Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Regional Demand Disparities: North America accounts for nearly 35% of global consumption, fueled by high home‑ownership rates and established distribution networks. Asia-Pacific is the fastest‑growing region, driven by urbanization in China and India.

-

Replacement Cycle Dynamics: The average service life of asphalt shingles is 20–30 years. A significant cohort of homes built in the 1990s entered replacement window post‑2020, boosting tear‑off and re‑roofing volumes.

-

Premiumization: Demand is shifting toward architectural and luxury shingles offering enhanced aesthetics, thicker profiles, and superior impact resistance. These products command price premiums of 20–50% over basic 3‑tab shingles.

-

Sustainability Focus: Manufacturers are increasing the use of recycled fiberglass, developing bio‑asphalt binders, and introducing recycling programs to divert tear‑off shingles from landfills.

-

Technological Integration: Digital tools—such as drone‑based roof inspections, AR‑assisted color selection, and BIM integration—are improving accuracy, customer experience, and project workflows.

Market Drivers

-

Residential Construction Growth: Expansion of single‑family housing and multifamily developments in emerging and mature markets.

-

Aging Roofing Stock: Large volumes of homes built in the 1990s and early 2000s reaching end‑of‑life simultaneously, creating elevated replacement demand.

-

Product Innovation: Introduction of polymer‑modified, impact‑resistant, and algae‑resistant shingles meeting stricter building codes and consumer expectations.

-

Energy Efficiency Needs: “Cool” shingles with reflective granules reduce solar heat gain, aligning with green building certifications and consumer cost‑savings.

-

Competitive Pricing: Asphalt shingles’ lower price point compared with metal and tile roofs makes them accessible to a broader homeowner base.

Market Restraints

-

Raw Material Volatility: Asphalt is petroleum‑derived; fluctuations in oil prices can squeeze manufacturer margins.

-

Climate Risk and Durability Concerns: In regions with extreme hail or wildfire risk, asphalt shingles may require frequent repairs or replacements unless specially engineered.

-

Alternative Roofing Solutions: Metal, concrete, and synthetic roofing materials—though costlier—offer longer lifespans (50+ years) and enticing warranty packages.

-

Environmental Regulations: Emissions controls on asphalt plants and landfill restrictions on shingle waste increase operational complexity.

-

Labor Shortages: Roofing installation requires skilled crews; labor scarcity and rising wage rates can delay projects and increase costs.

Market Opportunities

-

Recycling Infrastructure: Investment in collection and processing facilities to grind tear‑off shingles into granules for asphalt paving and new shingle backer mats.

-

Solar‑Ready Shingles: Development of integrated photovoltaic (PV) or solar‑reflective roofing systems that blend renewable energy generation with traditional shingle aesthetics.

-

High‑Performance Segments: Targeting regions prone to severe weather with UL 2218 Class 4 impact‑resistant and ASTM D3161 Class F wind‑resistant shingles.

-

Emerging Urban Markets: Rapid residential urbanization in Southeast Asia and Latin America offers new construction demand with growing middle classes.

-

Digital Services Expansion: Offering end‑to‑end roof visualization, cost estimation, and project tracking platforms to streamline the customer journey and reduce sell‑cycle times.

Market Dynamics

-

Supply Side: Consolidation among major asphalt shingle manufacturers (Owens Corning, GAF, CertainTeed) creates economies of scale and R&D investment capacity.

-

Demand Side: Housing affordability initiatives and resale home remodels drive steady demand even in fluctuating economic conditions.

-

Pricing: Competitive bidding among roofing contractors and retailer rebates (home improvement chains like Home Depot, Lowe’s) restrain retail price increases.

-

Regulatory: Stricter building codes in hurricane and wildfire‑prone regions mandate Class 4 impact resistance and fire ratings, lifting average selling prices.

-

Economic: Mortgage rate fluctuations and consumer confidence directly influence new home construction starts and remodeling budgets.

Regional Analysis

-

North America: Mature market with per‑capita consumption of 2.5 m²/year; high adoption of premium shingles; advanced recycling infrastructure.

-

Europe: Lower penetration due to dominance of tile and metal roofs; growing interest in “cool” and sustainable shingles.

-

Asia-Pacific: Highest CAGR (~6%); rapidly urbanizing; limited recycling infrastructure; price‑sensitive consumers ripe for entry‑level 3‑tab shingles.

-

Latin America: Moderate growth; emerging middle class; infrastructure for distribution rapidly expanding.

-

Middle East & Africa: Nascent market; predominantly metal and tile; potential growth in residential developments and military/hospitality projects.

