444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia co-sharing office space market has emerged as a transformative force in the commercial real estate landscape, fundamentally reshaping how businesses approach workspace solutions. This dynamic sector encompasses flexible workspace arrangements, shared office environments, and collaborative business hubs that cater to diverse organizational needs across the continent. The market has experienced remarkable growth with adoption rates increasing by 42% annually among small to medium enterprises seeking cost-effective workspace alternatives.

Australia’s unique business ecosystem has created fertile ground for co-sharing office space proliferation, driven by entrepreneurial culture, technological advancement, and evolving work preferences. Major metropolitan areas including Sydney, Melbourne, Brisbane, and Perth have witnessed substantial expansion in flexible workspace offerings, with occupancy rates reaching 78% across premium locations. The market encompasses various operational models from hot-desking arrangements to private office suites within shared environments.

Geographic distribution reveals concentrated development in central business districts and emerging commercial hubs, with 65% of facilities located within major urban centers. The sector attracts diverse clientele ranging from freelancers and startups to established corporations seeking agile workspace solutions. Technology integration, community building, and professional networking opportunities have become defining characteristics of successful co-sharing office space operations throughout Australia.

The Australia co-sharing office space market refers to the comprehensive ecosystem of flexible workspace providers offering shared office environments, collaborative facilities, and on-demand workspace solutions across Australian commercial real estate markets. This market encompasses traditional co-working spaces, executive suites, business centers, and hybrid workspace models that enable multiple organizations and individuals to share common facilities while maintaining operational independence.

Co-sharing office spaces typically feature open-plan work areas, private meeting rooms, dedicated desks, hot-desking options, and shared amenities including reception services, high-speed internet, printing facilities, and kitchen areas. These environments foster collaborative atmospheres while providing professional infrastructure that would otherwise require significant capital investment for individual businesses. The model emphasizes flexibility, community engagement, and resource optimization.

Modern co-sharing facilities integrate advanced technology platforms for booking management, access control, and member communication, creating seamless user experiences. The concept extends beyond physical workspace provision to include networking events, professional development programs, and business support services that enhance member value propositions and community building initiatives.

Australia’s co-sharing office space market represents a rapidly evolving sector characterized by innovative workspace solutions and changing business preferences toward flexible arrangements. The market has demonstrated resilient growth patterns with membership expansion rates of 35% year-over-year across major metropolitan areas. This growth trajectory reflects fundamental shifts in work culture, technological adoption, and cost optimization strategies among Australian businesses.

Key market drivers include increasing entrepreneurial activity, remote work normalization, and corporate downsizing initiatives that favor flexible workspace arrangements over traditional long-term leases. The sector benefits from strong demand fundamentals with occupancy rates maintaining above 75% in prime locations despite economic uncertainties. Technology startups, professional services firms, and creative industries represent primary user demographics.

Competitive landscape dynamics feature both international operators and domestic providers competing across service quality, location accessibility, and community engagement metrics. Market consolidation trends indicate strategic partnerships and acquisition activities as operators seek to expand geographic coverage and service capabilities. The sector’s evolution toward hybrid models combining traditional office features with flexible arrangements positions it for continued expansion.

Strategic market analysis reveals several critical insights shaping Australia’s co-sharing office space landscape. The sector demonstrates remarkable adaptability to changing business requirements and economic conditions, with operators continuously innovating service offerings to meet diverse client needs.

Entrepreneurial ecosystem growth serves as a primary catalyst for co-sharing office space demand across Australia. The country’s robust startup culture and government support for small business development create sustained demand for flexible workspace solutions. Young companies require professional environments without long-term lease commitments, making co-sharing spaces ideal for business development phases.

Corporate cost optimization strategies increasingly favor flexible workspace arrangements over traditional office leases. Organizations seek to reduce overhead expenses while maintaining professional presence, with co-sharing spaces offering significant cost savings compared to conventional office arrangements. This trend accelerated during economic uncertainties as businesses prioritized operational flexibility.

Remote work normalization has fundamentally altered workspace requirements, with many professionals seeking occasional office access rather than permanent desk assignments. Co-sharing spaces provide professional environments for remote workers requiring meeting facilities, high-speed internet, and collaborative spaces. The hybrid work model adoption drives demand for flexible membership options.

