444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asian Pacific bath and shower products market represents one of the most dynamic and rapidly evolving segments within the global personal care industry. This expansive market encompasses a comprehensive range of products including body washes, shower gels, bar soaps, bath salts, bubble baths, and specialized cleansing formulations designed to meet diverse consumer preferences across the region. The market demonstrates remarkable growth potential, driven by increasing urbanization, rising disposable incomes, and evolving consumer lifestyle preferences throughout key economies including China, Japan, India, South Korea, Australia, and Southeast Asian nations.

Market dynamics indicate substantial expansion opportunities, with the region experiencing a compound annual growth rate (CAGR) of 6.2% over the forecast period. This growth trajectory reflects the increasing consumer awareness regarding personal hygiene, wellness trends, and the growing influence of premium and organic product categories. The market landscape is characterized by intense competition among international brands and emerging local manufacturers, each striving to capture market share through innovative product formulations, sustainable packaging solutions, and targeted marketing strategies.

Consumer behavior patterns across the Asian Pacific region reveal significant variations in product preferences, with urban consumers increasingly gravitating toward premium and specialized formulations, while rural markets continue to demonstrate strong demand for traditional and value-oriented products. The market benefits from robust distribution networks spanning modern retail channels, e-commerce platforms, and traditional trade outlets, ensuring comprehensive market penetration across diverse demographic segments.

The Asian Pacific bath and shower products market refers to the comprehensive commercial ecosystem encompassing the manufacturing, distribution, and retail of personal cleansing products specifically designed for bathing and showering applications across the Asian Pacific region. This market includes liquid body cleansers, traditional bar soaps, specialty bath additives, exfoliating products, and therapeutic formulations that cater to diverse consumer needs ranging from basic hygiene maintenance to luxury wellness experiences.

Product categories within this market span multiple price points and formulation types, including conventional synthetic formulations, natural and organic alternatives, medicated products for specific skin conditions, and premium luxury offerings featuring exotic ingredients and sophisticated packaging. The market serves diverse consumer segments across age groups, income levels, and cultural preferences, reflecting the heterogeneous nature of the Asian Pacific consumer base.

Strategic analysis of the Asian Pacific bath and shower products market reveals a robust and expanding industry characterized by significant growth opportunities and evolving consumer preferences. The market demonstrates strong fundamentals supported by demographic trends, economic development, and increasing consumer sophistication regarding personal care products. Key growth drivers include urbanization rates exceeding 68% in major metropolitan areas, rising middle-class populations, and growing awareness of personal wellness and hygiene practices.

Market segmentation reveals distinct patterns across product categories, with liquid body washes and shower gels commanding the largest market share, followed by traditional bar soaps and specialty bath products. Premium and organic product segments are experiencing accelerated growth, reflecting consumer willingness to invest in higher-quality formulations and sustainable product options. The competitive landscape features a mix of established multinational corporations and innovative local brands, creating a dynamic environment for market expansion and product innovation.

Regional variations significantly influence market dynamics, with developed markets like Japan and Australia showing preference for premium and specialized products, while emerging economies demonstrate strong demand for value-oriented and traditional formulations. E-commerce penetration continues to expand rapidly, with online sales accounting for an increasing percentage of total market transactions, particularly among younger consumer demographics.

Consumer preference analysis reveals several critical insights that shape market development and strategic positioning. The following key insights define the current market landscape:

Economic development across the Asian Pacific region serves as a primary catalyst for market expansion, with rising disposable incomes enabling consumers to upgrade from basic cleansing products to premium and specialized formulations. The growing middle class, particularly in countries like China and India, demonstrates increasing purchasing power and willingness to invest in personal care products that offer enhanced benefits and superior user experiences.

Urbanization trends significantly impact market dynamics, as urban consumers typically exhibit higher consumption rates and preference for convenient, modern product formats. Urban lifestyle changes, including increased awareness of personal hygiene, exposure to international brands, and adoption of Western bathing practices, drive demand for diverse product categories and innovative formulations.

Health and wellness consciousness represents a fundamental market driver, with consumers increasingly seeking products that offer therapeutic benefits, natural ingredients, and skin-friendly formulations. This trend is particularly pronounced among health-conscious demographics who prioritize products free from harsh chemicals and synthetic additives, driving growth in the organic and natural product segments.

Digital connectivity and social media influence play crucial roles in shaping consumer preferences and driving product discovery. Online reviews, influencer recommendations, and social media marketing campaigns significantly impact purchasing decisions, particularly among younger consumers who rely heavily on digital platforms for product research and brand engagement.