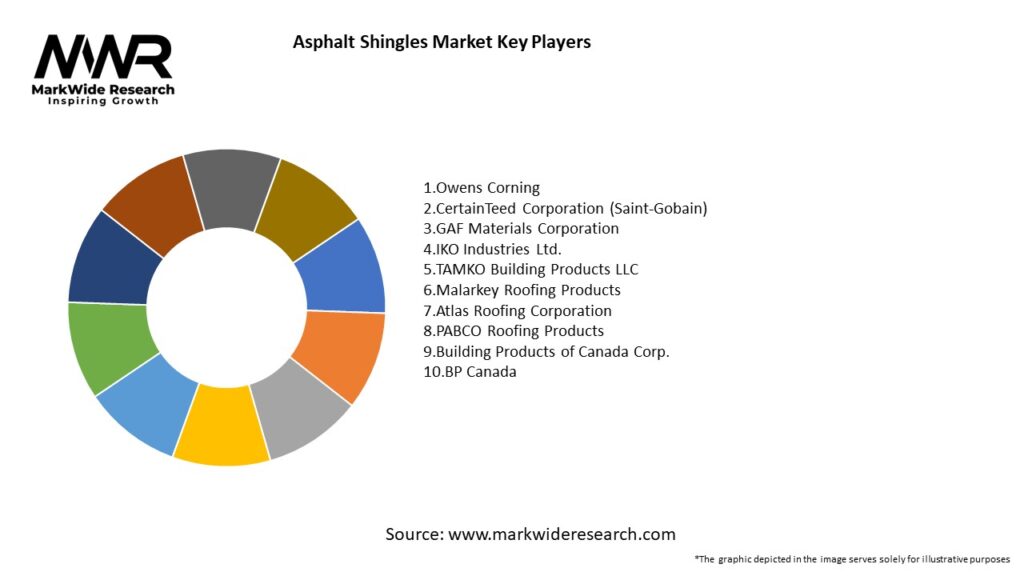

Competitive Landscape

Leading companies in the Asphalt Shingles Market:

- Owens Corning

- CertainTeed Corporation (Saint-Gobain)

- GAF Materials Corporation

- IKO Industries Ltd.

- TAMKO Building Products LLC

- Malarkey Roofing Products

- Atlas Roofing Corporation

- PABCO Roofing Products

- Building Products of Canada Corp.

- BP Canada

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

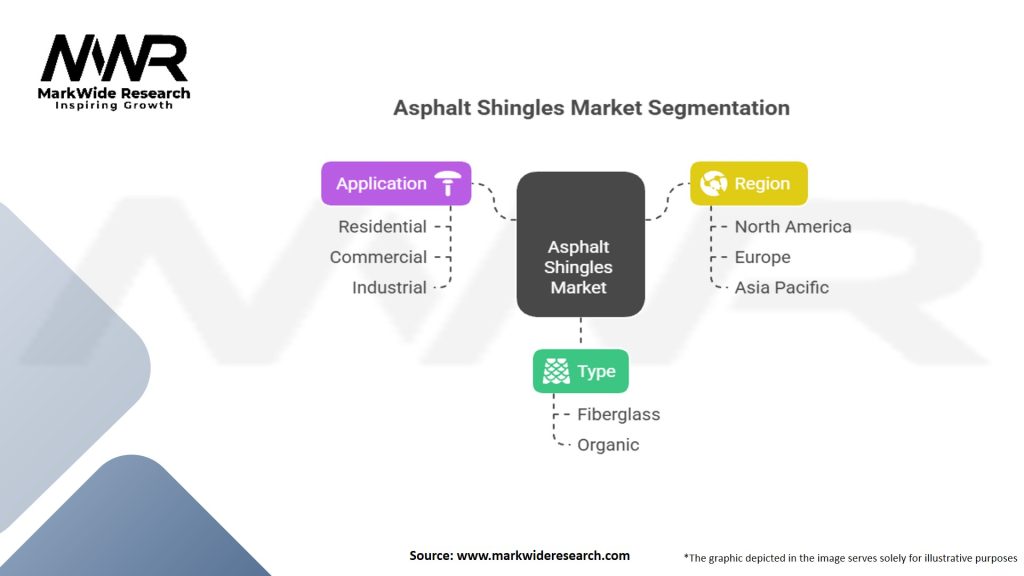

Segmentation

-

By Type: 3‑Tab Shingles; Dimensional/Architectural Shingles; Luxury/Laminated Shingles; Specialty Shingles (Impact‑Resistant, Cool).

-

By Application: New Residential Construction; Residential Reroofing; Commercial Lighting Commercial Roofing.

-

By Material: Fiberglass Base Mat; Organic Base Mat (declining share).

-

By Distribution Channel: Wholesale Distributors; Home Improvement Retailers; Roofing Contractors Direct Sales; E‑Commerce.

-

By Region: North America; Europe; Asia-Pacific; Latin America; Middle East & Africa.