Technology advancement enables sophisticated co-sharing space operations through mobile applications, smart access systems, and integrated communication platforms. These technological capabilities enhance user experiences while streamlining facility management, making co-sharing spaces more attractive to tech-savvy professionals and businesses.

High operational costs in premium locations present significant challenges for co-sharing office space operators, particularly in Sydney and Melbourne central business districts. Rent expenses, utility costs, and facility maintenance requirements create substantial overhead burdens that must be balanced against competitive pricing strategies to attract and retain members.

Market saturation concerns emerge in established metropolitan areas where numerous operators compete for limited target demographics. Oversupply conditions in certain locations lead to pricing pressures and reduced profitability margins, forcing operators to differentiate through enhanced services and unique value propositions.

Economic sensitivity affects co-sharing space demand during economic downturns as small businesses and freelancers reduce workspace expenses. Membership cancellations and downgrades impact revenue stability, requiring operators to maintain flexible business models that can adapt to changing economic conditions.

Regulatory compliance requirements including building codes, safety standards, and commercial lease regulations create operational complexities for co-sharing space providers. Compliance costs and administrative burdens particularly affect smaller operators with limited resources for regulatory management and legal consultation services.

Regional market expansion presents substantial growth opportunities as secondary cities and suburban areas develop demand for flexible workspace solutions. Cities like Adelaide, Canberra, and regional business centers offer untapped potential with lower operational costs and growing professional populations seeking modern workspace alternatives.

Corporate partnership development enables co-sharing space operators to secure stable revenue streams through enterprise agreements and bulk membership arrangements. Large corporations increasingly utilize flexible spaces for project teams, satellite offices, and employee flexibility programs, creating opportunities for long-term partnership agreements.

Specialized niche markets offer differentiation opportunities through industry-specific co-sharing spaces tailored to particular professional sectors. Legal practices, healthcare professionals, creative industries, and technology companies represent specialized segments with unique workspace requirements and willingness to pay premium rates for targeted services.

Technology integration advancement creates opportunities for enhanced service delivery through artificial intelligence, Internet of Things applications, and advanced booking systems. Smart building technologies and data analytics enable optimized space utilization and personalized user experiences that command premium pricing.

Supply and demand equilibrium varies significantly across Australian metropolitan areas, with Sydney and Melbourne experiencing tight market conditions while emerging markets show greater availability. Demand fluctuations correlate with economic cycles, business formation rates, and corporate real estate strategies, creating dynamic market conditions requiring adaptive operational approaches.

Competitive intensity drives continuous innovation in service offerings, facility design, and pricing strategies. Operators differentiate through community building initiatives, specialized amenities, and strategic location selection. Market leaders leverage economies of scale while boutique operators focus on personalized services and niche market segments.

Pricing dynamics reflect location premiums, facility quality, and service levels with significant variation across market segments. Hot-desking arrangements typically command lower rates than dedicated desks or private offices, while premium locations and enhanced services justify higher pricing structures. Membership flexibility and contract terms influence pricing strategies.

Technology adoption rates accelerate across the sector as operators recognize competitive advantages from digital platform integration. Mobile applications, smart access systems, and data analytics capabilities become standard expectations rather than premium features, driving technology investment requirements across all market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Australia’s co-sharing office space market dynamics. Primary research initiatives include structured interviews with industry operators, facility managers, and key stakeholders across major metropolitan areas to gather firsthand market intelligence and operational insights.

Secondary research components encompass analysis of industry reports, commercial real estate data, government statistics, and economic indicators relevant to flexible workspace demand patterns. Data collection spans multiple years to identify trends, seasonal variations, and cyclical patterns affecting market performance and growth trajectories.

Quantitative analysis methods include statistical modeling, trend analysis, and comparative assessments across geographic regions and market segments. Survey methodologies capture user preferences, satisfaction levels, and workspace utilization patterns to understand demand drivers and service requirements among different demographic groups.

Market validation processes involve cross-referencing multiple data sources, expert consultations, and industry benchmarking to ensure research accuracy and reliability. MarkWide Research employs rigorous quality control measures and peer review processes to maintain high standards for market intelligence and strategic insights.

