444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Atrazine Market encompasses the global production, distribution, and consumption of atrazine, one of the most widely used herbicides in the world. Primarily employed for pre- and post-emergent control of broadleaf and grassy weeds in crops such as corn, sorghum, sugarcane, and turf, atrazine plays a critical role in modern agriculture by enhancing crop yields and reducing manual labor. Introduced in the 1950s, atrazine’s cost-effectiveness, broad-spectrum activity, and systemic mode of action have made it a staple in weed management programs.

With global demand for agricultural productivity steadily rising to meet the needs of a growing population, the atrazine market has experienced substantial growth over the past decades. However, regulatory scrutiny, environmental concerns, and shifting agricultural practices have introduced complexities that both challenge and shape market dynamics. Developed markets in North America and Europe, which historically accounted for the largest share of atrazine consumption, have seen stricter regulations or partial bans, while emerging markets in Latin America, Asia-Pacific, and Africa continue to drive demand due to expanding crop acreage and favorable cost-benefit ratios.

Major agrochemical companies maintain significant investments in atrazine production capabilities, research into improved formulations, and strategic partnerships with agribusiness stakeholders. Furthermore, technological advancements in precision agriculture and integrated weed management are influencing application methods and optimal usage rates, underscoring the evolving landscape of the atrazine market.

Meaning

Atrazine is a selective systemic herbicide belonging to the triazine chemical class. It controls weeds by inhibiting photosynthesis—specifically by blocking electron transport at photosystem II—thereby halting plant growth and leading to eventual plant death. Due to its systemic action, atrazine is absorbed by roots and leaves and translocated throughout the plant, ensuring thorough weed control. Key attributes of atrazine include:

Selective Activity: Targets broadleaf and grassy weeds while being safe for most crop species at recommended application rates.

Residual Control: Provides extended weed control through soil persistence, reducing the frequency of reapplication.

Versatility: Applicable via multiple methods—soil incorporation, pre-emergent spray, or post-emergent foliar application.

Cost-Effectiveness: Compared to newer herbicides, atrazine offers a lower cost per acre of treatment, making it attractive for large-scale farming operations.

The term “atrazine market” refers not only to the volumes of active ingredient produced and sold, but also to the market for various commercial formulations—liquid flowables, emulsifiable concentrates, granular formulations, and premixes with other herbicides.

Executive Summary

The global atrazine market is undergoing a period of transition marked by divergent regional trends, evolving regulatory frameworks, and growing emphasis on sustainable agriculture. Valued at approximately USD 1 billion in 2023, the market is projected to grow at a modest compound annual growth rate (CAGR) of 2–3% from 2024 to 2030. Key factors propelling the market include rising demand for corn and other major cereal crops, especially in North and South America, where atrazine remains integral to weed management strategies. Emerging economies in Brazil, Argentina, and Southeast Asia represent significant growth opportunities due to expanding cropped area, mechanization, and limited availability of alternative herbicides in similar price brackets.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regional Disparities: While North America remains the largest market by volume, accounting for over 40% of global consumption, significant growth is observed in Latin America (particularly Brazil and Argentina) and Asia-Pacific (notably India and Southeast Asia). Europe’s demand is negligible due to long-standing regulatory bans.

Crop Focus: Corn dominates atrazine usage, representing nearly two-thirds of global demand, followed by sorghum, sugarcane, and turfgrass.

Formulation Trends: Granular and controlled-release formulations are gaining traction for their reduced environmental mobility and improved application efficiency, offsetting some regulatory pressures.

Precision Agriculture Integration: Adoption of GPS-guided sprayers, optical weed detection, and variable-rate technology enables targeted application, reducing atrazine usage by up to 20% without compromising weed control efficacy.

Sustainability Initiatives: Industry-led stewardship programs and public-private partnerships are educating farmers on best management practices (BMPs) to minimize runoff, buffer zones, and integrated weed management (IWM) incorporating crop rotation and mechanical control.

