444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global attapulgite market is expected to experience significant growth over the forecast period (2021-2028), according to industry experts. Attapulgite, also known as palygorskite, is a naturally occurring clay mineral that is primarily used in the production of adsorbents, thickeners, and absorbents. It has a unique combination of physical and chemical properties that make it suitable for a wide range of industrial applications, including agriculture, oil and gas, pharmaceuticals, and cosmetics.

Attapulgite is a type of clay mineral that is composed of magnesium silicate hydroxide. It is named after the town of Attapulgus, Georgia, where it was first discovered in the United States in the 1930s. Attapulgite has a unique structure that gives it excellent adsorption and absorption properties, making it an ideal material for a wide range of industrial applications.

Executive Summary

The attapulgite market is expected to grow at a steady pace over the next several years, driven by increasing demand for the mineral in a variety of industries. The market is characterized by intense competition among major players, with companies investing heavily in research and development to improve product quality and expand their customer base. Key drivers of market growth include the rising demand for oil and gas products, increasing use of attapulgite in the agriculture and animal feed industries, and growing popularity of attapulgite-based skincare products.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Oil & Gas Sector Dominance: A large share of attapulgite usage is linked to drilling fluid formulations where its rheological and fluid-loss control properties are prized.

Diversification to Absorbents & Pet Litter: Growing demand for litter and spill cleanup markets helps stabilize demand when oil cycles down.

Growth in Specialty Formulations: Cosmetic, pharmaceutical, and agricultural applications demand higher-purity, functional-grade attapulgite.

Regional Supply Constraints: Geographic concentration of deposits means supply chains and transportation can be bottlenecks.

Derivative Products & Functionalization: Surface-modified or nanoscale attapulgite products are emerging for specialty markets, enhancing adsorption, compatibility, and performance.

Market Drivers

Drilling & Exploration Activity: Upturns in global oil & gas exploration stimulate demand for drilling fluid additives including attapulgite.

Environmental Regulations & Spill Response: Stricter standards around oil spills, chemical leaks, and industrial discharges promote absorbent use.

Pet Industry Growth: Increased pet adoption fuels demand for litter products, of which attapulgite is a key ingredient.

Growth in Specialty Industries: Cosmetics, pharmaceuticals, agrochemicals, and niche industrial formulations require purified or functional-grade attapulgite.

Formulation Efficiency & Cost Optimization: Users prefer multifunctional additives like attapulgite that combine thickening, suspension, and absorption, reducing need for multiple additives.

Market Restraints

Competition from Alternative Clays & Materials: Bentonite, attapulgite derivatives, synthetic absorbents, silica gels, and polymer-based additives compete on cost or performance.

Deposit Scarcity & Quality Variation: Limited high-quality reserves constrain supply and force reliance on imports.

Processing Costs: Purification, drying, milling, and surface treatment impose high energy and capital costs.

Volatility in End-Use Sectors: The oil & gas industry’s cyclicality causes demand fluctuations.

Logistics & Transportation: Bulk clay is low value per weight, making transport over long distances expensive relative to value.

Market Opportunities

Functionalized & Nano-Attapulgite: Surface modifications (e.g., organically treated, coatings) tailored for high-end industrial, cosmetic, or pharmaceutical markets.

Environmental Remediation Projects: Use in treating industrial effluents, oil spill sites, and soil amendments.

Regional Manufacturing Hubs: Establish localized processing near demand centers (Middle East, Southeast Asia, Latin America).

Green Application Expansion: Use in biodegradable composite materials, green coatings, and sustainable products.

Hybrid Formulations: Combining attapulgite with polymers, activated carbon, or other clays for synergistic performance in specialty formulations.

Market Dynamics

The attapulgite market is highly dynamic, driven by a range of factors including changing consumer preferences, technological advancements, and regulatory changes. Key drivers of market growth include increasing demand for oil and gas products, growing popularity of attapulgite-based skincare products, and increasing use of attapulgite in the agriculture and animal feed industries.

Regional Analysis

The Asia Pacific region is expected to be the fastest-growing market for attapulgite, driven by increasing demand from the agriculture and animal feed industries in China and India. North America and Europe are also significant markets for attapulgite, with major players in the industry headquartered in these regions.

Competitive Landscape

Leading Companies in the Attapulgite Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

