444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia blood glucose monitoring market represents a critical segment of the nation’s healthcare technology landscape, driven by the increasing prevalence of diabetes and growing awareness of preventive healthcare measures. Blood glucose monitoring systems have become essential tools for millions of Australians managing diabetes, with the market experiencing robust growth at a 6.2% CAGR over recent years. The Australian healthcare system’s emphasis on chronic disease management and the aging population demographic contribute significantly to market expansion.

Market dynamics in Australia reflect a sophisticated healthcare infrastructure that supports advanced glucose monitoring technologies. The integration of continuous glucose monitoring (CGM) systems and smart glucose meters has revolutionized diabetes management, offering patients real-time insights into their glucose levels. Healthcare providers increasingly recommend these monitoring solutions as part of comprehensive diabetes care programs, leading to higher adoption rates across urban and rural communities.

Technological advancement remains a key driver, with manufacturers introducing innovative features such as smartphone connectivity, cloud-based data management, and artificial intelligence-powered analytics. The market benefits from strong government support through the National Diabetes Services Scheme (NDSS), which provides subsidized access to glucose monitoring supplies for registered participants, representing approximately 78% of diagnosed diabetics in Australia.

The Australia blood glucose monitoring market refers to the comprehensive ecosystem of medical devices, consumables, and digital health solutions designed to measure and track blood glucose levels in diabetic and pre-diabetic individuals across the Australian continent. This market encompasses traditional fingerstick glucose meters, advanced continuous glucose monitoring systems, test strips, lancets, and associated software applications that enable effective diabetes management.

Blood glucose monitoring serves as the cornerstone of diabetes self-management, allowing patients to make informed decisions about medication dosing, dietary choices, and lifestyle modifications. The Australian market specifically addresses the unique healthcare needs of the population, considering factors such as geographic distribution, healthcare accessibility, and regulatory requirements established by the Therapeutic Goods Administration (TGA).

Market participants include multinational medical device manufacturers, local distributors, healthcare providers, and digital health companies that collectively work to deliver comprehensive glucose monitoring solutions. The market’s significance extends beyond commercial considerations, playing a vital role in public health outcomes and healthcare cost management across Australia’s diverse communities.

Australia’s blood glucose monitoring market demonstrates strong growth momentum, driven by increasing diabetes prevalence and technological innovation in monitoring devices. The market landscape features a diverse range of products from traditional glucose meters to sophisticated continuous monitoring systems, catering to varying patient needs and preferences. Market penetration has reached significant levels, with approximately 85% of diagnosed diabetics actively using some form of glucose monitoring technology.

Key market segments include self-monitoring blood glucose (SMBG) devices, continuous glucose monitoring systems, and associated consumables such as test strips and sensors. The continuous glucose monitoring segment represents the fastest-growing category, experiencing adoption rates of 23% annually among Type 1 diabetics and gaining traction among Type 2 diabetes patients. Healthcare digitization trends have accelerated the integration of mobile health applications and cloud-based data management platforms.

Competitive dynamics feature established global players alongside emerging technology companies, creating a vibrant ecosystem of innovation and choice for Australian consumers. Government support through subsidized access programs and clinical guidelines promoting regular glucose monitoring contribute to sustained market growth. The market outlook remains positive, supported by demographic trends, technological advancement, and increasing healthcare awareness among the Australian population.

Market insights reveal several critical trends shaping the Australia blood glucose monitoring landscape. The following key observations provide strategic understanding of market dynamics:

Primary market drivers propelling the Australia blood glucose monitoring market include the escalating diabetes epidemic and increasing healthcare awareness among the population. Diabetes prevalence in Australia has reached concerning levels, with approximately 1.2 million Australians diagnosed with diabetes and an estimated additional 500,000 living with undiagnosed diabetes. This growing patient population creates sustained demand for reliable glucose monitoring solutions.

