direct current power system market is experiencing significant momentum driven by the nation’s renewable energy transition and infrastructure modernization initiatives. The market demonstrates strong growth potential with increasing adoption across multiple sectors including telecommunications, data centers, renewable energy, and electric vehicle infrastructure.

Key market drivers include government policies supporting renewable energy adoption, the growing demand for energy-efficient solutions, and the expansion of electric vehicle charging networks. The market benefits from Australia’s abundant solar resources, with solar PV installations accounting for approximately 35% of DC power system deployments. Battery energy storage systems represent another significant growth area, with adoption rates increasing by 28% annually.

Technological innovation continues to enhance system performance and reduce implementation costs. Advanced power electronics, smart inverters, and energy management systems are enabling more sophisticated DC power applications. The market is characterized by increasing collaboration between technology providers, system integrators, and end-users to develop customized solutions that meet specific operational requirements.

Regional distribution shows strong concentration in major metropolitan areas, with New South Wales and Victoria representing approximately 55% of market activity. However, significant growth opportunities exist in regional areas, particularly in mining operations, agricultural applications, and remote community power systems.

Market segmentation analysis reveals diverse application areas driving DC power system adoption across Australia. The following key insights highlight the most significant market developments:

Technology trends indicate increasing sophistication in system design and implementation. Smart DC systems with advanced monitoring and control capabilities are becoming standard, while modular designs enable scalable deployments across various applications. The integration of artificial intelligence and machine learning technologies is enhancing system optimization and predictive maintenance capabilities.

Renewable energy expansion serves as the primary catalyst for DC power system growth in Australia. The nation’s commitment to achieving net-zero emissions by 2050 has accelerated investments in solar and wind energy projects, which naturally generate DC power. Solar photovoltaic installations continue to proliferate across residential, commercial, and utility-scale applications, creating substantial demand for DC power management and conversion systems.

Government policy support through various incentive programs and regulatory frameworks encourages DC power system adoption. The Renewable Energy Target and state-level initiatives provide financial incentives for renewable energy projects that incorporate advanced DC power technologies. Building codes and energy efficiency standards increasingly favor DC power solutions for their superior efficiency characteristics.

Electric vehicle market growth represents another significant driver, with EV adoption rates increasing rapidly across Australia. The expansion of charging infrastructure requires sophisticated DC fast-charging systems capable of delivering high-power charging capabilities. Fleet electrification initiatives by government agencies and commercial organizations further accelerate demand for DC charging solutions.

Data center expansion driven by cloud computing, digital transformation, and increasing data consumption creates substantial demand for reliable DC power systems. Edge computing deployments and 5G network infrastructure require distributed DC power solutions to support critical telecommunications equipment. The growing emphasis on energy efficiency in data center operations favors DC power systems that eliminate multiple power conversion stages.

High initial capital costs present a significant barrier to DC power system adoption, particularly for smaller organizations and residential applications. The specialized equipment, installation requirements, and system integration complexity contribute to elevated upfront investments compared to traditional AC power systems. Return on investment timelines may extend beyond acceptable periods for some potential adopters, limiting market penetration.

Technical complexity and the requirement for specialized expertise create implementation challenges. The design, installation, and maintenance of DC power systems require skilled technicians and engineers with specific training and certification. Skills shortage in the Australian market limits the availability of qualified personnel, potentially constraining market growth and increasing project costs.

Regulatory and standards challenges create uncertainty for market participants. The evolving nature of DC power system standards and the need for compliance with multiple regulatory frameworks can complicate project development and implementation. Grid interconnection requirements and safety standards may vary across jurisdictions, creating additional complexity for system designers and installers.

Technology compatibility issues with existing AC-based infrastructure require careful consideration and potentially costly modifications. The integration of DC power systems with legacy electrical systems may necessitate additional conversion equipment and control systems, increasing overall project complexity and costs. Interoperability concerns between different manufacturers’ equipment can limit system flexibility and increase long-term maintenance requirements.

