444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia dental device market represents a dynamic and rapidly evolving sector within the country’s healthcare industry, characterized by increasing demand for advanced dental technologies and innovative treatment solutions. Market dynamics indicate robust growth driven by an aging population, rising awareness of oral health importance, and technological advancements in dental equipment and devices. The market encompasses a comprehensive range of products including diagnostic equipment, therapeutic devices, dental implants, orthodontic appliances, and consumable materials used in dental practices across Australia.

Growth trajectories show the market expanding at a compound annual growth rate (CAGR) of 6.8%, reflecting strong demand from both public and private dental sectors. Key market drivers include increasing prevalence of dental disorders, growing geriatric population requiring specialized dental care, and rising disposable income enabling patients to seek advanced dental treatments. The market benefits from Australia’s well-established healthcare infrastructure, supportive government policies, and increasing adoption of digital dentistry solutions.

Regional distribution shows concentration in major metropolitan areas including Sydney, Melbourne, Brisbane, and Perth, where approximately 75% of dental practices are located. The market demonstrates strong potential for continued expansion, supported by ongoing technological innovations, increasing dental tourism, and growing emphasis on preventive dental care among Australian consumers.

The Australia dental device market refers to the comprehensive ecosystem of medical devices, equipment, instruments, and consumable materials specifically designed for dental diagnosis, treatment, and oral healthcare delivery within the Australian healthcare system. This market encompasses all technological solutions used by dental professionals, including general practitioners, specialists, and dental technicians, to provide comprehensive oral healthcare services to patients across the continent.

Market scope includes diagnostic imaging equipment such as digital X-ray systems and intraoral cameras, therapeutic devices including dental lasers and ultrasonic scalers, restorative materials, orthodontic appliances, dental implants, and surgical instruments. The market also covers consumable products like dental adhesives, impression materials, and sterilization equipment essential for maintaining clinical standards in dental practices.

Industry definition extends beyond traditional dental equipment to include emerging technologies such as computer-aided design and manufacturing (CAD/CAM) systems, 3D printing solutions for dental applications, and digital workflow management systems that enhance practice efficiency and patient outcomes.

Market performance demonstrates sustained growth momentum driven by technological innovation, demographic shifts, and evolving patient expectations for advanced dental care. The Australian dental device sector benefits from strong healthcare infrastructure, regulatory support, and increasing integration of digital technologies in dental practices nationwide.

Key growth factors include rising prevalence of dental diseases, with oral health issues affecting approximately 90% of adults in some form, driving demand for both preventive and therapeutic dental devices. The market shows particular strength in digital dentistry adoption, with digital impression systems experiencing 45% growth in adoption rates among Australian dental practices over recent years.

Competitive landscape features a mix of international manufacturers and local distributors, with market leaders focusing on innovation, quality, and comprehensive service support. The sector demonstrates resilience and adaptability, particularly evident during recent global challenges where dental practices rapidly adopted new technologies and safety protocols.

Future prospects remain highly positive, supported by government initiatives promoting oral health awareness, increasing dental insurance coverage, and growing recognition of the connection between oral health and overall systemic health among Australian consumers.

Strategic insights reveal several critical factors shaping the Australia dental device market landscape:

Market intelligence indicates strong potential for continued growth, particularly in advanced diagnostic equipment, minimally invasive treatment devices, and digital workflow solutions that enhance practice efficiency and patient experience.

Primary growth drivers propelling the Australia dental device market include demographic, technological, and socioeconomic factors that create sustained demand for advanced dental solutions.

Demographic influences represent the most significant driver, with Australia’s aging population requiring increased dental care services. The growing number of individuals over 65 years creates substantial demand for dental implants, prosthetic devices, and specialized treatment equipment. Population aging trends show this demographic segment expanding rapidly, directly correlating with increased dental device utilization.

Technological advancement serves as another crucial driver, with innovations in digital dentistry, 3D printing, and minimally invasive treatment options attracting both practitioners and patients. The integration of artificial intelligence in diagnostic equipment enhances treatment accuracy and efficiency, driving adoption among forward-thinking dental practices.

Rising health awareness among Australian consumers contributes significantly to market growth, with increasing recognition of oral health’s impact on overall wellbeing. This awareness translates into higher demand for preventive care devices and advanced treatment options.

Economic factors including rising disposable income and improved dental insurance coverage enable more Australians to access advanced dental treatments, directly benefiting the dental device market. Government initiatives promoting oral health awareness and preventive care further support market expansion.