Technological innovation serves as a significant growth catalyst, with manufacturers continuously introducing advanced features such as painless monitoring, extended sensor wear time, and predictive analytics. The integration of artificial intelligence and machine learning algorithms enables personalized glucose management recommendations, appealing to tech-savvy Australian consumers. Smartphone connectivity has become a standard expectation, allowing seamless data sharing with healthcare providers and family members.

Government support initiatives through the National Diabetes Services Scheme provide substantial market stimulus by reducing financial barriers to glucose monitoring supplies. The scheme’s coverage of test strips, lancets, and subsidized access to CGM systems for eligible patients significantly expands market accessibility. Healthcare provider advocacy for regular glucose monitoring as part of comprehensive diabetes care further drives adoption rates across different patient demographics.

Aging population dynamics contribute to market expansion, as older Australians face higher diabetes risk and require more frequent glucose monitoring. The growing emphasis on preventive healthcare and early diabetes detection has expanded the market beyond diagnosed diabetics to include pre-diabetic individuals and those at high risk of developing diabetes.

Market restraints present challenges to the Australia blood glucose monitoring market’s growth trajectory. High device costs remain a significant barrier, particularly for advanced continuous glucose monitoring systems that require substantial upfront investment and ongoing sensor replacement expenses. Despite government subsidies, many patients face considerable out-of-pocket costs that limit access to premium monitoring technologies.

Technical limitations of current glucose monitoring technologies create user frustration and potential safety concerns. Issues such as sensor accuracy variations, calibration requirements, and interference from medications or environmental factors can undermine user confidence. Device complexity particularly affects older patients who may struggle with smartphone applications and digital interfaces required for modern monitoring systems.

Regulatory constraints imposed by the Therapeutic Goods Administration, while ensuring safety and efficacy, can delay the introduction of innovative glucose monitoring technologies available in other markets. The approval timeline for new devices may extend several months or years, limiting Australian patients’ access to cutting-edge monitoring solutions and potentially affecting market competitiveness.

Healthcare system limitations in rural and remote areas of Australia create accessibility challenges for glucose monitoring supplies and technical support. Geographic barriers and limited healthcare infrastructure in certain regions may restrict patient access to advanced monitoring technologies and professional guidance for optimal device utilization.

Market opportunities in the Australia blood glucose monitoring sector present significant potential for growth and innovation. The expanding telehealth ecosystem creates opportunities for integrated glucose monitoring solutions that enable remote patient management and virtual consultations. Healthcare digitization trends accelerated by recent global events have increased acceptance of digital health technologies among both patients and providers.

Artificial intelligence integration represents a transformative opportunity, enabling predictive glucose management, personalized treatment recommendations, and automated insulin dosing systems. Machine learning algorithms can analyze individual glucose patterns to provide actionable insights for improved diabetes management outcomes. The development of non-invasive glucose monitoring technologies presents revolutionary potential for the Australian market.

Partnership opportunities between glucose monitoring manufacturers and Australian healthcare organizations, insurance providers, and technology companies can create innovative service delivery models. Value-based healthcare initiatives that demonstrate improved patient outcomes through effective glucose monitoring may attract additional funding and support from government and private payers.

Market expansion into adjacent areas such as gestational diabetes monitoring, workplace wellness programs, and sports performance optimization offers diversification opportunities. The growing health consciousness among non-diabetic Australians interested in metabolic health monitoring represents an emerging market segment with substantial growth potential.

Market dynamics in the Australia blood glucose monitoring sector reflect complex interactions between technological advancement, regulatory frameworks, and evolving patient needs. Competitive intensity has increased significantly as established medical device manufacturers face challenges from innovative digital health companies and technology startups entering the glucose monitoring space.

Supply chain considerations have gained prominence, particularly regarding the reliability of test strip and sensor supplies during global disruptions. Australian distributors and manufacturers have invested in supply chain resilience to ensure consistent product availability for diabetic patients who depend on regular monitoring supplies. Local manufacturing initiatives have emerged to reduce dependence on international supply chains.