Microgrid development presents substantial opportunities for DC power system deployment across Australia. Remote communities, mining operations, and agricultural facilities increasingly seek energy independence through localized power generation and storage systems. DC microgrids offer superior efficiency for integrating renewable energy sources with battery storage systems, creating significant market potential in regional and remote areas.

Smart city initiatives across major Australian metropolitan areas create opportunities for integrated DC power solutions. LED street lighting, electric vehicle charging, and renewable energy integration within urban environments favor DC power systems for their efficiency and controllability. Digital infrastructure requirements for smart city applications align well with DC power system capabilities.

Industrial electrification trends offer significant growth potential as manufacturing facilities seek to reduce carbon emissions and improve energy efficiency. Process industries, mining operations, and manufacturing plants can benefit from DC power systems that provide precise control and improved efficiency for electric motor drives and process equipment. The transition from fossil fuel-based processes to electric alternatives creates demand for sophisticated DC power solutions.

Energy storage integration opportunities continue to expand as battery costs decline and performance improves. Grid-scale energy storage, commercial energy storage, and residential battery systems all utilize DC power natively, creating natural synergies with DC power system technologies. The growing emphasis on energy resilience and grid stability drives demand for integrated DC power and storage solutions.

Supply chain dynamics in the Australia DC power system market reflect both global technology trends and local manufacturing capabilities. International suppliers dominate the high-technology components market, while local system integrators and installation contractors provide essential services for project implementation. The market benefits from Australia’s strong engineering and technical services sector, which supports system design and integration activities.

Competitive dynamics show increasing collaboration between traditional electrical equipment manufacturers and emerging technology companies. Strategic partnerships between power electronics specialists, renewable energy developers, and system integrators create comprehensive solution offerings. The market demonstrates a trend toward vertical integration as companies seek to control more aspects of the value chain.

Innovation cycles in DC power systems are accelerating, driven by advances in semiconductor technology, energy storage, and digital control systems. Wide bandgap semiconductors enable higher efficiency and power density in DC power conversion equipment. Digital twins and predictive analytics are becoming standard features in advanced DC power systems, improving reliability and reducing maintenance costs.

Customer adoption patterns vary significantly across market segments, with early adopters in data centers and telecommunications leading the way. Government agencies and large corporations with sustainability commitments drive demand for innovative DC power solutions. Residential adoption remains more price-sensitive but shows increasing interest in integrated solar and battery systems that utilize DC power natively.

Comprehensive market analysis for the Australia direct current power system market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes extensive interviews with industry participants, technology providers, system integrators, and end-users across various market segments. Secondary research incorporates analysis of industry reports, government publications, technical standards, and regulatory documents.

Data collection methods encompass both quantitative and qualitative approaches to capture market dynamics comprehensively. Survey research targets key stakeholders including manufacturers, distributors, installers, and end-users to gather insights on market trends, challenges, and opportunities. Expert interviews with industry leaders, technology developers, and regulatory officials provide deeper understanding of market drivers and constraints.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and projections. Bottom-up analysis aggregates data from individual market segments, applications, and regional markets to build comprehensive market models. Top-down analysis leverages macroeconomic indicators, energy consumption data, and infrastructure investment trends to validate market size estimates.

Analytical frameworks include Porter’s Five Forces analysis to assess competitive dynamics, SWOT analysis to evaluate market strengths and challenges, and scenario analysis to model different growth trajectories. Cross-validation of data sources and analytical results ensures reliability and accuracy of market insights and projections.

New South Wales leads the Australian DC power system market, accounting for approximately 32% of total market activity. The state benefits from significant data center investments in Sydney, extensive renewable energy projects, and progressive government policies supporting clean energy adoption. Major infrastructure projects including the Sydney Metro and WestConnex incorporate advanced DC power systems for improved efficiency and reliability.

Victoria represents the second-largest regional market with approximately 23% market share, driven by Melbourne’s position as a major business and technology hub. The state’s commitment to renewable energy targets and significant investments in battery energy storage create substantial demand for DC power systems. Industrial applications in manufacturing and food processing sectors contribute to steady market growth.