Market challenges present certain limitations to the Australia dental device market’s growth potential, requiring strategic consideration from industry participants.

High equipment costs represent a primary restraint, particularly for smaller dental practices seeking to upgrade to advanced digital systems. The substantial capital investment required for cutting-edge dental technology can limit adoption rates, especially among practices in regional areas with smaller patient bases.

Regulatory complexity creates challenges for device manufacturers and distributors, with stringent approval processes and compliance requirements potentially delaying product launches and increasing operational costs. The need for extensive clinical validation and documentation can slow market entry for innovative devices.

Skills shortage in specialized dental fields affects market growth, as the availability of trained professionals capable of utilizing advanced dental devices remains limited in certain regions. This constraint particularly impacts the adoption of sophisticated diagnostic and treatment equipment requiring specialized expertise.

Economic sensitivity influences market dynamics, as dental treatments often represent discretionary healthcare spending that may be deferred during economic uncertainty. This factor can create cyclical demand patterns affecting device sales and practice investment decisions.

Competition from alternative treatments and changing patient preferences toward minimally invasive procedures may limit demand for certain traditional dental devices, requiring manufacturers to adapt their product portfolios accordingly.

Emerging opportunities within the Australia dental device market present significant potential for growth and innovation across multiple segments and applications.

Digital dentistry expansion offers substantial opportunities, particularly in areas such as intraoral scanning, digital impression systems, and computer-guided surgery. The growing acceptance of digital workflows among dental professionals creates demand for integrated solutions that streamline practice operations and improve patient outcomes.

Teledentistry development represents an emerging opportunity, especially for serving rural and remote communities where access to dental care remains limited. Remote monitoring devices and teleconsultation platforms can expand market reach while addressing healthcare accessibility challenges.

Preventive care focus creates opportunities for diagnostic and monitoring devices that enable early detection and intervention. The shift toward preventive dentistry aligns with healthcare cost reduction initiatives and patient preference for minimally invasive treatments.

Dental tourism growth in Australia presents opportunities for high-end dental device manufacturers, as international patients seek advanced treatment options. This trend drives demand for premium equipment and technologies that differentiate Australian dental practices in the global market.

Sustainability initiatives open new market segments for environmentally conscious dental products, including biodegradable materials, energy-efficient equipment, and recyclable consumables that align with growing environmental awareness among healthcare providers and patients.

Market dynamics in the Australia dental device sector reflect complex interactions between technological innovation, regulatory frameworks, competitive pressures, and evolving healthcare delivery models.

Supply chain considerations significantly impact market dynamics, with global sourcing patterns affecting product availability and pricing. Recent disruptions have highlighted the importance of supply chain resilience and local manufacturing capabilities for critical dental devices and consumables.

Competitive intensity varies across different device categories, with established international manufacturers competing alongside emerging technology companies and local distributors. This competition drives innovation while potentially pressuring profit margins across the value chain.

Technology adoption cycles influence market dynamics, as dental practices evaluate the return on investment for new equipment against existing capabilities. The pace of adoption varies significantly between metropolitan and regional practices, creating diverse market segments with different growth trajectories.

Regulatory evolution continues to shape market dynamics, with authorities adapting frameworks to accommodate emerging technologies while maintaining safety and efficacy standards. These regulatory changes can create both opportunities and challenges for market participants.

Patient expectations increasingly influence market dynamics, with demand for faster, more comfortable, and aesthetically superior treatment outcomes driving innovation in dental device design and functionality.

Research approach employed for analyzing the Australia dental device market incorporates comprehensive primary and secondary research methodologies to ensure accurate and reliable market intelligence.

Primary research includes extensive interviews with dental professionals, practice managers, device manufacturers, distributors, and regulatory experts across Australia. This approach provides firsthand insights into market trends, challenges, and opportunities from key industry stakeholders.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, company financial statements, and academic research papers relevant to the Australian dental device market. This comprehensive literature review ensures thorough understanding of market context and historical trends.

Data validation processes include cross-referencing multiple sources, statistical analysis of market data, and expert review of findings to ensure accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of market intelligence.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing device categories, practice demographics, and utilization patterns to develop comprehensive market assessments. The methodology accounts for regional variations and practice size differences across the Australian dental landscape.

Trend analysis incorporates both quantitative and qualitative assessment techniques to identify emerging patterns and future market directions, providing stakeholders with actionable insights for strategic planning and investment decisions.

Regional distribution across Australia reveals distinct patterns in dental device market development, with significant variations in adoption rates, practice density, and technology utilization between different states and territories.