Price sensitivity remains a significant constraint across many market segments, particularly in price-conscious economies where consumers prioritize value over premium features. Economic fluctuations and currency volatility can impact consumer spending patterns, leading to shifts toward more affordable product alternatives during periods of economic uncertainty.

Regulatory complexities across different countries within the Asian Pacific region create challenges for manufacturers seeking to expand their market presence. Varying safety standards, ingredient restrictions, and labeling requirements necessitate significant compliance investments and can delay product launches or limit market access for certain formulations.

Cultural resistance to certain product categories or formulations can limit market penetration in traditional communities where established bathing practices and product preferences remain deeply ingrained. Overcoming these cultural barriers requires substantial marketing investments and careful product positioning strategies.

Supply chain disruptions and raw material availability issues can impact product consistency and pricing stability. The region’s dependence on global supply chains for certain specialty ingredients makes the market vulnerable to international trade disruptions and commodity price fluctuations.

Emerging market penetration presents substantial growth opportunities, particularly in underserved rural areas and developing economies where basic infrastructure improvements and rising incomes create new consumer segments. These markets offer significant potential for both premium and value-oriented product categories, depending on local economic conditions and consumer preferences.

Product innovation opportunities abound in areas such as sustainable packaging, natural and organic formulations, multi-functional products, and culturally-specific ingredients. Companies that successfully develop products addressing specific regional needs and preferences can achieve competitive advantages and capture market share from established players.

Digital transformation initiatives offer opportunities to enhance customer engagement, improve distribution efficiency, and develop direct-to-consumer business models. E-commerce platforms, subscription services, and digital marketing strategies can help companies reach new customer segments and build stronger brand relationships.

Strategic partnerships with local distributors, retailers, and cultural influencers can accelerate market entry and expansion efforts. Collaborative approaches that leverage local market knowledge and established distribution networks can significantly reduce market entry barriers and improve competitive positioning.

Competitive intensity within the Asian Pacific bath and shower products market continues to escalate as both international and domestic brands compete for market share across diverse consumer segments. This competitive pressure drives continuous innovation in product formulations, packaging design, and marketing strategies, ultimately benefiting consumers through improved product quality and expanded choice options.

Supply chain evolution reflects the market’s adaptation to changing consumer demands and operational challenges. Companies are increasingly investing in local manufacturing capabilities, sustainable sourcing practices, and flexible distribution networks to improve responsiveness to market changes and reduce operational risks. Supply chain efficiency improvements of 23% have been achieved through digital optimization and strategic partnerships.

Technology integration plays an increasingly important role in market dynamics, with companies leveraging data analytics, artificial intelligence, and digital platforms to better understand consumer preferences, optimize product development, and enhance customer experiences. These technological capabilities enable more targeted marketing approaches and personalized product recommendations.

Regulatory evolution continues to shape market dynamics as governments across the region implement stricter safety standards, environmental regulations, and consumer protection measures. Companies must adapt their operations and product formulations to comply with evolving regulatory requirements while maintaining competitive positioning and profitability.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include consumer surveys, focus groups, and in-depth interviews with industry stakeholders across key markets within the Asian Pacific region. These primary research efforts provide valuable insights into consumer preferences, purchasing behaviors, and market trends that quantitative data alone cannot capture.

Secondary research encompasses extensive analysis of industry reports, company financial statements, regulatory filings, and trade publications to gather comprehensive market intelligence. This research approach ensures thorough coverage of market dynamics, competitive landscapes, and industry trends across all major product categories and geographic markets.

Data validation processes include cross-referencing multiple data sources, conducting expert interviews, and employing statistical analysis techniques to ensure research accuracy and reliability. Market forecasting models incorporate historical trends, current market conditions, and projected economic indicators to develop realistic growth projections and market scenarios.

Regional analysis methodology involves country-specific research approaches that account for local market conditions, cultural factors, and regulatory environments. This localized research approach ensures that market insights accurately reflect the diverse conditions and opportunities present across different Asian Pacific markets.

China represents the largest single market within the region, accounting for approximately 42% of total regional consumption. The Chinese market demonstrates strong growth across all product categories, with particular strength in premium and organic segments driven by increasing consumer sophistication and rising disposable incomes. Urban centers like Shanghai, Beijing, and Guangzhou lead market development, while tier-two and tier-three cities present significant expansion opportunities.

Japan maintains its position as a mature but innovative market characterized by high consumer standards and preference for premium, technologically advanced products. Japanese consumers demonstrate strong brand loyalty but remain open to products offering superior quality or unique benefits. The market shows particular strength in specialized and therapeutic product categories, reflecting the population’s focus on health and wellness.

