444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia 3D mammogram industry market represents a transformative segment within the nation’s healthcare technology landscape, driven by advancing diagnostic capabilities and increasing awareness of breast cancer screening. Three-dimensional mammography, also known as digital breast tomosynthesis, has emerged as a revolutionary imaging technology that provides superior visualization compared to traditional 2D mammography systems. The Australian market demonstrates robust growth potential with adoption rates increasing by approximately 12.5% annually across major healthcare facilities.

Healthcare providers throughout Australia are increasingly recognizing the clinical advantages of 3D mammography technology, which offers enhanced detection capabilities for breast abnormalities while reducing false-positive rates by approximately 15-20%. The technology’s ability to create detailed cross-sectional images enables radiologists to identify potential cancerous tissues with greater precision, particularly in women with dense breast tissue who comprise nearly 40% of the screening population.

Market dynamics indicate strong institutional investment in advanced imaging infrastructure, supported by government initiatives promoting early cancer detection and improved healthcare outcomes. The integration of artificial intelligence and machine learning algorithms with 3D mammography systems is further accelerating market expansion, with digital transformation initiatives driving technological adoption across both public and private healthcare sectors.

The Australia 3D mammogram industry market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and implementation of three-dimensional mammography systems and related services within the Australian healthcare sector. This market includes advanced imaging equipment, software solutions, maintenance services, and professional training programs designed to enhance breast cancer screening capabilities across the continent.

Digital breast tomosynthesis technology forms the cornerstone of this market, utilizing sophisticated X-ray imaging techniques to capture multiple low-dose images from different angles, subsequently reconstructed into detailed three-dimensional representations of breast tissue. This innovative approach enables healthcare professionals to examine breast tissue layer by layer, significantly improving diagnostic accuracy and reducing the need for additional imaging procedures.

Market participants include medical device manufacturers, healthcare technology providers, imaging centers, hospitals, diagnostic laboratories, and specialized breast cancer screening facilities. The ecosystem also encompasses regulatory bodies, healthcare policymakers, and professional medical associations that establish standards and guidelines for 3D mammography implementation and utilization.

Australia’s 3D mammogram industry is experiencing unprecedented growth driven by technological advancements, increasing healthcare awareness, and supportive government policies promoting early cancer detection. The market demonstrates strong momentum with healthcare facilities investing significantly in next-generation imaging technologies to improve patient outcomes and diagnostic efficiency.

Key market drivers include rising breast cancer incidence rates, aging population demographics, and growing emphasis on preventive healthcare measures. The technology’s proven ability to reduce callback rates by approximately 25-30% while maintaining high sensitivity for cancer detection has accelerated adoption across major metropolitan and regional healthcare centers.

Competitive landscape features established medical device manufacturers alongside emerging technology companies developing innovative software solutions and artificial intelligence applications. The market benefits from strong collaboration between international technology providers and local healthcare institutions, fostering knowledge transfer and customized solution development.

Future prospects remain highly favorable, with continued investment in healthcare infrastructure, expanding screening programs, and technological innovations expected to drive sustained market growth. The integration of cloud-based imaging platforms and telemedicine capabilities is creating new opportunities for remote diagnostics and specialist consultation services.

Market analysis reveals several critical insights shaping the Australia 3D mammogram industry landscape:

Primary market drivers propelling the Australia 3D mammogram industry include demographic trends, technological advancements, and evolving healthcare policies that prioritize early cancer detection and improved patient outcomes.

Demographic factors play a crucial role, with Australia’s aging population creating increased demand for comprehensive breast cancer screening services. Women aged 50-74 represent the primary screening demographic, and this population segment is expanding steadily, driving consistent demand for advanced mammography services.

Clinical superiority of 3D mammography technology serves as a fundamental market driver, with healthcare providers recognizing the technology’s ability to detect invasive cancers at earlier stages while reducing false-positive results. The improved diagnostic accuracy translates to better patient outcomes and reduced healthcare system burden.

Government initiatives supporting cancer prevention and early detection programs provide substantial market momentum. National screening programs and healthcare funding allocations specifically targeting advanced diagnostic technologies create favorable conditions for market expansion.

Healthcare digitalization trends accelerate adoption of sophisticated imaging systems integrated with artificial intelligence and machine learning capabilities. These technological enhancements improve workflow efficiency and diagnostic precision, making 3D mammography systems increasingly attractive to healthcare providers.

Market challenges affecting the Australia 3D mammogram industry include cost considerations, technical complexities, and infrastructure requirements that may limit adoption rates in certain healthcare settings.