Queensland shows strong growth potential with abundant solar resources and expanding mining operations driving DC power system adoption. The state accounts for approximately 18% of market activity, with particular strength in utility-scale solar projects and mining applications. Regional communities increasingly adopt DC microgrid solutions for energy independence and reliability.

Western Australia demonstrates significant market opportunity, particularly in mining and resource extraction industries. The state’s remote operations and abundant renewable energy resources create ideal conditions for DC power system deployment. Perth’s data center market and growing renewable energy sector contribute to approximately 15% of national market activity.

South Australia and Tasmania represent emerging markets with strong renewable energy focus and innovative energy policies. These states collectively account for approximately 12% of market activity but show above-average growth rates driven by grid modernization and renewable energy integration initiatives.

Market leadership in the Australia DC power system sector is distributed among several key categories of participants, each bringing distinct capabilities and market focus. The competitive landscape reflects both global technology leaders and specialized local providers.

Competitive strategies focus on technology innovation, local partnerships, and comprehensive service offerings. Product differentiation through advanced features, higher efficiency, and improved reliability creates competitive advantages. Strategic acquisitions and joint ventures enable companies to expand capabilities and market reach.

Market positioning varies across segments, with some companies focusing on specific applications while others pursue broad market coverage. Local presence and technical support capabilities increasingly influence customer selection decisions, particularly for complex system integration projects.

Application-based segmentation reveals distinct market characteristics and growth patterns across different use cases for DC power systems in Australia:

By Application:

By Voltage Level:

By Component Type:

Data center applications dominate the Australian DC power system market due to the critical nature of digital infrastructure and the inherent efficiency advantages of DC power distribution. Hyperscale data centers increasingly adopt 380V DC distribution systems that eliminate multiple power conversion stages, achieving efficiency improvements of 8-12% compared to traditional AC systems. Edge computing deployments require compact, efficient DC power solutions that can operate reliably in diverse environmental conditions.

Renewable energy integration represents a rapidly growing category driven by Australia’s abundant solar and wind resources. Solar photovoltaic systems naturally generate DC power, making DC power systems essential for efficient energy conversion and storage. Battery energy storage systems operate natively in DC, creating synergies with renewable energy generation and grid stabilization applications. Hybrid renewable systems combining solar, wind, and storage require sophisticated DC power management capabilities.

Electric vehicle charging infrastructure shows the highest growth rate among application categories, driven by accelerating EV adoption and government support for charging network expansion. DC fast charging systems require high-power DC conversion capabilities and advanced thermal management. Fleet charging applications for commercial and government vehicles create demand for scalable DC charging solutions with intelligent load management.

Industrial applications encompass diverse use cases including motor drives, process control, and material handling systems. Variable frequency drives for industrial motors benefit from DC power systems that provide precise control and improved efficiency. Mining operations utilize DC power systems for reliable operation in harsh environments and remote locations.

Energy efficiency improvements represent the primary benefit for organizations adopting DC power systems. Elimination of multiple power conversions reduces energy losses by 10-15% compared to traditional AC systems, resulting in significant operational cost savings over system lifetime. Reduced cooling requirements due to lower heat generation further enhance overall system efficiency and reduce facility operating costs.

Enhanced reliability and power quality provide critical advantages for mission-critical applications. DC power systems offer superior voltage regulation, reduced electromagnetic interference, and improved fault tolerance compared to AC systems. Uninterruptible power supply capabilities integrated into DC systems ensure continuous operation during grid disturbances or outages.

Simplified system architecture reduces complexity and maintenance requirements through consolidated power management and distribution. Modular designs enable scalable deployments that can grow with changing requirements. Standardized components and plug-and-play interfaces simplify installation and reduce commissioning time.

Future-proofing benefits position organizations for evolving energy landscapes and technology trends. Native compatibility with renewable energy sources, energy storage systems, and electric vehicle charging infrastructure provides strategic advantages. Smart grid integration capabilities enable participation in demand response programs and energy trading opportunities.