New South Wales dominates the market landscape, accounting for approximately 35% of national dental device consumption, driven by high practice density in Sydney and surrounding metropolitan areas. The state benefits from strong healthcare infrastructure, research institutions, and early adoption of advanced dental technologies.

Victoria represents the second-largest regional market, with Melbourne contributing roughly 25% of market activity. The state demonstrates strong growth in digital dentistry adoption and serves as a hub for dental device distribution across southeastern Australia.

Queensland shows robust market development, particularly in Brisbane and Gold Coast regions, with growing dental tourism contributing to demand for premium dental devices. The state’s aging population and lifestyle factors drive consistent market growth.

Western Australia presents unique market characteristics, with Perth serving as the primary market center while remote mining communities create specialized demand for portable and durable dental equipment. The state’s economic cycles influence investment patterns in dental technology.

South Australia, Tasmania, Northern Territory, and Australian Capital Territory collectively represent smaller but strategically important market segments, with government initiatives and university partnerships driving innovation adoption in these regions.

Market competition in the Australia dental device sector features a diverse ecosystem of international manufacturers, local distributors, and specialized technology providers competing across multiple product categories and market segments.

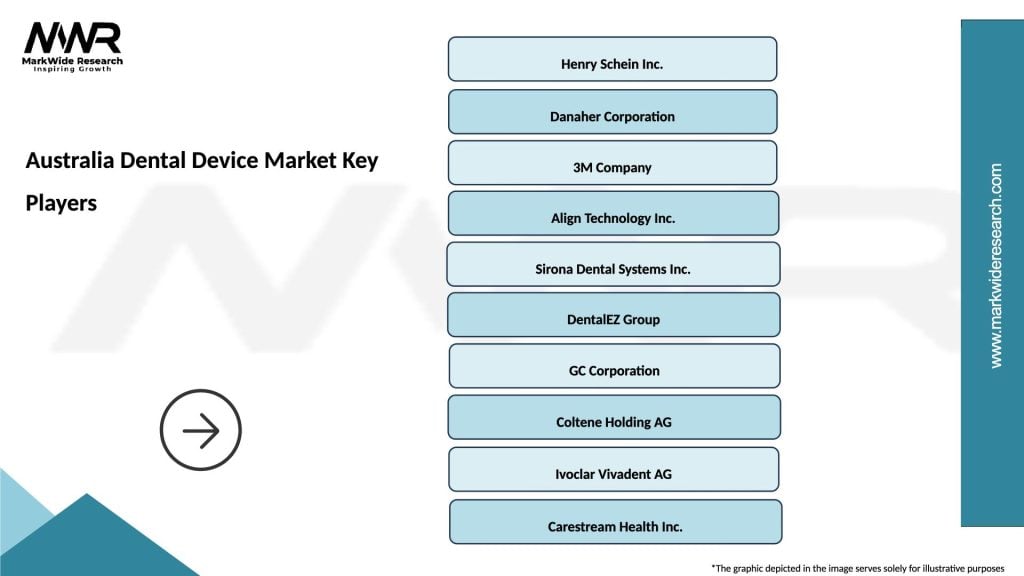

Leading market participants include:

Competitive strategies focus on innovation, service quality, and comprehensive support systems that help dental practices maximize their technology investments. Market leaders emphasize training programs, technical support, and integrated solutions that address multiple practice needs.

Market consolidation trends show ongoing merger and acquisition activity as companies seek to expand product portfolios and market reach while achieving operational efficiencies in the competitive Australian market.

Market segmentation analysis reveals distinct categories within the Australia dental device market, each characterized by unique growth patterns, competitive dynamics, and customer requirements.

By Product Type:

By End User:

By Technology:

Diagnostic equipment represents a high-growth category driven by technological advancement and increasing emphasis on early detection and accurate diagnosis. Digital imaging systems show particularly strong adoption, with digital radiography penetration reaching 80% among Australian dental practices.

Therapeutic devices demonstrate steady growth supported by increasing patient volumes and preference for minimally invasive treatments. Dental lasers and advanced scaling systems gain popularity as practitioners seek to improve treatment outcomes while enhancing patient comfort.

Dental implants constitute a premium market segment with robust growth prospects driven by aging demographics and increasing acceptance of implant therapy. The category benefits from technological improvements in implant design and surgical techniques that improve success rates and reduce treatment times.

Orthodontic appliances show strong growth, particularly in clear aligner systems that appeal to adult patients seeking aesthetic treatment options. This segment demonstrates significant innovation with digital treatment planning and custom manufacturing capabilities.