Pricing dynamics continue to evolve as competition intensifies and government subsidy programs influence market accessibility. The introduction of biosimilar test strips and generic glucose monitoring supplies has created price pressure on established brands while expanding patient choice. Value-based pricing models that link device costs to patient outcomes are gaining traction among healthcare payers.

Innovation cycles have accelerated, with manufacturers releasing new product generations more frequently to maintain competitive advantage. User experience optimization has become a critical differentiator, with companies investing heavily in intuitive device design, mobile applications, and customer support services to enhance patient satisfaction and loyalty.

Research methodology employed for analyzing the Australia blood glucose monitoring market incorporates comprehensive primary and secondary research approaches to ensure data accuracy and market insight reliability. Primary research includes structured interviews with healthcare professionals, diabetes educators, patients, and industry stakeholders across major Australian cities and regional centers to capture diverse perspectives on market trends and challenges.

Secondary research encompasses analysis of government health statistics, clinical studies, regulatory filings, and industry reports to establish baseline market understanding. Data triangulation methods validate findings across multiple sources to ensure research credibility and minimize potential biases. MarkWide Research analysts utilize proprietary databases and industry networks to access real-time market intelligence and emerging trend identification.

Quantitative analysis incorporates statistical modeling techniques to project market growth trajectories, segment performance, and competitive positioning. Qualitative assessment provides contextual understanding of market dynamics, regulatory impacts, and technological disruption patterns. Market sizing methodologies combine bottom-up and top-down approaches to ensure comprehensive market coverage and accurate growth projections.

Research validation processes include expert panel reviews, industry stakeholder feedback, and cross-referencing with established healthcare databases to maintain analytical rigor. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making purposes.

Regional analysis of the Australia blood glucose monitoring market reveals significant variations in adoption patterns, healthcare infrastructure, and patient demographics across different states and territories. New South Wales and Victoria represent the largest market segments, accounting for approximately 58% of total market share due to higher population density and advanced healthcare facilities in major metropolitan areas.

Queensland demonstrates strong growth potential, driven by an aging population and increasing diabetes prevalence, particularly in coastal retirement communities. The state’s telehealth initiatives have facilitated greater access to glucose monitoring technologies in regional areas. Western Australia shows unique market characteristics with significant mining industry presence, creating demand for robust glucose monitoring solutions suitable for remote work environments.

South Australia and Tasmania exhibit higher per-capita adoption rates of traditional glucose monitoring devices, while showing slower uptake of advanced CGM systems compared to larger states. Northern Territory faces unique challenges related to Indigenous health disparities and geographic isolation, requiring specialized distribution and support strategies for glucose monitoring programs.

Rural and remote areas across all states present common challenges including limited healthcare provider access, supply chain logistics, and technology support services. Government initiatives targeting rural diabetes management have improved market penetration in these underserved regions, with mobile health clinics and telehealth programs facilitating greater access to glucose monitoring technologies and education.

Competitive landscape in the Australia blood glucose monitoring market features a diverse mix of established multinational corporations and innovative technology companies competing across different product segments and price points. Market leadership positions are held by companies with strong brand recognition, extensive distribution networks, and comprehensive product portfolios.

Competitive strategies include product differentiation through technological innovation, strategic partnerships with healthcare providers, and comprehensive patient support programs. Market consolidation trends have emerged as larger companies acquire innovative startups to enhance their technology portfolios and market reach.

Market segmentation of the Australia blood glucose monitoring market reveals distinct categories based on technology type, end-user demographics, and distribution channels. Product segmentation divides the market into traditional self-monitoring blood glucose devices and advanced continuous glucose monitoring systems, each serving different patient needs and clinical applications.

By Technology:

By End User:

By Distribution Channel:

Category-wise analysis provides detailed understanding of specific market segments within the Australia blood glucose monitoring landscape. Traditional glucose meters continue to dominate market volume due to their affordability, simplicity, and widespread insurance coverage. These devices appeal particularly to older patients and those with stable diabetes management routines who prefer familiar technology.