Environmental benefits support sustainability objectives through improved energy efficiency and renewable energy integration. Reduced carbon footprint from lower energy consumption and enhanced renewable energy utilization aligns with corporate sustainability goals. Circular economy principles through improved equipment longevity and recyclability contribute to environmental stewardship.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and smart systems represent a fundamental trend transforming DC power system capabilities. Internet of Things (IoT) integration enables remote monitoring, predictive maintenance, and automated optimization of system performance. Artificial intelligence and machine learning algorithms optimize energy management and predict system behavior under varying load conditions.

Modular and scalable designs are becoming standard in DC power system architecture, enabling flexible deployment and future expansion. Containerized solutions provide rapid deployment capabilities for temporary or remote applications. Plug-and-play components simplify system integration and reduce installation complexity.

Wide bandgap semiconductors including silicon carbide (SiC) and gallium nitride (GaN) enable higher efficiency and power density in DC power conversion equipment. These advanced materials allow operation at higher frequencies and temperatures, reducing system size and improving performance. Power density improvements of 30-50% are achievable with next-generation semiconductor technologies.

Energy storage integration continues to evolve with improved battery technologies and sophisticated energy management systems. Lithium-ion battery costs continue declining while performance improves, making energy storage more economically attractive. Second-life battery applications from electric vehicles create new opportunities for stationary energy storage systems.

Cybersecurity focus intensifies as DC power systems become more connected and digitally enabled. Secure communication protocols, encryption technologies, and intrusion detection systems become essential components of modern DC power systems. Regulatory compliance requirements for critical infrastructure protection drive security feature adoption.

Major infrastructure projects across Australia continue to drive DC power system adoption and innovation. The Snowy 2.0 pumped hydro project incorporates advanced DC transmission technologies for efficient power transfer. Renewable energy zones in various states utilize DC power systems for grid integration and energy storage applications.

Technology partnerships between international suppliers and local system integrators accelerate market development and knowledge transfer. Research collaborations between universities, government agencies, and industry participants advance DC power system technologies and applications. Demonstration projects showcase innovative DC power solutions and validate performance in Australian conditions.

Regulatory developments including updated electrical safety standards and grid connection requirements influence DC power system design and implementation. Australian Standards for DC power systems continue evolving to address new technologies and applications. Grid codes increasingly accommodate DC power system integration and grid support functions.

Manufacturing investments by international companies establish local production capabilities and reduce supply chain dependencies. Service network expansion improves local support capabilities for DC power system customers. Training programs and certification initiatives address skills shortages in the DC power system sector.

According to MarkWide Research analysis, recent industry developments indicate accelerating adoption of DC power systems across multiple sectors, with particular strength in renewable energy integration and electric vehicle charging applications.

Strategic positioning recommendations for market participants emphasize the importance of developing comprehensive solution portfolios that address diverse customer requirements. Technology integration capabilities combining power electronics, energy storage, and digital control systems create competitive advantages and customer value. Local partnerships with system integrators and service providers enhance market reach and customer support capabilities.

Investment priorities should focus on research and development activities that advance DC power system efficiency, reliability, and cost-effectiveness. Manufacturing capabilities for key components and systems reduce supply chain risks and improve cost competitiveness. Service infrastructure development ensures long-term customer satisfaction and recurring revenue opportunities.

Market entry strategies for new participants should consider niche applications where specialized expertise can create differentiation. Vertical integration opportunities in specific market segments may provide sustainable competitive advantages. Acquisition strategies can accelerate market entry and capability development.

Customer engagement approaches should emphasize total cost of ownership benefits rather than initial capital costs. Demonstration projects and pilot programs help customers understand DC power system benefits and build confidence in technology adoption. Financing solutions and performance guarantees can address customer concerns about technology risks and investment returns.

Regulatory engagement with government agencies and standards organizations helps shape favorable policy environments and technical standards. Industry collaboration through trade associations and technical committees advances market development and addresses common challenges.

Long-term growth prospects for the Australia DC power system market remain highly positive, driven by fundamental trends in energy transition, digitalization, and infrastructure modernization. Market expansion is expected to accelerate over the next decade as technology costs continue declining and performance improvements make DC power systems increasingly attractive across diverse applications.