Category‑wise Insights

-

3‑Tab Shingles: ~40% volume share; highly price‑sensitive; entry‑level for new builds and DIY home centers.

-

Architectural Shingles: ~45% volume; stronger margins; preferred for remodeling and higher‑end homes.

-

Luxury Shingles: ~10% volume, fastest growing; simulates slate or cedar; premium price point.

-

Specialty: Impact‑ and cool‑roof shingles are fastest growth segments, commanding 15–30% price premiums.

Key Benefits for Industry Participants and Stakeholders

-

Contractors: Quicker installs and reduced labor costs per square.

-

Distributors/Retailers: High turnover SKUs with broad appeal and repeat remodeling demand.

-

Homeowners: Affordable, attractive, and warranty‑backed protection.

-

Municipalities: Potential for cooler urban environments through reflective asphalt shingles.

-

Environmental Groups: Shingle recycling reduces landfill loads and supports circular economy.

SWOT Analysis

-

Strengths: Low cost, ease of installation, broad availability, evolving performance specs.

-

Weaknesses: Moderate durability (20–30 years service life), petroleum reliance, landfill impacts.

-

Opportunities: Recycling scale‑up, solar integrations, mid‑emerging market expansion.

-

Threats: Oil price spikes, extreme climate events, alternative roofing materials, labor shortages.

Market Key Trends

-

Polymer‑Modified Asphalt: Enhances elasticity and wind uplift resistance up to 150 mph.

-

Cool Roof Shingles: Reflective coatings reducing heat island effect and energy costs.

-

Solar‑Ready Shingles: Built‑in mounting tracks for integrated PV panels.

-

Digital Roof Mapping: Drone and AI‑powered roof measurement tools empowering contractors.

-

Recycled Content: Mandates and incentives pushing for 30–50% recycled fiberglass or asphalt in new shingles.

Covid-19 Impact

-

Short‑Term Slowdown: Early 2020 supply chain disruptions and project postponements.

-

Accelerated Remodels: Stay‑at‑home orders drove homeowners to invest in home improvements, boosting reroofing.

-

Health & Safety Protocols: PPE and contactless quoting/install practices became standard.

-

Supply Chain Resilience: Manufacturers diversified raw asphalt sources and increased local inventories.

Key Industry Developments

-

GAF’s ReShingle Program: Financing packages for homeowners to replace roofs with Lifetime shingles.

-

Owens Corning’s Carbon Initiative: Piloting bio‑asphalt binders to reduce greenhouse gas emissions.

-

IKO’s Asia Expansion: New manufacturing plant in Malaysia targeting Southeast Asia growth.

-

TAMKO’s Polymer Line: Launch of FLEX™ polymer‑modified shingles with enhanced flex and granule adhesion.

-

Roofstock Partnership: Integration of shingle lifecycle data into real estate investment platforms.

Analyst Suggestions

-

Boost Recycling Investments: Collaborate with municipalities and highway agencies to scale shingle grind‑and‑reuse programs.

-

Enhance Digital Tools: Develop contractor portals with real‑time pricing, AR color previews, and supply tracking.

-

Target Premium Niche: Grow luxury and specialty portfolios in affluent urban markets.

-

Expand in Emerging Regions: Leverage joint ventures to build local plants tailored to regional price points.

-

Advance Sustainability Claims: Obtain certifications (e.g. Cradle to Cradle, ENERGY STAR) to meet green building standards.

Future Outlook

The Asphalt Shingles Market is expected to reach USD 38 billion by 2030, driven by:

-

Mid‑Single‑Digit CAGR: Underpinned by replacement cycles, new home construction, and product upgrades.

-

Premium Segment Growth: Projected 6–8% CAGR for architectural and specialty shingles.

-

Sustainability: Rising use of recycled content and bio‑asphalt binders could reduce the industry’s carbon footprint by 20–30%.

-

Integration with Renewables: Solar‑ready shingles represent a nascent but high‑potential segment, potentially capturing 5–10% of new installs in sun‑belt regions.

-

Digital Transformation: End‑to‑end digital roofing platforms will streamline sales, quoting, and service life tracking.

Conclusion

Asphalt shingles remain the backbone of residential and light commercial roofing due to their cost‑effectiveness, ease of installation, and evolving performance characteristics. While the market faces headwinds from raw material volatility and rising competition from alternative roofing materials, sustained demographic tailwinds, technological innovations, and increasing focus on sustainability will support steady growth. Providers that invest in premium product lines, recycling infrastructure, and digital customer experiences will be best positioned to capture the market’s next wave of expansion. The Asphalt Shingles Market’s resilience and adaptability will ensure it retains a central role in roofing solutions worldwide through 2030 and beyond.