Continuous glucose monitoring systems represent the premium market segment with higher growth rates but limited adoption due to cost considerations. CGM technology shows strongest uptake among Type 1 diabetes patients, young adults, and individuals with frequent hypoglycemic episodes. The category benefits from increasing clinical evidence supporting improved outcomes and quality of life benefits.

Test strip consumables generate substantial recurring revenue for manufacturers, with patients requiring regular supply replenishment. Generic test strips have gained market share by offering cost savings while maintaining acceptable accuracy standards. Sensor technology for CGM systems represents a high-value consumable category with opportunities for technological advancement and cost reduction.

Digital health integration has become a critical category differentiator, with mobile applications and cloud-based data management increasingly influencing purchase decisions. Artificial intelligence features such as glucose trend prediction and personalized recommendations are emerging as premium category attributes that justify higher pricing for advanced monitoring systems.

Industry participants in the Australia blood glucose monitoring market enjoy numerous strategic advantages and growth opportunities. Manufacturers benefit from a stable and expanding patient population requiring ongoing monitoring supplies, creating predictable revenue streams through consumable product sales. The regulatory environment provides clear pathways for product approval while maintaining high safety standards that protect brand reputation.

Healthcare providers gain access to comprehensive patient data through connected glucose monitoring systems, enabling more informed treatment decisions and improved patient outcomes. Remote monitoring capabilities reduce the need for frequent in-person consultations while maintaining effective diabetes management oversight. Clinical integration with electronic health records streamlines workflow and enhances care coordination.

Patients experience significant quality of life improvements through advanced glucose monitoring technologies that provide real-time insights, reduce finger stick frequency, and offer predictive alerts for glucose excursions. Mobile connectivity enables easy data sharing with healthcare teams and family members, creating support networks for diabetes management. Government subsidies through the NDSS program make advanced monitoring technologies more accessible to eligible patients.

Healthcare payers benefit from improved diabetes management outcomes that reduce long-term complications and associated healthcare costs. Preventive monitoring programs can identify glucose control issues early, preventing costly emergency interventions and hospitalizations. Value-based care models that incorporate glucose monitoring data demonstrate measurable improvements in patient health metrics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Australia blood glucose monitoring landscape reflect broader healthcare digitization and patient empowerment movements. Continuous glucose monitoring adoption continues accelerating, with flash glucose monitoring serving as a bridge technology for patients transitioning from traditional fingerstick methods to real-time monitoring systems.

Smartphone integration has become a standard expectation rather than a premium feature, with patients demanding seamless data synchronization and mobile application functionality. Artificial intelligence integration represents an emerging trend, with manufacturers incorporating predictive analytics and personalized recommendations into their monitoring platforms. MWR analysis indicates that AI-powered features influence purchase decisions for approximately 34% of tech-savvy patients.

Telehealth compatibility has gained significant importance, particularly following increased virtual healthcare adoption. Remote patient monitoring capabilities enable healthcare providers to track patient glucose patterns and intervene proactively when concerning trends emerge. Data interoperability between different monitoring systems and electronic health records has become a critical requirement for healthcare provider adoption.

Personalization trends include customizable alert settings, individual glucose target ranges, and lifestyle-specific monitoring recommendations. Social connectivity features allow patients to share glucose data with family members and support networks, creating collaborative diabetes management approaches. Gamification elements in mobile applications encourage consistent monitoring behavior and glucose control achievement.

Industry developments in the Australia blood glucose monitoring market reflect rapid technological advancement and evolving regulatory landscapes. Recent product launches have focused on improved sensor accuracy, extended wear time, and enhanced user experience through intuitive mobile applications and simplified calibration processes.

Regulatory approvals by the Therapeutic Goods Administration have expanded patient access to advanced continuous glucose monitoring systems, with several new CGM products receiving approval for broader patient populations including Type 2 diabetes patients using non-insulin therapies. Reimbursement expansions through the National Diabetes Services Scheme have improved affordability for eligible patients.