Capital investment requirements represent a significant barrier for smaller healthcare facilities and regional centers with limited budgets. The substantial upfront costs associated with 3D mammography systems, including equipment acquisition, installation, and staff training, can delay implementation timelines.

Technical expertise requirements pose challenges for healthcare facilities lacking specialized radiologic personnel trained in 3D mammography interpretation. The learning curve associated with new technology adoption may temporarily impact operational efficiency during transition periods.

Infrastructure limitations in certain regional areas may restrict market penetration, particularly where existing facilities require significant upgrades to accommodate advanced imaging equipment. Power requirements, space constraints, and connectivity issues can complicate implementation processes.

Regulatory compliance requirements, while necessary for patient safety, can create administrative burdens and extend approval timelines for new technology implementations. Healthcare facilities must navigate complex certification processes and ongoing quality assurance requirements.

Emerging opportunities within the Australia 3D mammogram industry present significant potential for market expansion and technological innovation across multiple healthcare sectors.

Artificial intelligence integration offers substantial opportunities for enhancing diagnostic accuracy and workflow efficiency. Advanced AI algorithms can assist radiologists in identifying subtle abnormalities, potentially improving detection rates while reducing interpretation time and human error.

Telemedicine applications create new possibilities for remote diagnostics and specialist consultation services, particularly benefiting rural and regional communities with limited access to specialized breast imaging services. Cloud-based platforms enable secure image sharing and collaborative diagnosis.

Mobile mammography units equipped with 3D technology present opportunities to expand screening accessibility in underserved areas. These mobile solutions can reach remote communities and provide comprehensive breast cancer screening services where fixed facilities are not economically viable.

Preventive healthcare emphasis creates opportunities for expanded screening programs targeting younger demographics and high-risk populations. Personalized screening protocols based on genetic factors and family history can drive increased utilization of advanced mammography services.

Public-private partnerships offer opportunities for collaborative initiatives that combine government funding with private sector innovation, accelerating technology adoption and improving healthcare accessibility across diverse communities.

Market dynamics within the Australia 3D mammogram industry reflect complex interactions between technological innovation, healthcare policy, demographic trends, and competitive forces that collectively shape market evolution and growth trajectories.

Supply chain dynamics involve sophisticated relationships between international medical device manufacturers, local distributors, healthcare facilities, and service providers. These relationships influence pricing structures, technology availability, and implementation timelines across different market segments.

Competitive dynamics drive continuous innovation and service enhancement as market participants strive to differentiate their offerings through advanced features, superior performance, and comprehensive support services. This competition benefits healthcare providers through improved technology options and competitive pricing.

Regulatory dynamics significantly impact market development through evolving standards, certification requirements, and quality assurance protocols. Healthcare facilities must adapt to changing regulatory landscapes while maintaining compliance and operational efficiency.

Economic dynamics influence investment decisions and adoption patterns, with healthcare budgets, reimbursement policies, and cost-benefit analyses playing crucial roles in technology selection and implementation strategies. Economic pressures drive demand for cost-effective solutions that demonstrate clear clinical and financial benefits.

Comprehensive research methodology employed in analyzing the Australia 3D mammogram industry market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research involves direct engagement with healthcare professionals, medical device manufacturers, hospital administrators, and industry experts through structured interviews, surveys, and focus group discussions. This approach provides firsthand insights into market trends, challenges, and opportunities from key stakeholders.

Secondary research encompasses analysis of published reports, government statistics, medical literature, industry publications, and regulatory documents. This comprehensive review provides historical context, market benchmarks, and comparative analysis across different geographic regions and healthcare systems.

Data validation processes include cross-referencing multiple sources, statistical analysis, and expert review to ensure information accuracy and eliminate potential biases. Quantitative data undergoes rigorous verification through independent sources and industry databases.

Market modeling utilizes advanced analytical techniques to project future trends, growth patterns, and market dynamics based on historical data, current market conditions, and identified growth drivers. These models incorporate various scenarios to provide comprehensive market outlook perspectives.

Regional market analysis reveals distinct patterns of 3D mammography adoption and growth across Australia’s diverse geographic and demographic landscape, with significant variations in market penetration and development strategies.

New South Wales leads market activity with approximately 35% market share, driven by high population density, advanced healthcare infrastructure, and significant investment in medical technology. Sydney’s major hospitals and imaging centers serve as early adopters of innovative mammography systems.

