444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia compound feed market is a thriving sector within the country’s agricultural industry. Compound feed refers to a mixture of various ingredients that are specifically formulated to provide balanced nutrition to animals. It is a crucial component of modern livestock production systems as it ensures that animals receive the necessary nutrients for their growth, development, and overall health.

Meaning

Compound feed, also known as complete feed or balanced feed, is a combination of different ingredients such as grains, protein sources, vitamins, minerals, and additives. These ingredients are carefully selected and mixed in specific proportions to meet the nutritional requirements of animals at different stages of life. Compound feed plays a vital role in optimizing animal performance and improving the efficiency of feed utilization.

Executive Summary

The Australia compound feed market has been witnessing steady growth in recent years. The increasing demand for animal protein, rising livestock population, and growing awareness about the importance of quality nutrition for animals are the key factors driving the market. The market is characterized by the presence of both domestic and international players offering a wide range of compound feed products.

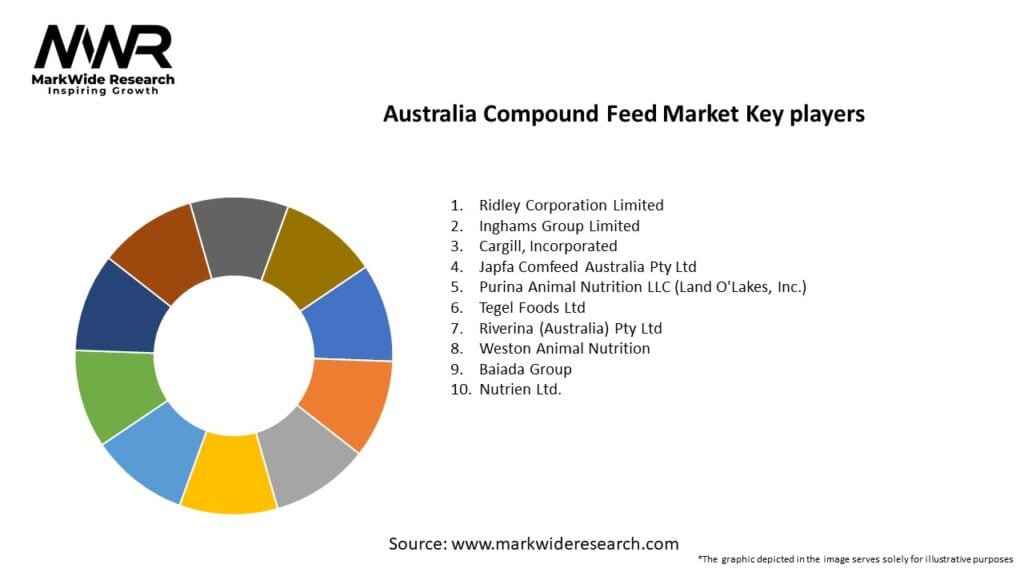

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia compound feed market is characterized by intense competition among both domestic and international players. Manufacturers are focusing on product innovation, research and development, and strategic collaborations to gain a competitive edge. Additionally, increasing investments in marketing and distribution networks are crucial for expanding market reach and enhancing customer engagement.

Regional Analysis

The compound feed market in Australia is geographically diverse, with significant production and consumption centers spread across the country. The major states contributing to the market include New South Wales, Victoria, Queensland, and Western Australia. Each region has its specific characteristics in terms of livestock population, agricultural practices, and consumer preferences, which influence the demand and supply dynamics of compound feed.

Competitive Landscape

Leading Companies in the Australia Compound Feed Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Australia compound feed market. The initial disruptions in supply chains, logistical challenges, and fluctuations in raw material prices affected feed production and availability. However, the demand for animal protein remained relatively stable, leading to a gradual recovery in the market. The pandemic also highlighted the importance of ensuring a secure and resilient supply of feed to support livestock production during challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Australia compound feed market is expected to witness steady growth in the coming years. Factors such as population growth, increasing per capita income, and changing dietary preferences are likely to drive the demand for animal protein, thereby boosting the market. However, manufacturers need to navigate challenges related to raw material prices, regulatory compliance, and environmental sustainability to sustain long-term growth.

Conclusion

The Australia compound feed market plays a vital role in supporting the country’s livestock industry by providing nutritionally balanced feed for animals. The market is driven by factors such as increasing demand for animal protein, technological advancements in feed manufacturing, and growing focus on animal welfare. However, challenges such as fluctuating raw material prices, stringent regulations, and environmental concerns exist. To thrive in this competitive landscape, industry participants need to embrace innovation, sustainability, and digitalization, while ensuring supply chain resilience. The future outlook for the market remains positive, with opportunities in organic and specialty feed, aquaculture, and precision livestock farming.

What is Compound Feed?

Compound feed refers to a mixture of various feed ingredients formulated to meet the nutritional needs of livestock and poultry. It is designed to enhance growth, reproduction, and overall health in animals.

What are the key players in the Australia Compound Feed Market?

Key players in the Australia Compound Feed Market include Ridley Corporation, GrainCorp, and Ingham’s Group, which are known for their extensive product offerings and distribution networks in the animal nutrition sector, among others.

What are the growth factors driving the Australia Compound Feed Market?

The Australia Compound Feed Market is driven by increasing demand for high-quality animal protein, rising livestock production, and advancements in feed formulation technologies. Additionally, the growing trend towards sustainable farming practices is influencing feed production.

What challenges does the Australia Compound Feed Market face?

The Australia Compound Feed Market faces challenges such as fluctuating raw material prices, regulatory compliance issues, and competition from alternative feed sources. These factors can impact profitability and supply chain stability.

What opportunities exist in the Australia Compound Feed Market?

Opportunities in the Australia Compound Feed Market include the development of specialty feeds tailored for specific livestock needs and the integration of technology in feed production. Additionally, increasing consumer awareness of animal welfare can drive demand for premium feed products.

What trends are shaping the Australia Compound Feed Market?

Trends in the Australia Compound Feed Market include a shift towards organic and non-GMO feed ingredients, the use of precision nutrition to optimize animal health, and the incorporation of alternative protein sources. These trends reflect changing consumer preferences and sustainability goals.

Australia Compound Feed Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pellets, Crumbles, Mash, Liquid |

| End User | Poultry, Swine, Ruminants, Aquaculture |

| Distribution Channel | Direct Sales, Retail, Online, Wholesalers |

| Ingredient Type | Cereal Grains, Protein Meals, Additives, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Compound Feed Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at