New South Wales dominates the Australian co-sharing office space market with 38% market share, primarily concentrated in Sydney’s central business district and emerging commercial hubs. The state benefits from high business density, international corporate presence, and robust startup ecosystem that drives consistent demand for flexible workspace solutions.

Victoria represents the second-largest market segment with 32% share, centered around Melbourne’s diverse business community and creative industries. The state’s strong coffee culture and collaborative work preferences align well with co-sharing space concepts, supporting healthy occupancy rates and membership growth across multiple operators.

Queensland accounts for 18% of market activity with Brisbane leading development initiatives and Gold Coast emerging as a secondary market. The state’s growing technology sector and tourism industry create diverse demand patterns for flexible workspace arrangements, particularly among creative professionals and digital nomads.

Western Australia, South Australia, and other territories collectively represent 12% market share with Perth, Adelaide, and Canberra showing increasing adoption rates. These markets offer growth opportunities with lower operational costs and developing professional communities seeking modern workspace alternatives to traditional office arrangements.

Market leadership dynamics feature a combination of international operators and domestic providers competing across service quality, location accessibility, and community engagement metrics. The competitive environment encourages continuous innovation and service enhancement to attract and retain members in increasingly saturated markets.

By Workspace Type: The market segments into hot-desking arrangements, dedicated desks, private offices, meeting rooms, and virtual office services. Hot-desking represents the largest segment due to flexibility and cost-effectiveness, while private offices command premium pricing for businesses requiring confidentiality and personalized environments.

By End User: Market segmentation includes freelancers, startups, small-to-medium enterprises, large corporations, and remote workers. SMEs constitute the primary user base seeking professional environments without long-term lease commitments, while corporate adoption increases for project teams and satellite office requirements.

By Industry Vertical: Technology companies, professional services, creative industries, consulting firms, and financial services represent key industry segments. Technology startups demonstrate highest adoption rates due to collaborative culture and flexible growth requirements, followed by creative professionals seeking inspiring work environments.

By Location Type: Central business districts, suburban commercial areas, and mixed-use developments offer different value propositions. CBD locations command premium rates due to accessibility and prestige, while suburban facilities attract cost-conscious users seeking convenient neighborhood access.

Hot-desking Services represent the most dynamic market category with flexible arrangements appealing to freelancers, remote workers, and small businesses requiring occasional office access. This category benefits from low commitment requirements and cost-effective pricing structures that accommodate varying usage patterns and budget constraints.

Private Office Solutions within co-sharing environments attract established businesses seeking professional privacy while maintaining access to shared amenities and networking opportunities. This premium category commands higher rates but provides stable revenue streams for operators through longer-term commitments and consistent utilization.

Meeting Room Facilities serve both internal members and external clients requiring professional presentation environments. This category generates additional revenue streams through hourly bookings and supports member retention by providing essential business infrastructure for client meetings and team collaborations.

Virtual Office Services cater to businesses requiring professional addresses and administrative support without physical workspace needs. This category offers high-margin services with minimal space requirements, making it attractive for operators seeking to maximize revenue per square foot while serving diverse client needs.

For Businesses and Entrepreneurs: Co-sharing office spaces provide immediate access to professional work environments without capital investment requirements or long-term lease obligations. Startups and small businesses benefit from networking opportunities, shared resources, and scalable workspace solutions that adapt to changing business needs and growth trajectories.

For Property Owners and Developers: Co-sharing space operators offer stable tenancy with professional management and higher rental yields compared to traditional office leasing arrangements. Property owners benefit from reduced vacancy risks and enhanced building utilization through flexible space management and diverse tenant bases.

For Remote Workers and Freelancers: Professional work environments provide separation between home and work while offering networking opportunities and collaborative atmospheres. Access to high-quality facilities, meeting rooms, and business services enhances productivity and professional image without individual investment requirements.

For Large Corporations: Flexible workspace solutions enable agile real estate strategies with reduced overhead costs and enhanced employee satisfaction through workspace choice and flexibility. Companies can establish satellite offices, accommodate project teams, and provide employee benefits through co-sharing space partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid Work Model Integration represents the most significant trend reshaping co-sharing office space demand patterns. Organizations increasingly adopt flexible work arrangements combining remote work with periodic office access, driving demand for part-time memberships and flexible booking options that accommodate varying usage patterns.