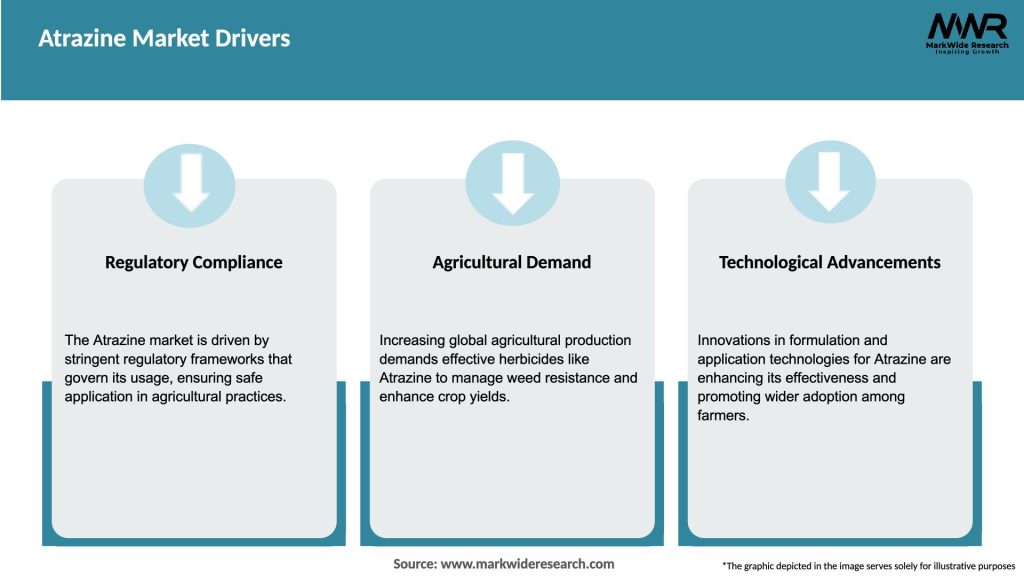

Market Drivers

Rising Demand for High-Yield Crops: As global population grows and diets shift toward higher caloric intake, demand for staple grains—especially corn—increases, bolstering need for effective weed control.

Cost-Effectiveness: Atrazine’s lower cost per treated hectare compared to many newer herbicides makes it an attractive choice for large-scale, price-sensitive operations in both developed and emerging markets.

Long Residual Activity: The compound’s soil half-life of 60–100 days provides extended pre-emergent weed control, reducing the need for multiple applications and associated labor costs.

Industry Stewardship Programs: Initiatives by manufacturers and agricultural extension services promote responsible use, BMPs, and compliance with regulatory requirements, enhancing atrazine’s acceptability.

Formulation Innovations: Development of granular, controlled-release, and encapsulated formulations minimizes atrazine leaching and runoff, addressing environmental concerns and extending the product’s market life.

Market Restraints

Regulatory Bans and Restrictions: Atrazine is banned in the EU and restricted in several other jurisdictions. Ongoing scrutiny by environmental agencies keeps the market in flux.

Environmental Concerns: Atrazine’s detected presence in groundwater and potential endocrine-disrupting effects in wildlife raise public opposition and drive tighter regulations.

Competition from Alternative Herbicides: Rising availability of post-emergent, glyphosate-resistant, and non-triazine herbicides provides growers alternatives, particularly where atrazine is restricted.

R&D Cost Pressures: Developing next-generation formulations with reduced environmental impact requires substantial R&D investment, affecting profit margins.

Market Saturation in Developed Regions: With high adoption rates and limited arable land expansion, growth in North America and Europe is constrained, shifting focus to emerging economies.

Market Opportunities

Emerging Market Expansion: Increased corn and sorghum acreage in Sub-Saharan Africa, Southeast Asia, and Latin America presents growth avenues where atrazine remains a cost-effective choice.

Precision Application Technologies: Integrating atrazine application with drone-based spraying, optical sensing, and AI-driven weed mapping can optimize usage and reduce environmental impact.

Stewardship Collaborations: Partnerships with NGOs, government agencies, and farmer cooperatives to promote BMPs, buffer zones, and regular soil and water monitoring can improve atrazine’s environmental profile.

Formulation Diversification: Controlled-release granules, polymer-coated formulations, and adjuvant systems that enhance soil binding reduce runoff and persistent residues.

Crop Protection Packages: Atrazine premixes with complementary herbicides (e.g., mesotrione, S-metolachlor) in ready-to-use formulations enable broader weed spectrum control and simplify logistics.

Organic and Sustainable Agri-Innovation: Research into bio-based triazine analogues or microbial agents that mimic atrazine’s mode of action could appeal to markets seeking reduced synthetic chemical loads.