India presents exceptional growth potential with its large and expanding middle class, rapid urbanization, and increasing awareness of personal care products. The Indian market shows strong demand across all price points, with traditional products maintaining significant market share alongside growing acceptance of modern formulations. Regional preferences vary significantly, requiring localized product strategies and distribution approaches.

Southeast Asian markets including Thailand, Indonesia, Malaysia, and the Philippines demonstrate robust growth driven by economic development and changing consumer lifestyles. These markets show increasing preference for natural and organic products, influenced by traditional medicine practices and growing environmental consciousness. Regional market share distribution shows 28% concentrated in ASEAN countries.

Australia and New Zealand represent mature markets with sophisticated consumers who prioritize quality, sustainability, and ethical sourcing. These markets lead regional trends in organic and natural products, often serving as testing grounds for new product concepts before broader regional launches.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive landscape reflects a healthy mix of global corporations and regional specialists, creating dynamic market conditions that benefit consumers through innovation and competitive pricing.

Competitive strategies vary significantly across market segments and geographic regions. Premium brands focus on product innovation, brand building, and channel partnerships, while value-oriented competitors emphasize cost efficiency, wide distribution, and local market adaptation. The competitive environment encourages continuous innovation and market responsiveness.

Product-based segmentation reveals distinct market dynamics across different product categories, each serving specific consumer needs and preferences:

By Product Type:

By Price Segment:

By Distribution Channel:

Liquid body cleansers continue to dominate market growth, driven by consumer preference for convenience, variety, and perceived hygiene benefits. This category benefits from continuous innovation in formulations, fragrances, and packaging designs that appeal to diverse consumer preferences. Premium liquid products incorporating natural ingredients, moisturizing properties, and therapeutic benefits show particularly strong growth potential.

Traditional bar soaps maintain significant market presence, particularly in rural areas and among consumers who prefer traditional cleansing methods. This segment benefits from cultural familiarity, cost-effectiveness, and the introduction of premium bar soap formulations that combine traditional formats with modern ingredients and benefits.

Specialty bath products represent a high-growth category driven by increasing consumer interest in wellness, relaxation, and self-care practices. Products in this category, including bath salts, aromatherapy oils, and therapeutic formulations, command premium pricing and demonstrate strong customer loyalty among target demographics.

Children’s products constitute a specialized segment with unique formulation requirements, safety considerations, and marketing approaches. This category shows steady growth driven by increasing parental awareness of gentle, safe formulations and the willingness to invest in specialized products for children’s sensitive skin.

Men’s grooming products within the bath and shower category demonstrate accelerating growth as male consumers become more engaged with personal care routines. This segment benefits from targeted product development, masculine packaging designs, and marketing strategies that appeal to male preferences and lifestyle patterns.

Manufacturers benefit from the market’s robust growth trajectory and expanding consumer base, providing opportunities for revenue growth, market share expansion, and product portfolio diversification. The diverse market landscape allows companies to pursue multiple strategic approaches, from premium positioning to value-oriented strategies, depending on their capabilities and target markets.

Retailers gain from the category’s consistent demand, high turnover rates, and attractive profit margins. Bath and shower products serve as traffic drivers for retail locations while offering opportunities for private label development and exclusive brand partnerships. The category’s resilience during economic downturns provides retailers with stable revenue streams.

Consumers enjoy expanding product choices, improved formulations, and competitive pricing resulting from market competition and innovation. The diverse product landscape ensures that consumers can find products matching their specific needs, preferences, and budget constraints, while continuous innovation delivers enhanced benefits and user experiences.

Supply chain partners including raw material suppliers, packaging manufacturers, and logistics providers benefit from the market’s growth and the increasing sophistication of product formulations. These partnerships create opportunities for collaborative innovation and long-term business relationships that support mutual growth objectives.

Investors find attractive opportunities in a market characterized by steady growth, resilient demand, and diverse investment options ranging from established multinational corporations to innovative startup companies developing niche products and sustainable solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic formulations represent the most significant trend shaping market development, with consumers increasingly seeking products free from synthetic chemicals and harsh additives. This trend drives innovation in ingredient sourcing, formulation development, and marketing strategies as companies work to meet growing demand for clean, natural products without compromising performance or user experience.

Sustainable packaging solutions gain momentum as environmental consciousness influences purchasing decisions across all consumer segments. Companies are investing in recyclable materials, refillable containers, and reduced packaging designs to appeal to environmentally aware consumers while addressing regulatory pressures and corporate sustainability goals.

Personalization and customization emerge as key differentiators, with companies developing products tailored to specific skin types, preferences, and cultural requirements. This trend extends to packaging design, fragrance selection, and marketing messages that resonate with targeted consumer segments and create stronger brand connections.