Victoria represents the second-largest regional market with strong growth momentum, particularly in Melbourne’s metropolitan area where healthcare facilities prioritize advanced diagnostic capabilities. The state’s emphasis on preventive healthcare drives consistent demand for 3D mammography services.

Queensland demonstrates robust market potential with expanding healthcare infrastructure and growing population demographics. Brisbane and Gold Coast regions show particularly strong adoption rates, while regional centers are increasingly investing in advanced imaging technologies.

Western Australia presents unique opportunities with significant mining industry healthcare requirements and growing urban populations in Perth. The state’s geographic challenges create demand for mobile and telemedicine-enabled mammography solutions.

South Australia, Tasmania, and Northern Territory represent emerging markets with growing awareness of 3D mammography benefits and increasing healthcare investment. These regions benefit from government initiatives promoting healthcare accessibility and technology adoption.

Competitive landscape within the Australia 3D mammogram industry features established international medical device manufacturers alongside emerging technology companies and specialized service providers competing across multiple market segments.

Market competition drives continuous innovation in imaging quality, workflow efficiency, and integrated software solutions. Companies differentiate through advanced features, comprehensive service offerings, and specialized applications targeting specific healthcare segments.

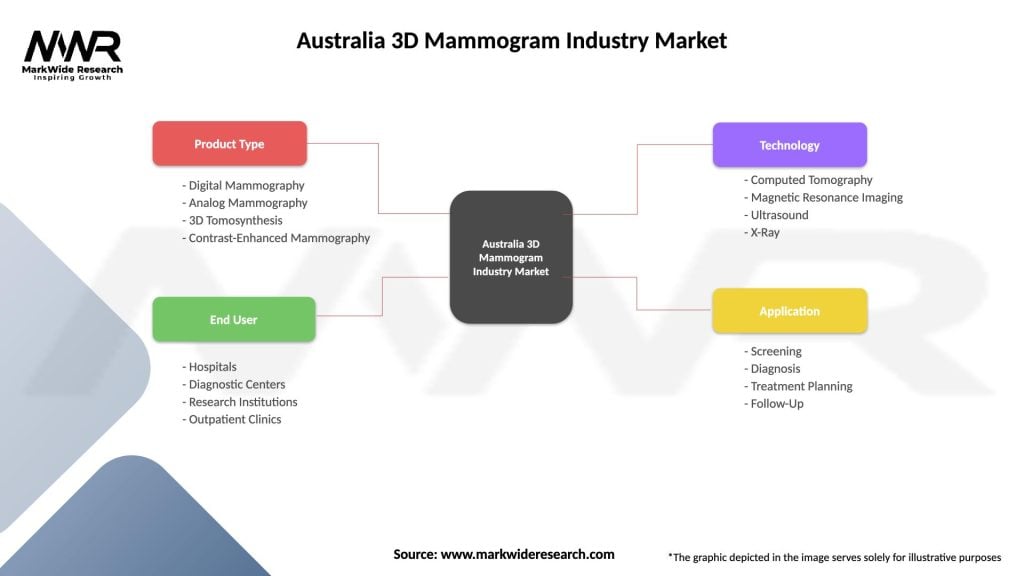

Market segmentation analysis reveals distinct categories within the Australia 3D mammogram industry based on technology type, end-user applications, and geographic distribution patterns.

By Technology:

By End User:

By Application:

Category analysis provides detailed insights into specific market segments within the Australia 3D mammogram industry, revealing unique growth patterns, challenges, and opportunities across different technology and application categories.

Digital Breast Tomosynthesis represents the largest market category, accounting for the majority of 3D mammography installations. This technology demonstrates consistent growth driven by proven clinical benefits and increasing healthcare provider confidence in diagnostic accuracy improvements.

AI-Integrated Systems emerge as the fastest-growing category with significant potential for market disruption. These advanced platforms offer automated image analysis, workflow optimization, and decision support capabilities that enhance radiologist productivity and diagnostic consistency.

Hospital Segment dominates end-user categories with substantial investment in comprehensive breast imaging programs. Large healthcare institutions prioritize integrated solutions that seamlessly connect with existing hospital information systems and electronic health records.

Imaging Centers represent a rapidly expanding category as specialized diagnostic facilities invest in advanced 3D mammography systems to differentiate their services and attract patients seeking superior imaging quality and comfort.

Screening Applications drive the largest volume of mammography procedures, with routine screening programs creating consistent demand for high-throughput 3D systems capable of handling large patient volumes efficiently.

Industry participants and stakeholders within the Australia 3D mammogram market realize substantial benefits through improved clinical outcomes, operational efficiency, and enhanced patient satisfaction across multiple dimensions.