Strategic partnerships between glucose monitoring manufacturers and Australian healthcare organizations have created integrated care delivery models that combine monitoring technology with clinical support services. Digital health collaborations with technology companies have enhanced mobile application functionality and data analytics capabilities.

Manufacturing investments in local production capabilities have improved supply chain resilience and reduced dependence on international suppliers. Research collaborations with Australian universities and research institutions have accelerated innovation in glucose monitoring technologies and clinical applications. Acquisition activities have consolidated market positions and expanded technology portfolios among leading manufacturers.

Analyst recommendations for stakeholders in the Australia blood glucose monitoring market emphasize strategic positioning for long-term growth and competitive advantage. Manufacturers should prioritize user experience optimization and mobile application development to meet evolving patient expectations for connected healthcare solutions. Investment in artificial intelligence capabilities will become increasingly important for maintaining competitive differentiation.

Healthcare providers should develop comprehensive glucose monitoring programs that integrate traditional and advanced monitoring technologies based on individual patient needs and preferences. Staff training initiatives for diabetes educators and healthcare professionals will ensure optimal utilization of new monitoring technologies and improved patient outcomes. Telehealth integration strategies should incorporate glucose monitoring data for enhanced remote patient management.

Government policymakers should consider expanding subsidy programs to include emerging monitoring technologies that demonstrate clinical benefits and cost-effectiveness. Rural healthcare initiatives require targeted strategies to improve glucose monitoring access and support services in underserved regions. Data privacy regulations should balance patient protection with innovation facilitation in connected health technologies.

Investors should focus on companies demonstrating strong innovation pipelines, strategic partnerships, and sustainable competitive advantages in the evolving glucose monitoring landscape. Market consolidation opportunities may emerge as smaller companies seek partnerships or acquisition by larger organizations with established distribution networks and regulatory expertise.

Future outlook for the Australia blood glucose monitoring market remains highly positive, driven by demographic trends, technological innovation, and increasing healthcare digitization. Market growth projections indicate sustained expansion at a compound annual growth rate of 7.1% over the next five years, supported by an aging population and rising diabetes prevalence across all age groups.

Technological evolution will likely focus on non-invasive monitoring solutions, extended sensor durability, and enhanced artificial intelligence capabilities for predictive glucose management. Integration with wearable devices and Internet of Things platforms will create comprehensive health monitoring ecosystems that extend beyond glucose tracking to include activity, sleep, and nutrition data.

Regulatory developments may streamline approval processes for innovative monitoring technologies while maintaining safety standards. Reimbursement policy evolution could expand coverage for advanced monitoring systems based on demonstrated clinical outcomes and cost-effectiveness studies. MarkWide Research projects that continuous glucose monitoring adoption will reach 45% of the diagnosed diabetic population within the next decade.

Market consolidation trends may continue as established medical device companies acquire innovative technology startups to enhance their digital health capabilities. Partnership models between monitoring manufacturers, healthcare providers, and technology companies will create integrated diabetes management platforms that deliver comprehensive patient support services beyond device provision.

The Australia blood glucose monitoring market represents a dynamic and rapidly evolving healthcare technology sector with significant growth potential and strategic importance for diabetes management across the continent. Market fundamentals remain strong, supported by increasing diabetes prevalence, technological innovation, and government initiatives that improve patient access to monitoring technologies.

Technological advancement continues to drive market evolution, with continuous glucose monitoring systems gaining adoption while traditional glucose meters maintain their essential role in diabetes care. Digital health integration has become a critical success factor, enabling connected monitoring solutions that enhance patient engagement and clinical outcomes. The market benefits from Australia’s robust healthcare infrastructure and supportive regulatory environment that facilitates innovation while ensuring patient safety.

Strategic opportunities abound for market participants who can successfully navigate the complex landscape of patient needs, regulatory requirements, and competitive dynamics. Future success will depend on companies’ ability to deliver user-friendly, accurate, and cost-effective monitoring solutions that integrate seamlessly with evolving healthcare delivery models. The Australia blood glucose monitoring market is well-positioned for sustained growth and continued innovation in support of the nation’s diabetes management objectives.