Multi-functional products gain popularity as consumers seek convenience and value through products offering multiple benefits. Formulations combining cleansing, moisturizing, aromatherapy, and therapeutic properties appeal to time-conscious consumers while commanding premium pricing and improving customer satisfaction.

Digital engagement strategies become increasingly important as companies leverage social media, influencer partnerships, and online communities to build brand awareness and customer loyalty. Digital platforms enable direct consumer communication, product education, and personalized marketing approaches that enhance brand relationships and drive sales growth.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to expand their market presence, access new technologies, and enter emerging markets. Recent industry consolidation activities demonstrate the importance of scale, distribution capabilities, and product portfolio diversity in achieving sustainable competitive advantages.

Manufacturing localization initiatives gain importance as companies establish regional production facilities to reduce costs, improve supply chain resilience, and better serve local markets. These investments demonstrate long-term commitment to regional markets while providing operational flexibility and reduced transportation costs.

Sustainability commitments drive significant industry changes as companies implement comprehensive environmental programs covering ingredient sourcing, manufacturing processes, packaging materials, and waste reduction. These initiatives respond to consumer demands while addressing regulatory requirements and corporate responsibility objectives.

Technology integration accelerates across all aspects of the value chain, from product development and manufacturing to marketing and distribution. Companies invest in digital capabilities, data analytics, and automation technologies to improve efficiency, enhance customer experiences, and maintain competitive positioning in an increasingly digital marketplace.

Regulatory harmonization efforts across the region aim to simplify compliance requirements and facilitate trade, though progress remains uneven across different countries. Industry participants actively engage with regulatory authorities to support the development of practical standards that protect consumers while enabling innovation and market access.

Market entry strategies should prioritize thorough understanding of local consumer preferences, regulatory requirements, and competitive dynamics before committing significant resources. MarkWide Research analysis indicates that successful market entry requires careful balance between global brand consistency and local market adaptation, particularly in culturally diverse markets where consumer preferences vary significantly.

Product development priorities should focus on natural and sustainable formulations that address specific regional needs while maintaining broad market appeal. Companies should invest in research and development capabilities that enable rapid response to changing consumer preferences and regulatory requirements while maintaining product quality and safety standards.

Distribution strategy optimization requires multi-channel approaches that combine traditional retail partnerships with expanding e-commerce capabilities. Companies should develop flexible distribution models that can adapt to varying market conditions and consumer shopping behaviors across different geographic regions and demographic segments.

Brand positioning strategies must carefully balance global consistency with local relevance, ensuring that marketing messages resonate with target consumers while maintaining brand integrity. Successful brands invest in understanding cultural nuances and consumer motivations that drive purchasing decisions in specific markets.

Investment priorities should emphasize sustainability initiatives, digital capabilities, and supply chain resilience to address evolving market requirements and consumer expectations. Companies that proactively address these areas will be better positioned to capitalize on growth opportunities while managing operational risks and regulatory challenges.

Long-term growth prospects remain highly favorable, supported by demographic trends, economic development, and evolving consumer preferences across the Asian Pacific region. MWR projections indicate sustained market expansion with annual growth rates averaging 6.8% over the next five years, driven by continued urbanization, rising incomes, and increasing consumer sophistication regarding personal care products.

Innovation trajectories will likely focus on sustainable formulations, personalized products, and technology-enhanced user experiences. Companies that successfully integrate these trends into their product development and marketing strategies will be best positioned to capture market share and build customer loyalty in an increasingly competitive environment.

Market consolidation may accelerate as companies seek scale advantages, distribution efficiencies, and technological capabilities necessary to compete effectively in mature markets while investing in emerging market opportunities. This consolidation will likely benefit consumers through improved product quality and expanded choice options.

Regulatory evolution will continue shaping market dynamics as governments implement stricter safety standards, environmental requirements, and consumer protection measures. Companies that proactively address regulatory trends and invest in compliance capabilities will maintain competitive advantages while avoiding potential market access restrictions.

Digital transformation will fundamentally alter how companies interact with consumers, manage operations, and compete in the marketplace. Organizations that successfully leverage digital technologies to enhance customer experiences, improve operational efficiency, and develop new business models will achieve sustainable competitive advantages in the evolving market landscape.

The Asian Pacific bath and shower products market presents exceptional opportunities for growth and innovation, supported by favorable demographic trends, economic development, and evolving consumer preferences across diverse regional markets. The market’s resilience, combined with continuous innovation potential and expanding consumer base, creates an attractive environment for industry participants seeking sustainable growth and competitive positioning.

