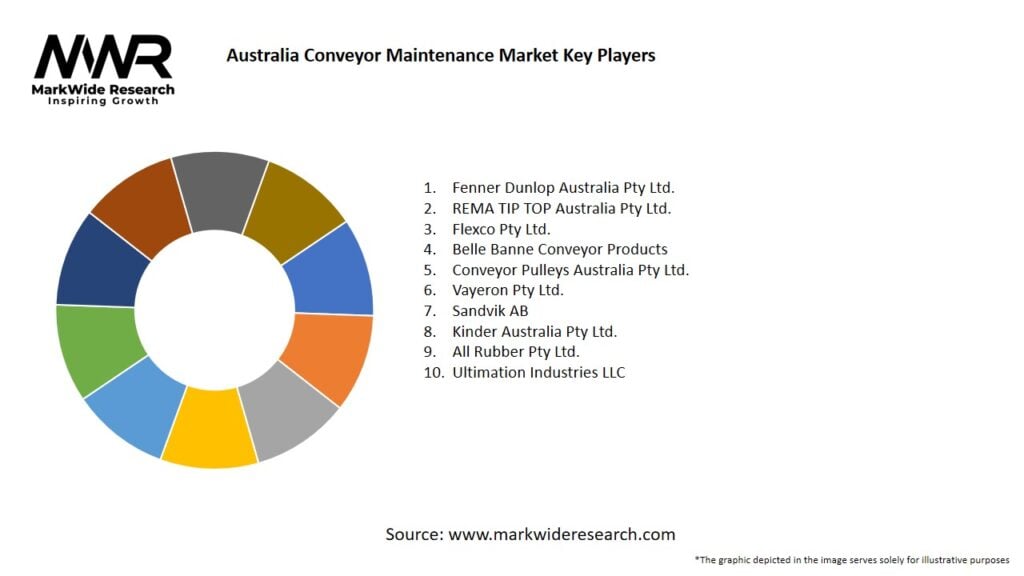

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

The mining sector accounts for over 60% of conveyor maintenance service demand in Australia, reflecting the extensive use of belt conveyors in open-pit and underground operations.

-

Predictive maintenance solutions, leveraging vibration sensors, temperature monitors, and cloud-based analytics, are projected to represent 25% of service revenue by 2028.

-

Government investment in infrastructure projects—such as port expansions and still-to-come renewable energy facilities—spurs demand for bulk material handling and associated maintenance services.

-

Tribal and remote community projects rely on modular conveyor systems; their maintenance needs are often addressed by mobile service units capable of rapid deployment across vast distances.

-

Environmental regulations, including dust and noise controls, require specialized maintenance protocols (e.g., seal replacements, belt scrubbing systems) to limit emissions and comply with state laws.

Market Drivers

-

Mining Production Growth: Expansion of iron ore, coal, and critical mineral extraction operations drives conveyor installation and ongoing maintenance needs.

-

Operational Efficiency Mandates: Companies prioritize preventive upkeep to eliminate unplanned stoppages, optimize throughput, and reduce repair costs.

-

Digitalization & IoT: Adoption of sensor-enabled conveyors and remote diagnostics enhances predictive maintenance, reducing manual inspections and enabling data-driven service schedules.

-

Regulatory Compliance: Australian WHS and environmental standards mandate regular equipment inspections, dust suppression, and noise control, necessitating professional maintenance services.

-

Aging Conveyor Infrastructure: Many existing conveyor systems installed decades ago require modernization and retrofitting, creating demand for refurbishment and upgrade services.

Market Restraints

-

Remote Location Challenges: Maintenance teams must travel long distances to mine sites, raising travel and logistics costs and impacting response times.

-

Skilled Labor Shortage: A scarcity of qualified maintenance technicians and engineers in regional areas can delay service delivery.

-

High Capital Expenditure: Upfront investment in IoT sensors, monitoring systems, and specialized tooling may deter smaller operators from adopting advanced maintenance solutions.

-

Variable Service Contracts: Short-term contracts limit long-term planning and investment in predictive analytics by service providers.

-

Downtime Acceptance: Some operators defer maintenance to scheduled shut-downs, potentially increasing the likelihood of catastrophic failures between windows.

Market Opportunities

-

Mobile Maintenance Hubs: Deploying fully equipped mobile service workshops to remote sites can improve response times and reduce travel costs.

-

Training & Certification Programs: Offering accredited training for regional technicians can build local capacity and address labor shortages.

-

Retrofit & Upgrade Services: Converting legacy systems to digital-ready conveyors (IoT, cloud connectivity) opens new revenue streams for maintenance providers.

-

Turnkey Maintenance Contracts: Bundling preventive, predictive, and corrective maintenance under long-term agreements enhances revenue predictability.