Technology evolution will continue advancing DC power system capabilities through improvements in power electronics, energy storage, and digital control systems. Next-generation semiconductors will enable higher efficiency and power density, while artificial intelligence integration will optimize system performance and reduce operational costs. Standardization efforts will improve interoperability and reduce system complexity.

Application diversification will expand DC power system adoption beyond traditional markets into new sectors including agriculture, transportation, and residential applications. Microgrid deployments in remote communities and industrial facilities will create significant growth opportunities. Smart city initiatives will integrate DC power systems into urban infrastructure for improved efficiency and sustainability.

Market maturation will bring improved cost competitiveness and simplified deployment processes. Supply chain localization will reduce costs and improve service capabilities. Skills development programs will address workforce requirements and support market growth. MWR projections indicate sustained growth rates exceeding 10% annually through the next decade.

Integration trends will see DC power systems becoming integral components of comprehensive energy management solutions. Grid modernization initiatives will incorporate DC power systems for improved efficiency and renewable energy integration. Sector coupling between electricity, heating, and transportation will create new opportunities for DC power system applications.

The Australia direct current power system market represents a dynamic and rapidly evolving sector with substantial growth potential across multiple applications and industries. Market fundamentals remain strong, supported by government policies promoting renewable energy adoption, increasing demand for energy-efficient solutions, and the ongoing digital transformation of critical infrastructure.

Technology advancement continues to enhance DC power system capabilities while reducing costs and complexity. The convergence of power electronics, energy storage, and digital technologies creates increasingly sophisticated solutions that deliver superior performance and value to customers. Market participants who invest in innovation and develop comprehensive solution portfolios are well-positioned for long-term success.

Growth opportunities span diverse applications from data centers and telecommunications to renewable energy integration and electric vehicle charging. Regional expansion into remote and industrial applications offers additional market potential. The increasing focus on sustainability and energy efficiency creates favorable conditions for continued DC power system adoption.

Success factors for market participants include technology leadership, local market presence, comprehensive service capabilities, and strategic partnerships. Organizations that can demonstrate clear value propositions and support customers throughout the project lifecycle will capture the greatest market opportunities. The Australia direct current power system market is poised for sustained growth as the nation continues its transition toward a more sustainable and efficient energy future.

What is Direct Current Power System?

Direct Current Power System refers to a system that uses direct current (DC) electricity for power distribution and transmission. This type of system is commonly used in various applications, including renewable energy sources like solar power, electric vehicles, and data centers.

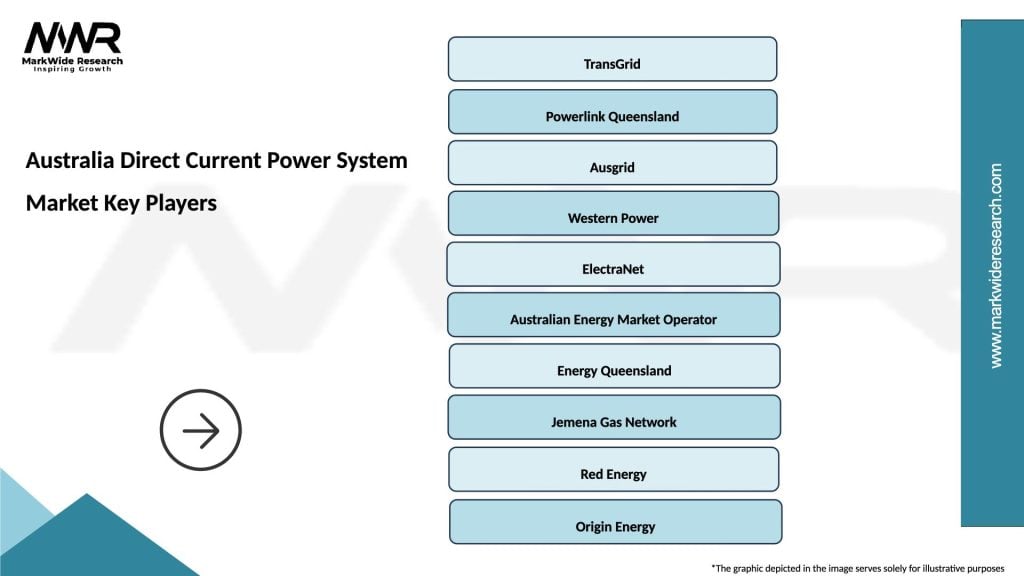

What are the key players in the Australia Direct Current Power System Market?