Healthcare Providers benefit from enhanced diagnostic capabilities that improve cancer detection rates while reducing false-positive results. The technology’s superior imaging quality enables more confident diagnoses and reduces the need for additional imaging procedures, improving workflow efficiency and patient throughput.

Patients experience significant advantages including more comfortable examinations, reduced callback rates, and earlier cancer detection when present. The improved diagnostic accuracy provides greater peace of mind and reduces anxiety associated with inconclusive screening results.

Radiologists gain access to superior imaging tools that enhance their diagnostic capabilities and professional confidence. The detailed 3D images provide clearer visualization of breast tissue structures, enabling more accurate interpretation and reducing diagnostic uncertainty.

Healthcare Systems realize cost benefits through reduced need for additional imaging procedures, fewer false-positive results, and improved resource utilization. The technology’s efficiency gains translate to better patient throughput and optimized facility utilization.

Technology Providers benefit from growing market demand, opportunities for innovation, and expanding service offerings. The competitive market environment drives continuous improvement and creates opportunities for differentiation through advanced features and superior performance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Australia 3D mammogram industry reflect technological evolution, changing healthcare delivery models, and emerging patient expectations that collectively drive market transformation.

Artificial Intelligence Integration represents the most significant trend, with AI-powered systems offering automated image analysis, abnormality detection, and workflow optimization. These capabilities enhance radiologist productivity while maintaining high diagnostic accuracy standards.

Cloud-Based Solutions are gaining momentum as healthcare facilities seek scalable, cost-effective platforms for image storage, sharing, and analysis. Cloud connectivity enables remote access, specialist consultation, and collaborative diagnosis capabilities.

Mobile Mammography Services expand rapidly to address healthcare accessibility challenges in rural and underserved communities. These mobile units equipped with 3D technology bring advanced screening capabilities directly to patients’ locations.

Personalized Screening Protocols emerge as healthcare providers adopt risk-based approaches considering genetic factors, family history, and individual patient characteristics. This trend drives demand for flexible, adaptable imaging systems.

Workflow Optimization becomes increasingly important as healthcare facilities seek to maximize efficiency and patient throughput. Integrated systems that streamline examination processes and reduce administrative burden gain preference.

Recent industry developments demonstrate the dynamic nature of the Australia 3D mammogram market, with significant technological advances, strategic partnerships, and regulatory changes shaping market evolution.

Technology Innovations include next-generation imaging sensors, enhanced image reconstruction algorithms, and integrated artificial intelligence capabilities that improve diagnostic accuracy and workflow efficiency. These advances position 3D mammography as the gold standard for breast cancer screening.

Strategic Partnerships between international medical device manufacturers and Australian healthcare institutions facilitate knowledge transfer, customized solution development, and accelerated technology adoption. These collaborations enhance local market presence and support capabilities.

Regulatory Approvals for advanced 3D mammography systems and AI-enhanced software platforms expand available technology options for healthcare providers. Streamlined approval processes encourage innovation while maintaining patient safety standards.

Investment Initiatives from both public and private sectors support healthcare infrastructure development and technology acquisition programs. Government funding allocations specifically targeting cancer screening capabilities drive market growth.

Training Programs developed by professional medical associations and equipment manufacturers ensure healthcare personnel possess necessary skills for optimal 3D mammography utilization. These educational initiatives support successful technology implementation and adoption.

Market analysts recommend strategic approaches for stakeholders seeking to capitalize on opportunities within the Australia 3D mammogram industry while addressing potential challenges and market dynamics.

Healthcare Providers should prioritize comprehensive technology evaluation processes that consider long-term clinical benefits, operational efficiency gains, and total cost of ownership. Investment in staff training and change management programs ensures successful implementation and optimal utilization.

Technology Vendors should focus on developing integrated solutions that address specific Australian healthcare needs, including rural accessibility challenges and integration with existing hospital systems. Local partnerships and support capabilities enhance competitive positioning.

Government Agencies should continue supporting cancer screening initiatives through funding programs, regulatory frameworks, and public awareness campaigns. Investment in healthcare infrastructure development ensures equitable access to advanced diagnostic technologies.

Investment Community should recognize the substantial growth potential within the 3D mammography market, particularly opportunities related to artificial intelligence integration, telemedicine applications, and mobile screening solutions.

MarkWide Research analysis suggests that stakeholders should prepare for continued market evolution driven by technological advancement and changing healthcare delivery models. Adaptability and innovation will be crucial for long-term success in this dynamic market environment.