-

Green Maintenance Solutions: Eco-friendly lubricants, biodegradable belt cleaners, and dust-minimizing belt scrapers help customers meet sustainability targets and attract environmentally conscious operators.

Market Dynamics

-

Shift to Predictive Maintenance: Transitioning from reactive break-fix to condition-based servicing reduces costs and maximizes equipment availability.

-

Partnership Models: OEMs collaborate with third-party service firms to provide end-to-end maintenance, combining original-part expertise with local capabilities.

-

Data Monetization: Maintenance providers leverage equipment performance data to offer advisory services and optimize clients’ operational practices.

-

Consolidation Trends: Mergers and acquisitions among regional service specialists are creating larger players with national coverage and deeper technical resources.

-

Service Automation: Use of drones for belt inspections and automated guided vehicles (AGVs) for component delivery is emerging in large facilities.

Regional Analysis

-

Western Australia: The lion’s share of demand stems from Pilbara and Kimberley mining regions, where iron ore and mineral conveyors operate continuously under harsh conditions.

-

Queensland: Coal-belt operations in Bowen and Surat Basins drive maintenance services for long-distance overland conveyors connecting mines to export terminals.

-

New South Wales & Victoria: Manufacturing hubs and port facilities in Newcastle, Melbourne, and Sydney create demand for package handling and bulk material conveyor maintenance.

-

Northern Territory: Remote mining and defense installations rely on modular conveyor systems with high uptime requirements, serviced by specialized regional teams.

-

South Australia & Tasmania: Mining in the Gawler Craton and port grain terminals in Tasmania support niche maintenance markets for agricultural and mineral handling conveyors.

Competitive Landscape

Leading companies in the Australia Conveyor Maintenance Market:

- Fenner Dunlop Australia Pty Ltd.

- REMA TIP TOP Australia Pty Ltd.

- Flexco Pty Ltd.

- Belle Banne Conveyor Products

- Conveyor Pulleys Australia Pty Ltd.

- Vayeron Pty Ltd.

- Sandvik AB

- Kinder Australia Pty Ltd.

- All Rubber Pty Ltd.

- Ultimation Industries LLC

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

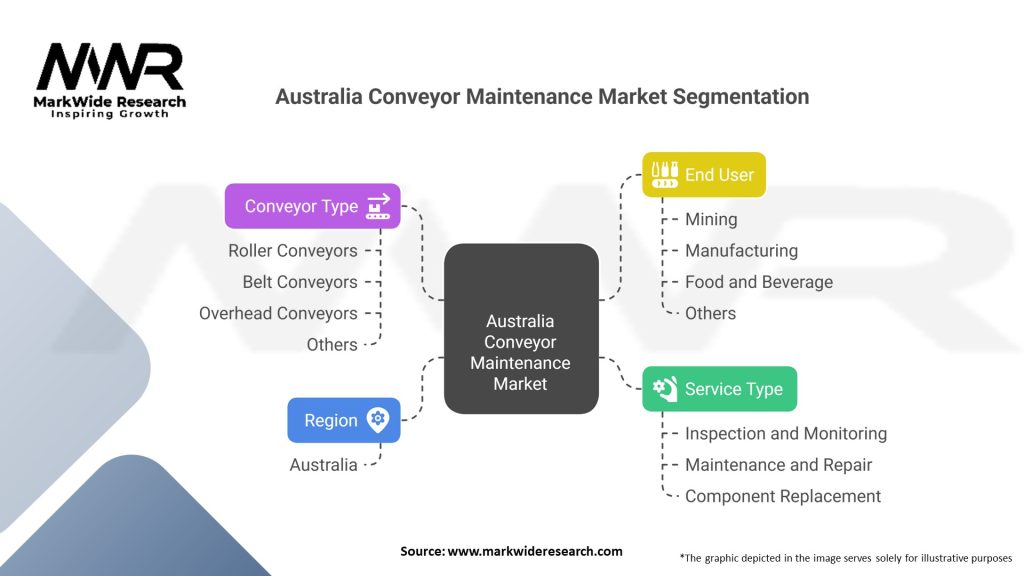

Segmentation

-

By Service Type: Preventive, Predictive, Corrective, Emergency Repairs, Retrofit & Upgrades

-

By End-User Industry: Mining, Manufacturing, Ports & Logistics, Food & Beverage, Waste Management

-

By Maintenance Model: Time-Based Contracts, Condition-Based Contracts, On-Demand Services

-

By Region: Western Australia, Queensland, New South Wales, Victoria, Other Regions

Category-wise Insights

-

Preventive Maintenance: Scheduled inspections and part replacements reduce unplanned stoppages but may result in unnecessary interventions if over-scheduled.

-

Predictive Maintenance: Sensor-driven analytics optimize service intervals, lowering overall maintenance costs and improving belt life.

