444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia crop protection chemicals market, also known as the pesticides market, plays a crucial role in the country’s agricultural sector. Crop protection chemicals are substances used to control pests, diseases, and weeds that can damage crops and reduce yields. These chemicals help farmers protect their crops and ensure food security for the nation. The market for crop protection chemicals in Australia has witnessed significant growth in recent years, driven by various factors such as increasing agricultural activities, growing demand for high-quality crops, and the need for sustainable farming practices.

Meaning

Crop protection chemicals, commonly referred to as pesticides, are substances or mixtures of substances used to prevent, destroy, or mitigate any pest, including insects, rodents, fungi, and weeds. These chemicals can be synthetic or naturally derived and are designed to safeguard crops from pests that can cause significant damage to agricultural production. Crop protection chemicals include herbicides, insecticides, fungicides, and other specialized formulations that target specific pests and diseases.

Executive Summary

The Australia crop protection chemicals market is a vital component of the country’s agricultural industry. It encompasses a wide range of chemical formulations and products designed to protect crops from pests, diseases, and weeds. This market has witnessed steady growth in recent years, driven by factors such as increasing agricultural activities, the need for enhanced crop yields, and the adoption of sustainable farming practices. The market is characterized by the presence of both domestic and international players, offering a diverse portfolio of crop protection solutions to cater to the specific needs of Australian farmers.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The Australia crop protection chemicals market is influenced by several drivers that propel its growth and development. These drivers include:

Market Restraints

While the Australia crop protection chemicals market exhibits growth potential, it also faces certain challenges and restraints that need to be addressed. These include:

Market Opportunities

The Australia crop protection chemicals market presents several opportunities for industry players and stakeholders. These opportunities arise from various factors, including:

Market Dynamics

The Australia crop protection chemicals market is dynamic, influenced by various factors that shape its growth and development. These dynamics include market trends, consumer preferences, technological advancements, regulatory frameworks, and environmental concerns.

The market is driven by the increasing demand for high-quality crops, the need for sustainable farming practices, and the adoption of integrated pest management approaches. Technological advancements in chemical formulations and application methods also contribute to market growth.

However, the market faces challenges in terms of regulatory compliance, environmental concerns, resistance development, and public perception. These factors require industry players to innovate and develop safer and more sustainable crop protection solutions.

It is essential for stakeholders in the market to stay updated with the latest trends, consumer demands, and regulatory changes to remain competitive. Collaboration between industry players, research institutions, and regulatory bodies is crucial for addressing challenges and capitalizing on opportunities in the market.

Regional Analysis

The Australia crop protection chemicals market exhibits regional variations in terms of crop types, farming practices, and pest pressures. The country’s diverse climate and agricultural landscape contribute to these regional differences. Some key regional insights include:

Understanding regional variations is crucial for manufacturers, distributors, and farmers to develop targeted crop protection solutions that address specific pest pressures and crop needs.

Competitive Landscape

Leading Companies in the Australia Crop Protection Chemicals (Pesticides) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

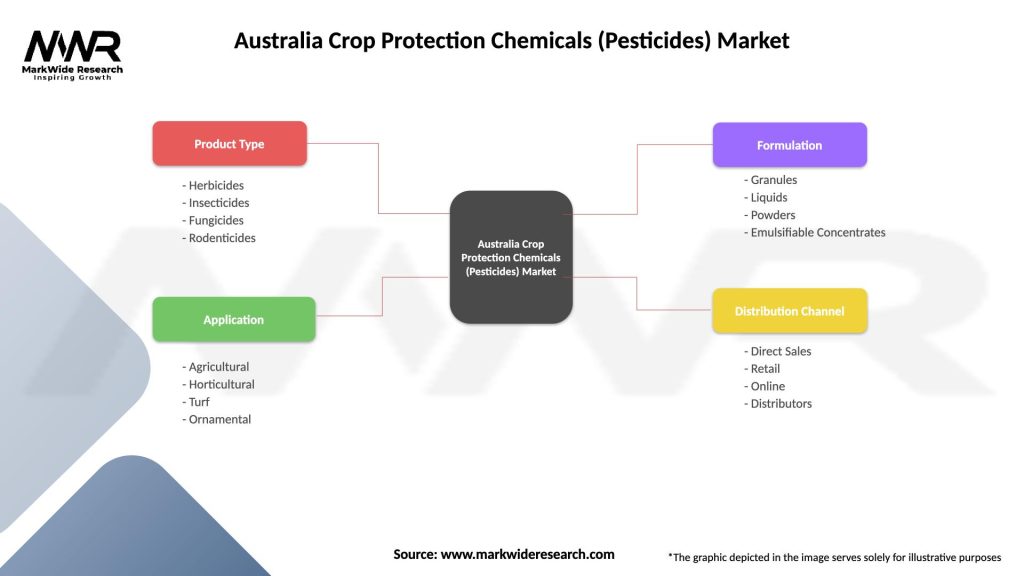

Segmentation

The Australia crop protection chemicals market can be segmented based on various criteria to gain insights into specific market segments. Some key segmentation parameters include:

Segmentation allows industry players and stakeholders to understand market dynamics, target specific customer segments, and develop tailored crop protection solutions.

Category-wise Insights

Each category of crop protection chemicals offers unique insights and considerations. Understanding these categories can help industry participants make informed decisions and address specific market needs. Here are some category-wise insights:

Understanding the characteristics, mode of action, and application methods for each category of crop protection chemicals is essential for effective pest management strategies.