Consumables market provides stable revenue streams for manufacturers and distributors, with consistent demand driven by routine dental procedures and infection control requirements. This category shows resilience during economic fluctuations due to its essential nature in dental practice operations.

Digital dentistry solutions represent the fastest-growing category, encompassing CAD/CAM systems, digital impression technologies, and practice management software that streamline workflows and improve patient experiences.

Dental practitioners benefit significantly from advanced dental devices through improved diagnostic accuracy, enhanced treatment outcomes, and increased practice efficiency. Modern equipment enables dentists to provide superior patient care while optimizing operational workflows and reducing treatment times.

Patient advantages include access to more comfortable, faster, and more effective dental treatments enabled by advanced device technologies. Digital dentistry solutions provide better treatment visualization and planning, leading to improved patient satisfaction and treatment acceptance rates.

Healthcare system benefits encompass improved oral health outcomes, reduced treatment complications, and more efficient resource utilization. Advanced diagnostic equipment enables early detection and intervention, potentially reducing long-term healthcare costs and improving population health outcomes.

Economic stakeholders including device manufacturers, distributors, and service providers benefit from sustained market growth, innovation opportunities, and expanding customer bases. The market provides employment opportunities and contributes to Australia’s healthcare technology sector development.

Research institutions gain access to advanced technologies for dental education and research purposes, supporting the development of future dental professionals and advancement of dental science. Collaboration between academia and industry drives innovation and knowledge transfer.

Regulatory bodies benefit from improved safety and efficacy standards in dental care delivery, supported by advanced device technologies that enhance treatment predictability and reduce adverse outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration represents the most significant trend transforming the Australia dental device market, with practices increasingly adopting comprehensive digital workflows that connect diagnostic, treatment planning, and fabrication processes. This trend drives demand for compatible systems and integrated solutions.

Minimally invasive dentistry continues gaining momentum, with practitioners and patients preferring treatment approaches that preserve natural tooth structure while achieving optimal outcomes. This trend supports growth in laser dentistry, air abrasion systems, and precision diagnostic equipment.

Artificial intelligence integration emerges as a transformative trend, with AI-powered diagnostic tools and treatment planning software beginning to appear in Australian dental practices. This technology promises to enhance diagnostic accuracy and treatment predictability.

Sustainability focus influences purchasing decisions, with dental practices increasingly considering environmental impact when selecting devices and consumables. Manufacturers respond with eco-friendly products and sustainable packaging solutions.

Patient experience enhancement drives adoption of technologies that improve comfort, reduce treatment time, and provide better communication tools. Virtual reality systems, advanced anesthesia delivery, and patient education technologies gain popularity.

Practice consolidation trends toward larger group practices and dental service organizations create demand for standardized equipment platforms and centralized management systems that support multiple locations efficiently.

Technological innovations continue reshaping the Australia dental device landscape, with recent developments including advanced 3D printing applications, improved implant surface technologies, and next-generation digital imaging systems offering enhanced diagnostic capabilities.

Regulatory updates include revised guidelines for digital health technologies and updated standards for dental device safety and efficacy. These developments ensure patient safety while facilitating innovation adoption in clinical practice.

Strategic partnerships between device manufacturers and software developers create integrated solutions that address multiple practice needs. These collaborations result in comprehensive platforms that streamline workflows and improve practice efficiency.

Market consolidation activities include mergers and acquisitions among device manufacturers and distributors, creating larger organizations with enhanced capabilities to serve the Australian market. These developments often result in expanded product portfolios and improved service offerings.

Educational initiatives expand training programs and certification courses for dental professionals, supporting adoption of advanced technologies and ensuring optimal utilization of sophisticated dental devices. Universities and professional organizations collaborate to provide comprehensive education.

Research collaborations between Australian universities, research institutions, and device manufacturers advance dental technology development and clinical validation. These partnerships contribute to evidence-based adoption of new technologies and treatment protocols.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges in the evolving Australia dental device market landscape.

Technology investment should prioritize digital integration capabilities and interoperability features that enable seamless workflow integration. MWR analysis suggests that practices investing in comprehensive digital platforms achieve higher efficiency gains and patient satisfaction scores compared to those adopting isolated technologies.

Market expansion strategies should consider regional variations and tailor approaches to address specific needs of metropolitan versus rural practices. Successful companies develop flexible service models that accommodate different practice sizes and geographic constraints.