Technology-Enhanced Experiences become standard expectations as operators integrate smart building features, mobile applications, and data analytics to optimize space utilization and user satisfaction. Contactless access systems and automated booking platforms enhance convenience while providing operational efficiency benefits for facility management.

Wellness and Sustainability Focus influences facility design and operational practices as members prioritize healthy work environments and environmentally responsible business practices. Green building certifications, air quality monitoring, and wellness amenities become competitive differentiators in member acquisition and retention strategies.

Community-Centric Programming evolves beyond basic networking events to include professional development workshops, industry-specific meetups, and collaborative project initiatives. MarkWide Research indicates that community engagement programs significantly impact member satisfaction and retention rates across successful operators.

Strategic Partnership Formation accelerates as co-sharing space operators collaborate with corporate clients, property developers, and technology providers to enhance service offerings and market reach. These partnerships enable integrated solutions that combine workspace access with business services, technology platforms, and professional development programs.

Market Consolidation Activities increase as larger operators acquire smaller competitors to expand geographic coverage and eliminate competition. Acquisition strategies focus on securing prime locations, accessing established member bases, and achieving operational economies of scale across multiple facilities.

Facility Design Innovation emphasizes flexibility, wellness, and technology integration to create differentiated user experiences. Operators invest in modular furniture systems, advanced air filtration, natural lighting, and collaborative spaces that adapt to changing user needs and preferences.

Corporate Real Estate Integration sees large companies incorporating co-sharing spaces into their workplace strategies through direct partnerships, membership programs, and satellite office arrangements. This trend provides stable revenue streams for operators while offering corporations enhanced flexibility and cost optimization.

Diversification Strategies should focus on developing multiple revenue streams through meeting room rentals, event hosting, virtual office services, and corporate partnership programs. Successful operators balance membership fees with ancillary services to maximize revenue per square foot and reduce dependency on single income sources.

Technology Investment Priorities must emphasize user experience enhancement through mobile applications, smart access systems, and data analytics platforms. MWR analysis suggests that technology-enabled operators achieve higher member satisfaction rates and operational efficiency compared to traditional facility management approaches.

Geographic Expansion Considerations should evaluate secondary markets and suburban locations offering lower operational costs and growing professional populations. Regional expansion strategies must balance market potential with operational complexity and brand consistency requirements across multiple locations.

Partnership Development Initiatives should target corporate clients, property developers, and complementary service providers to create integrated value propositions and stable revenue streams. Strategic partnerships enable market expansion while reducing individual investment requirements and operational risks.

Market expansion trajectory indicates continued growth across Australian metropolitan areas with projected annual growth rates of 15-20% over the next five years. Regional markets and suburban locations present significant opportunities as professional populations seek convenient workspace alternatives closer to residential areas.

Technology integration advancement will transform co-sharing space operations through artificial intelligence, Internet of Things applications, and predictive analytics. Smart building capabilities will become standard features rather than premium offerings, enabling optimized space utilization and personalized user experiences that justify premium pricing.

Corporate adoption acceleration suggests increasing enterprise utilization of flexible workspace solutions for project teams, satellite offices, and employee flexibility programs. Large corporations will likely develop comprehensive partnerships with co-sharing space operators to provide employees with workspace choice and support agile business operations.

Sustainability requirements will influence facility design, operational practices, and member preferences as environmental consciousness increases among Australian businesses. Green building certifications and sustainable business practices will become competitive necessities rather than optional differentiators in member acquisition strategies.

Australia’s co-sharing office space market represents a dynamic and rapidly evolving sector that has fundamentally transformed traditional workspace concepts across the continent. The market demonstrates robust growth fundamentals driven by changing work preferences, entrepreneurial ecosystem development, and corporate cost optimization strategies that favor flexible arrangements over conventional office leases.

Key success factors include strategic location selection, technology integration, community building initiatives, and diversified service offerings that cater to evolving user needs. Operators who effectively balance operational efficiency with member satisfaction while maintaining competitive pricing structures position themselves for sustainable growth in increasingly competitive markets.