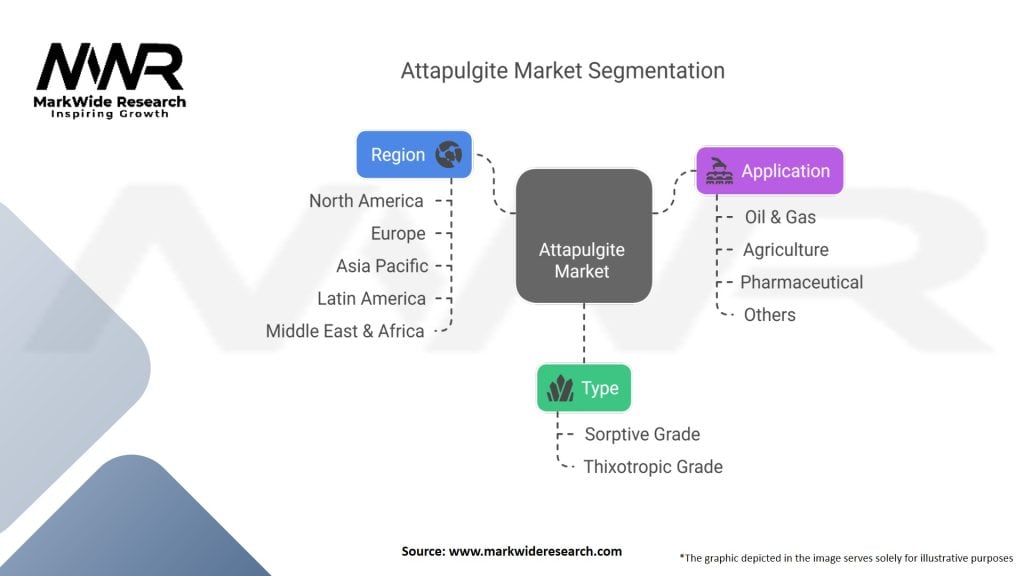

Segmentation

The attapulgite market can be segmented by application and geography. Applications of attapulgite include oil and gas, agriculture, animal feed, pharmaceuticals, and cosmetics. Geographically, the market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Category-wise Insights

Oil and gas is the largest application segment for attapulgite, accounting for over 40% of the market share. Other significant application segments include agriculture, animal feed, and cosmetics.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

There is a growing trend towards the use of natural and sustainable ingredients in a wide range of industries, including cosmetics, pharmaceuticals, and agriculture. This trend is expected to drive the demand for attapulgite-based formulations in the coming years.

Attapulgite is commonly used in the animal feed industry as an anti-caking agent and source of dietary fiber. As the global demand for animal feed continues to grow, the demand for attapulgite is expected to increase.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the attapulgite market, with disruptions to global supply chains and a decline in demand from some industries. However, the market has also seen increased demand from the pharmaceutical and personal care industrie, which has partially offset the negative impact of the pandemic. The pandemic has also highlighted the importance of natural and sustainable ingredients in a wide range of industries, which could drive the demand for attapulgite-based formulations in the future.

Key Industry Developments

In 2020, Geohellas S.A. launched a new attapulgite-based adsorbent product for use in a range of industrial applications. The product, called GeoAttic, is designed to provide superior adsorption performance and is expected to drive growth for the company in the coming years.

In 2018, Active Minerals International LLC announced the acquisition of Amcol Minerals Europe, a leading producer of specialty minerals including attapulgite. The acquisition is expected to strengthen Active Minerals’ position in the global attapulgite market.

Analyst Suggestions

Industry analysts suggest that major players in the attapulgite market should continue to invest in research and development to improve product quality and expand their customer base. They also suggest that strategic partnerships and acquisitions could help companies gain a competitive edge in the market.

Future Outlook

The global attapulgite market is expected to grow at a steady pace over the next several years, driven by increasing demand for the mineral in a variety of industries. Key drivers of market growth include the rising demand for oil and gas products, increasing use of attapulgite in the agriculture and animal feed industries, and growing popularity of attapulgite-based skincare products. Major players in the industry are expected to continue investing in research and development to improve product quality and expand their customer base, and exploring opportunities for strategic partnerships and acquisitions to gain a competitive edge.

Conclusion

In conclusion, attapulgite is a versatile and valuable mineral with a wide range of industrial applications. The global attapulgite market is expected to experience steady growth over the next several years, driven by increasing demand for attapulgite in a variety of industries. Major players in the industry are investing heavily in research and development to improve product quality and expand their customer base, and are also exploring opportunities for strategic partnerships and acquisitions to gain a competitive edge. The future outlook for the attapulgite market is positive, with significant potential for growth in emerging markets and the development of new applications for the mineral.

As the demand for natural and sustainable ingredients continues to rise, attapulgite-based formulations are expected to become more popular in a range of industries, including cosmetics, pharmaceuticals, and agriculture. However, the attapulgite market also faces several challenges, including limited availability of attapulgite deposits and intense competition among major players.

What is attapulgite?

Attapulgite is a clay mineral known for its unique properties, including high absorbency and thixotropic behavior. It is commonly used in various applications such as drilling fluids, cat litter, and as a filler in paints and plastics.

Who are the key players in the Attapulgite Market?

Key players in the Attapulgite Market include companies like Active Minerals International, Oil-Dri Corporation, and BASF, among others. These companies are involved in the extraction, processing, and distribution of attapulgite for various industrial applications.

What are the growth factors driving the Attapulgite Market?

The growth of the Attapulgite Market is driven by increasing demand in industries such as oil and gas, agriculture, and construction. Additionally, the rising need for environmentally friendly products and the expansion of the automotive sector contribute to market growth.

What challenges does the Attapulgite Market face?

The Attapulgite Market faces challenges such as fluctuating raw material prices and environmental regulations that impact mining activities. Additionally, competition from synthetic alternatives can hinder market growth.

What opportunities exist in the Attapulgite Market?

Opportunities in the Attapulgite Market include the development of new applications in the pharmaceutical and food industries. Furthermore, innovations in processing techniques can enhance product quality and expand market reach.

What trends are shaping the Attapulgite Market?

Trends in the Attapulgite Market include a growing focus on sustainability and eco-friendly products. Additionally, advancements in technology are leading to improved extraction and processing methods, enhancing the efficiency of attapulgite use in various applications.

Attapulgite Market

| Segmentation Details | Details |

|---|---|

| Type | Sorptive Grade, Thixotropic Grade |

| Application | Oil & Gas, Agriculture, Pharmaceutical, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Attapulgite Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at