Key players in the Australia Direct Current Power System Market include companies such as Redback Technologies, Powercor Australia, and Energy Networks Australia, among others. These companies are involved in the development and implementation of DC power systems across various sectors.

What are the growth factors driving the Australia Direct Current Power System Market?

The growth of the Australia Direct Current Power System Market is driven by the increasing adoption of renewable energy sources, the rise in electric vehicle usage, and the demand for efficient power distribution systems. These factors contribute to a shift towards more sustainable energy solutions.

What challenges does the Australia Direct Current Power System Market face?

The Australia Direct Current Power System Market faces challenges such as the high initial investment costs, the need for specialized infrastructure, and regulatory hurdles. These factors can hinder the widespread adoption of DC power systems in various applications.

What opportunities exist in the Australia Direct Current Power System Market?

Opportunities in the Australia Direct Current Power System Market include advancements in energy storage technologies, the integration of smart grid solutions, and the growing demand for sustainable energy practices. These trends can enhance the efficiency and reliability of DC power systems.

What trends are shaping the Australia Direct Current Power System Market?

Trends shaping the Australia Direct Current Power System Market include the increasing use of microgrids, the development of high-efficiency DC appliances, and the rise of electric mobility solutions. These trends are influencing how power is generated, distributed, and consumed.

Australia Direct Current Power System Market

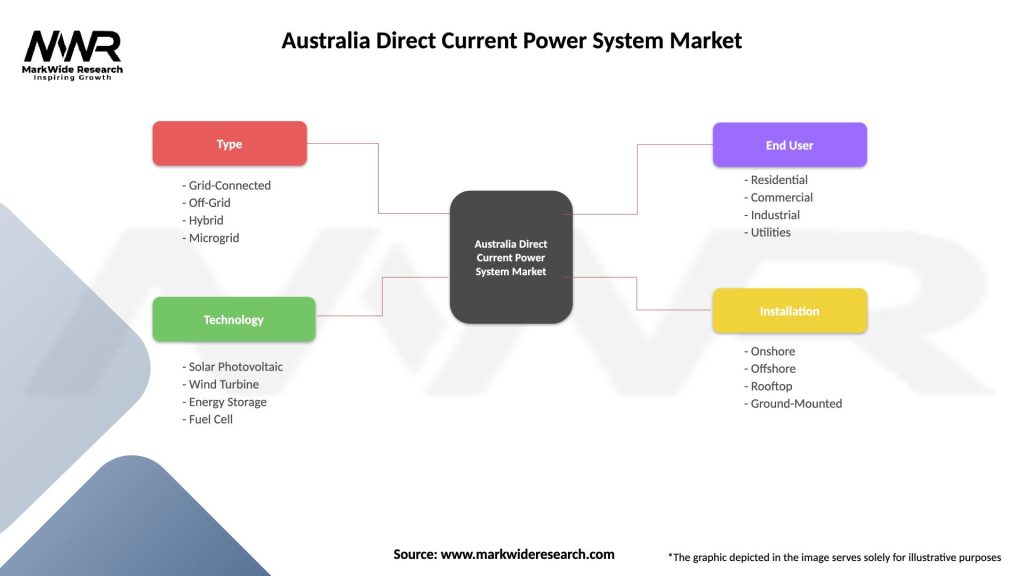

| Segmentation Details | Description |

|---|---|

| Type | Grid-Connected, Off-Grid, Hybrid, Microgrid |

| Technology | Solar Photovoltaic, Wind Turbine, Energy Storage, Fuel Cell |

| End User | Residential, Commercial, Industrial, Utilities |

| Installation | Onshore, Offshore, Rooftop, Ground-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Direct Current Power System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at