Future market outlook for the Australia 3D mammogram industry remains highly positive, with multiple growth drivers supporting sustained expansion and technological advancement over the coming years.

Technology Evolution will continue driving market growth through enhanced imaging capabilities, artificial intelligence integration, and improved workflow efficiency. Next-generation systems offering superior diagnostic accuracy and patient comfort will gain widespread adoption.

Market Expansion is expected to accelerate with projected growth rates of approximately 8-10% annually driven by increasing healthcare awareness, aging population demographics, and expanding screening programs. Regional market penetration will improve through mobile solutions and telemedicine capabilities.

Healthcare Integration will deepen as 3D mammography systems become standard components of comprehensive breast health programs. Integration with electronic health records, artificial intelligence platforms, and telemedicine networks will enhance clinical utility and accessibility.

Innovation Opportunities will emerge through artificial intelligence applications, personalized medicine approaches, and advanced imaging techniques. These innovations will further differentiate 3D mammography from traditional screening methods and drive continued adoption.

Regulatory Environment is expected to remain supportive with continued emphasis on cancer prevention and early detection programs. Government initiatives and healthcare policies will continue promoting advanced diagnostic technologies and improved patient outcomes.

The Australia 3D mammogram industry market represents a dynamic and rapidly evolving sector within the nation’s healthcare technology landscape, characterized by strong growth momentum, technological innovation, and expanding clinical applications. Market analysis reveals substantial opportunities for continued expansion driven by demographic trends, healthcare policy support, and advancing diagnostic capabilities.

Key success factors include superior clinical outcomes, enhanced patient experience, and operational efficiency gains that collectively position 3D mammography as the preferred screening technology. The market benefits from strong government support, growing healthcare awareness, and continuous technological advancement that improves diagnostic accuracy and accessibility.

Future prospects remain highly favorable with projected sustained growth supported by artificial intelligence integration, telemedicine expansion, and mobile screening solutions that address geographic accessibility challenges. MarkWide Research projections indicate continued market evolution driven by innovation and changing healthcare delivery models.

Strategic recommendations emphasize the importance of comprehensive planning, stakeholder collaboration, and adaptive approaches that respond to evolving market dynamics and technological opportunities. Success in this market requires understanding of clinical needs, regulatory requirements, and patient expectations while maintaining focus on improved healthcare outcomes and accessibility across Australia’s diverse communities.

What is 3D Mammogram?

3D Mammogram refers to a breast imaging technique that provides a three-dimensional view of breast tissue, allowing for more accurate detection of abnormalities compared to traditional two-dimensional mammography. This technology is particularly beneficial in identifying small tumors and reducing false positives.

What are the key players in the Australia 3D Mammogram Industry Market?

Key players in the Australia 3D Mammogram Industry Market include Hologic, Siemens Healthineers, GE Healthcare, and Fujifilm, among others. These companies are known for their advanced imaging technologies and contributions to breast cancer screening.

What are the growth factors driving the Australia 3D Mammogram Industry Market?

The growth of the Australia 3D Mammogram Industry Market is driven by increasing awareness of breast cancer, advancements in imaging technology, and government initiatives promoting regular screenings. Additionally, the rising prevalence of breast cancer among women is a significant factor.

What challenges does the Australia 3D Mammogram Industry Market face?

Challenges in the Australia 3D Mammogram Industry Market include high costs associated with advanced imaging systems and the need for trained professionals to operate these technologies. Furthermore, there may be resistance to adopting new technologies among some healthcare providers.

What opportunities exist in the Australia 3D Mammogram Industry Market?

Opportunities in the Australia 3D Mammogram Industry Market include the potential for technological innovations, such as AI integration for improved diagnostics, and expanding access to screening in rural areas. Additionally, increasing partnerships between healthcare providers and technology companies can enhance service delivery.

What trends are shaping the Australia 3D Mammogram Industry Market?

Trends shaping the Australia 3D Mammogram Industry Market include the growing adoption of personalized medicine approaches, increased focus on early detection, and the integration of telemedicine for remote consultations. These trends are enhancing patient access and improving overall outcomes.

Australia 3D Mammogram Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Digital Mammography, Analog Mammography, 3D Tomosynthesis, Contrast-Enhanced Mammography |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Technology | Computed Tomography, Magnetic Resonance Imaging, Ultrasound, X-Ray |

| Application | Screening, Diagnosis, Treatment Planning, Follow-Up |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia 3D Mammogram Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at