Training and support programs represent critical success factors for device manufacturers and distributors. Comprehensive education initiatives that help practitioners maximize technology benefits create competitive advantages and customer loyalty.

Partnership development with local distributors, service providers, and educational institutions can enhance market penetration and customer support capabilities. Strategic alliances often provide more effective market access than direct sales approaches.

Innovation focus should align with key market trends including sustainability, patient experience enhancement, and artificial intelligence integration. Companies that anticipate and address these trends position themselves for long-term success.

Regulatory compliance strategies must stay ahead of evolving requirements while maintaining operational efficiency. Proactive engagement with regulatory authorities and industry associations supports successful market participation.

Market prospects for the Australia dental device sector remain highly positive, with multiple growth drivers supporting sustained expansion across key product categories and market segments. The convergence of demographic trends, technological advancement, and evolving healthcare delivery models creates a favorable environment for continued market development.

Growth projections indicate the market will maintain robust expansion, with digital dentistry segments expected to achieve growth rates exceeding 15% annually over the next five years. Traditional equipment categories will show steady growth supported by replacement cycles and practice expansion.

Technology evolution will continue driving market transformation, with artificial intelligence, machine learning, and advanced materials science contributing to next-generation dental devices. These innovations promise to enhance diagnostic accuracy, treatment outcomes, and practice efficiency.

Market maturation in metropolitan areas will drive geographic expansion toward regional and rural markets, supported by teledentistry solutions and mobile dental services. This expansion will create new opportunities for device manufacturers and service providers.

Regulatory environment evolution will likely accommodate emerging technologies while maintaining rigorous safety and efficacy standards. Adaptive regulatory frameworks will support innovation while ensuring patient protection and professional accountability.

Competitive dynamics will intensify as the market attracts new entrants and existing players expand their capabilities. Success will depend on innovation, service quality, and ability to address evolving customer needs in a rapidly changing healthcare landscape.

The Australia dental device market presents exceptional opportunities for growth and innovation, driven by favorable demographics, technological advancement, and increasing emphasis on oral health importance. Market fundamentals remain strong, supported by robust healthcare infrastructure, professional education systems, and regulatory frameworks that ensure quality and safety standards.

Key success factors for market participants include embracing digital transformation, developing comprehensive service capabilities, and maintaining focus on customer needs and outcomes. The market rewards companies that combine technological innovation with practical solutions addressing real-world practice challenges.

Future market development will be shaped by continued technological evolution, changing patient expectations, and evolving healthcare delivery models. Organizations that anticipate and adapt to these changes while maintaining commitment to quality and service excellence will achieve sustainable competitive advantages in this dynamic and growing market.

What is Dental Device?

Dental devices refer to a range of instruments and equipment used in dental care, including diagnostic tools, treatment devices, and preventive care products. These devices play a crucial role in oral health management and dental procedures.

What are the key players in the Australia Dental Device Market?

Key players in the Australia Dental Device Market include companies such as Dentsply Sirona, Henry Schein, and Straumann, which offer a variety of dental products and technologies. These companies are known for their innovative solutions in dental implants, orthodontics, and restorative dentistry, among others.

What are the growth factors driving the Australia Dental Device Market?

The Australia Dental Device Market is driven by factors such as the increasing prevalence of dental diseases, rising awareness about oral hygiene, and advancements in dental technology. Additionally, the growing demand for cosmetic dentistry and dental implants contributes to market growth.

What challenges does the Australia Dental Device Market face?

Challenges in the Australia Dental Device Market include stringent regulatory requirements, high costs associated with advanced dental technologies, and competition from alternative treatment options. These factors can hinder market expansion and innovation.

What opportunities exist in the Australia Dental Device Market?

Opportunities in the Australia Dental Device Market include the development of smart dental devices, increasing investment in dental research, and the expansion of tele-dentistry services. These trends can enhance patient care and accessibility to dental services.

What trends are shaping the Australia Dental Device Market?

Trends in the Australia Dental Device Market include the integration of digital technologies such as CAD/CAM systems, the rise of minimally invasive procedures, and the growing focus on preventive care. These innovations are transforming dental practices and improving patient outcomes.

Australia Dental Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Orthodontic Devices, Endodontic Instruments, Dental Implants, Restorative Materials |

| Technology | 3D Printing, CAD/CAM Systems, Laser Dentistry, Digital Imaging |

| End User | Dental Clinics, Hospitals, Research Laboratories, Academic Institutions |

| Application | Cosmetic Dentistry, Preventive Care, Oral Surgery, Periodontics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Dental Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at