Market Dynamics

Supply Side Dynamics: Consolidation among agrochemical majors (e.g., mergers of Syngenta and ChemChina, formation of Corteva) has centralized production and distribution channels, enabling optimized supply chains and R&D synergies. Contract manufacturing organizations (CMOs) in India, China, and Eastern Europe provide cost-competitive production of active ingredient.

Demand Side Dynamics: Farmer adoption is influenced by commodity prices (e.g., corn futures), local agronomic recommendations, and crop rotation practices. Crop advisors and cooperatives leverage agronomic data to recommend atrazine where legally permissible and agronomically favorable.

Economic Influences: Exchange rates, raw material costs (cyanuric chloride, ammonia), and energy prices for chemical synthesis affect atrazine production economics.

Regulatory Influences: Ongoing EPA reviews in the U.S., Canada’s re-evaluation process, and water quality mandates drive stewardship obligations and can influence application guidelines and buffer zones.

Regional Analysis

North America: Largest regional market. U.S. accounts for ~85% of North American consumption. Despite periodic regulatory reviews by the EPA, atrazine remains approved with label conditions (e.g., surface water monitoring, buffer zones).

Latin America: Rapid growth in Brazil and Argentina; expanding corn and sugarcane acreage. Brazil’s regulatory environment remains permissive, with stewardship guidelines managed by Ministry of Agriculture, providing substantial opportunity.

Asia-Pacific: India, Thailand, and Indonesia lead in consumption. India’s agricultural mechanization and fertilizer & pesticide subsidies bolster atrazine use. China’s market is growing, though environmental inspections have introduced localized restrictions.

Europe: Banned since 2004; negligible commercial use. Illegal or unauthorized stockpiles exist but face strict enforcement.

Middle East & Africa: Emerging markets with limited local production and heavy imports. Use in cereal and sugarcane cultivation is expanding as arable land increases.

Competitive Landscape

Leading Companies in the Atrazine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Formulation:

Liquid Flowable (SL, DF)

Emulsifiable Concentrate (EC)

Granular (GR, G)

Microencapsulated

Premixes (Atrazine + other herbicides)

By Application:

Pre-emergent Soil Application

Post-emergent Foliar Application

Turf and Ornamental Use

By Crop:

Corn (Maize)

Sorghum

Sugarcane

Turf, Ornamentals

Other (Wheat, Rice, etc., where permitted)

By Region: North America, Latin America, Europe, Asia-Pacific, MEA.

Category-wise Insights

Liquid Formulations: Popular due to uniform coverage and ease of application with existing spray equipment.

Granular Formulations: Preferred where soil incorporation is feasible; lower drift potential and easier in no-till systems.

Microencapsulated: Emerging category offering controlled release and reduced off-target movement.

Premixes: Provide broad-spectrum weed control and simplified logistics, but may face price resistance.

Key Benefits for Industry Participants and Stakeholders

Enhanced Crop Yields: Consistent weed control leads to higher harvestable yield per hectare.

Cost Savings: Fewer applications needed due to residual activity, reducing labor and machinery costs.

Operational Efficiency: Readily integrated into existing agronomic programs and equipment.

Market Stability: Established supply chains and global regulatory approvals in key markets ensure continuity.

Innovation Potential: Formulation R&D produces differentiated products addressing stewardship and environmental concerns.

SWOT Analysis

Strengths: Established efficacy, low cost, broad-spectrum activity, long track record in major agricultural markets.

Weaknesses: Environmental concerns (groundwater contamination, non-target impacts), regulatory uncertainty, potential for resistant weed biotypes.

Opportunities: Growth in emerging markets, precision agriculture integration, formulation innovations (controlled release, reduced-drip technologies), stewardship partnerships.

Threats: Regulatory bans or severe restrictions, persistent public opposition, emergence of herbicide-resistant weeds necessitating integrated management, competition from novel modes-of-action herbicides.

Market Key Trends

Precision Application Technologies: GPS-guided sprayers and optical detection minimize over-application and drift, enhancing atrazine stewardship.

Granular and Controlled-Release Formulations: Expanded adoption to reduce off-target movement and environmental loading.