-

Corrective & Emergency Repairs: Reactive response teams are crucial for high-impact breakdowns, especially in continuous mining operations.

-

Retrofit & Upgrade Services: Modernizing drive systems, installing variable-speed drives (VSDs), and integrating remote monitoring add value and extend system life.

Key Benefits for Industry Participants and Stakeholders

-

Maximized Uptime: Proactive maintenance minimizes conveyor stoppages, ensuring continuous material flow.

-

Cost Savings: Early fault detection and optimized service intervals reduce spare-part wastage and emergency repair expenses.

-

Safety Compliance: Regular inspections and component replacements mitigate accident risks and ensure WHS compliance.

-

Asset Longevity: Quality maintenance extends conveyor belt and component lifespan, improving return on investment.

-

Operational Insight: Data from predictive systems informs process improvements and asset-replacement planning.

SWOT Analysis

Strengths:

-

Established expertise in harsh mining environments.

-

Recurring revenue from long-term service contracts.

-

Integration of digital monitoring enhances service offerings.

Weaknesses:

-

High logistics costs for remote site visits.

-

Dependency on commodity market cycles.

-

Limited local skilled workforce in regional areas.

Opportunities:

-

Expansion of IoT-driven predictive maintenance services.

-

Growth of renewable energy projects requiring conveyor installations (e.g., biomass handling).

-

Training partnerships to develop regional maintenance talent.

Threats:

-

Economic downturns reducing mining CAPEX and maintenance budgets.

-

Increasing competition from global service providers entering the Australian market.

-

Technology obsolescence if service providers fail to adopt new monitoring tools.

Market Key Trends

-

Sensor-Integrated Belts: Embedding sensors directly into belt fabric for real-time wear and tear monitoring.

-

Autonomous Inspection Drones: Routine aerial belt inspections to detect misalignment and structural issues.

-

Digital Twin Models: Virtual replicas of conveyor systems to simulate wear, predict failures, and optimize maintenance schedules.

-

Cloud-Based Maintenance Platforms: Centralized dashboards combining data across multiple sites for portfolio management.

-

Green Service Practices: Use of biodegradable belt cleaners, eco-friendly lubricants, and waste minimization in maintenance operations.

Covid-19 Impact

At the height of the pandemic, maintenance schedules were disrupted by travel restrictions and workforce limitations, leading many operators to adopt remote monitoring and virtual inspections. Post-pandemic recovery has accelerated digital transformation in maintenance practices, with increased investment in predictive tools and reduced reliance on large on-site crews. Emphasis on contactless diagnostics and safety protocols during service visits has become standard.

Key Industry Developments

-

Metso Outotec introduced a remote conveyor health-monitoring service in 2023, combining vibration, temperature, and belt-tension sensors with cloud analytics.

-

RPMGlobal launched Conveyor3D™, a digital twin solution that models belt wear and locomotive behavior to predict maintenance needs.

-

Fowler Simmons established mobile maintenance hubs in Pilbara and Bowen Basin regions, reducing response times by 40%.

-

Thompson Group partnered with a major port operator to deliver a five-year predictive maintenance contract across multiple terminal conveyors.

Analyst Suggestions

-

Invest in Local Capabilities: Build regional service centers and train local technicians to reduce travel costs and improve response times.

-

Expand Predictive Offerings: Integrate advanced analytics and machine-learning models to move from reactive to condition-based maintenance.

-

Develop Flexible Contracts: Offer tiered service agreements combining preventive, predictive, and emergency support to suit varied client needs and budgets.

-

Leverage Digital Twins: Use virtual modeling to plan maintenance, test upgrade scenarios, and forecast lifecycle costs.

-

Adopt Sustainable Practices: Incorporate eco-friendly materials and waste-reduction measures to align with corporate sustainability goals and government regulations.

Future Outlook

The Australia Conveyor Maintenance market is set to evolve toward fully digitized, condition-based service ecosystems. Adoption of integrated sensor networks, autonomous inspection tools, and digital twin platforms will enable maintenance providers to offer predictive, data-driven solutions that minimize downtime and extend asset life. As mining, logistics, and manufacturing sectors continue to invest in automation and sustainability, conveyor maintenance services will diversify into green technologies and remote support models, ensuring resilient and efficient material handling operations across Australia’s vast landscapes.

Conclusion

In conclusion, the Australia Conveyor Maintenance market presents significant opportunities for service providers who can combine local expertise, advanced monitoring technologies, and sustainable practices. By transitioning from traditional break-fix models to predictive, data-driven maintenance strategies—and by developing regional capabilities to support remote operations—stakeholders can deliver higher uptime, cost savings, and regulatory compliance in a market critical to Australia’s resource and logistics industries.