Strategic success in this dynamic market requires careful balance between global consistency and local adaptation, with particular emphasis on understanding cultural preferences, regulatory requirements, and competitive dynamics in specific geographic markets. Companies that invest in natural and sustainable product formulations, digital capabilities, and flexible distribution strategies will be best positioned to capitalize on emerging opportunities while managing evolving market challenges.

The market’s future trajectory appears highly promising, with sustained growth expected across all major product categories and geographic regions. As consumer awareness of personal care and wellness continues to expand, coupled with increasing disposable incomes and urbanization trends, the Asian Pacific bath and shower products market will likely maintain its position as one of the most dynamic and attractive segments within the global personal care industry, offering substantial value creation opportunities for all stakeholders throughout the value chain.

What is Bath and Shower Products?

Bath and shower products refer to a range of personal care items designed for use during bathing and showering, including soaps, body washes, shampoos, conditioners, and bath oils. These products are essential for personal hygiene and skin care, catering to various consumer preferences and skin types.

What are the key players in the Asian Pacific Bath and Shower Products Market?

Key players in the Asian Pacific Bath and Shower Products Market include Procter & Gamble, Unilever, Johnson & Johnson, and Colgate-Palmolive, among others. These companies are known for their diverse product offerings and strong market presence in the region.

What are the growth factors driving the Asian Pacific Bath and Shower Products Market?

The growth of the Asian Pacific Bath and Shower Products Market is driven by increasing consumer awareness of personal hygiene, rising disposable incomes, and the growing trend of self-care and wellness. Additionally, the expansion of e-commerce platforms has made these products more accessible to consumers.

What challenges does the Asian Pacific Bath and Shower Products Market face?

The Asian Pacific Bath and Shower Products Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards natural and organic products. These factors can impact product development and market dynamics.

What opportunities exist in the Asian Pacific Bath and Shower Products Market?

Opportunities in the Asian Pacific Bath and Shower Products Market include the rising demand for eco-friendly and sustainable products, the introduction of innovative formulations, and the potential for growth in emerging markets. Brands can capitalize on these trends to enhance their product lines.

What trends are shaping the Asian Pacific Bath and Shower Products Market?

Trends shaping the Asian Pacific Bath and Shower Products Market include the increasing popularity of natural and organic ingredients, the rise of personalized skincare solutions, and the integration of technology in product development. These trends reflect changing consumer preferences and a focus on health and wellness.

Asian Pacific Bath and Shower Products Market

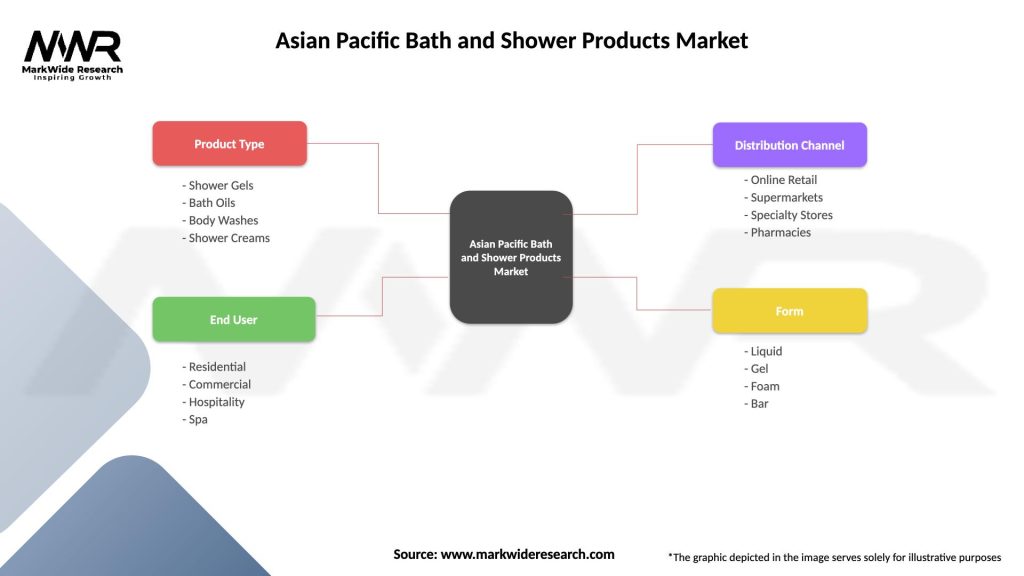

| Segmentation Details | Description |

|---|---|

| Product Type | Shower Gels, Bath Oils, Body Washes, Shower Creams |

| End User | Residential, Commercial, Hospitality, Spa |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Form | Liquid, Gel, Foam, Bar |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asian Pacific Bath and Shower Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at