Integrated Weed Management (IWM): Atrazine as one component of crop rotation, mechanical control, and alternative herbicides to mitigate resistance.

Sustainable Agriculture Programs: Farmer training and watershed management collaborations promote atrazine use within BMP frameworks.

Digital Advisory Platforms: Apps and decision-support tools guide optimal application timing and rates based on weather, soil moisture, and weed pressure.

Covid-19 Impact

Short-Term Disruptions: Lockdowns in key production hubs disrupted raw material supply chains but were swiftly mitigated by strategic stockpiling.

Labor Constraints: Field labor shortages increased mechanization and reliance on chemical weed control, supporting atrazine usage.

Market Resilience: Despite logistical challenges, demand remained stable as food production was deemed essential.

Digital Adoption: Accelerated use of digital ag platforms for remote advisory services enhanced atrazine stewardship and optimized application timing under movement restrictions.

Key Industry Developments

Sustainable Formulation Launches: Major players introduced granular microencapsulated atrazine products with reduced leachability.

Stewardship Collaborations: Public-private partnerships (e.g., EPA’s Atrazine Ecological Risk Assessment commitments) advanced buffer zone guidelines and monitoring programs.

Resistance Management Programs: Industry-funded weed resistance clinics and regional grower networks provide education on rotating modes of action and optimizing atrazine use.

Strategic Mergers & Acquisitions: Consolidation among agrochemical giants and CMOs enhanced production capacity and distribution networks.

R&D Investments: Increased spending on atrazine lifecycle management, including environmental fate modeling and digital predictive tools for application optimization.

Analyst Suggestions

Invest in Sustainable Formulations: Prioritize granular and controlled-release technologies to reduce environmental impact and support regulatory compliance.

Enhance Precision Ag Integration: Partner with ag-tech firms to integrate atrazine application into digital platforms that optimize timing, rate, and coverage.

Strengthen Stewardship and Education: Expand farmer training on BMPs, resistance management, and buffer zone implementation to secure long-term market access.

Diversify in Emerging Markets: Focus on Latin America, Asia-Pacific, and Africa where atrazine demand is rising with expanding corn and sugarcane acreage.

Support Regulatory Engagement: Maintain transparent data sharing and collaboration with regulators to demonstrate atrazine’s risk-benefit profile and sustain conditional approvals.

Develop Resistance Mitigation Strategies: Encourage multi-mode-of-action premixes and crop rotation guidelines to preserve atrazine’s efficacy and delay resistance development.

Future Outlook

The global atrazine market is projected to grow at a modest CAGR of 2–3% through 2030, driven by robust demand in North and Latin America and growth in Asia-Pacific and Africa. Key factors shaping the future include:

Precision Agriculture Synergies: Site-specific application technologies will reduce usage rates by up to 20% while maintaining weed control efficacy.

Formulation Evolution: Broad adoption of microencapsulated and granular controlled-release products will address environmental and regulatory pressures.

Regulatory Stability: Continued conditional approvals in major markets hinge on demonstrated stewardship outcomes and research into safer application methods.

Emerging Market Expansion: Growth in Brazil, Argentina, India, and Sub-Saharan Africa will offset declines in the EU and contribute over 30% of global demand by 2030.

Integrated Weed Management: Atrazine will remain a cornerstone in IWM programs, combined with herbicides of differing modes of action, crop rotation, and mechanical controls to sustain long-term efficacy.

The atrazine market’s resilience lies in its established efficacy, cost advantages, and ongoing innovations that mitigate environmental risks. Stakeholders who align with precision agriculture, sustainable formulation, and robust stewardship programs will secure a competitive edge in an evolving regulatory and agronomic landscape.

Conclusion

The Atrazine Market stands at a critical juncture as it navigates increasing global food demand, environmental sustainability imperatives, and stringent regulatory landscapes. Atrazine’s proven performance, cost-effectiveness, and wide crop application footprint ensure its continued relevance in major agricultural regions, particularly in North and Latin America as well as emerging Asia-Pacific markets.

However, the future of atrazine hinges on the industry’s ability to innovate in formulation technology, enhance stewardship, and integrate precision application methods that reduce off-target impacts and mitigate resistance. Collaborative efforts among agrochemical companies, regulatory bodies, academic researchers, and farming communities will be essential to balance crop productivity goals with ecological safeguards.