Future market evolution will likely emphasize hybrid work model accommodation, advanced technology integration, and sustainability initiatives that align with changing business priorities and social consciousness. The sector’s adaptability to economic conditions and user preference changes suggests continued expansion potential across metropolitan and regional markets throughout Australia.

What is Co sharing Office Space?

Co sharing office space refers to shared work environments where individuals or companies can rent desks or office space on a flexible basis. This model promotes collaboration and networking among diverse professionals and businesses.

What are the key players in the Australia Co sharing Office Space Market?

Key players in the Australia Co sharing Office Space Market include WeWork, Spaces, and Hub Australia, among others. These companies offer various flexible workspace solutions catering to startups, freelancers, and established businesses.

What are the growth factors driving the Australia Co sharing Office Space Market?

The growth of the Australia Co sharing Office Space Market is driven by the increasing demand for flexible work arrangements, the rise of remote work culture, and the need for cost-effective office solutions among startups and small businesses.

What challenges does the Australia Co sharing Office Space Market face?

Challenges in the Australia Co sharing Office Space Market include fluctuating demand due to economic uncertainties, competition from traditional office spaces, and the need for continuous innovation to meet evolving client needs.

What opportunities exist in the Australia Co sharing Office Space Market?

Opportunities in the Australia Co sharing Office Space Market include the potential for expansion into suburban areas, the integration of technology for enhanced user experience, and the growing trend of hybrid work models that require flexible office solutions.

What trends are shaping the Australia Co sharing Office Space Market?

Trends shaping the Australia Co sharing Office Space Market include the increasing focus on wellness and sustainability in workspace design, the rise of niche co-working spaces catering to specific industries, and the adoption of advanced technology for seamless operations.

Australia Co sharing Office Space Market

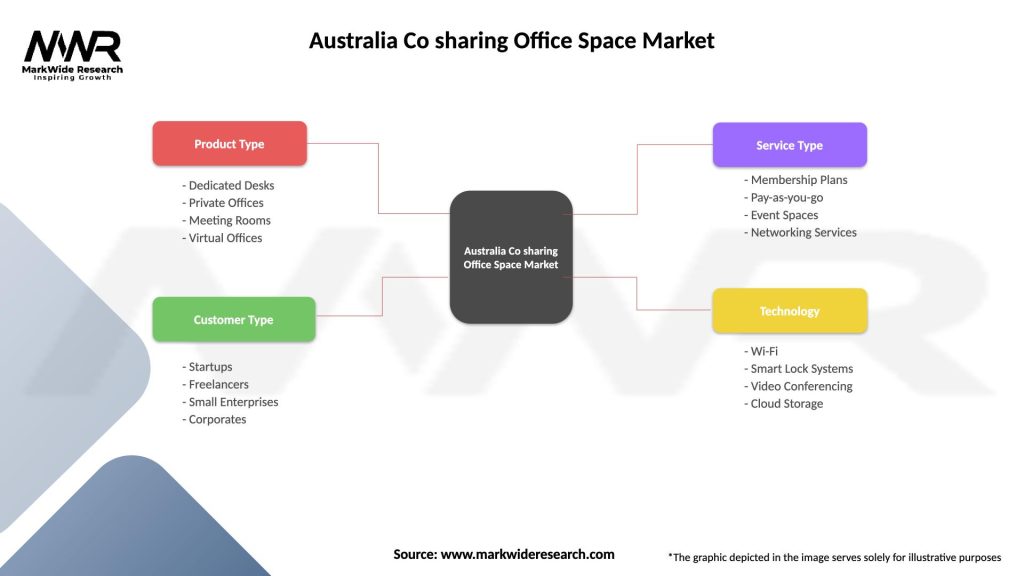

| Segmentation Details | Description |

|---|---|

| Product Type | Dedicated Desks, Private Offices, Meeting Rooms, Virtual Offices |

| Customer Type | Startups, Freelancers, Small Enterprises, Corporates |

| Service Type | Membership Plans, Pay-as-you-go, Event Spaces, Networking Services |

| Technology | Wi-Fi, Smart Lock Systems, Video Conferencing, Cloud Storage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Co sharing Office Space Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at