Key Benefits for Industry Participants and Stakeholders

The Australia crop protection chemicals market offers several benefits for industry participants and stakeholders. These benefits include:

Industry participants and stakeholders should collaborate and invest in research and development to maximize these benefits and address emerging challenges.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides insights into the internal and external factors influencing the Australia crop protection chemicals market. Here is a SWOT analysis of the market:

Understanding the strengths, weaknesses, opportunities, and threats can help industry participants devise strategies to capitalize on opportunities, mitigate risks, and overcome challenges in the market.

Market Key Trends

The Australia crop protection chemicals market is characterized by several key trends that influence its growth and development. These trends reflect changing consumer preferences, technological advancements, and regulatory shifts. Some key market trends include:

Industry participants should stay updated with these key trends to align their strategies and offerings with evolving market demands.

Covid-19 Impact

The Covid-19 pandemic has had both short-term and long-term impacts on the Australia crop protection chemicals market. The pandemic disrupted global supply chains and affected agricultural activities and trade. Some key impacts include:

While the immediate impacts of the pandemic were challenging, the long-term effects include increased awareness of food security and safety, technological advancements, and the importance of resilient agricultural systems.

Key Industry Developments

The Australia crop protection chemicals market has witnessed significant industry developments in recent years. These developments reflect the changing landscape of the market and the efforts of industry participants to address emerging challenges and opportunities. Some key industry developments include:

These industry developments demonstrate the commitment of market participants to address sustainability, innovation, and the evolving needs of farmers and consumers.

Analyst Suggestions

Based on market trends and insights, analysts suggest the following recommendations for industry participants and stakeholders in the Australia crop protection chemicals market:

Future Outlook

The future outlook for the Australia crop protection chemicals market is optimistic, with several factors driving its growth and development. These factors include the increasing demand for high-quality crops, the adoption of sustainable farming practices, and the need for innovative and effective pest management solutions.

The market is expected to witness continued advancements in crop protection technologies, formulations, and application methods. Manufacturers will focus on developing bio-based, organic, and low-residue solutions to meet consumer demands for sustainable and safe agricultural produce.

Furthermore, the integration of digital technologies and precision agriculture techniques will enable targeted and efficient application of crop protection chemicals, reducing environmental impact and optimizing resource utilization.

Industry players should adapt to evolving market trends, collaborate with stakeholders, and invest in research and development to capitalize on opportunities and ensure long-term sustainability in the Australia crop protection chemicals market.

Conclusion

The Australia crop protection chemicals market plays a vital role in safeguarding the country’s agricultural sector and ensuring food security. The market has experienced significant growth, driven by increasing agricultural activities, the demand for high-quality crops, and the adoption of sustainable farming practices.

While the market offers numerous opportunities, it also faces challenges such as regulatory compliance, environmental concerns, resistance development, and public perception. Industry participants should focus on innovation, collaboration, and sustainability to address these challenges and capitalize on emerging trends.

What is Crop Protection Chemicals (Pesticides)?

Crop Protection Chemicals, commonly known as pesticides, are substances used to prevent, destroy, or control pests that can harm crops. They play a crucial role in agriculture by protecting plants from insects, weeds, and diseases, thereby enhancing crop yield and quality.

What are the key companies in the Australia Crop Protection Chemicals (Pesticides) Market?

Key companies in the Australia Crop Protection Chemicals (Pesticides) Market include Bayer CropScience, Syngenta, and Corteva Agriscience, among others. These companies are involved in the development and distribution of various pesticide products tailored for Australian agriculture.

What are the growth factors driving the Australia Crop Protection Chemicals (Pesticides) Market?

The Australia Crop Protection Chemicals (Pesticides) Market is driven by factors such as the increasing demand for food production, advancements in agricultural technology, and the need for effective pest management solutions. Additionally, the rise in organic farming practices is influencing the development of biopesticides.

What challenges does the Australia Crop Protection Chemicals (Pesticides) Market face?

The Australia Crop Protection Chemicals (Pesticides) Market faces challenges such as regulatory restrictions on pesticide use, public concerns regarding environmental impact, and the development of pest resistance. These factors can hinder the effectiveness and acceptance of certain pesticide products.

What opportunities exist in the Australia Crop Protection Chemicals (Pesticides) Market?

Opportunities in the Australia Crop Protection Chemicals (Pesticides) Market include the growing trend towards sustainable agriculture, the development of innovative pesticide formulations, and the increasing adoption of precision farming techniques. These trends can lead to more efficient pest control and reduced chemical usage.

What trends are shaping the Australia Crop Protection Chemicals (Pesticides) Market?

Trends shaping the Australia Crop Protection Chemicals (Pesticides) Market include the rise of integrated pest management (IPM) practices, the use of digital agriculture technologies, and the increasing focus on environmentally friendly products. These trends are influencing how pesticides are developed and applied in modern farming.

Australia Crop Protection Chemicals (Pesticides) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Herbicides, Insecticides, Fungicides, Rodenticides |

| Application | Agricultural, Horticultural, Turf, Ornamental |

| Formulation | Granules, Liquids, Powders, Emulsifiable Concentrates |

| Distribution Channel | Direct Sales, Retail, Online, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Crop Protection Chemicals (Pesticides) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at