In conclusion, the Atrazine Market remains crucial for modern agriculture’s weed management efforts. Despite challenges related to environmental concerns and regulatory restrictions, atrazine continues to be an important tool for farmers striving to optimize crop yields and ensure food security. Industry participants must focus on sustainability, innovation, and compliance to thrive in this dynamic and evolving market. The Atrazine market has been a subject of both economic importance and environmental concern due to its widespread use as a herbicide. Atrazine’s effectiveness in controlling weeds has made it a popular choice among farmers globally, contributing to increased crop yields and food production. However, its persistence in the environment and potential groundwater contamination have raised significant environmental and health issues.

What is Atrazine?

Atrazine is a widely used herbicide primarily for controlling weeds in crops such as corn and sugarcane. It works by inhibiting photosynthesis in plants, making it effective in agricultural applications.

Who are the key players in the Atrazine Market?

Key players in the Atrazine Market include Syngenta, Bayer, and Corteva Agriscience, among others. These companies are involved in the production and distribution of Atrazine for agricultural use.

What are the main drivers of growth in the Atrazine Market?

The main drivers of growth in the Atrazine Market include the increasing demand for food production, the need for effective weed management solutions, and the expansion of agricultural land. Additionally, advancements in agricultural technology are contributing to its growth.

What challenges does the Atrazine Market face?

The Atrazine Market faces challenges such as regulatory scrutiny regarding environmental and health impacts, potential restrictions on usage, and competition from alternative herbicides. These factors can affect market dynamics and product availability.

What opportunities exist in the Atrazine Market?

Opportunities in the Atrazine Market include the development of new formulations that enhance efficacy and reduce environmental impact, as well as expanding into emerging markets where agricultural practices are evolving. Additionally, increasing organic farming practices may create niche markets.

What trends are shaping the Atrazine Market?

Trends shaping the Atrazine Market include a growing focus on sustainable agriculture, the integration of precision farming techniques, and the development of herbicide-resistant crop varieties. These trends are influencing how Atrazine is used and perceived in modern agriculture.

Atrazine Market

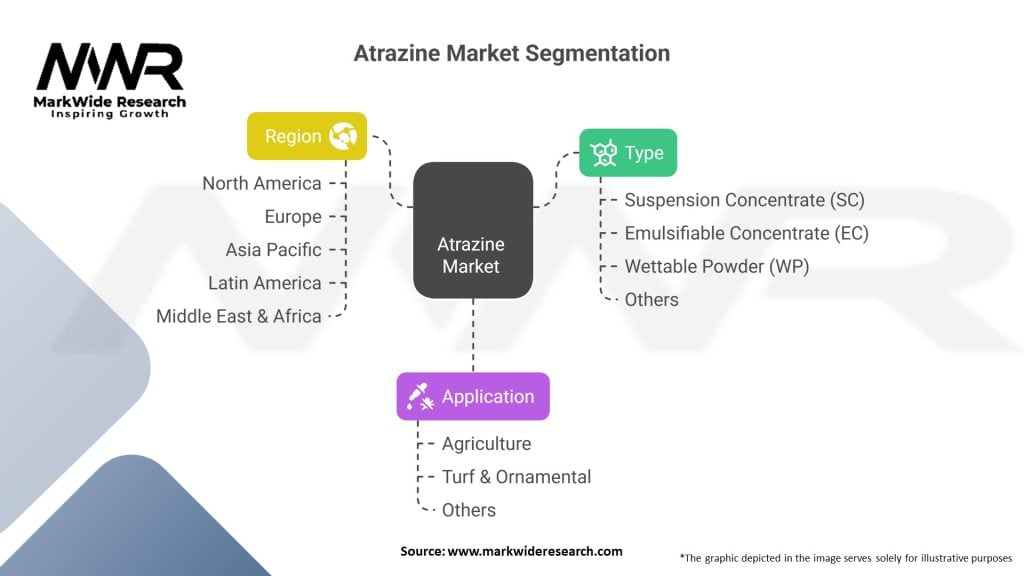

| Segmentation Details | Description |

|---|---|

| Type | Suspension Concentrate (SC), Emulsifiable Concentrate (EC), Wettable Powder (WP), Others |

| Application | Agriculture, Turf & Ornamental, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Atrazine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at