What is Blood Glucose Monitoring?

Blood Glucose Monitoring refers to the methods and devices used to measure the concentration of glucose in the blood, primarily for managing diabetes. This includes various technologies such as glucometers, continuous glucose monitors, and test strips.

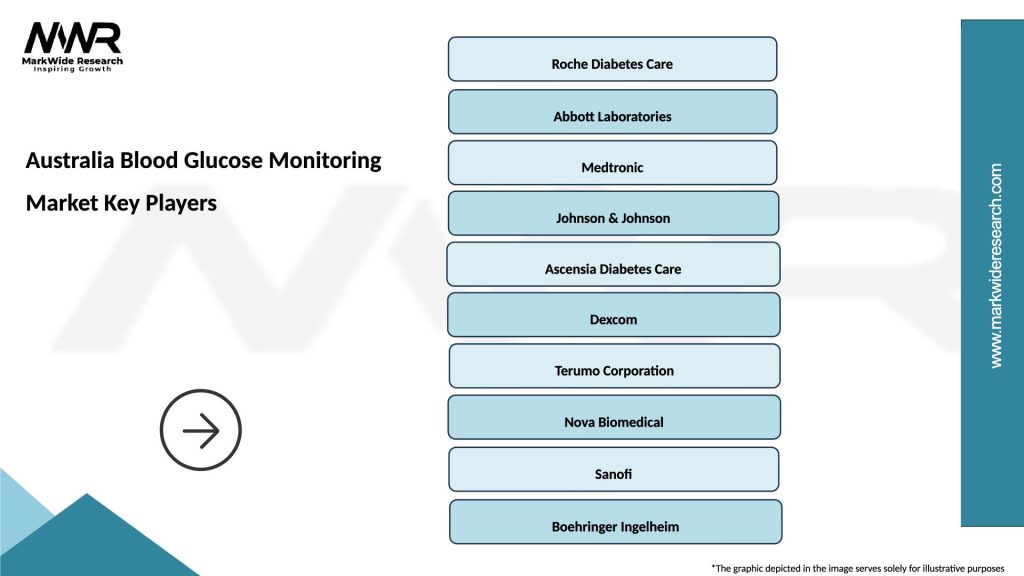

What are the key players in the Australia Blood Glucose Monitoring Market?

Key players in the Australia Blood Glucose Monitoring Market include Abbott Laboratories, Roche Diagnostics, and Medtronic, among others. These companies are known for their innovative products and significant market presence.

What are the growth factors driving the Australia Blood Glucose Monitoring Market?

The growth of the Australia Blood Glucose Monitoring Market is driven by the increasing prevalence of diabetes, advancements in monitoring technology, and rising awareness about diabetes management. Additionally, the demand for home healthcare solutions is contributing to market expansion.

What challenges does the Australia Blood Glucose Monitoring Market face?

The Australia Blood Glucose Monitoring Market faces challenges such as high costs of advanced monitoring devices and regulatory hurdles. Additionally, the lack of reimbursement policies for certain devices can hinder market growth.

What opportunities exist in the Australia Blood Glucose Monitoring Market?

Opportunities in the Australia Blood Glucose Monitoring Market include the development of innovative wearable devices and mobile health applications. There is also potential for growth in telehealth services that facilitate remote monitoring and management of diabetes.

What trends are shaping the Australia Blood Glucose Monitoring Market?

Trends in the Australia Blood Glucose Monitoring Market include the increasing adoption of continuous glucose monitoring systems and the integration of artificial intelligence in diabetes management. Additionally, there is a growing focus on personalized medicine and patient-centric solutions.

Australia Blood Glucose Monitoring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blood Glucose Meters, Continuous Glucose Monitors, Test Strips, Lancets |

| Technology | Self-Monitoring, Flash Glucose Monitoring, Continuous Glucose Monitoring, Smart Devices |

| End User | Hospitals, Homecare, Diabetes Clinics, Pharmacies |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Blood Glucose Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at